In October, the International Monetary Fund (IMF) committed a blunder when it issued a forecast for Venezuela’s end-of-year annual inflation rate. An inflation forecast in a country that is toying with hyperinflation is a mug’s game.

The IMF’s October 2016 World Economic Outlook (WEO) forecast for Venezuela’s 2016 year-end annual inflation rate was 720 percent. The IMF’s figure gave the appearance that it was based on a finger-in-the-wind estimate. Indeed, the last serious connection between Venezuela and the IMF was back in September of 2004, when an Article IV Executive Board Consultation occurred.

However, the IMF published a forecast anyway. What became a magic number of 720 percent was repeated over and over in the financial press. Sometimes the press reported it as a forecast, which it was, but more often than not, it was reported it as if it were a measured rate, which it was not.

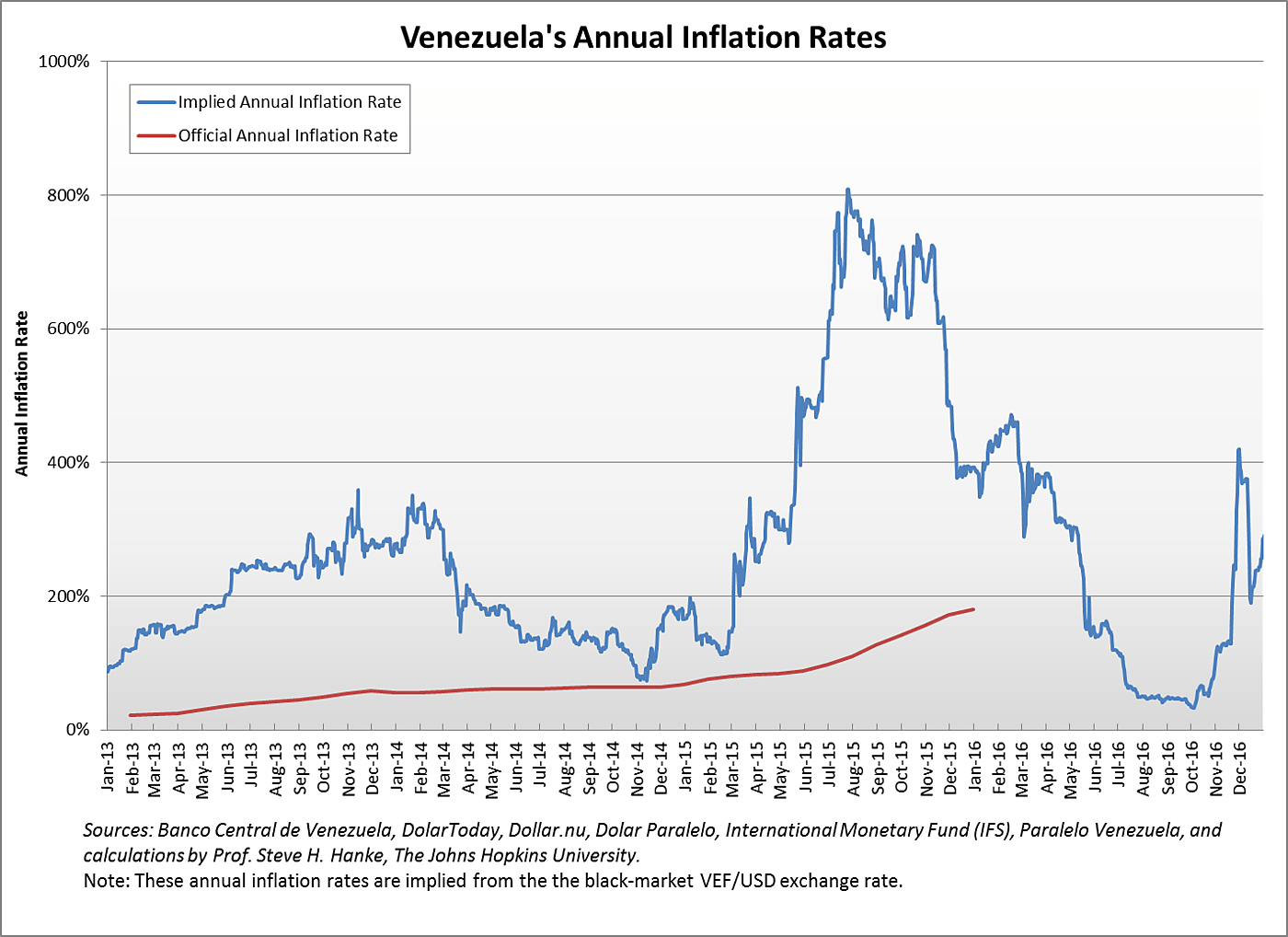

The only accurate measured rate of the general level of inflation in Venezuela is produced by the Johns Hopkins-Cato Institute Troubled Currencies Project (TCP), which I direct. This project measures inflation as it occurs. It does not produce inflation forecasts. The TCP’s measured inflation rates are based on the long-established principle of Purchasing Power Parity. Using this method, changes in black market (read: free market) exchange rates are translated into overall inflation rates. Based on my calculations, the 30-day moving average for Venezuela’s annual year-over-year inflation in December 2016 was 290 percent. This rate is less than half of the IMF’s forecast.