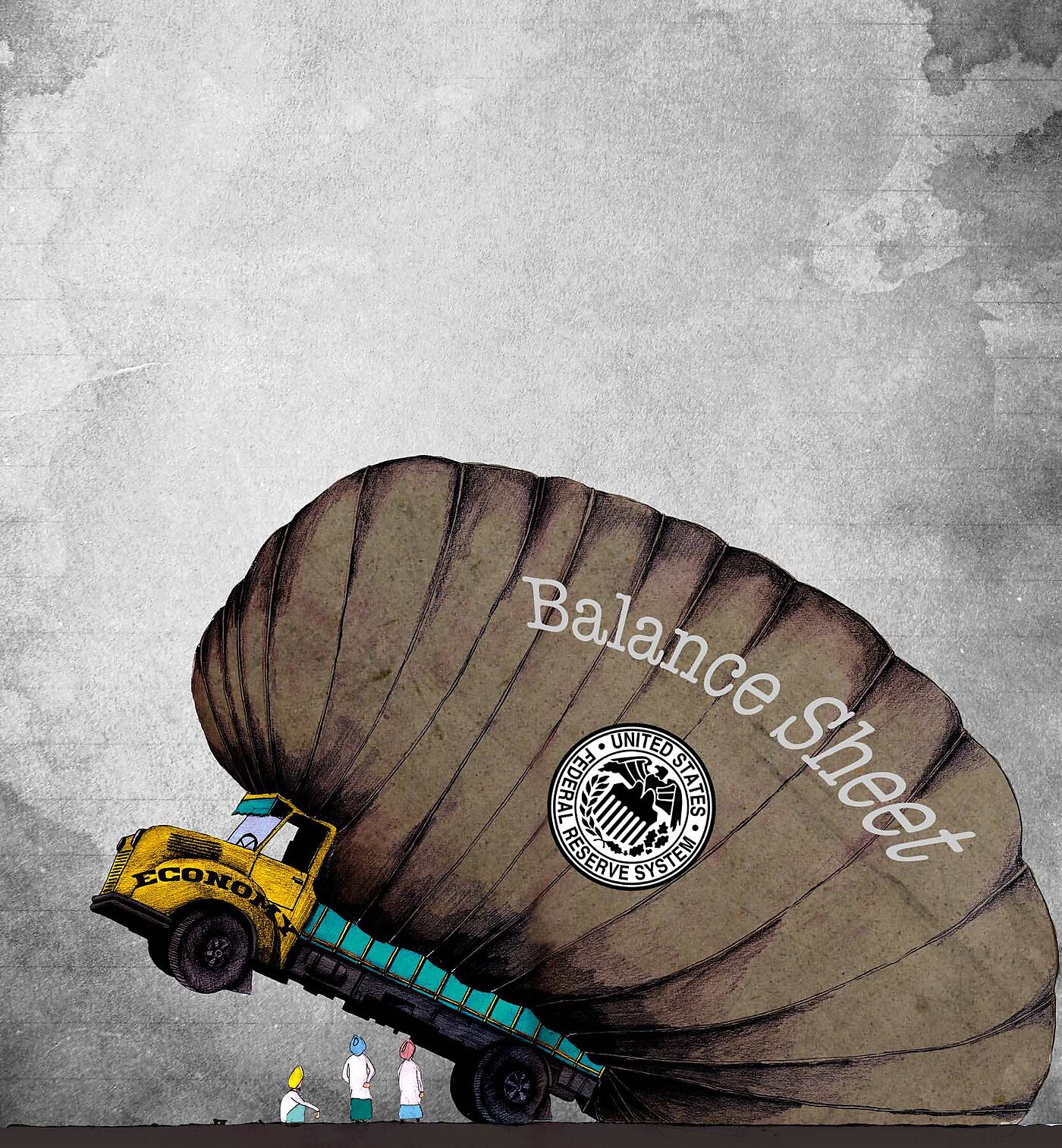

To recap, David’s original blog post proposed that one good reason not to normalize the Fed’s balance sheet (which has been swollen by the QE programs) is that the big balance sheet is a bigly profitable undertaking, reducing the cost of financing the public debt. I argued here on Alt‑M that David’s case as stated rested on a non sequitur because it ignored duration risk. The Fed is earning a large spread only by taking on duration risk (borrowing short and lending long). We can’t assume that the return is worth the risk. David in reply now acknowledges the issue of duration risk (neither “duration” nor “risk” appeared in his original blog post), so our remaining disagreement is about the risk-return tradeoff.

In his reply, David restates “the gist of [his] story” with the following hypothetical:

Suppose that the Fed makes a one-time purchase of a 10-year treasury bond yielding a risk-free 2.5% annual nominal coupon … financed by “printing” reserves. … Suppose further that the interest paid on reserves remains below 2.5% for the duration of the bond. Then the Fed makes a profit off the rate of return differential in each of the 10 years it holds the bond on its books. If I understand my critics correctly, none would dispute the financial benefit associated with this Fed intervention as far as the public purse is concerned; at least, as long as it is somehow known ex ante that the short rate will remain below the long rate in the manner assumed.

It’s true that this is a story of unambiguous benefit. I can restate my critique of it by saying that it is not, however, a coherent story. Supposing that it is known ex ante that the short rate will remain below the long rate is tantamount to supposing zero duration risk. A story supposing zero duration risk is incoherent if it simultaneously supposes that the long rate remains persistently above the short rate. Why wouldn’t investors arbitrage away the supernormal profits from a risk-free operation? In any case the relevant question, granted that the Fed is undertaking duration risk, is whether the return is worth the risk being borne.

As I see it, we have to choose one of three ways to think about how it is possible for the Fed to earn profits from borrowing short and lending long. (a) Markets are efficient and so the Fed is earning at most a normal return to bearing duration risk. We cannot infer from experience since 2008 (see below) that the risk is so negligible that the returns surely more than cover the risk. (b) The Fed has grasped a profit opportunity that market arbitrageurs (e.g. private hedge funds or other financial intermediaries) have failed to grasp for no good reason. Private arbitrageurs are persistently leaving money on the table. (c) The Fed has grasped a profit opportunity not available to market players because the Fed is the most efficient maturity-transformer in the economy. I reject (b) as implausible, and I presume that David does too. I find (a) more plausible than (c), absent evidence of the Fed’s efficiency advantage over private firms as a profitable intermediary. The Fed’s ability to shift losses to taxpayers does not constitute an efficiency advantage in the relevant sense.

David helpfully advances the discussion by pointing out that we can more directly analyze the question at hand by consolidating the Fed and the Treasury balance sheets. Doing so, I believe, reinforces my point that shortening the maturity structure of the consolidated debt (whether the Fed does it or the Treasury does it) reduces current interest paid but at the cost of increased interest-rate risk. (We now switch from duration to refinance risk because the Fed by itself is a net lender to the Treasury, but the Fed+Treasury is a net borrower from the public.) David acknowledges the point:

if the point is that financing short-term at low rates entails risk relative to financing long-term at high rates, then I agree. The question, however, is not whether QE exposes the taxpayer to duration risk. Of course it does. The same would be true if the Treasury was to shorten the average duration of its debt on its own.

Whether it is net-beneficial for the Fed to shorten the duration of the consolidated debt compared to the duration of the debt the Treasury has issued then depends on whether the Treasury’s debt is overly long in duration. Like David, I confess that I don’t know how to answer that question, how to compute the optimal public debt duration. But this means that the assessment whether the Fed’s duration-shortening action is net-beneficial is up in the air. It is not settled by the Fed’s apparent profits.

David adds some humor but not any greater clarity when he writes:

Larry’s argument implicitly assumes (possibly correctly) that the Treasury has structured its debt optimally. If it has, then there is no “free lunch” for the Fed. If this is the case, then I would have to agree. (And it’s heartwarming to see Larry thinking so highly of a government agency’s ability to run its operations!)

Logically, to judge that Fed action to shorten the consolidated debt fails a cost-benefit test (which is a stronger claim than my saying that the Fed’s profits don’t settle the question, but the stronger claim might be true) does not require one to judge that the current Treasury debt duration is optimal, but only that it doesn’t need shortening. It could be just right, or it could already be too short.

David goes on to suggest that the market is over-estimating the risk of a rise in interest rates: “An ex ante gamble that pays off ex post is not a justification. Sure. But billions in remittances [from Fed to Treasury], year after year, one fluke after another?” My answer to that question, given a presumption of financial market efficiency, is: yes. Suppose that a rise in interest rates that would punish the consolidated Fed+Treasury is a relatively rare event, like spinning one of two green numbers (0 or 00) on a Las Vegas roulette wheel. Ten non-green spins in a row doesn’t mean that the risk is over-estimated. This is of course the well-known “peso problem”: How can Mexican peso bonds pay higher returns than US dollar bonds year after year, over a period when the peso never devalues against the dollar? Because the risk of devaluation is still there. I think David is ignoring the peso problem when he writes: “But the fact of consistently positive and sometimes very large remittances from Fed to Treasury for years (and even decades) might lead one to question that assumption.”

My reference to the historical plight of U.S. thrift institutions when interest rates spiked in the late 1970s and early 1980s, by the way, was not to warn about a Fed bankruptcy (it seems likely that a technical Fed insolvency would in fact force no change to its ongoing operations), but rather to emphasize that interest rate run-ups do happen once in a while, and when they do those carrying big duration risks or refinance risks pay heavily. That is why I described the consequences as they would be felt by taxpayers.

Finally, I noted that normalization of the Fed’s balance sheet calls for making bank reserve scarce again. David protests that this is contrary to Milton Friedman’s “optimum quantity of money” prescription, which he says aims at “eliminating all liquidity premia.” I wouldn’t characterize the OQM prescription that way. It rather calls for ending inefficient price discrimination on consolidated government liabilities by paying the same return on Fed liabilities (bank reserves and Federal Reserve Notes held by the public) as on Treasuries of the same duration and default risk. It does not imply that reserves are non-scarce in the sense that banks indifferently hold excess reserves. While there would be no cost of holding reserves relative to overnight Treasuries, there is still a cost of holding reserve relative to a well-chosen portfolio of business loans that inframarginally pays a higher return (net of defaults). The OQM does not imply the end of banks’ comparative advantage in making loans.