Back in 2010, I wrote a post entitled “What’s the Ideal Point on the Laffer Curve?”

Except I didn’t answer my own question. I simply pointed out that revenue maximization was not the ideal outcome.

I explained that policy makers instead should seek to maximize prosperity, and that this implied a much lower tax rate.

But what is that tax rate, several people have inquired?

The simple answer is that the tax rate should be set to finance the legitimate functions of government.

But that leads to an obvious follow-up question. What are those legitimate functions?

According to my anarcho-capitalist friends, there’s no need for any public sector. Even national defense and courts can be shifted to the private sector.

In that case, the “right” tax rate obviously is zero.

But what if you’re a squishy, middle-of-the-road moderate like me, and you’re willing to go along with the limited central government envisioned by America’s Founding Fathers?

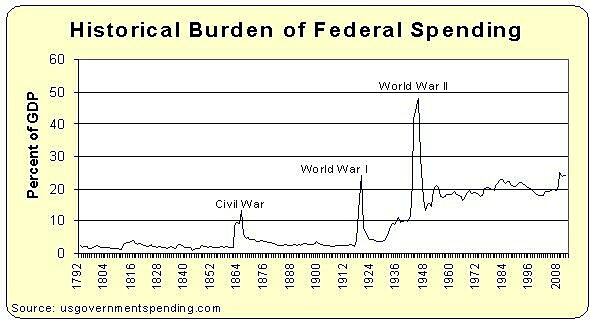

That system operated very well for about 150 years and the federal government consumed, on average, only about 3 percent of economic output. And even if you include state and local governments, overall government spending was still less than 10 percent of GDP.

Moreover, for much of that time, America prospered with no income tax.

But this doesn’t mean there was no tax burden. There were federal excise taxes and import taxes, so if the horizontal axis of the Laffer Curve measured “Taxes as a Share of GDP,” then you would be above zero.

Or you could envision a world where those taxes were eliminated and replaced by a flat tax or national sales tax with a very low rate. Perhaps about 5 percent.

So I’m going to pick that number as my “ideal” tax rate, even though I know that 5 percent is just a rough guess.

For more information about the growth-maximizing size of government, watch this video on the Rahn Curve.

There are two key things to understand about my discussion of the Rahn Curve.

First, I assume in the video that the private sector can’t provide core public goods, so the discussion beginning about 0:33 will irk the anarcho-capitalists. I realize I’m making a blunt assumption, but I try to keep my videos from getting too long and I didn’t want to distract people by getting into issues such as whether things like national defense can be privatized.

Second, you’ll notice around 3:20 of the video that I explain why I think the academic research overstates the growth-maximizing size of government. Practically speaking, this seems irrelevant since the burden of government spending in almost all nations is well above 20 percent-25 percent of GDP.

But I hold out hope that we’ll be able to reform entitlements and take other steps to reduce the size and scope of government. And if that means total government spending drops to 20 percent-25 percent of GDP, I don’t want that to be the stopping point.

At the very least, we should shrink the size of the state back to 10 percent of economic output.

And if we ever get that low, then we can have a fun discussion with the anarcho-capitalists on what else we can privatize.

P.S. If a nation obeys Mitchell’s Golden Rule for a long enough period of time, government spending as a share of GDP asymptotically will approach zero. So perhaps there comes a time where my rule can be relaxed and replaced with something akin to the Swiss debt brake, which allows for the possibility of government growing at the same rate as GDP.