“Europe’s Taxes Aren’t as Progressive as Its Leaders Like to Think,” wrote the Wall Street Journal’s Joseph C. Sternberg yesterday. Citing tax expert Stefan Bach from the German Institute for Economic Research, Sternberg shows how Germany’s tax system is only mildly progressive overall. Sternberg therefore states that politicians need to “tackle” indirect taxation if they want to have a major impact on the economy.

Now, Sternberg is undoubtedly right that broad-based tax systems which incorporate social contributions and VATs tend to be less progressive than those which rely more heavily on progressive income taxes. That is, if we narrowly look at the effects of taxes alone, rather than government spending. But does it make any economic sense to look at a tax system in isolation?

Good economic theory would suggest that to the extent we care about progressivity and redistribution, revenues should be collected in the least distortionary way possible, with redistribution done via cash transfers. So judging the desirability of a tax system by its degree of progressivity is not a good starting point. From an economic perspective, the assessment should be how distortionary different taxation systems across the world are. European tax systems have huge problems in this regard, but their progressivity or otherwise should not be a major consideration.

The second and more important related point is that assessing progressivity should not seek to separate the issues of taxes from transfers. To judge progressivity, one must look at the position of households across the income spectrum after both, not least because one person’s taxes are (now or later) another person’s cash transfer.

I cannot find figures to do this for Germany, but am familiar with some headline UK and US stats.

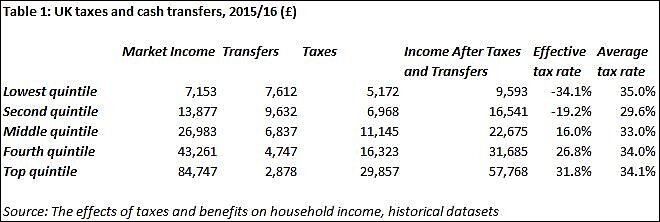

Every year when the UK Office for National Statistics (ONS) releases its publication “The effects of taxes and benefits on household income, historical datasets” a similar lament to Sternberg’s arises. Calculating total taxes paid as a proportion of gross income (market income plus government cash transfers), critics of the tax system assert that the poorest quintile pay 35.0% of their gross income in taxes, on average, which is almost identical to the average 34.1% for the top quintile (2015/16 figures). Like Sternberg, many conclude that the tax system is not progressive enough.

Yet a few seconds’ thought to what these figures show highlights how misleading this is. Gross income (the denominator in the calculation) includes cash transfers, which are transfers from one group to another. That a household uses money redistributed to it to spend, in turn paying what the ONS describes as indirect taxes (things like VAT, beer duty, tobacco duty, the TV license and fuel duty), can hardly be described as “regressive”. This is akin to taking from Peter to pay Paul and then saying that – because Paul spends a large proportion of this money – the tax system is unfair.

Put simply, benefits don’t fall like manna from heaven. One person’s taxes are someone else’s cash transfers. That the tax system is not ultra-progressive then is not what matters – it’s what the overall tax AND transfers system does that counts.

Thought of in this way, we can calculate effective tax rates, which measure the net contribution for the average household in each income quintile as a proportion of their market income. This is key: how much of the income that you earn is being taxed away and given to others? I.e. how progressive is the taxpayer-funded welfare state.

Table 1 shows the poorest fifth of households in the UK on average actually face an effective tax rate (all taxes minus cash benefits, divided by earned income) of ‑34.1 per cent, while the richest fifth face an average tax rate of 31.8 per cent. This means that, for every £1 earned in market income, the average household in the poorest quintile is transferred another 34.1p in cash benefits, while the average household in the top decile pays 31.8p in tax. The tax and cash transfers system, in other words, is very progressive.

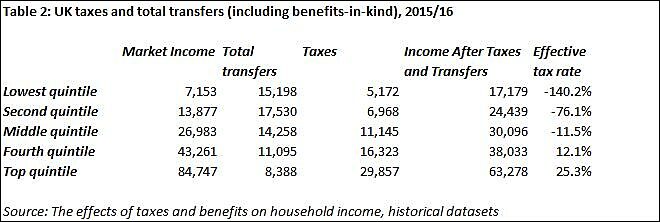

But even this excludes so-called “benefits in kind,” which the UK state provides lots of, and which disproportionately benefit the poor. Once benefits-in-kind (education, healthcare, and subsidies for housing, rail and buses) are considered, these effective tax rates for the average household in the richest and poorest fifths become ‑140.2 per cent and 25.3 per cent respectively (see Table 2).

Now, the UK figures are not completely comprehensive. Unlike the figures below for the US (below), they do not seek to assign the impact of corporate income taxes on workers across the income distribution. They also exclude the cash-value benefits of other public goods, such as defense, law and order etc., and the courts which uphold property rights, where there is an argument that the rich benefit disproportionately (though development work stresses the importance of property rights for the poor too). But overall, it’s clear that welfare states are hugely redistributive.

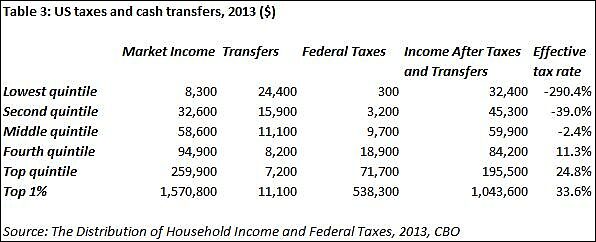

Can similar figures be found for the US? The best comparator figures I can find come from the CBO’s June 2016 report “The Distribution of Household Income and Federal Taxes, 2013.” There are three important differences in the methodology from the UK figures which means they are likely to look more progressive on the surface: the quintiles are assigned by market income, rather than disposable income; the transfers include transfers from state and local programs but only federal taxes (and sales taxes tend to be more regressive); and the figures presented include in-kind assistance, meaning they are closer in methodology to Table 2 than Table 1. But the results show the same trend.

The average household in the bottom quintile receives around $2.90 in cash transfers or in-kind benefits for every $1 earned, against the top quintile which faced an effective tax rate of 24.8%. Interestingly, as Greg Mankiw noted before, middle income Americans have shifted since 1979 from being, on average, net contributors to net beneficiaries under this measure.

Of course, averages hide a lot of information. Government programs redistribute heavily to those with children and to old people. But if we are going to assess crude measures of progressivity by looking across the income spectrum, it makes sense to include transfers too.

In conclusion, there are many problems with tax systems here and in Europe. But aiming to make them more progressive should not be an underlying economic aim. To the extent that redistribution is considered a valid goal, it should be undertaken through spending, and these stats above show countries such as the US and UK are already hugely redistributive or “progressive” in this regard.