The PPI measures prices received by U.S. businesses for final demand.

It has one big advantage over the CPI—the PPI does not include the extremely misleading old lagged BLS surveys of rent and estimates of “owner-equivalent” rent. Such “shelter” accounts for a third of the CPI, which makes it a very serious issue indeed.

Although market rents have been falling since last summer, BLS estimates of rents on old and new leases still keep soaring in CPI monthly reports—at a 9.6 percent annual rate for the past three months!

That statistical snafu made inflation in 2021 look lower than it really was, because shelter inflation was largely based on depressed 2020 pandemic rents. Today, the lagged BLS rent estimates have the opposite effect of greatly exaggerating inflation in early 2023 because reported shelter inflation (a third of the CPI) is still largely based on leases from the peak inflation of early 2022.

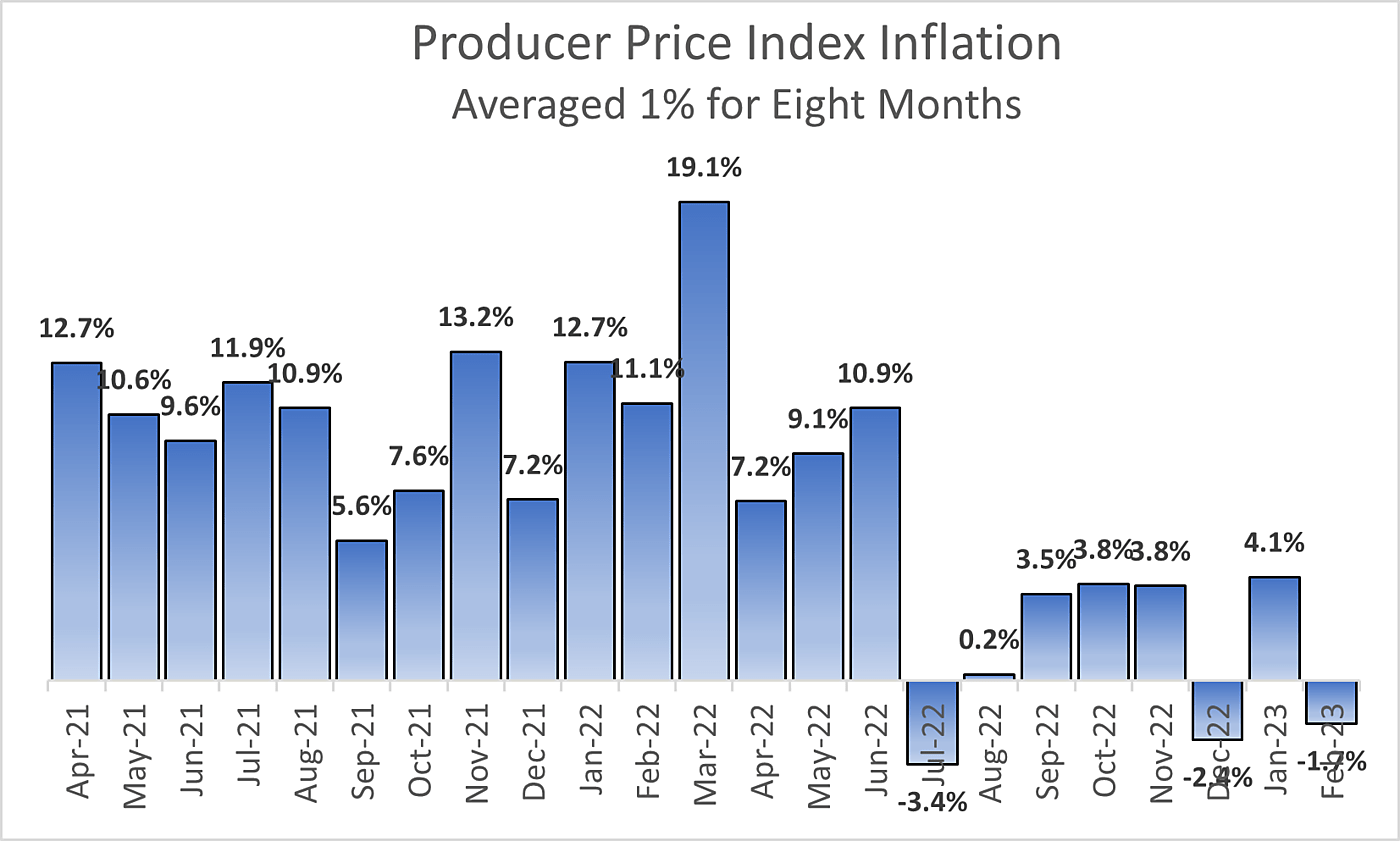

Once we exclude shelter from CPI inflation, the resulting “CPI less shelter” is about like the PPI. CPI-less shelter has averaged just 1.1 percent since last June, as shown in my March 14 blog post.

Like the CPI, the PCE inflation does include those distortive rent estimates, unfortunately, but the weight of rent and its owner-equivalent is only half as large as it is in the CPI, which lessens the exaggeration of overall PCE inflation.

It is also noteworthy that the PCE, unlike the CPI, draws upon the PPI for many price trends. “Most PCE price indexes are derived by extrapolating consumer and producer price indexes…”

Together with the PCE’s lower weight rent (and getting past January’s suspect seasonal adjustments) the PCE index reliance on this below-zero February PPI report bodes well for the next PCE inflation report which, unfortunately, will arrive after the current FOMC meeting.