The president released his budget request this morning. As expected, his plan is heavy on new spending and new taxes, and very light on structural reforms.

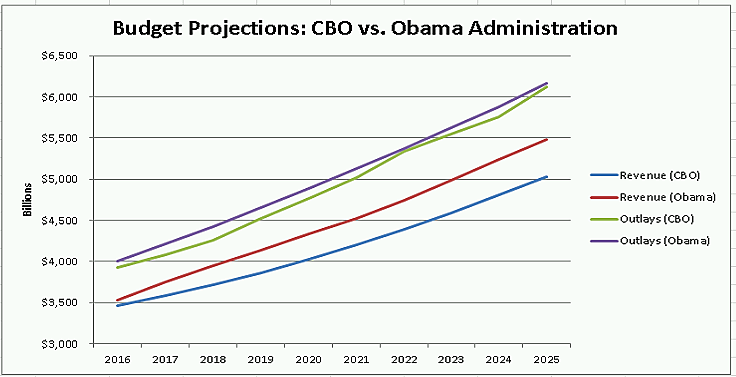

Overall, the president says that he would collect $2.994 trillion more in revenue from 2016 to 2025 than the Congressional Budget Office (CBO) baseline projections. He would also spend $1.028 trillion more during that same time frame.

The excess revenue would result in slightly smaller deficits than the CBO projected during this period. The president’s budget predicts that debt held by the public will equal 73.3 percent of gross domestic product in 2025, compared to 78.7 percent projected by the CBO.

However, the president’s budget assumes faster economic growth than the CBO does, which makes the president’s budget numbers look rosier. If GDP was constant between the two proposals, the president’s debt-to-GDP ratio in 2025 would increase to 74.2 percent. This is still less than the CBO’s projections, but it comes at the expense of higher taxes.

Here are some of the president’s proposals:

Spending

- Spending Caps: The president proposes lifting the bipartisan Budget Control Act spending caps passed in 2011. He suggests increasing discretionary spending by $75 billion in fiscal 2016. The increase would be split evenly between defense and non-defense spending categories.

- Infrastructure: The budget includes a $478 billion surface transportation proposal. The money would be spent over six years on highways, mass transit, and freight networks.

- Entitlement Reform: The budget request does not include any meaningful plans to reform spending for Social Security, Medicare, or Medicaid. The president includes $400 billion in health savings, but a large share of the savings comes from cuts to providers and increased drug costs for pharmaceutical companies. That does not represent real reform of these programs.

Taxes

- Foreign Earnings: To pay for his large infrastructure proposal, the president proposes a 14 percent one-time tax on the accumulated foreign earnings of U.S. corporations. Currently, multinational corporations are subject to U.S. taxes when their earnings are repatriated to the United States. President Obama would hit companies first with this 14 percent tax, then subject them to an ongoing 19 percent tax on foreign earnings. These proposals would burden U.S. companies with an uncompetitive tax regime compared to the lower-rate territorial systems nearly all our trading partners have.

- Bank tax: Previewed in the State of the Union, President Obama would assess a new tax on banks with greater than $50 billion in assets.

- New tax credits: The proposal includes an expanded child tax credit for families making less than $120,000 annually. It also creates a new tax credit of $500 for families where both parents work outside of the home.

- High-income individuals: The president includes a “Buffett Rule” proposal called a “Fair Share Tax.” He also proposes limiting itemized deductions for high-income earners.

- Other tax proposals: The president proposes a large expansion of the estate or “death” tax. He also proposes raising the top capital gains tax rate from 23.8 percent to 28 percent for high-income households.