The Biden administration has released its federal budget for 2022, which envisions a large increase in the size of government. As the pandemic recedes and economic growth resumes, policymakers should be paring back spending and deficits to normal levels. Unfortunately, the Biden spending plan risks following last year’s crisis with a new fiscal crisis as it tries to sustain spending and borrowing at dangerously high levels.

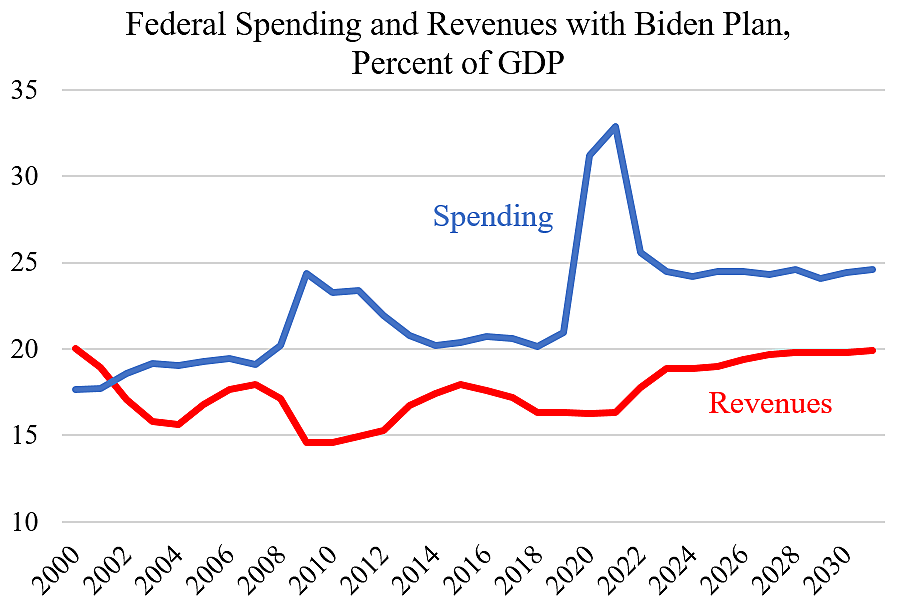

The chart below shows federal spending and revenues as a percent of gross domestic product. Federal spending trended up from 17.7 percent under President Clinton in 2000 to 21.0 percent under President Trump in 2019. Spending jumped to 31.2 percent in 2020 with the pandemic, which was higher than the 24.4 percent peak reached during the Great Recession. Pandemic-related spending is expected to decline the next few years, but Biden is proposing that overall spending and deficits remain at substantially heightened levels.

The Biden budget shows federal debt held by the public rising from 100 percent of GDP in 2020 to 117 percent by 2031. We are not at war, and yet that level of debt is higher than the 31 percent reached in the Civil War, 33 percent reached in World War I, and 106 percent reached in World War II.

Regarding the budget, Treasury Secretary Janet Yellen said, “I believe it is a fiscally responsible program.” Let’s scale the budget figures to family size to see how off-base that claim is. Biden proposes to spend $7.2 trillion this year relying on $3.7 trillion in borrowing, and he proposes to push up accumulated debt from $24 trillion this year to $39 trillion by 2031. That is like a family spending $72,000 this year putting $37,000 on credit cards, and then pushing up family debt from $240,000 to $390,000 as it continues spending more than it earns. Would any financial advisor tell the family that was responsible?

Yellen is apparently trusting administration forecasts that interest rates will remain low such that rising federal debt does not explode budget costs. But macroeconomic forecasting is a terribly inaccurate art. In January 2008, for example, the CBO projected strong and rising economic growth, oblivious that a deep recession had already begun. Nobody knows where interest rates, inflation, and growth will be in coming years, so the responsible thing would be to cut debt now while the economy is growing to help avert a financial crisis down the road if things don’t go as planned.

The administration may think that its new social and infrastructure spending is important, but there is no reason why any of it should be done at the federal level. State legislatures are entirely capable of spending more on everything from highways to paid family leave, if that is what their residents want. Besides, the federal government is already overloaded with more than 2,300 mismanaged subsidy and benefit programs, and there is no way that Congress could properly oversee all the new programs that Biden wants to create.