President Trump’s nomination of Jerome Powell as the next chairman of the Federal Reserve System is a bet that he will continue Janet Yellen’s policies and not rock financial markets. The expectation is that Powell will follow the Fed’s already-announced normalization schedule, which calls for slowly reducing the Fed’s $4.2 trillion balance sheet, by rolling off maturing mortgage-backed securities (MBS) and longer-term Treasuries, and gradually increasing the target range for the fed funds rate.[1]

The presidential vote of confidence for Powell reflects the White House and Treasury’s desire for low interest rates to fund the public debt and support high asset prices, as well as the probability that the Senate will quickly confirm the nominee.

Mr. Powell also appears open to revisiting financial regulations, such as the Volcker rule and regulations that discriminate against smaller banks. In testimony, before the Senate Committee on Banking, Housing, and Urban Affairs, on June 22, 2017, Governor Powell set forth “Guiding Principles to Simplify and Reduce Regulatory Burden.” One of the key principles is that Fed policymakers “should assess whether we can adjust regulation in common-sense ways that will simplify rules and reduce unnecessary regulatory burden without compromising safety and soundness.” He emphasized that the Fed’s goal should be “to establish a regulatory framework that helps ensure the resiliency of our financial system, the availability of credit, economic growth, and financial market efficiency.” However, during his tenure on the Fed’s Board of Governors since May 2012, he has consistently voted in favor of tightening the Fed’s grip on financial regulation.[2] Thus, one must remain skeptical about whether he would embrace market-friendly deregulation.

Unconventional Monetary Policy and Uncertainty

Unconventional monetary policy — in the form of quantitative easing (i.e., large-scale asset purchases) and ultra-low interest rates — has misallocated credit, distorted interest rates, encouraged risk taking, inflated asset prices, fueled government deficit spending, and done little to promote long-run private investment.[3]

By purchasing massive amounts of high-risk MBS and long-term government bonds, the Fed helped lower longer-term interest rates but steered credit away from private investment, which was also impeded by stricter macro-prudential regulations. Moreover, by keeping short-run interest rates near zero for more than seven years, paying interest on excess reserves (IOER) above the effective fed funds rate, and convincing markets that rates would stay low for a long time (forward guidance), the Fed has increased the reach for yield and appears more interested in priming Wall Street than in letting markets set interest rates and allocate credit.

The Fed’s current operating procedure is to administer the target range for the fed funds rate using IOER and reverse repos, in contrast to the pre-crisis arrangement whereby the Fed’s open market desk bought or sold short-term Treasuries to increase or decrease bank reserves, and then let market participants determine the effective funds rate.[4] As a result, changes in the monetary base are no longer “high powered” — the money multiplier has collapsed and the monetary transmission mechanism that prevailed prior to 2008 is broken.

Unconventional monetary policy, macro-prudential regulation, and the lack of any monetary rule have increased uncertainty about the future of monetary policy and, thus, have had a negative effect on private investment. To his credit, Mr. Powell has recognized some, but not all, of these problems. In January this year, he told members of the American Finance Association in Chicago that “the current extended period of very low nominal rates calls for a high degree of vigilance against the buildup of risks to the stability of the financial system.” However, he downplayed that risk by saying that “the bottom line is that there has not been an excessive buildup of leverage, maturity transformation, or broadly unsustainable asset prices.”[5]

The Limits of Monetary Policy

The purpose of the Bernanke-Yellen monetary policy has been to lower longer-term rates and pump up asset prices creating a wealth effect to spur spending and real economic growth. But there has been a differential impact favoring the housing and government sectors, while private investment has been sluggish due to regime uncertainty, regulatory costs, and a fall in the private saving rate. From a long-run perspective, the Fed cannot permanently increase wealth by monetary policy. Powell recognizes the limits of monetary policy when he notes that “ultimately, the only way to get sustainably higher interest rates is to improve the broader environment for growth, by adopting policies designed to increase productivity and potential output over the long term — policies that are mainly outside the scope of our work at the Federal Reserve.”[6] Recognition of the limits of monetary policy is an important first step toward sound monetary policy.

The Schizophrenic Nature of Fed Policy

In his January speech, however, Powell is silent on the schizophrenic nature of Fed policy — a policy designed to increase risk taking, allocate credit to favored sectors, and stimulate economic activity but that plugs up the monetary transmission mechanism by paying IOER, and discourages lending to productive ventures by an onerous system of macro-prudential regulation. As market analyst Brian Barnier notes, “Low interest rates don’t help if companies face high risk and uncertainty. Central banks that cause volatility and uncertainty have been defeating their own interest rate actions.”

Normalizing Monetary Policy and Instituting a Rules-Based Regime

Regime uncertainty could be reduced by first normalizing monetary policy by reducing the size of the Fed’s balance sheet and ultimately eliminating IOER and restoring a market-driven fed funds rate. A rule-based monetary regime could then be instituted to guide monetary policy. In the present unconventional regime — with the absence of a competitively determined fed funds rate and a weak link between base money (i.e., currency in circulation plus bank reserves), broad monetary aggregates, and nominal GDP — the implementation of monetary rules such as the Taylor rule and a final demand rule would fail.

Under unconventional monetary policy, we therefore are stuck in a fully discretionary fiat money regime — and, thus, in a fog of uncertainty. Maintaining such a system ignores the institutional uncertainty brought about by not having a credible monetary rule. Such a rule would help depoliticize monetary policy and incentivize the Fed to take a long-run perspective, thereby reducing uncertainty.[7] As Karl Brunner has pointed out regarding the knowledge problem facing monetary policymakers,

We suffer neither under total ignorance nor do we enjoy full knowledge. Our life moves in a grey zone of partial knowledge and partial ignorance. More particularly, the products emerging from our professional work reveal a wide range of diffuse uncertainty about the detailed response structure of the economy.… A nonactivist [rules-based] regime emerges under the circumstances … as the safest strategy. It does not assure us that economic fluctuations will be avoided. But it will assure us that monetary policymaking does not impose additional uncertainties … on the market place.[8]

In a speech at the Forecasters Club of New York in February, Powell argued that monetary rules can help guide policy, but he sees those rules as too simple to take account of the complexity confronting policymakers. He has in mind the Taylor rule, which would set the nominal fed funds rate based on a single equation:

(1) R = r* + π + a (π – πLR) + b (gap)

where

R = nominal federal funds rate

r* = neutral real federal funds rate

π = the inflation rate

πLR = 2 percent

gap = percentage deviation of output from its potential level or unemployment from its natural rate.

Taylor, in his 1993 article, set a = 0.5 and b = 0.5.

According to Powell,

I think it’s fair to say that simple policy rules are widely thought to be both interesting and useful, but to represent only a small part of the analysis needed to assess the appropriate path for policy. I am unable to think of any critical, complex human activity that could be safely reduced to a simple summary equation. In particular, no major central bank uses policy rules in a prescriptive way, and it is hard to predict the consequences of requiring the FOMC to do so, as some have proposed. Policy should be systematic, but not automatic.

In fact, complexity is what makes a rules-based regime desirable. No one on the Federal Reserve Board or the Federal Open Market Committee predicted the 2008 financial crisis. The purpose of a systematic, rules-based monetary regime is to keep the economy on track and prevent a sharp decline in final demand. No rule can be perfect; there is always a learning process. But as Brunner noted, a nonactivist rule would reduce uncertainty inherent in a period-by-period discretionary monetary regime. A long-run strategy based on achieving a stable growth path of nominal final demand would avoid the type of errors associated with a purely discretionary regime.

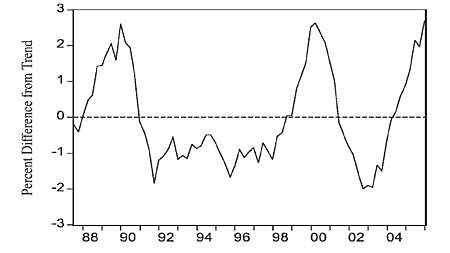

The Great Moderation and the Case for a Final Demand Rule

During the “Great Moderation” (1987–2006), under Fed chairman Alan Greenspan, the trend rate of growth of final demand, as measured by nominal final sales to domestic purchasers (FSDP), was 5.4 percent per year — split into real growth of 3 percent and inflation of 2.4 percent.[9] Cato’s former chairman Bill Niskanen found that variation around that trend “had significant effects on asset prices and the real economy, and most of this variation was a consequence of the Fed’s response to financial crises.” Figure 1 from his 2006 Cato Journal article is reproduced below.

Figure 1: Nominal Final Sales to Domestic Purchasers

Based on his research, Niskanen concluded that the Greenspan Fed implicitly followed a final demand rule but that it overreacted in increasing demand when faced with financial crises. Niskanen sees the primary duty of the Fed as maintaining “a steady increase in aggregate demand consistent with a low target rate of inflation.”

The Great Moderation was also in line with the Taylor rule but that rule depends on knowledge of r* and the output gap, both of which are difficult to estimate. As Powell noted in his February speech, “The neutral rate changes significantly over time, and estimates of its level entail substantial uncertainty.” Moreover, “there is particularly high uncertainty about measuring the deviation of output from its potential,” and the values of the coefficients, a and b, in Taylor’s rule need to be specified.

Niskanen prefers a final demand rule over an interest rate rule, in part, because it does not require imputing values to r*, or estimating the output gap.[10] In the 2009 edition of Cato’s Handbook for Policymakers, he recommended that “Congress should amend the Full Employment and Balanced Growth Act of 1978 to clarify the congressional guidance on the conduct of monetary policy.” In particular, he argued that

Congress is best advised (1) to specify a target rate of increase of final sales and (2) to instruct the Federal Reserve to minimize the variance around this target rate. The target rate of increase of final sales may best be about 5 percent a year, sufficient to finance a realistic rate of economic growth of 3 percent and an acceptable rate of inflation of about 2 percent.[11]

Niskanen saw nominal FSDP as “a feasible target” because it is “almost completely determined by U.S. monetary policy, whereas the rate of economic growth and the inflation rate are separately affected by a variety of domestic and foreign conditions.” The problem is that, under the Fed’s current operating procedure, the link between base money creation and final demand has been severed. Moving to a rules-based regime thus requires normalizing monetary policy and restoring the monetary transmission mechanism as discussed earlier.

Some congressional leaders think it’s time to create a rules-based monetary regime. The Financial CHOICE Act of 2017 (H.R 10), which recently passed the House, would make the Fed responsible for specifying a monetary rule and justifying to Congress any deviations from it.[12] Whether the CHOICE Act passes or not, it is important to consider alternative monetary rules and to be prepared to make the case for rules over discretion when the opportunity for reform arises.

The Phillips Curve Is a Poor Guide for Monetary Policy

The Phillips Curve model of the economy, which posits an inverse relationship between unemployment and inflation, has been a poor guide for monetary policy, yet the Fed still incorporates that relationship into its thinking.[13] With the rate of unemployment now at 4.1 percent, policymakers are puzzled why inflation hasn’t increased to the Fed’s target of 2 percent. They could look to their own operating procedures used since October 2008. Without IOER and Dodd-Frank type regulations, banks would be lending more, and base money would have a stronger impact on overall money growth and the price level.

Powell’s Challenge

Mr. Powell, no doubt, will be under pressure from the White House and Treasury to keep rates low — even if markets are pushing them upward. Intervening to postpone necessary adjustments, however, would only complicate future policy changes and increase the costs of adjustment.

It is essential that Powell understand the risks involved in the post-2008 operating techniques and the underpricing of risk that unconventional monetary policy has occasioned. His challenge will be making the transformation to a new policy regime that gets the Fed out of the business of allocating credit and pegging interest rates at artificial levels.

Conclusion

Congress has ultimate authority for monetary policy. During the confirmation process, there needs to be a discussion of the limits of monetary policy and how Mr. Powell sees the future of monetary policy, and the steps he would take in a crisis situation. Finally, Congress needs to make the Fed accountable for its mistakes and ensure it abides by the rule of law.

_____________________

[1] See George Selgin, “Operation SNAIL,” Alt‑M, September 26, 2017.

[2] See Binyamin Appelbaum, “In Choice of Fed Chairman, Trump Downgrades Deregulation,” New York Times, October 29, 2017.

[3] There is no doubt that nonmonetary forces have contributed to historically low interest rates. Real rates have been declining for some time, due to slower productivity growth, demographics, and other factors (see Powell’s January 7, 2017 speech). It is hard to deny, however, that Fed policy has not contributed to the low-interest environment and helped fuel selected asset prices. Indeed, Powell, in his January address to the American Finance Association, argued that, with regard to the impact of “highly accommodative monetary policies, … studies generally show that they lowered rates across the curve and moved other asset prices as well.” At the same time, he admitted that “isolating the effects of these policies is challenging.” If Mr. Powell is correct that rates are mostly reflecting nonmonetary factors, then asset prices may be sustainable, but if he is wrong, then there is a strong possibility that as the Fed exits its unconventional polices, there will be a significant market correction.

[4] For a detailed discussion of the Fed’s pre- and post-crisis operating procedures, see George Selgin, “Interest on Reserves and the Fed’s Balance Sheet,” testimony before the House Subcommittee on Monetary Policy and Trade, May 17, 2016. See also Norbert Michel and Selgin, “Fed Must Stop Rewarding Banks for Not Lending,” American Banker, May 30, 2017.

[5] The IMF is less sanguine. In its latest Global Financial Stability Report (October 2017), the IMF raises “concerns about a continuing buildup in debt loads and overstretched asset valuations [that] could have global economic repercussions” (p. 42).

[6] Jerome Powell, “Low Interest Rates and the Financial System,” Speech at the 77th Annual Meeting of the American Finance Association, Chicago, January 7, 2017.

[7] Thomas Hoenig, vice chairman of the Federal Deposit Insurance Corporation and former president of the Federal Reserve Bank of Kansas, has argued “that monetary and regulatory policies have for some time been overly focused on short-run effects at the expense of long-run goals, which has unintentionally served to increase uncertainty and economic fragility.” See Hoenig, “The Long-Run Imperatives of Monetary Policy and Macroprudential Supervision,” Cato Journal (Spring/Summer 2017), p. 195.

[8] Karl Brunner, “The Control of Monetary Aggregates,” in Controlling Monetary Aggregates III, p. 61. Boston: Federal Reserve Bank of Boston, 1980.

[9] Final sales to domestic producers (FSDP) is defined as “the sum of nominal gross domestic product plus imports minus exports minus the change in private inventories.” See Niskanen, “Monetary Policy and Financial Regulation,” in Cato Handbook for Policymakers (2009), 7th ed., p. 377.

[10] In his 1992 Cato Journal article, “Political Guidance on Monetary Policy,” Niskanen examined three viable monetary rules: (1) targeting the price of gold or a broad price index, (2) targeting a monetary aggregate, and (3) targeting nominal GDP or domestic final sales. He argued that “any one of these rules would be better than guidance based on interest rates or exchange rates, or on any real variable such as the growth of output or the level of the unemployment rate” (p. 281). His preferred rule, however, is to minimize “the variance around an approved target path of nominal domestic final sales” — an objective that “is probably the most that can be expected of monetary policy” (p. 285).

[11] Market monetarists, such as Scott Sumner and David Beckworth, prefer to target nominal GDP (NGDP) rather than final sales. Their arguments for a final demand rule, however, are similar to Niskanen’s. For example, Beckworth argues that “a NGDP target aims to stabilize total dollar spending. It is one target that has embedded in it both the supply of and the demand for money (i.e. total dollar spending = money supply x velocity of money). The beauty of a NGDP target is that the Fed does not need to know what is exactly happening to the money supply or money demand. All the Fed only needs to worry about is the product of the two components. There is no need to track the money supply or estimate money demand. By focusing on total dollar spending, the Fed will be fostering a stable monetary environment where movements in money supply and money demand are offsetting each other.” Bill Woolsey, in comparing a monetary rule targeting NGDP versus one targeting FSDP, finds no significant difference.

[12] See Title X of H.R. 10: “Fed Oversight Reform and Modernization.” H.R. 10 also calls for a Centennial Monetary Commission to examine the Fed’s history and to recommend reforms.

[13] See, e.g., J. A. Dorn, “It’s Time to Bury the Phillips Curve,” Investor’s Business Daily, September 26, 2017.