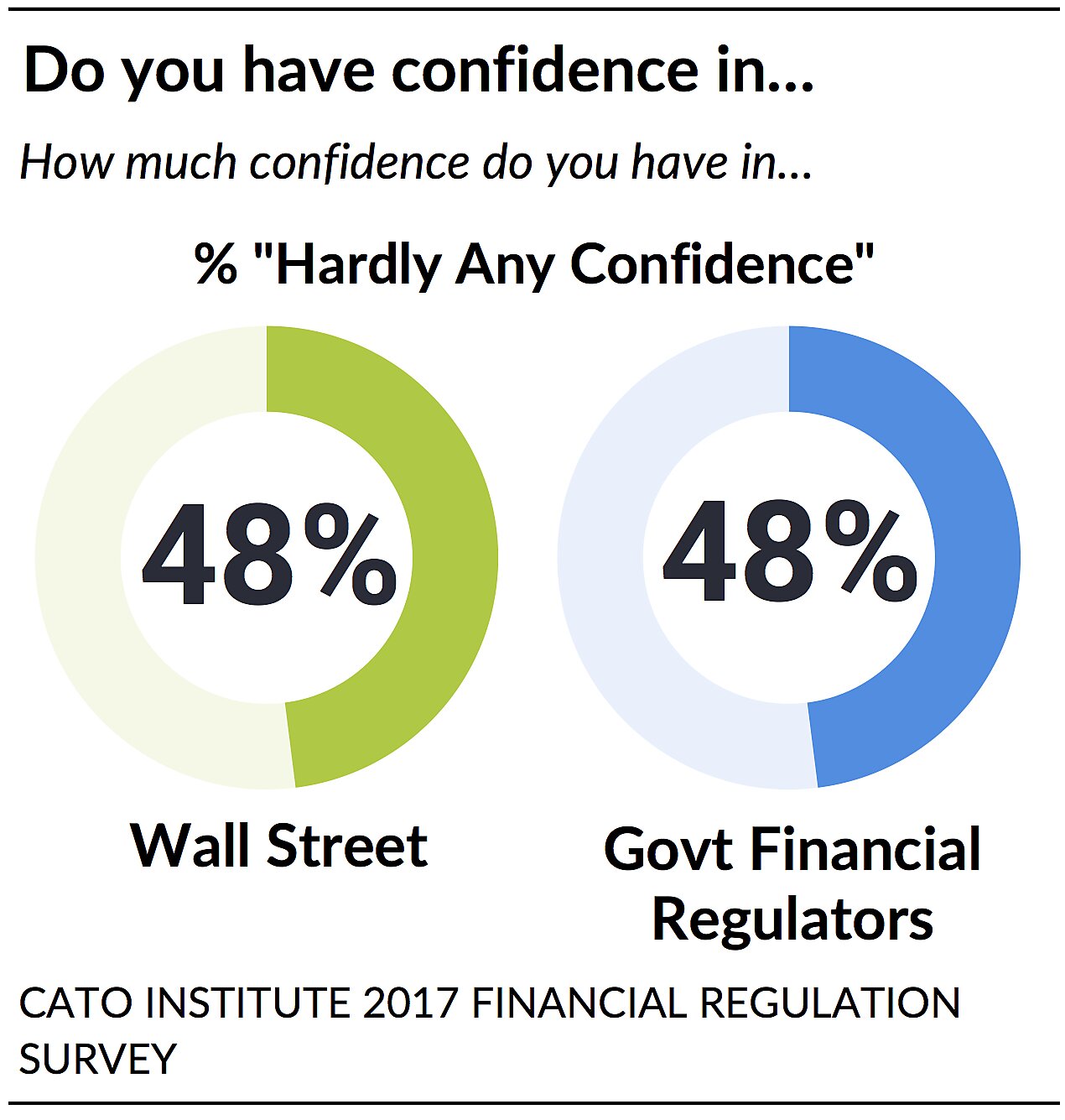

The new Cato Institute 2017 Financial Regulation national survey of 2,000 U.S. adults released today finds that Americans distrust government financial regulators as much as they distrust Wall Street. Nearly half (48%) have “hardly any confidence” in either.

Click here for full survey report

Americans have a love-hate relationship with regulators. Most believe regulators are ineffective, selfish, and biased:

- 74% of Americans believe regulations often fail to have their intended effect.

- 75% believe government financial regulators care more about their own jobs and ambitions than about the well-being of Americans.

- 80% think regulators allow political biases to impact their judgment.

But most also believe regulation can serve some important functions:

- 59% believe regulations, at least in the past, have produced positive benefits.

- 56% say regulations can help make businesses more responsive to people’s needs.

However, Americans do not think that regulators help banks make better business decisions (74%) or better decisions about how much risk to take (68%). Instead, Americans want regulators to focus on preventing banks and financial institutions from committing fraud (65%) and ensuring banks and financial institutions fulfill their obligations to customers (56%).

Americans Are Wary of Wall Street, But Believe It Is Essential

Nearly a decade after the 2008 financial crisis, Americans remain wary of Wall Street.

- 77% believe bankers would harm consumers if they thought they could make a lot of money doing so and get away with it.

- 64% think Wall Street bankers “get paid huge amounts of money” for “essentially tricking people.”

- Nearly half (49%) of Americans worry that corruption in the industry is “widespread” rather than limited to a few institutions.

At the same time, however, most Americans believe Wall Street serves an essential function in our economy.

- 64% believe Wall Street is “essential” because it provides the money businesses need to create jobs and develop new products.

- 59% believe Wall Street and financial institutions are important for helping develop life-saving technologies in medicine.

- 53% believe Wall Street is important for helping develop safety equipment in cars.

Few Americans Want “More” Financial Regulations—They Want the Right Kinds of Regulations, Properly Enforced

Polls routinely find that a plurality or majority of Americans want more oversight of Wall Street banks and financial institutions. This survey is no different. A plurality (41%) of Americans think more oversight of the financial industry is needed. However, only 18% think the problem with federal oversight of the banking industry is that there are “too few” rules on Wall Street. Instead, 63% say the government either fails to “properly enforce existing rules” (40%) or enacts the “wrong kinds” of regulations on big banks (23%).

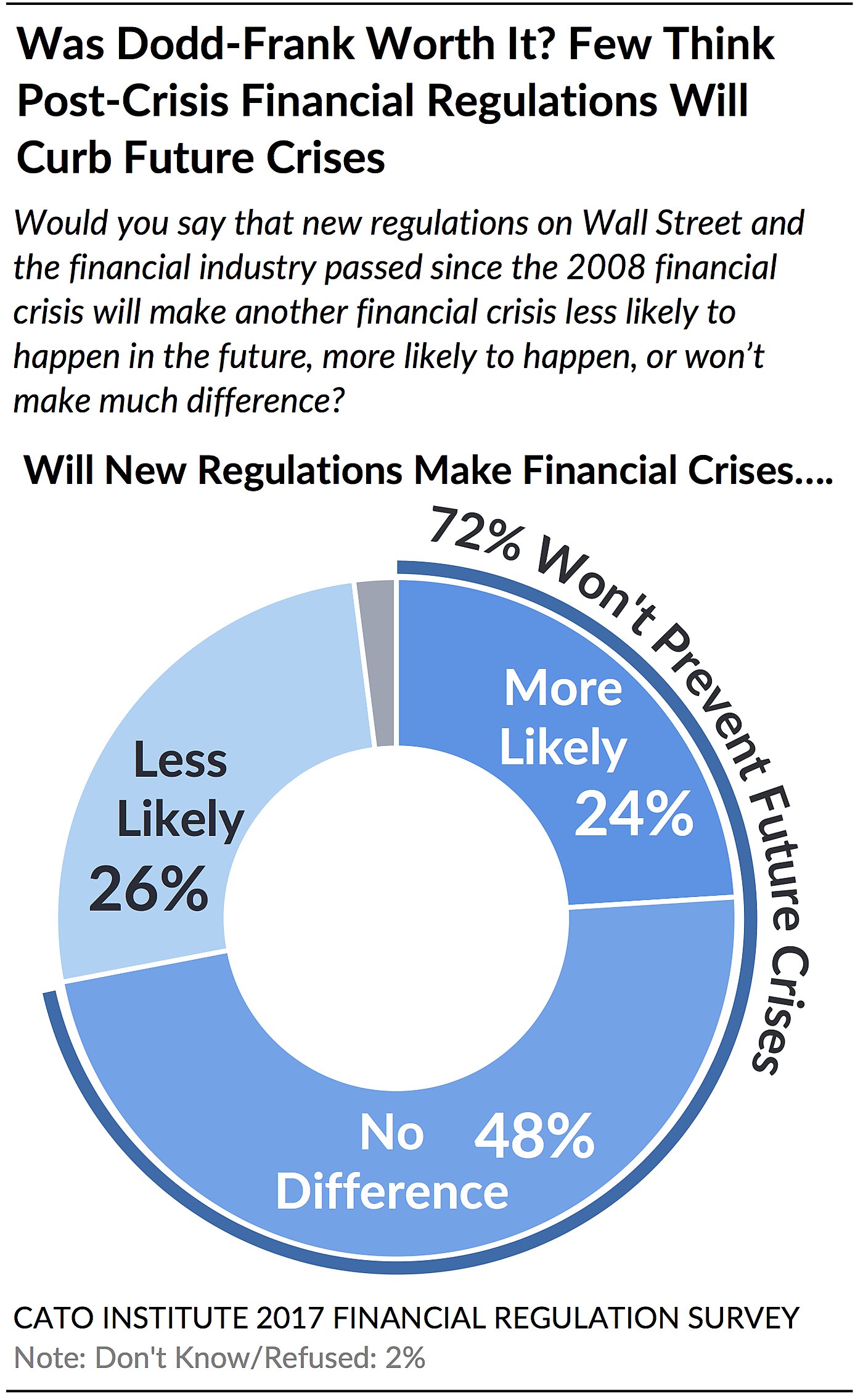

Most Are Skeptical Dodd-Frank Will Prevent Future Financial Crises

Will Dodd-Frank financial reforms work? Nearly three-fourths (72%) of Americans don’t believe that new regulations on Wall Street and the financial industry passed since the 2008 financial crisis will make future crises less likely. Just over a quarter (26%) believe such regulations will make future financial downturns less likely.

Americans Oppose Too Big to Fail

Americans reject the idea that some banks are so important to the U.S. economy that they should receive taxpayer dollars when facing bankruptcy. Instead, 65% say that “any bank and financial institution” should be allowed to fail if it can no longer meet its obligations. A third (32%), however, believe that some banks are too important to the U.S. financial system to be allowed to fail.

- Part of the reason most oppose the “Too Big to Fail” model may be that 60% believe that banks would make better financial decisions if they were convinced government would let them go out of business.

- Clinton voters (41%) are about twice as likely as Trump voters (20%) to believe some banks are too integral to the U.S. economy to fail. Libertarians are most opposed (81%) to bailing out banks.

Despite Distrust of Wall Street, Americans Like Their Own Banks and Financial Institutions

- 90% are satisfied with their personal bank; 76% believe their bank has given them good information about the rates and risks associated with their account.

- 87% are satisfied with their credit card issuer; 81% believe their credit card issuer has given them good information about the rates, fees, and risks associated with their card.

- 83% are satisfied with their mortgage lender.

- Of those who have used payday or installment lenders in the past year, 63% believe the lender gave them good information about the fees and risks associated with the loan.[1]

Americans Want Regulators to Prioritize Fraud Protection, Ensure Banks Keep Promises

Financial regulators have a variety of tasks and goals. The public, however, believes that regulation should serve two primary functions: to protect consumers from fraud (65%) and to ensure banks fulfill obligations to their account holders (56%). Other initiatives such as restricting access to risky financial products (13%) is a priority among far fewer people.

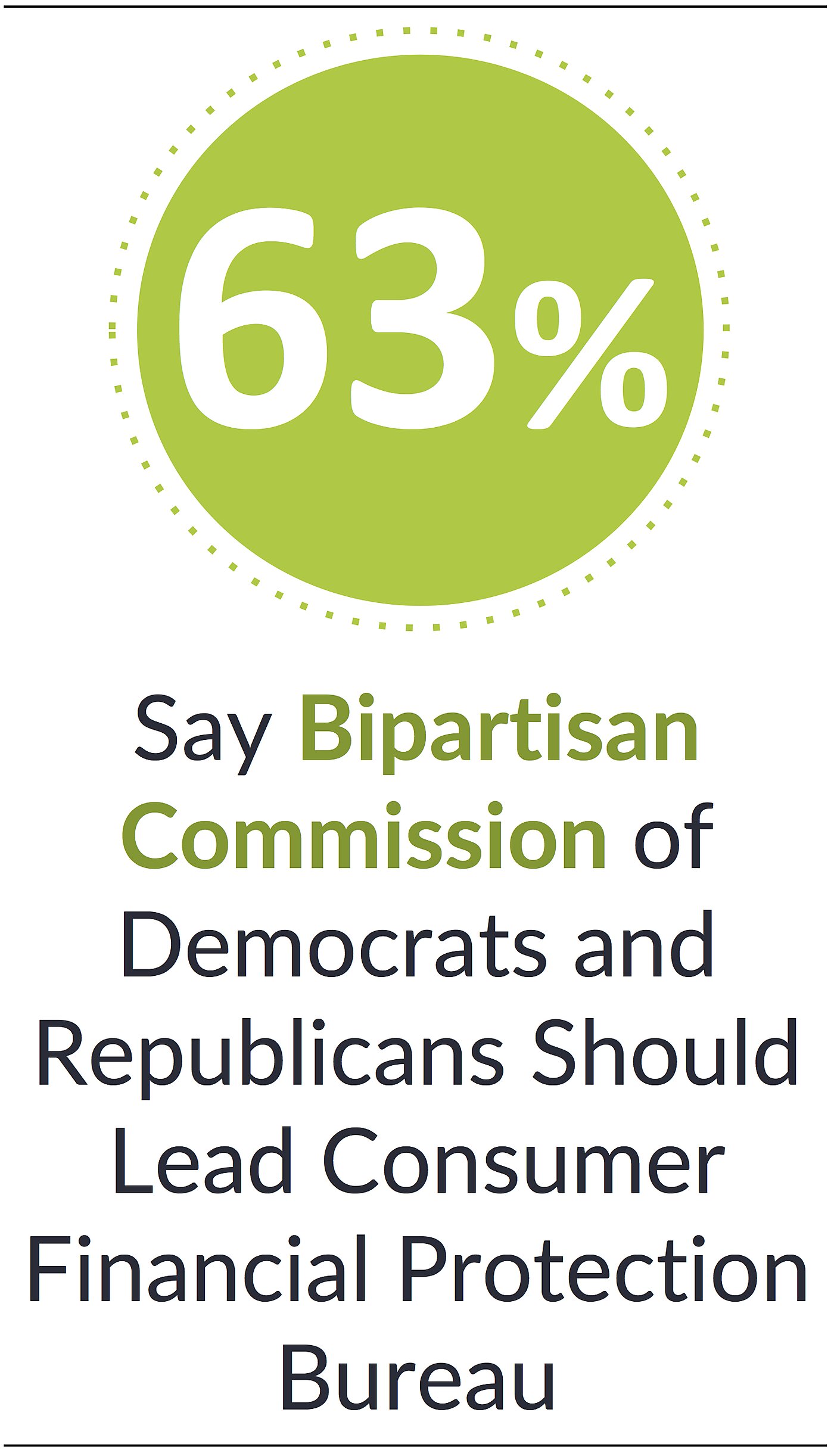

Democrats and Republicans Want a Bipartisan Commission to Run CFPB, Divided on CFPB Independence

- Most support changing the structure of the Consumer Financial Protection Bureau (CFPB), a new federal agency created by Dodd-Frank in 2011. Nearly two-thirds (63%) of Americans think the CFPB should be run by a bipartisan commission of Democrats and Republicans, rather than by a single director. Support is post-partisan with 67% of Democrats and 64% of Republicans in favor of a bipartisan commission leading the agency.

- A majority (54%) of Americans think that Congress should not set the CFPB’s budget and should only have limited oversight of the agency. Given that only 7% of the country has confidence in Congress, these numbers are not surprising. A majority of Democrats (58%) support keeping the CFPB independent while a plurality of Republicans (50%) say Congress should closely oversee the new agency and set its budget.

- Few Americans (26%) believe the CFPB has achieved its mission to make the terms and conditions of credit cards and financial products easier to understand. Instead, 71% say that since the CFPB was created in 2011 credit card terms and conditions have not become easier to understand—including 54% who believe they have stayed the same and 17% who think they have become less clear.

Americans as Likely to Say CEOs, NFL Football and NBA Basketball Players Are Overpaid, But Most Oppose Government Regulating Pay

Americans are about equally likely to think that CEOs (73%) and professional athletes like NBA players (74%) and NFL players (72%) are paid “too much.” Yet, the public doesn’t think the government ought to regulate the salaries of either corporate executives (53%) or professional athletes like NBA players (69%). Nonetheless, there is more support for regulating CEO pay (43%) than NBA salaries (28%).

Notably, compared to CEOs (73%) and NBA players (74%), far fewer believe that major tech company entrepreneurs are overpaid (51%).

Democrats support (56%) government regulating the salaries of CEOs but oppose regulating salaries of NBA players (66%) and famous actors (69%). In contrast, about 7 in 10 Republicans oppose government regulating the salaries of all three professions, even though they are more likely than Democrats to believe NBA players (60% vs. 47%) and famous actors (59% vs. 37%) are overpaid.

Most Support Risk-Based Pricing for Loans, Say Low Credit Scores are Due to Irresponsibility

Nearly three-fourths of Americans (74%) say they’d be “unwilling” to pay more for their home mortgage, car loan, or student loan to help those with low credit scores access these loans.

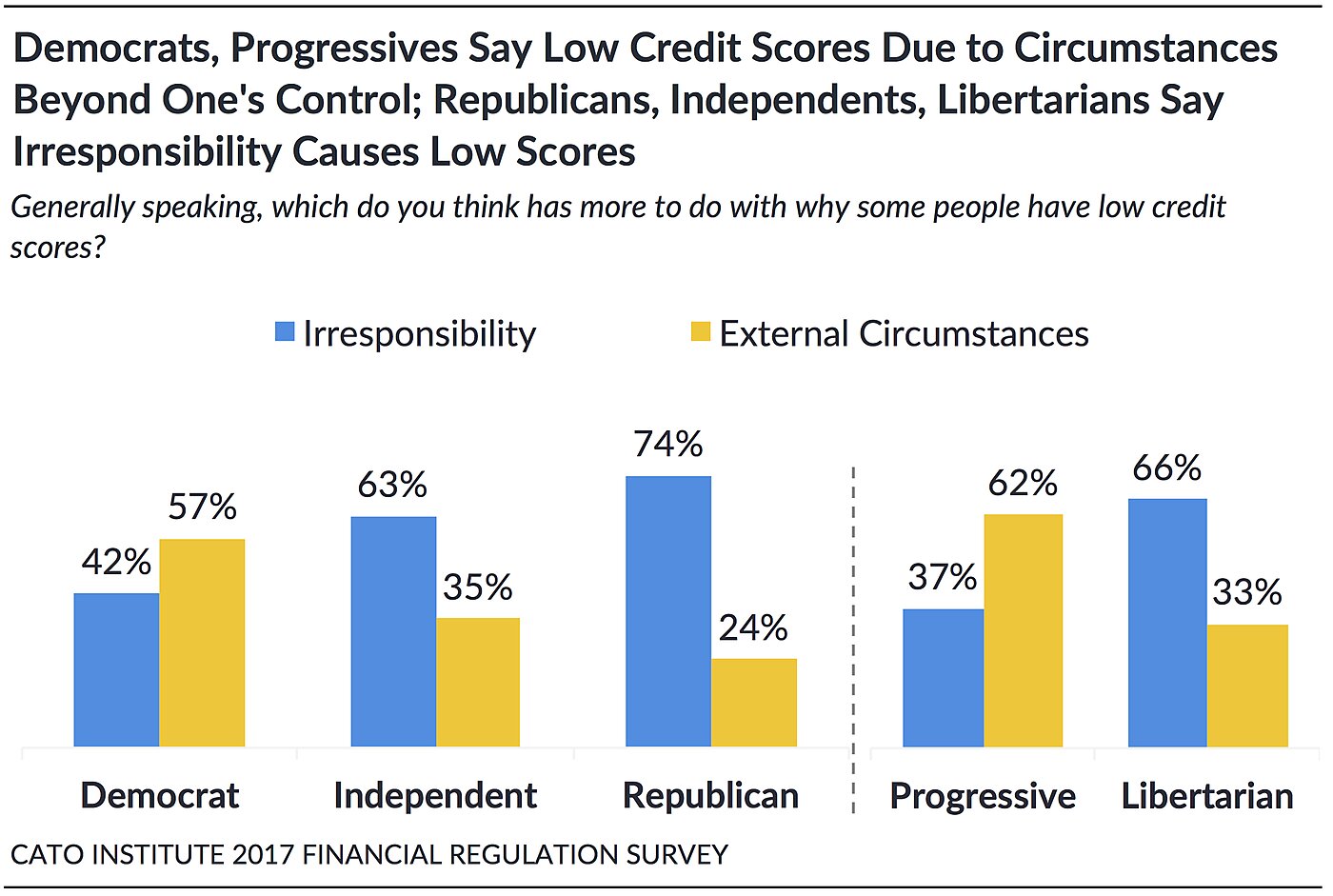

Americans may be unwilling to pay more to help those with low credit scores in part because a majority (58%) believe low credit scores are primarily due to irresponsibility, rather than circumstances beyond a person’s control (41%).

- Partisans sharply disagree about the cause of a low credit score. Most Democrats (57%) say low scores are primarily the result of “circumstances beyond [one’s] control” while 74% of Republicans and 63% of independents say “irresponsibility” is the primary cause.

Americans are Unsure if Banks Charging Some People Higher Interest Rates is Justified or Predatory

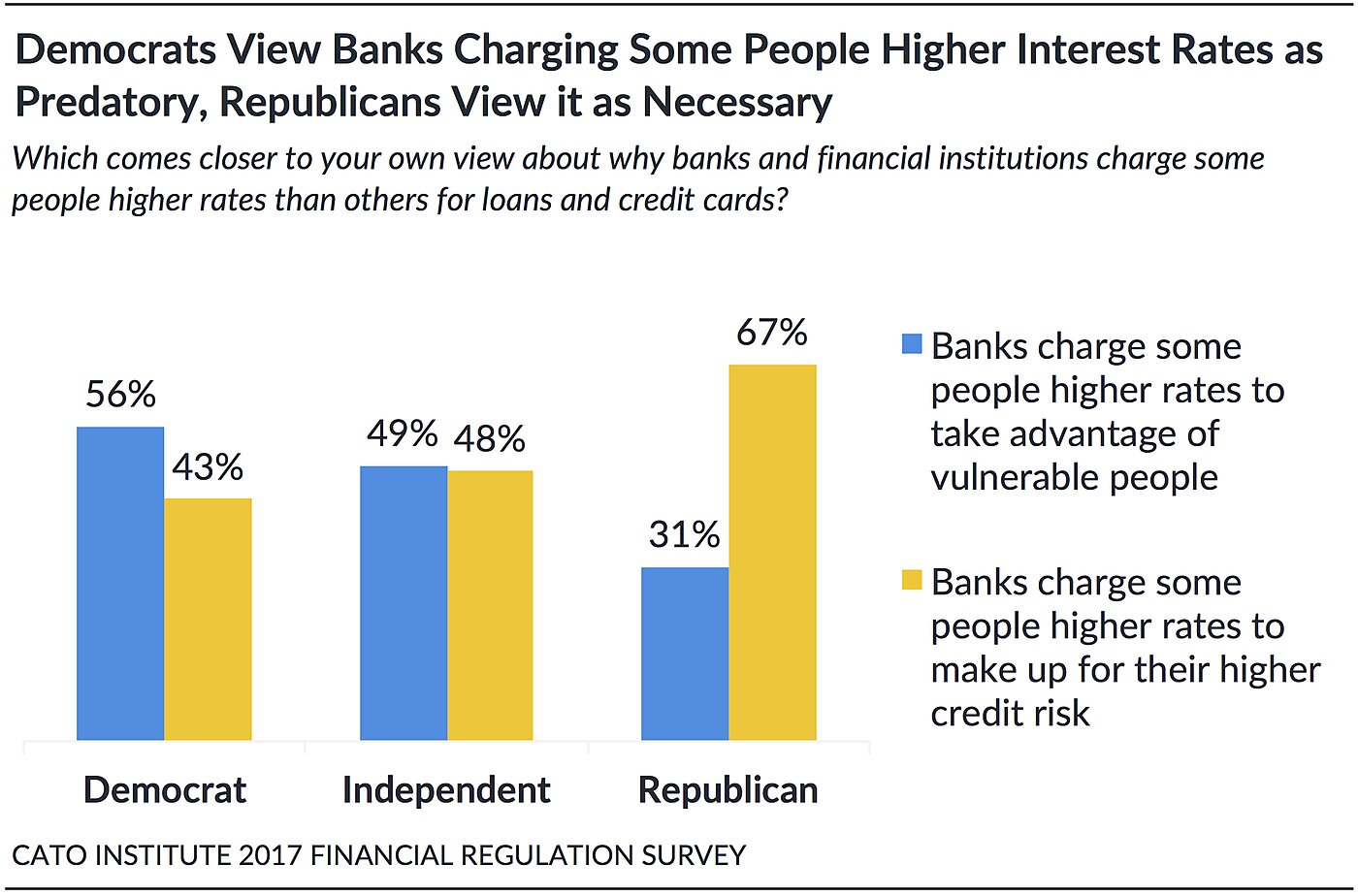

A slim majority (52%) believe banks and financial institutions need to charge some people higher interest rates for loans and credit cards if those individuals present higher credit risks. Another 46% believe banks charge some people higher rates for loans in order to take advantage of those with few other options.

- Partisans disagree about why banks charge people different rates. A majority (56%) of Democrats believe lenders charge some people higher interest rates because they are predatory and take advantage of the vulnerable. In contrast, two-thirds (67%) of Republicans believe banks need to do this to compensate themselves for some borrowers’ greater credit risk.

Most Oppose Accredited Investor Standard, Say Law Should Not Restrict Investment Options Based on Wealth

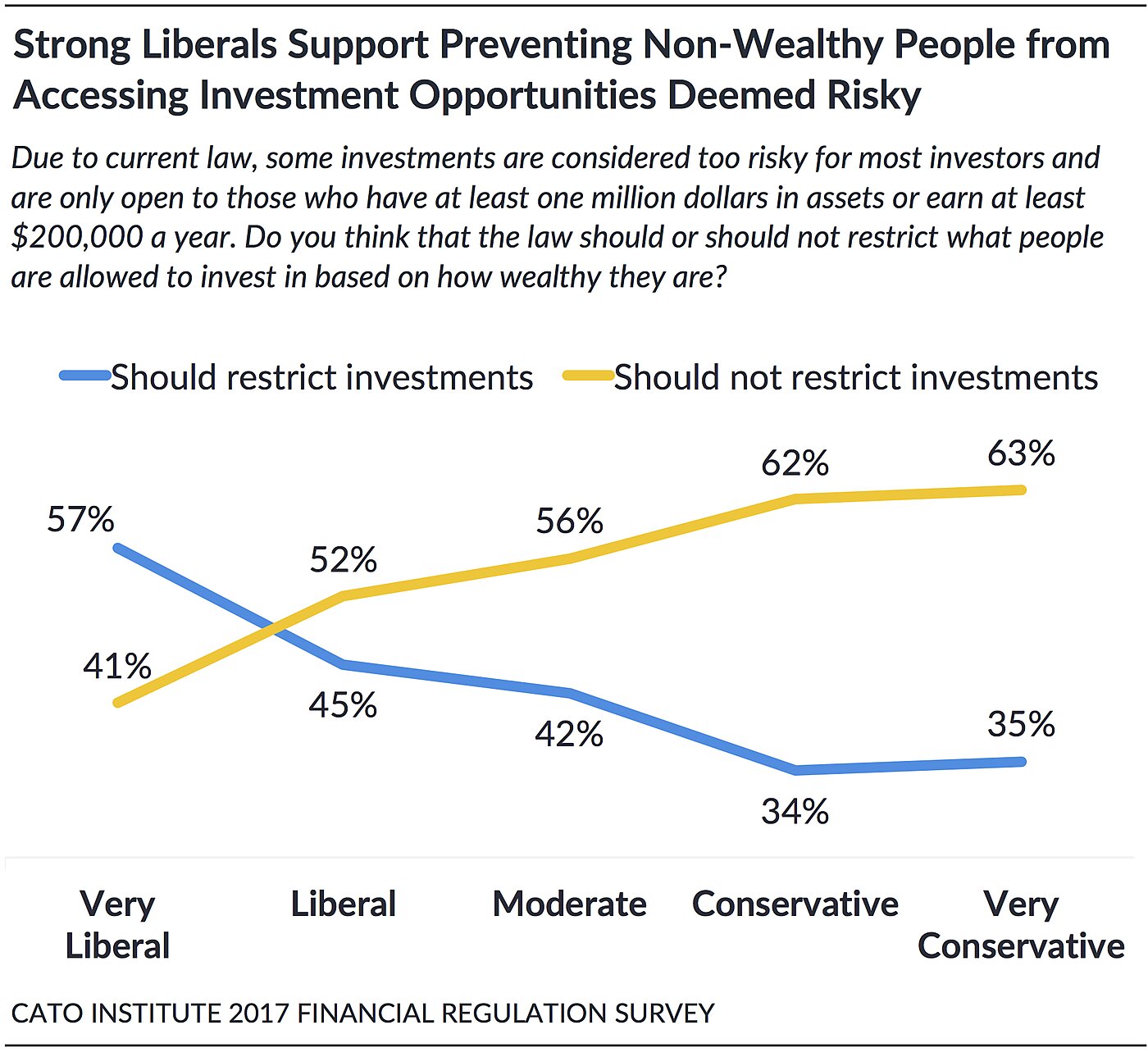

Due to current law, some investments are deemed too risky for the common investor and are only available to those with one million dollars in assets or who make $200,000 or more a year. However, a majority of Americans (58%) say the law should not restrict what people are allowed to invest in based on their wealth or income—even if the investments in question are risky. Thirty-nine percent (39%) think the law should restrict access to certain investments deemed risky.

- Strong liberals are unique in their support (57%) of government restricting access to risky investments based on a person’s wealth. Support drops to 45% among moderate liberals and to a third among conservatives.

Most Support Helping Low-Income Families Own Homes Unless Policies Escalate Mortgage Defaults

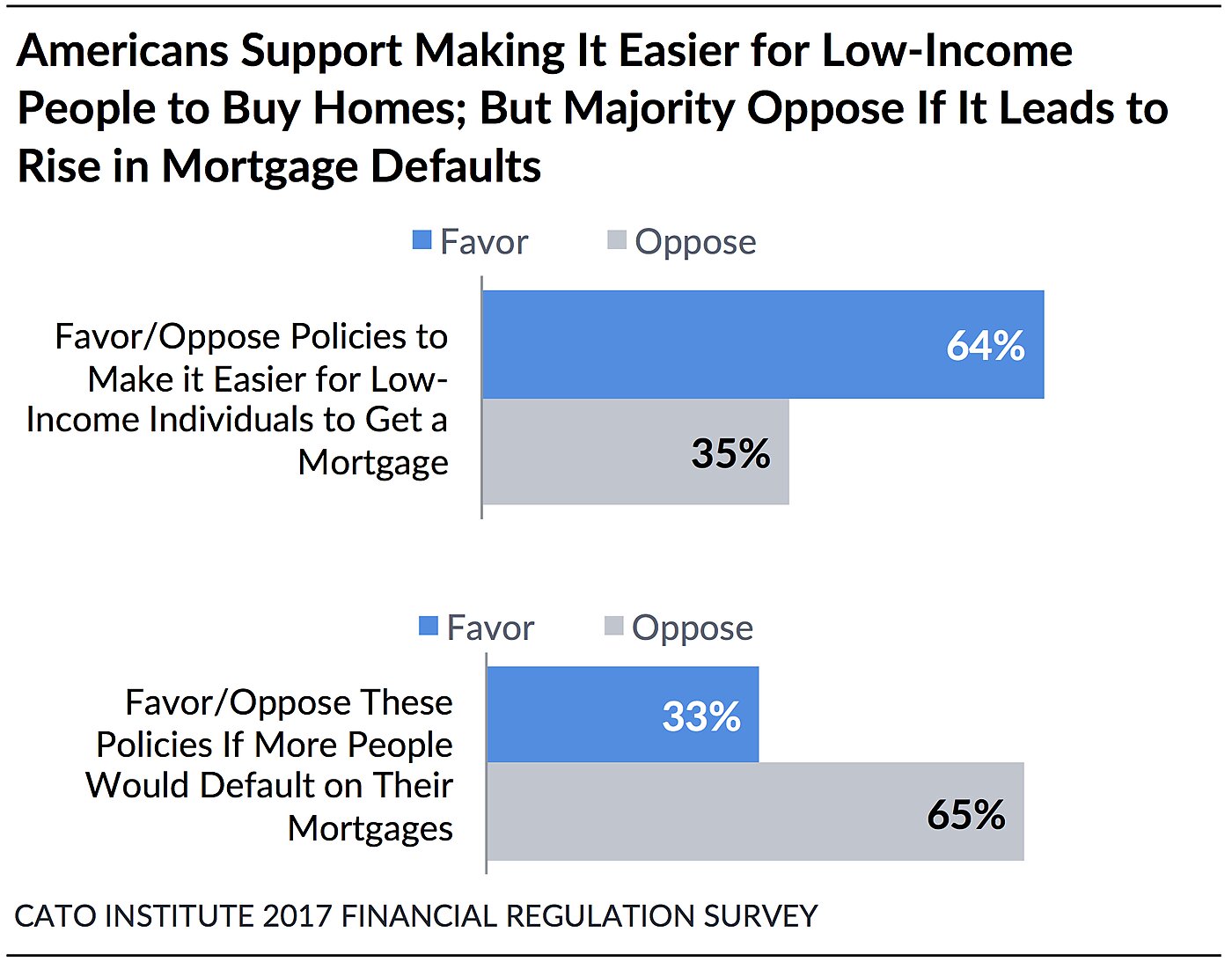

Nearly two-thirds (64%) of the public support government policies intended to make it easier for low-income families to obtain a mortgage. However, a majority (66%) would oppose such policies if they resulted in more mortgage defaults and home foreclosures.

43% of Americans Would Pay for $500 Unexpected Expense with Savings

Less than half (43%) of Americans say they would pay for an unexpected $500 expense using money from savings or checking. The remainder would put the expense on a credit card (23%), ask family and friends for money (8%), sell something (7%), borrow the money from a bank or payday lender (5%), or simply not be able to pay it (12%).[2]

Most Say Bad Financial Decisionmaking Due to Lack of Financial Education and Self-Discipline

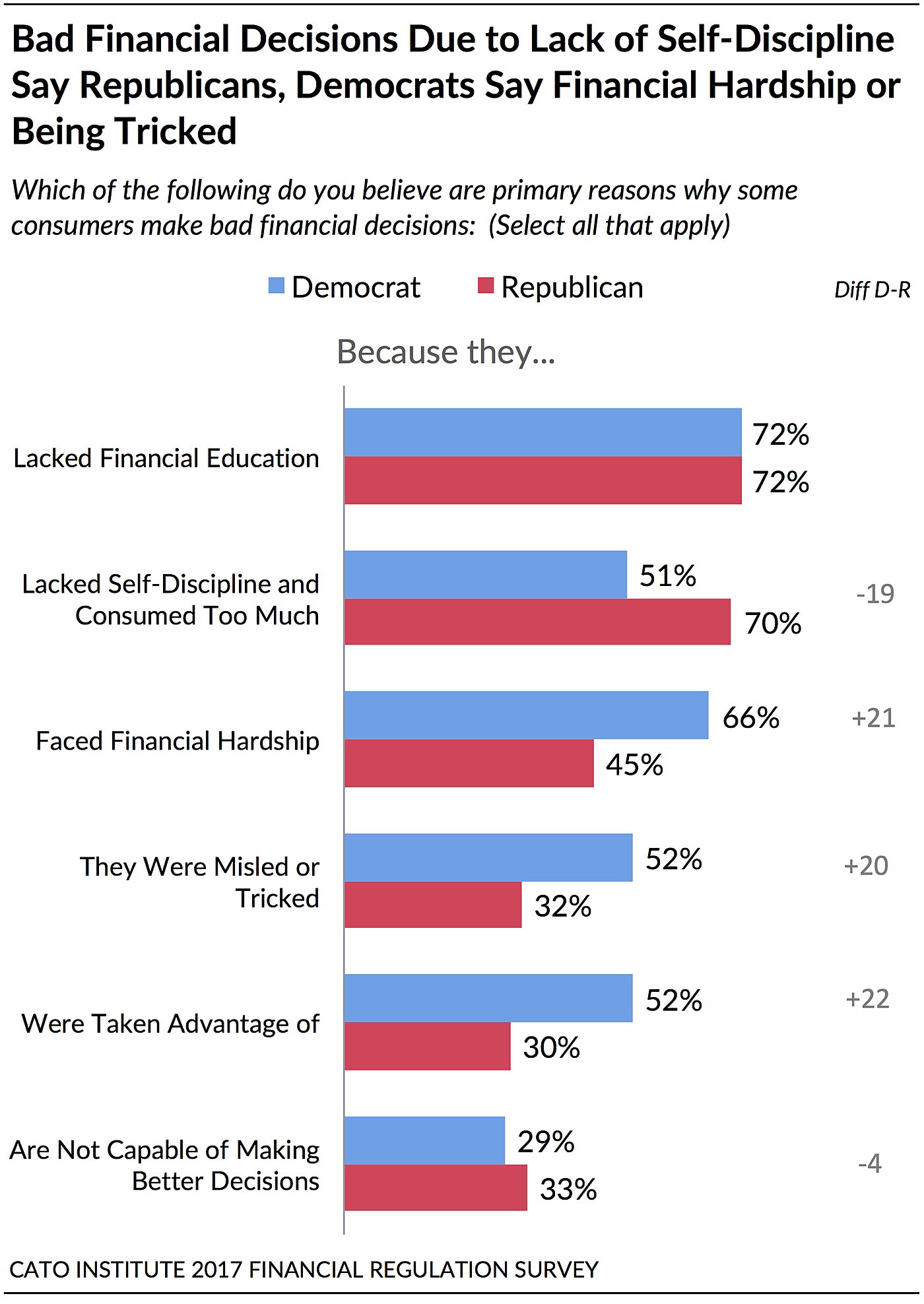

The public says the top three reasons consumers make bad financial decisions include lacking financial education (70%), lacking self-discipline (60%), and facing financial hardship (54%). Less than half say that consumers being “misled or tricked” (43%), taken advantage of (42%), or incapable (30%) are primary causes.

- Both Democrats (72%) and Republicans (72%) agree that a lack of financial education is key.

- Republicans (70%) are nearly 20 points more likely than Democrats (51%) to say that a lack of self-discipline is a primary reason for unwise decisionmaking.

- Democrats are roughly 20 points more likely than Republicans to say that poor financial decisionmaking is due to external circumstances such as financial hardship (66% vs. 45%), being tricked (52% vs. 32%), or being taken advantage of (52% vs. 30%).

Most Say Government Should Allow Individuals to Make Their Own Financial Decisions—Even If They Make the Wrong Ones

When it comes to promoting and managing consumers’ financial health, most believe (58%) that individuals “should be allowed to make their own decisions even if they make the wrong ones.” However, 4 in 10 say that sometimes government regulators “need to write laws that prevent people from making bad decisions.”

- A majority of Democrats (57%) believe that sometimes regulators need to write laws that protect people from making bad decisions

- Majorities of Republicans (73%) and independents (69%) don’t think government should restrict people’s financial choices to protect them.

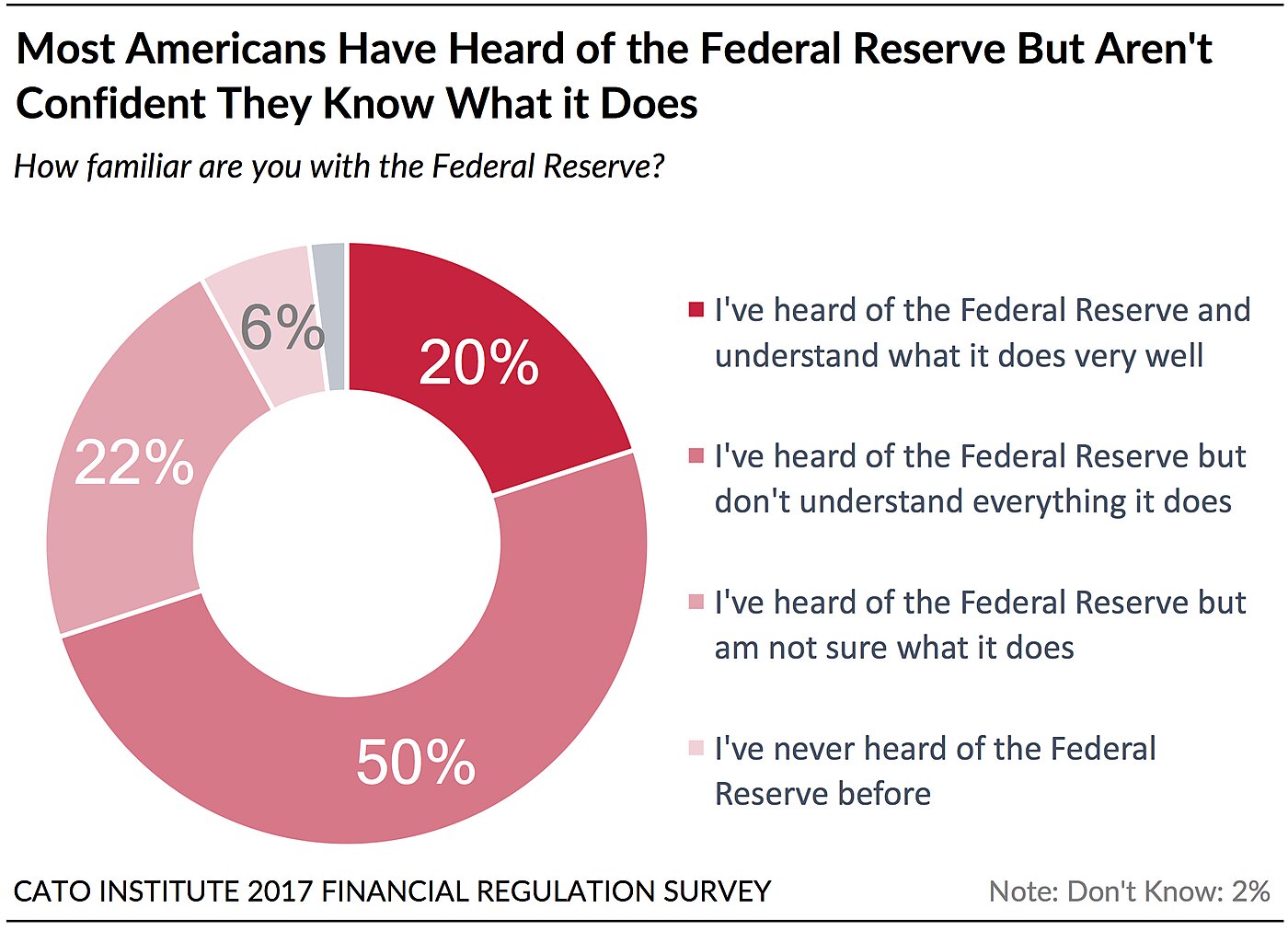

Few Americans Know a Lot about the Federal Reserve; Among Those Informed, the Fed Polarizes Partisans

- Only 20% of Americans say they have heard of the Federal Reserve and understand what it does very well. Half (50%) have heard of the Fed but don’t understand everything it does; 22% have heard of the Fed but don’t know what it does while 6% have never heard of it.

- Tea Partiers (67%), libertarians (57%) and conservatives (50%) are about three times as likely as liberals (19%) to say the Fed has “too much power.”

- Pluralities of libertarians (50%) and strong conservatives (50%) believe the Fed helped cause the 2008 financial crisis. In contrast, a plurality of liberals (43%) believe the Fed cut the crisis short.

- Among those with an opinion, 68% of Democrats want Federal Reserve officials to primarily determine interest rates in the economy. Conversely, 74% of Republicans want the free-market system to do this.

Click here for full poll results and methodological information

Sign up here to receive forthcoming Cato Institute survey reports

The Cato Institute 2017 Financial Regulation Survey was designed and conducted by the Cato Institute in collaboration with YouGov. YouGov collected responses online May 24–31, 2017 from a national sample of 2,000 Americans 18 years of age and older. Restrictions are put in place to ensure that only the people selected and contacted by YouGov are allowed to participate. The margin of error for the survey is +/- 2.17 percentage points at the 95% level of confidence.