In case anyone wonders why I haven’t posted for a while, it’s because I’m supposed to be working on my Little Fed Book. I say “supposed to be” because it isn’t the actual writing of that book that’s kept me from posting here. It’s the writer’s block that’s had me in its grip, as it does for a while each time I’m supposed to start a big project.

This time ‘round part of the problem is that I decided to begin by writing about an episode concerning which I knew relatively little: the story of the Second Bank of the United States. Once that was out of the way, I figured, the rest would be downhill. I hadn’t reckoned on the slogging it would take to get elevated in the first place.

I knew the basics well enough from teaching them: the post-1811 state banking boom and subsequent suspensions; the calls for a new Federal bank to see to a quick resumption of specie payments and to supply a “uniform” paper currency; Jackson’s famous veto aimed at foiling its supporters’ attempt to renew the Bank’s charter; and the subsequent “Bank War” in which Jackson and Biddle traded blows aimed in the one case at assuring the Bank’s demise and in the other at undermining the Bank’s opponents by making their actions appear responsible for plunging the country into a depression. I also knew where to look for evidence concerning the Bank’s actual conduct. But the more I studied those sources, the more I realized that I needed a better framework by which to understand the Bank’s relations with state-chartered banks. In particular, I needed to better understand why its relations with Northeastern banks tended to differ from those with banks elsewhere, as well as why its conduct toward other banks changed over time.

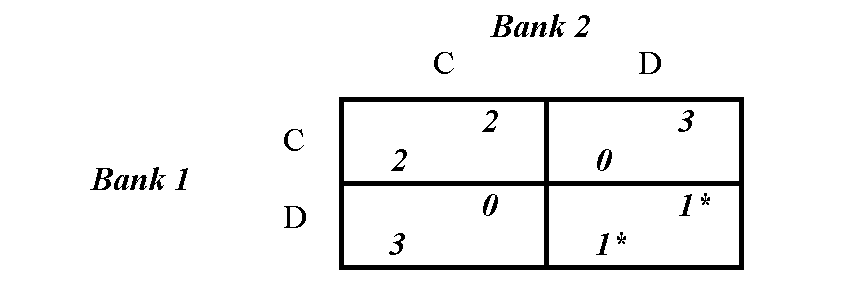

When, while straightening up the mess in my office (my favorite writer’s‑block therapy), I happened to come across a paper I wrote in grad school called “A Game Theory Illustration of Bank Competition,” it occurred to me that game theory might be a good way to come to terms with the Second B.U.S. In the paper I represented the banking “game” as one in which a player might choose either to cooperate with a rival by accumulating or reissuing the rival’s notes, or to defect by returning those notes for redemption in specie. When the players are equally privileged, the payoffs are symmetrical. Moreover, because mixed strategies (that is, those in which one bank cooperates while the other defects) involve persistent reserve gains by the defecting bank, and persistent losses by the cooperative “sucker,” the payoffs are those of a Prisoner’s Dilemma. All-around defection is therefore the unique Nash Equilibrium:

The banks end up, in other words, taking part in the routine (say, daily) exchange and settlement of claims, including checks as well as notes, with specie alone being treated as a reserve asset. The system’s capacity for expansion will then depend solely on the available stock of specie reserves and what banks determine to be their optimal specie reserve ratios.

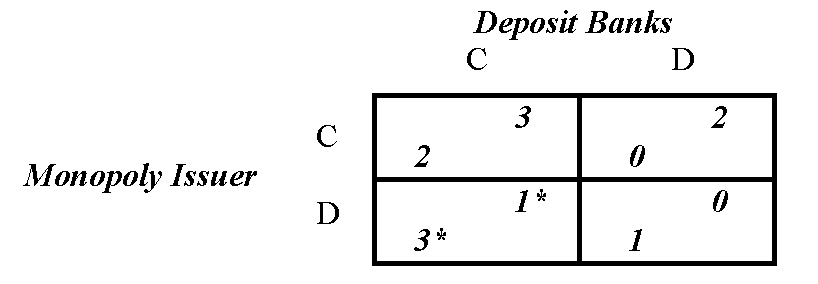

To appreciate the strategies employed by the second Bank, it helps to first consider the situation faced by a “pure” currency monopolist, meaning a bank that enjoys an irrevocable, exclusive privilege of issuing paper money. Because the public ordinarily finds paper more convenient than gold, the privileged bank’s monopoly causes other banks to treat its notes and other claims against it that are readily convertible into its notes as superior substitutes, in “normal” times at least, to specie. The relative payoffs to the less privileged bank or banks for cooperating versus defecting are then more or less the reverse of those for the game involving equal rivals, giving rise to a mixed-strategy Nash Equilibrium in which the less privileged banks hold and reissue the privileged bank’s notes, perhaps even lodging their specie with it, while it nevertheless continues to redeem any items it collects from them:

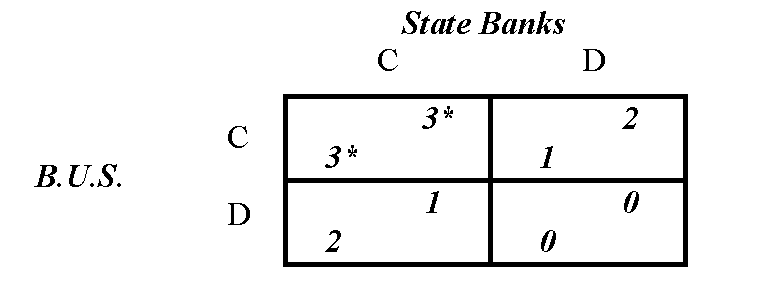

In what ways did the situation confronting the Second Bank of the United States differ from that faced by our “pure” currency monopolist? First of all the Bank’s charter, rather than granting it irrevocable privileges, was to lapse after two decades unless renewed by a Congressional vote. That meant that the Bank had to take into account the political consequences of its actions, including the possibility that, by making life difficult for state banks, it might discourage legislators in the affected states from voting for its renewal. Concern about renewal prospects would incline the Bank to assign lower payoffs for defection than those a pure monopolist might anticipate. This change alone might suffice to give rise to a cooperative Nash Equilibrium, that is, one in which the state and Federal banks elect to “live and let live”:

Second, the Bank’s privileges did not include an outright currency monopoly. Instead they consisted mainly of its status as a government depository, together with its ability to establish branches anywhere, which allowed its notes to command the same value everywhere, and therefore to be uniquely useful in interstate commerce. The notes of state chartered banks, in contrast, tended to be discounted as they traveled beyond their place of issue.

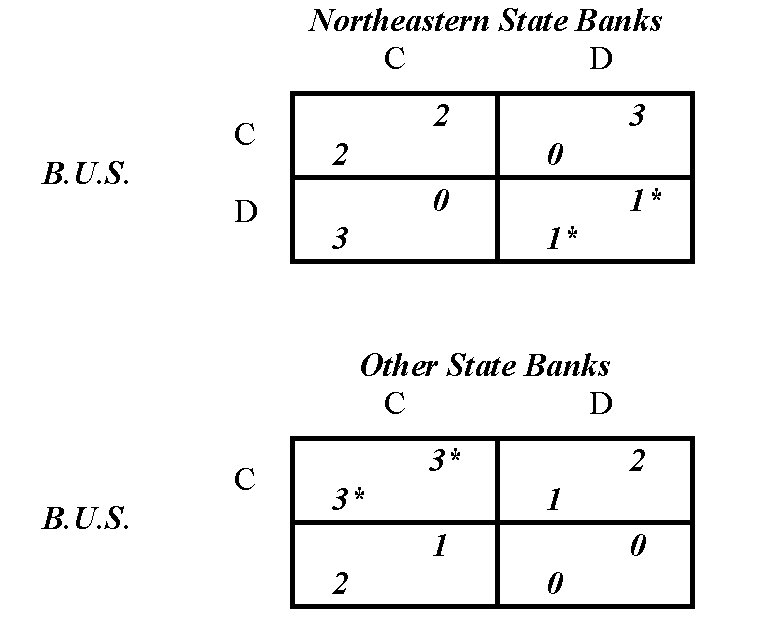

State banks thus had some incentive for retaining and reissuing the Second Bank’s notes instead of redeeming them, just as in the pure monopolist case; but the strength of this incentive differed in different parts of the country. In particular, northeastern banks tended to treat B.U.S. notes as relatively poor substitutes for specie, which they were frequently called upon to supply for international transactions (and, starting in 1818, for Suffolk Bank settlements), while banks elsewhere tended to treat them as good substitutes, which (so long as they traded at par) could be readily employed to offset the (typically adverse) flow of trade with the northeast. Forbearance by the B.U.S. toward northeastern banks would therefore have made a “sucker” of it. Consequently a non-cooperative “hard money” equilibrium tended to be prevail between the Bank and northeastern state banks, while a cooperative “soft money” equilibrium tended to prevail elsewhere:

And so things went during the Bank’s first years, with its non-northeastern branches playing “live and let live” with neighboring state banks, and generously expanding their own lending, and its northeastern ones aggressively redeeming local notes, and having local banks redeem theirs just as aggressively.

Murray Rothbard offers an excellent summary of the situation in The Panic of 1819. Before the panic, Rothbard observes, the Bank on the whole served

as an expansionary, rather than as a limiting force. The expansionary attitude of the Bank was encouraged by the Treasury, which wanted the Bank to accept and use the various state bank notes in which the Treasury received its revenue, particularly its receipts from [western] public land sales… In New England, on the other hand, both the private banks and the branches of the Bank of the United States pursued a conservative policy.

The catch was that things simply couldn’t go on this way for very long. The general expansion led to rising U.S. prices, which eventually worsened the trade deficit, increasing the demand for specie, especially in the northeast. Also, because the Bank’s various branches were collectively responsible for receiving and redeeming its notes, regardless of where the notes came from, and with no arrangements for any eventual inter-branch reckoning, the Bank’s northeastern branches found themselves hemorrhaging reserves. Eventually specie was commanding a premium even relative to B.U.S. notes, reflecting the public’s doubts concerning its continuing ability to meet demands placed upon it.

At last the Bank of the United States had no choice but to take steps to stem its reserve losses, which it did by calling on its non-northeastern branches to abandon their live-and-let-live policy toward state banks while aggressively contracting their own lending. It was this inevitable reversal of the Bank’s politically-motivated policy of forbearance–a reversal that would continue under Biddle’s presidency–that triggered the Panic of 1819.

Apologists for central banks like to portray them as conservative institutions that serve to keep other (“commercial”) banks on tight leashes; and although central banking doctrine was hardly developed at the time, the same thinking played a prominent part in the decision to establish a new federal bank in 1816. But though the new B.U.S. was certainly capable of being a conservative presence that would help to rein-in reckless state banks, in practice the Bank followed the state banks’ lead, behaving conservatively only where state banks were themselves already inclined to be conservative, while fostering expansion elsewhere. The events leading to the Panic of 1819 suggest that competition among co-equal banks was both a sufficient and a necessary condition for the avoidance of excessive bank lending. The presence of a privileged federal bank, in contrast, appears to have been neither sufficient nor necessary. That presence was, on the other hand, uniquely responsible for the extent of excessive expansion that ultimately occurred. In light of such considerations the Panic of 1819 deserves to be regarded as the United States’ first central-bank inspired financial crisis.