But Commissioner Peirce is not just a positive voice for innovation sitting at the top of a congenitally risk-averse institution. She’s also one of the most literate public officials on the topic of digital tokens and the decentralized platforms on which one can use them. Although Peirce sometimes finds herself in the minority on the SEC board, her fellow Commissioners must surely rate her views on crypto highly.

I was therefore very encouraged by Peirce’s proposal, in a speech she gave last week, to create a three-year safe harbor that would exempt digital token projects from many provisions of the securities laws. The proposal is both realistic and potentially transformative. If Peirce can muster support from her SEC colleagues, this safe harbor may decisively clear the cloud of uncertainty that has surrounded U.S.-focused crypto projects for several years.

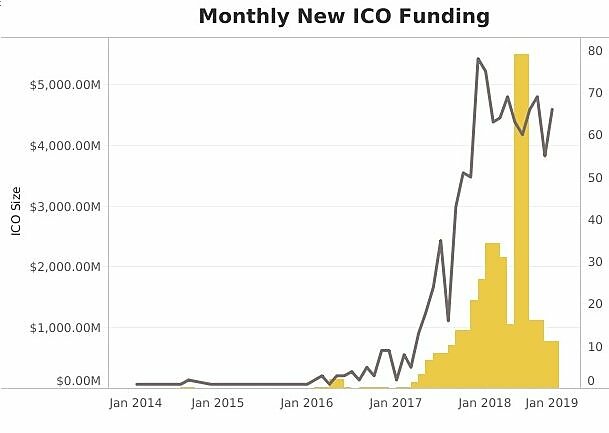

To understand the proposal’s significance, one must recognize that, at present, U.S. crypto projects operate in a regulatory no man’s land. That uncertainty persists despite growing interest in the possibilities of crypto technology. Since the launch of Ethereum in 2014 and particularly from mid-2016, entrepreneurs have attracted a growing amount of startup funding through initial coin offerings (ICOs), in which individuals exchange funds for the promise of a future digital token. According to Coindesk, ICOs had raised a cumulative $22.5 billion as of the end of 2018.

But ICO activity had started to slow down by the middle of that year, after the SEC’s chairman Jay Clayton declared "every ICO I’ve seen" to be a securities offering. The Commission also began launching selective enforcement actions against crypto projects, although many of these involved outright fraud rather than just allegations of an unregistered securities offering. It remains unclear whether the SEC will pursue all ICOs as unregistered offerings, as Clayton’s remark suggested, or only the most egregious cases that may have knowingly flouted the securities laws and attempted to fleece consumers.

Chairman Clayton seems to fear that failing to clamp down on ICOs could enable issuers of securities to evade the law. This is because, following Supreme Court precedent from the 1946 Howey case, a security in the United States is "an investment of money in a common enterprise with the expectation of profits from the efforts of others." Buying in a token offering clearly meets two of these conditions ("investment of money" and "expectation of profits"). The other two criteria ("common enterprise" and "efforts of others") are less clearly applicable. Indeed, legal experts have argued over this question since token offerings started to become popular.

But the 74-year-old Howey test to which the SEC has clung in its evaluation of digital tokens has ushered in what Commissioner Peirce rightly described in her recent speech as "a regulatory Catch 22." She continued:

Would-be networks cannot get their tokens out into people’s hands because their tokens are potentially subject to the securities laws. However, would-be networks cannot mature into a functional or decentralized network that is not dependent upon a single person or group to carry out the essential managerial or entrepreneurial efforts unless the tokens are distributed to and freely transferable among potential users, developers, and participants of the network.

Peirce’s proposal is not the first attempt at partial regulatory relief for digital token projects. In June 2018, the SEC’s Director of Corporation Finance, William Hinman, stated that decentralized ownership of tokens, what Peirce refers to as "getting tokens . . . into people’s hands," would mean they were not securities, even if the tokens had met the Howey test before the network became "truly decentralized."

Hinman’s standard never became SEC guidance or rulemaking. Indeed, a subsequent SEC guidance document on digital assets, which market participants criticized for muddling rather than clarifying matters, features the term “decentralized” only once. Still, Hinman’s standard was widely interpreted as leaving Bitcoin and Ethereum off the hook, simply because those networks had been around for nine and five years, respectively, at the time of his speech. Other crypto projects, in contrast, were caught if not gutted.

A three-year safe harbor such as Peirce proposes would, instead, reassure many smaller and newer initiatives. This is because the Howey criteria of "common enterprise" and "efforts of others" are most likely to apply to crypto projects in their infancy. Entrepreneurs will raise money from interested participants to develop the network. During that time, the success of the network hinges critically on the founders’ entrepreneurial efforts. But once the network becomes functional or decentralized, as many may after three years, it will no longer be a common enterprise and its success won’t depend mainly on the efforts of its creators.

Peirce’s safe harbor would offer a limited but highly valuable bridge for crypto networks to get their tokens into people’s hands, achieving the decentralization that, according to the Hinman standard, causes them not to be securities. The proposed rule would not exempt crypto projects from all regulation, as they would still be liable for violating the anti-fraud provisions of the securities laws. Furthermore, to be able to rely on the safe harbor, entrepreneurs---or the Initial Development Team (IDT), as the proposal calls them---would need to release substantial information about themselves, the network’s design, transaction history, and the timeline for its development on a public website.

While one always worries about prescriptive disclosures, the proposed rule’s requirements are succinct and relevant, and similar to the information that the more successful crypto projects have divulged in their white papers. The information required is of a technical and factual, rather than legal, nature, which may make it possible for developers to provide it without needing to resort to expensive outside counsel. The proposal also requires the IDT to undertake "good faith and reasonable efforts" to create liquidity for users by allowing secondary trading on an appropriately licensed platform. Finally, IDT members would have to make public the details of any sale of five percent or more of their token holdings during the three-year safe harbor period.

Apart from establishing that digital tokens distributed in the development of a decentralized network are not securities, Commissioner Peirce’s proposal would also exempt entities dealing in such tokens from regulation as exchanges, brokers, and dealers, as those activities are defined in the securities laws. This matters to developers, who might otherwise be alleged to operate as unregistered intermediaries. It would also facilitate the growth of platforms specializing in the secondary trading of safe-harbor tokens, thus helping to fulfill the proposal’s liquidity mandate.

I have some concerns regarding specific parts of the proposal. First, I wonder if the text of the rule should refer to the contracts for digital tokens, rather than the tokens themselves. The definition of “token” in the proposed rule includes a transaction history and other network features that may not be available at the time of fundraising and will not become so until later in the network’s development. Referring specifically to the contracts for tokens might avoid subsequent confusion as to whether individual tokens always met the rule’s definition.

Second, I believe the rule should explicitly state that the IDT’s commitment to return money to token buyers-–-on demand or with some delay, fully or partially-–-counts as good-faith liquidity provision. Some networks may be too small to find it worthwhile to list their tokens on outside exchanges. Moreover, the SEC should provide for alternative avenues to meet its liquidity requirement in case secondary venues do not develop as quickly as it anticipates. Enabling unilateral liquidity provision through a money-back guarantee would achieve that.

The proposed rule’s interaction with other federal and state-level statutes will affect its chances of success. By definition, the regulations promulgated and enforced by other agencies lie outside the SEC’s purview, so it is important to ponder where conflicts might arise. For example, in its most recent guidance, the Financial Crimes Enforcement Network (FinCEN) at the U.S. Treasury noted that developers and sellers of software for token platforms-–-the equivalent of the proposed rule’s IBT-–-are not money services businesses (MSBs) and are therefore exempt from the Bank Secrecy Act’s licensing and reporting requirements, which FinCEN monitors.

However, token issuers may be MSBs if they are "the only person authorized to issue and redeem" tokens. On the other hand, FinCEN’s guidance states that token issuers "registered with, and functionally regulated or examined by the SEC . . . will not be an MSB under [its] regulations." Instead, they are subject to FinCEN rules for SEC-regulated institutions, notably broker-dealers. But Commissioner Peirce’s safe harbor explicitly exempts token issuers from broker-dealer regulation! FinCEN should explain how the SEC’s safe harbor would fit into its MSB regulatory regime.

Things could get even more complicated at the state level. For instance, New York, which as a financial services hub holds much sway among state regulators, requires businesses engaged in "controlling, administering or issuing a Virtual Currency" to obtain a BitLicense from its Department of Financial Services. California has not had a clear policy on crypto projects, although a bill currently under consideration would make “virtual currency business activities” subject to licensing, albeit with broader exemptions than New York’s regime. IBTs relying on the SEC safe harbor might also run afoul of the money licensing laws of 53 other states and territories.

Uncertainty about the application of the securities laws has been an important concern, and a barrier to growth, for many crypto projects in the last five years. Commissioner Peirce’s safe harbor would go a long way toward addressing that uncertainty. She deserves applause and praise for her leadership on a fraught subject. The next step is to explain, to the greatest possible extent, the safe harbor’s implications for regulations that agencies other than the SEC enforce and for which new crypto initiatives might be liable. But this proposal is welcome news to all who believe new technologies deserve a fighting chance.