The last recession officially ended in 2009. A persistently large deficit is remarkable when the country is so many years into a cyclical expansion, when tax revenues as a percent of GDP are ordinarily above their secular average. A traditionally prudent fiscal policy welcomes a falling ratio of debt to GDP during boom years to offset the debt growth of recession years, so that the debt remains stable over the business cycle as a whole, or even declines secularly between unusual spending spikes like wars. Today, however, the US federal government’s deficit is large and growing (and thus the US federal government’s debt is growing with unusual speed) despite an economy in its ninth year of expansion.

Economist John Cochrane on his blog recently reproduced a chart from a Deutsche Bank report (the report itself is behind a paywall), plotting the US unemployment rate (a rough proxy for the cyclical state of the economy and thereby federal tax revenue) against the US federal budget deficit. Usually the deficit and unemployment rate move together, because high unemployment (as in 2010) is symptomatic of a recession in real output, which also lowers federal tax revenues relative to federal spending. Well into an expansion (as in 2018) the reverse is true: unemployment is low in a recovered or booming economy, and deficits are low (or even surpluses arise) because tax revenues are cyclically high relative to expenditures. “Until now,” Cochrane comments.

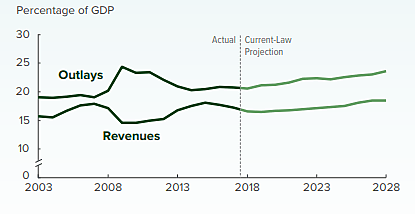

The last two years have seen a widening of the deficit as a percent of GDP. As the chart above shows, the CBO expects this trend to continue. Today we have a growing economy with a low unemployment rate yet a growing federal budget deficit.

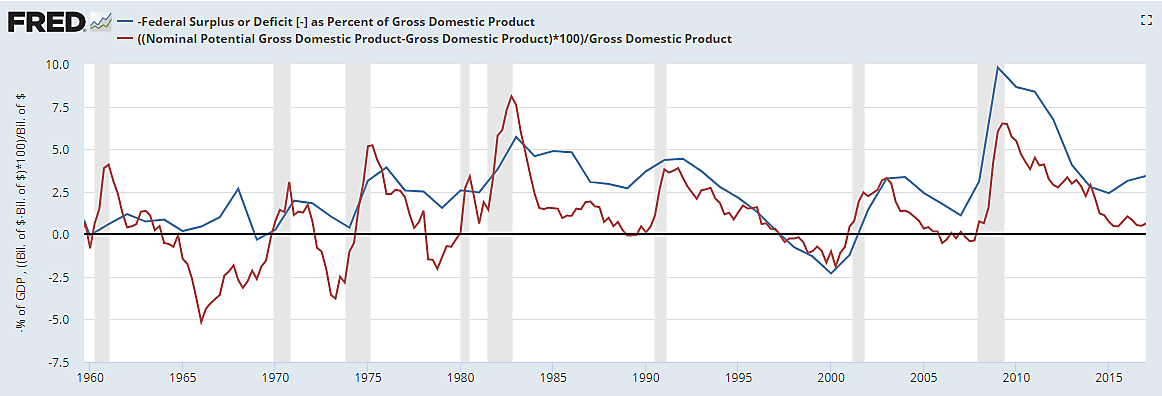

The CBO’s estimated “output gap” is a better proxy than the unemployment rate for the cyclical movement of income over the business cycle. (Here I put aside doubts about whether potential output is estimated in the best way, on the grounds that any shortcoming in the construction of the series is at least consistent over time.) Using the FRED database, I plot the federal budget deficit as a percent of GDP together with the output gap, measured as the percentage difference between the CBO-estimated “potential GDP” of the US economy and actual GDP. The overall pattern is that deficits follow the cyclical state of the economy.

There are two striking divergences from the pattern, however: (1) since the start of 2015, the deficit has been rising despite a falling output gap, and (2) between 1965 and 1968 under the Johnson administration the deficit grew despite a large negative output gap, meaning that output exceeded its estimated sustainable potential, which was made possible by an unemployment rate below its normal or natural rate.

As an aside, the chart also suggests that the budget surpluses of 1997–2000 were driven by a negative output gap (output unsustainably high). The explanation does not lie with any extraordinary efforts on the part of Congress or the White House beyond avoiding a repeat of the exceptional 1965–68 fiscal policies.

The Deutsche Bank report puts the 2018 US budget deficit at nearly 4.5% of GDP. This level is well above the level in any other major economy (see “Figure 6” in Cochrane’s blog entry). The Euro area as a whole has an average budget deficit of only about 1% of GDP. Even Italy is below 1.5%, while Germany runs a surplus. This is further evidence that the current US budget deficit path is abnormally – and avoidably — high.

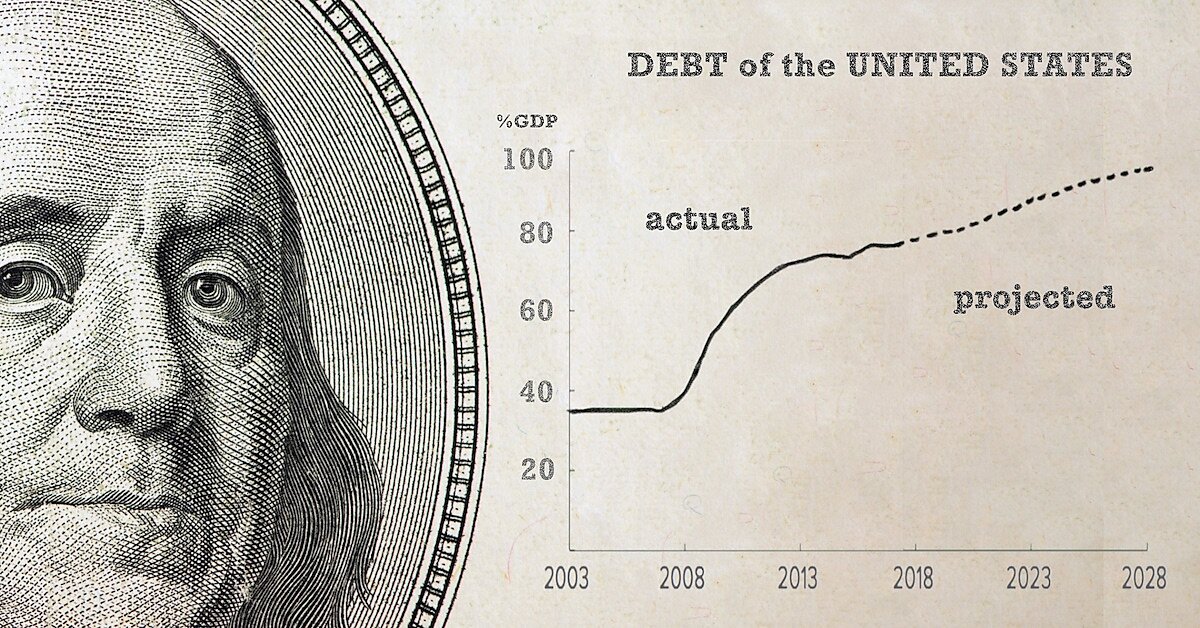

A high deficit means a rapidly growing federal debt. Since 2007 Q2 the federal debt held by the public has more than doubled, to 75 percent from 34 percent of GDP. The stock of debt measured in dollars has tripled during this period, from just below $5 trillion to above $15 trillion. Thus far the global market has absorbed this outpouring of US Treasury bonds without requiring more than historically low yields on the bonds. But how much larger can the federal debt grow before it causes obvious trouble? The CBO projects that the debt held by the public will rise to 100 percent of GDP by 2028. The CBO’s director Keith Hall has darkly remarked of his agency’s projections: “Such high and rising debt would have serious negative consequences for the budget and the nation. In particular, the likelihood of a fiscal crisis in the United States would increase.”

What would a “fiscal crisis” mean for the United States? First, consider a country that borrows in a currency that it cannot print, for example Greece (in euros) or Ecuador (in dollars). Such a country faces a fiscal or sovereign debt crisis when a mounting expectation of default (inability or unwillingness to repay all the bondholders in full and on time) drives up the default risk premium part of the real yield that bondholders require to buy its bonds. With real bond yields above the economy’s real growth rate, the debt compounds faster than GDP, boosting the ratio of debt to GDP, which raises the default risk premium still further, and so on. Without a rescue, this culminates in actual default (Ecuador 2008, Greece 2011).

The United States, of course, issues bonds in a currency that it can print in unlimited amounts, so there never need be a failure to pay the number of dollars owed, even if tax revenues are insufficient to cover all obligations. Mounting debt therefore raises not the risk of default risk in the conventional sense but the risk of repayment in increasingly cheapened dollars. To avoid Treasury default the Fed can pursue a policy of rapid money-printing that raises the inflation trend. Potential buyers of unindexed bonds, who can be expected to become concerned about this possibility even before inflation rises, will add an inflation-risk premium rather than a default-risk premium to real bond yields. As Cochrane comments, “Borrowing in your own currency only means that our government can substitute inflation and devaluation for explicit default, if it refuses to fix its finances.”

The concept of the Fed needing to “print money” (expand the monetary base) to allow the Treasury to service its bond debt was discussed decades ago in connection with what Sargent and Wallace called “unpleasant monetarist arithmetic.” The key concept they introduced was that simply rolling over a country’s debt, once the Treasury bond yield exceeds the economy’s growth rate, implies an endlessly growing ratio of Treasury debt to GDP. At some high debt-to-GDP ratio the market becomes saturated with Treasury bonds, and bond revenue reaches a maximum. This means that further borrowing raises the yield on the entire debt (as it rolls over) so much that the new borrowing provides no net revenue. There is a peak to the bond-revenue “Laffer Curve.” If spending and tax commitments mean that the deficit cannot be reduced (“austerity” is politically impossible, including sizable government asset sales), and no stream of external gifts can be obtained, the last resort for avoiding default is to increase the revenue from printing money. Growth in the monetary base must rise to help finance the mounting debt, given the other policy constraints.

Before the Fed began in 2008 to pay interest on part of bank reserves (namely banks’ deposits held at the Fed), there was a clear distinction between the base and the interest-bearing debt of the federal government. With banks not incentivized to hold excess reserves, higher base growth translated into higher growth in the broader money stock in circulation, say M2. Faster money growth in turn meant more units of money chasing each unit of goods and services, causing faster price level growth. Domestic money-holders bore the burden of a higher inflation tax.

Since gaining authority to pay interest on reserves in 2008, by contrast, the Fed has raised the interest rate it pays on excess reserves as necessary to persuade commercial banks to hold them rather than to create additional deposits by “lending out” the excess reserves, and thus has kept M2 growth from rising with higher base money growth. Thus the dramatic base growth since 2008 has not yet imposed an inflation tax. Instead, insofar as the Fed has acquired Treasury rather than private securities, and has paid banks the full Treasury yield rate on their depository reserves, it has been meant merely a fiscally pointless swap of one interest-bearing government liability in the hand of the non-Fed public (commercial bank deposits on the Fed’s books) for another (Treasuries held outside the Fed). But this means that Fed purchases of Treasuries no longer in effect retire them. That is, Fed acquisition of Treasuries no longer reduces the consolidated Fed-Treasury burden of debt service to the public The Treasuries held by the Fed are now properly counted (as they have been all along) as federal debt held by the public. Rising Fed holdings of Treasury debt, financed by interest-bearing reserves, are part of the rising ratio of debt to GDP.

The fiscal status quo ante would be effectively restored if Congress would take up George Selgin’s proposal that the Fed pay interest only on required reserves, not on excess reserves. Holding the interest rate on reserves constant (at zero or even above), faster base growth would again mean higher inflation. But isn’t the Fed committed to not exceeding a 2 percent rate of inflation? Only rather weakly. It is a commitment that the Fed adopted at its own initiative, and can repudiate at its own initiative. It is not embodied in any binding legislated mandate. Ask yourself: if it came down to a choice between the Treasury defaulting on bonds because permanently faster money-printing would permanently raise inflation above 2 percent, and raising the Fed’s current inflation-rate target, which option do you think would prevail? (I would expect higher inflation, though Jeff Hummel has made a coherent case for expecting default.)

It is to avoid this kind of inflationary “solution” to mounting US federal debt that we dollar-holders must be concerned to do something about the current trajectory of high US budget deficits and a persistently rising ratio of debt to GDP.