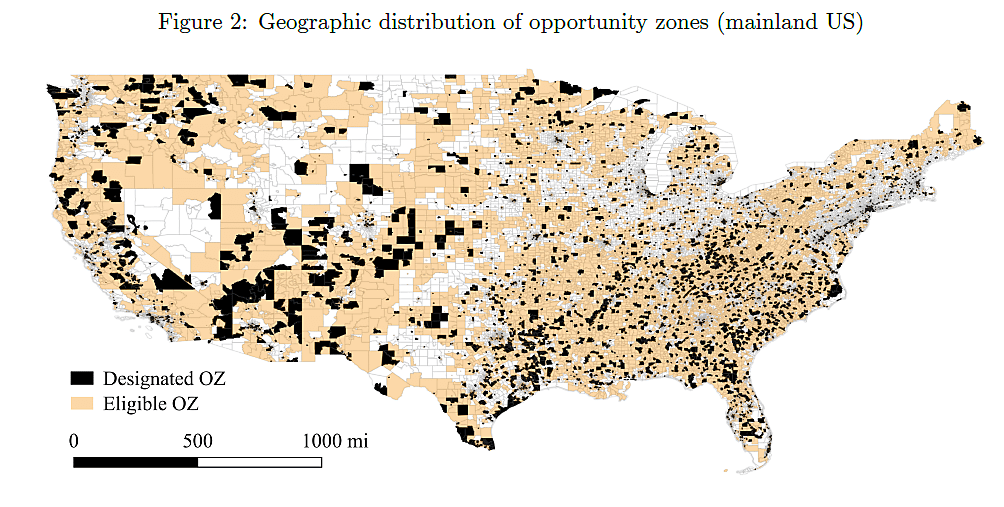

The Republican Tax Cuts and Jobs Act of 2017 created 8,700 “opportunity zones” across the country, which receive special capital gains tax breaks. O Zones have divided our cities and towns into winner and loser zones, while encouraging political corruption.

O Zones are supposed to alleviate poverty, but the main beneficiaries are likely to be certain landowners within the politically chosen zones. When governments alter the profitability of parcels of land through taxes and regulations, changes in expected future returns are capitalized into current land prices. Markets are forward looking.

News articles have highlighted the windfalls that O Zones have bestowed on some lucky landowners, as I noted here and here. Now a statistical study has confirmed the basic economic logic. A study by Alan Sage, Mike Langen, and Alex Van de Minne found that O Zone designation has:

resulted in a 14% price increase for “redevelopment” properties and a 20% price increase for vacant development sites … Our findings suggest that the OZ program has thus far primarily passed through the statutory tax benefits to existing land owners, with limited evidence of additional value creation.

The authors investigated whether there is evidence of increased productivity within O‑Zones and spillover benefits to other properties. They find no such effect:

If the tax benefit would spur the local economy, one would expect price increases for all properties [in the zones], not just the ones getting the actual tax benefit. Instead, we find that only properties that benefit from the tax break—redevelopment properties and vacant land—see their prices increase. The tax break is essentially factored into the land price.

The study concludes,

Our findings cast doubt on the capacity of the OZ program to achieve its ostensible goal of creating value in low-income communities … Whereas an increase in land productivity could produce benefits for residents of OZs, a pass-through of tax benefit will likely benefit only existing owners of commercial real estate in target neighborhoods.

The problems with O Zones are discussed further here, here, here, here, here, and here.