Today’s Financial Times, among other media outlets, is reporting that share of national income coming from wages has “fallen to its lowest level since records began after the second world war.…” That level now stands at 58 percent, the post-war average is 63 percent. The remainder comes largely from profits and capital gains.

It won’t be long before many start to suggest the usual, but broken, remedies of higher taxes, increasing the minimum wage and more unionization. Putting aside the fact that I have no idea what the “correct” share for wages should be (and suspect neither does anyone else), this trend should come as no surprise when you have an economic system that bases much of its “prosperity” on the creation on serial asset bubbles. Wages stagnating? Well let’s run up house or stock prices. Or at least that seems to be the thinking of the Federal Reserve.

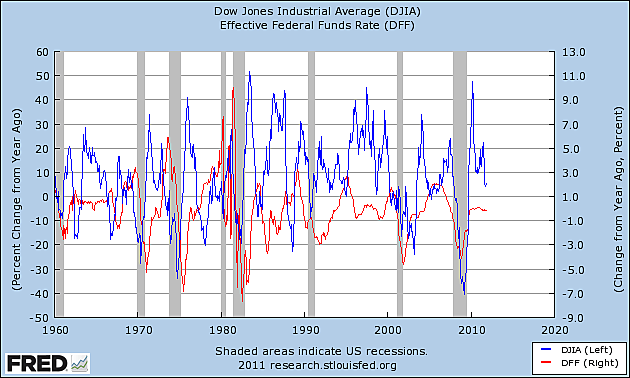

The chart below compares the annual percentage change in the Dow-Jones Index (left axis) and the annual percent change in the effective federal funds rate (right axis), both on a monthly basis. The correlation is a negative 0.1, indicating that as the federal funds rate is lowered, the Dow increases. Of course the opposite then holds when the federal funds rate is raised.

The rub with all this is that running up asset prices only benefits those with assets. The increase in asset prices will also increase capital gains, lowering the wage share of national income. Even worse is that running up some asset prices, like that for housing, does nothing to increase wages, which are ultimately driven by increasing labor productivity. So if you really want to help labor, let’s stop trying to create false wealth via easy credit, and try improving labor productivity instead.