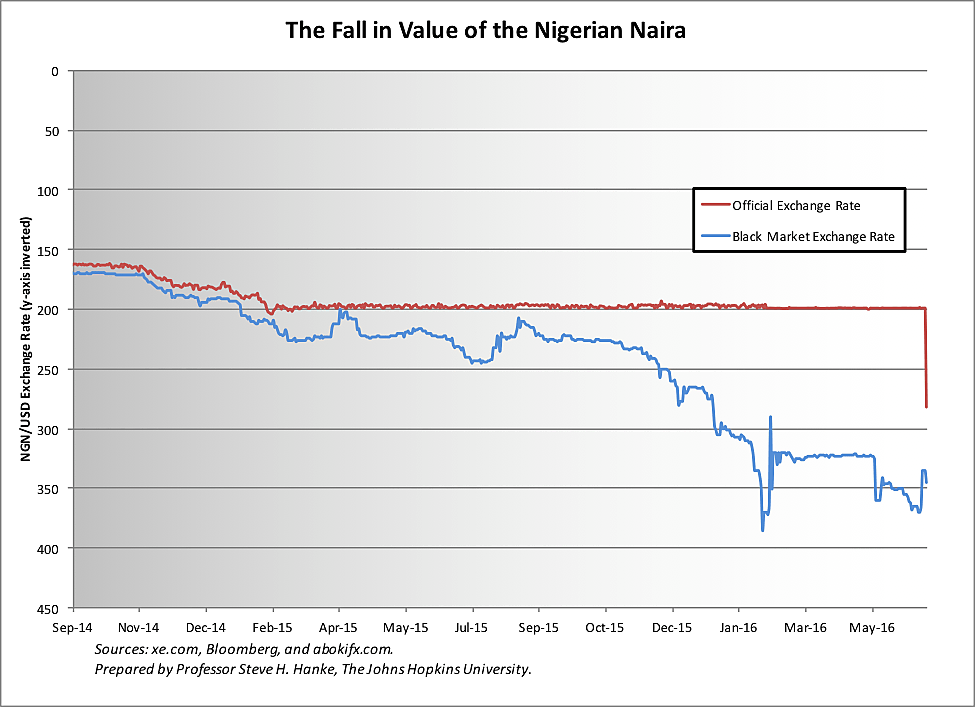

On Monday afternoon, the Central Bank of Nigeria (CBN) ended the Nigerian naira’s sixteen-month peg to the U.S. dollar, sending the naira into a freefall. The currency had been pegged at 197 naira per dollar, but as the chart below shows, it had been trading at over 320 naira per dollar for months on the black market (read: free market) and currently sits at 345 naira per dollar. At the time of writing, the naira was officially trading at 282.50 naira per dollar.

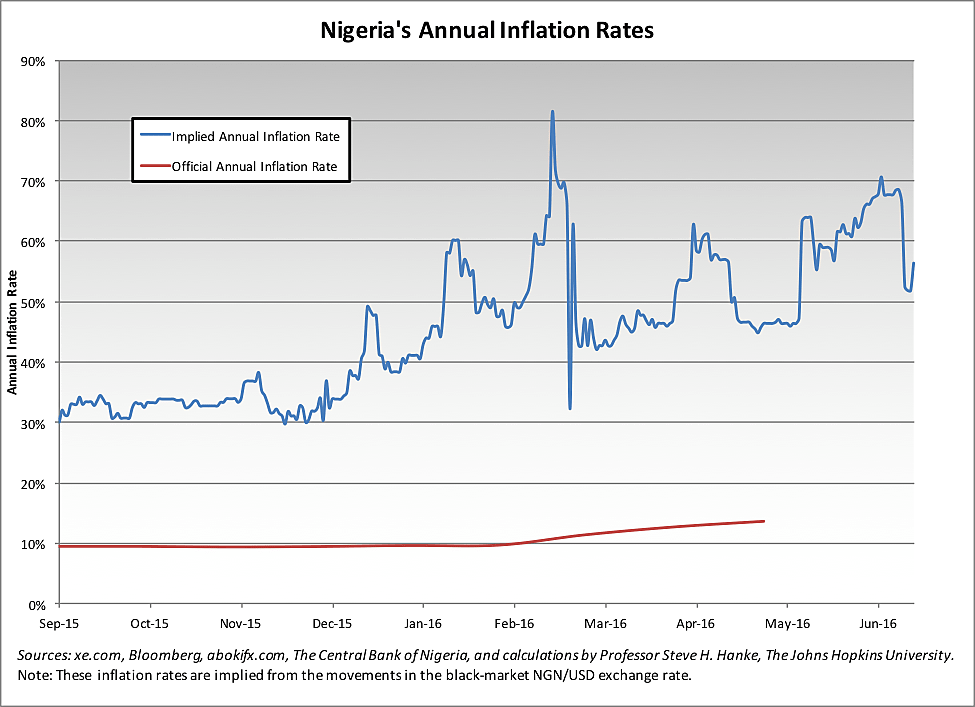

The official inflation rate for Nigeria in May was 15.6 percent. However, by using changes in the black market exchange rate data and applying the Purchasing Power Parity Theory, I calculate that the annual inflation rate implied by the free market is actually much higher – currently sitting at over 56 percent (see the accompanying chart).

A managed, floating exchange-rate regime is ill-suited for a country with weak institutions and little discipline, like Nigeria. More troubles lie ahead.