Evidence of the Jones Act’s failures continues to mount. Just weeks after the release of an OECD study predicting substantial gains from the law’s repeal, the Congressional Research Service (CRS) has a new report out which places the law’s shortcomings in sharp relief.

The report’s description of U.S. shipbuilding is particularly eyebrow-raising. Rather than bolstering this sector through the Jones Act’s domestic build mandate, the CRS notes the sector has experienced a steady deterioration in competitiveness since the law’s passage:

A 1922 government report on shipbuilding indicated that U.S.-built ships cost 20% more than those built in foreign yards. The cost differential increased to 50% in the 1930s. In the 1950s, U.S. shipyard prices were double those of foreign yards, and by the 1990s, they were three times the price of foreign yards. Today, the price of a U.S.-built tanker is estimated to be about four times the global price of a similar vessel, while a U.S.-built container ship may cost five times the global price, according to one maritime consulting firm.

Unsurprisingly, this loss of competitiveness has translated into commercial ship output that amounts to barely a rounding error in total global production:

The Merchant Marine Act of 1970 (P.L. 91–469) added as an additional objective of U.S. maritime policy to have a merchant marine “supplemented by efficient facilities for building and repairing vessels.” U.S. shipyards typically build only two or three oceangoing ships per year, and none for export, so they do not achieve economies of scale. There may be gaps of several years in between orders for container ships. In recent years, the demand has been sufficient to sustain one shipyard that builds only commercial ships. However, this yard stated that its employment had fallen below 100 people and that it had no vessels under construction or on order as of March 31, 2019.

The relationship between the Jones Act and the commercial shipbuilding sector’s travails is almost certainly causal. Drawn to a captive domestic market, U.S. shipyards have not sought to compete internationally and thus cannot achieve scale. This focus on the U.S. market means fewer opportunities for specialization and related productivity gains, while the lack of international competition reduces the need for improvement and innovation.

The result is spiraling costs and decreased demand for U.S.-built ships, leaving shipyards with less output to spread their fixed costs across. It’s a vicious cycle that shows no sign of ending.

These spiraling shipbuilding costs aren’t just an economic problem. While the Jones Act is often justified on national security grounds, the high cost of domestic shipbuilding encouraged by this law has also impaired the military’s ability to source its sealift ships from U.S. shipyards:

The cost differential is also an issue for Department of Defense officials in charge of military sealift ships. As discussed later in this report, the military has modified a plan to build sealift ships domestically, finding it unaffordable, and instead will buy more used foreign-built cargo ships. Since U.S. shipyards do not build vessels for export, they are not required to compete with foreign shipyards on price or vessel characteristics.

Indeed, just last week the Secretary of the Navy said that he “can’t really afford a lot of $400 million ships when I can go out and buy used [roll-on/roll-off ships] for $35 to $40 million.” And if high ship costs are a deterrent to notorious spendthrift Uncle Sam, the effect is surely no less pronounced within the broader maritime industry.

These high ship acquisition costs, as well as operating costs at least 2.7 times those of foreign-flagged vessels, help explain why demand for U.S. coastwise shipping has declined despite the many advantages of ocean transport:

While domestic ships are carrying fewer tons of freight today than they did in the 1950s, their most direct competitors, railroads and pipelines, are carrying more. Domestic ships have lost market share to land modes even though ships have economic advantages. Ocean carriers do not need to acquire and maintain rights-of-way like railroads and pipelines. They can move much more cargo per trip and per gallon of fuel than trucks and railroads. Although ships are slower than truck and rail modes, many shippers are willing to sacrifice transit time for substantially lower costs, as long as delivery schedules are reliable.

Also seemingly explained is the lack of coastal shipping to transport containers arriving aboard large cargo ships from abroad. Instead of being placed on smaller ships as part of a hub-and-spoke system, they are placed on rail and roads, with the latter leading to increased highway congestion:

Transshipment of international containerized cargo by feeder ships is prevalent abroad, but the practice does not exist in the United States. The Jones Act would require such ships be U.S.-built, ‑crewed, and ‑owned. Lack of transshipment services increases demand for rail and road connections to ports, as smaller feeder container ships do not play a role in distributing international containerized cargo among U.S. ports.

Not everyone, however, can take refuge from the Jones Act through the use of overland forms of transportation, and the CRS report notes that the Jones Act fleet tends to “operate in markets where shippers have little alternative.” This means the non-contiguous states and territories of Alaska, Hawaii, and Puerto Rico which have little choice but to suffer the law’s exorbitant costs.

Meanwhile, high ship acquisition costs also undoubtedly play a role in the absence of entire ship types from the Jones Act fleet, and the advanced age and insufficient quantities of those that do exist:

Not all ship designs are represented in the Jones Act fleet. “Project cargo” or “heavy-lift” vessels are often used to carry oversized pieces of equipment such as smaller vessels, ship engines and modules, wind turbine parts, and power generation equipment. They would be useful for moving dredging fleets to project sites. There have not been any such vessels in the Jones Act fleet in recent decades. The Department of Defense has used “national defense” waivers of the Jones Act to move radar systems and newly built vessels on foreign-flag heavy-lift vessels. This type of cargo typically does not generate regular shipments in any one region; thus these ships would likely need to extend their market reach beyond the United States to include the international market. However, the higher cost structure of Jones Act operators is an obstacle to competing for international shipments.

Two dry bulk ships are in the oceangoing Jones Act fleet, and they appear to be mostly inactive, possibly because they are nearly 40 years old. This is twice the economic life of a ship in the global fleet (where ships are typically sent for scrapping between 15 and 20 years of age). The sole Jones Act-qualified chemical tanker was built in 1968. No LNG tankers are in the Jones Act fleet despite new domestic markets as a result of the shale gas boom. The lack of sufficient Jones Act-qualified tanker capacity to move booming shale oil production coastwise added to pressure for lifting the crude oil export ban in 2015.

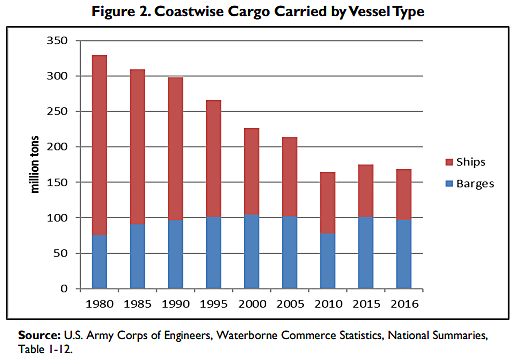

One result is that despite the economy’s continued expansion, and thus increased transportation needs, the number of ships and amount of cargo they carry are in long-term decline:

The report is rife with examples of the Jones Act’s inability to meet its stated aims. It points out, for example, that the law “has not succeeded in meeting the stated policy goal of sustaining a growing merchant marine that carries an increasing proportion of the nation’s commerce.” The objective of “providing shipping service on all routes essential for maintaining the flow [of commerce] at all times” and having the “safest” types of vessels are similarly unmet, with the CRS stating that “the Jones Act fleet does not appear to achieve either of these goals.” The report adds that “One can also question whether the policy objective of having ‘the best equipped and most suitable types of vessels’ has been achieved.”

The failure of protectionist policy is one of the world’s more predictable phenomena, and prior to its passage some appeared to foresee its problems and urge a different course. As the CRS report points out, the minority report to a 1919 House committee report to the bill that would become the Jones Act called for an approach based on competition and the removal of restrictions:

…in order to build up and sustain an American merchant marine it is absolutely necessary to remove every restriction against American merchants acquiring ships, whether built in the United States or out of the United States, at the lowest possible price, in order to enable them to compete with other nations in the transportation of the commerce of the world…Our American iron and steel manufacturers were unable to compete until they had to. When they had to they did compete successfully. Our shipbuilders can and will do likewise.

And more than 50 years ago the Lyndon B. Johnson administration accurately stated that protectionism and federal largesse would not reverse the U.S. merchant marine’s dwindling fortunes:

At a 1967 congressional hearing, Alan Boyd, Secretary of Transportation in the Lyndon B. Johnson Administration, testified that the U.S. merchant marine was “too small, too old, and too unproductive,” and stated, “you do not revitalize an industry by flooding it with Federal dollars and imprisoning it within a wall of protection.”

These voices, however, have been consistently ignored in favor of those advocating yet more protectionism and government intervention, the very policies that led to the U.S. maritime sector’s current predicament. But their record of failure has never been starker or more plain to see. It’s time for a new approach based on the principles of free markets, openness, and competition whose record of success is unsurpassed. It’s a plan just crazy enough to work.