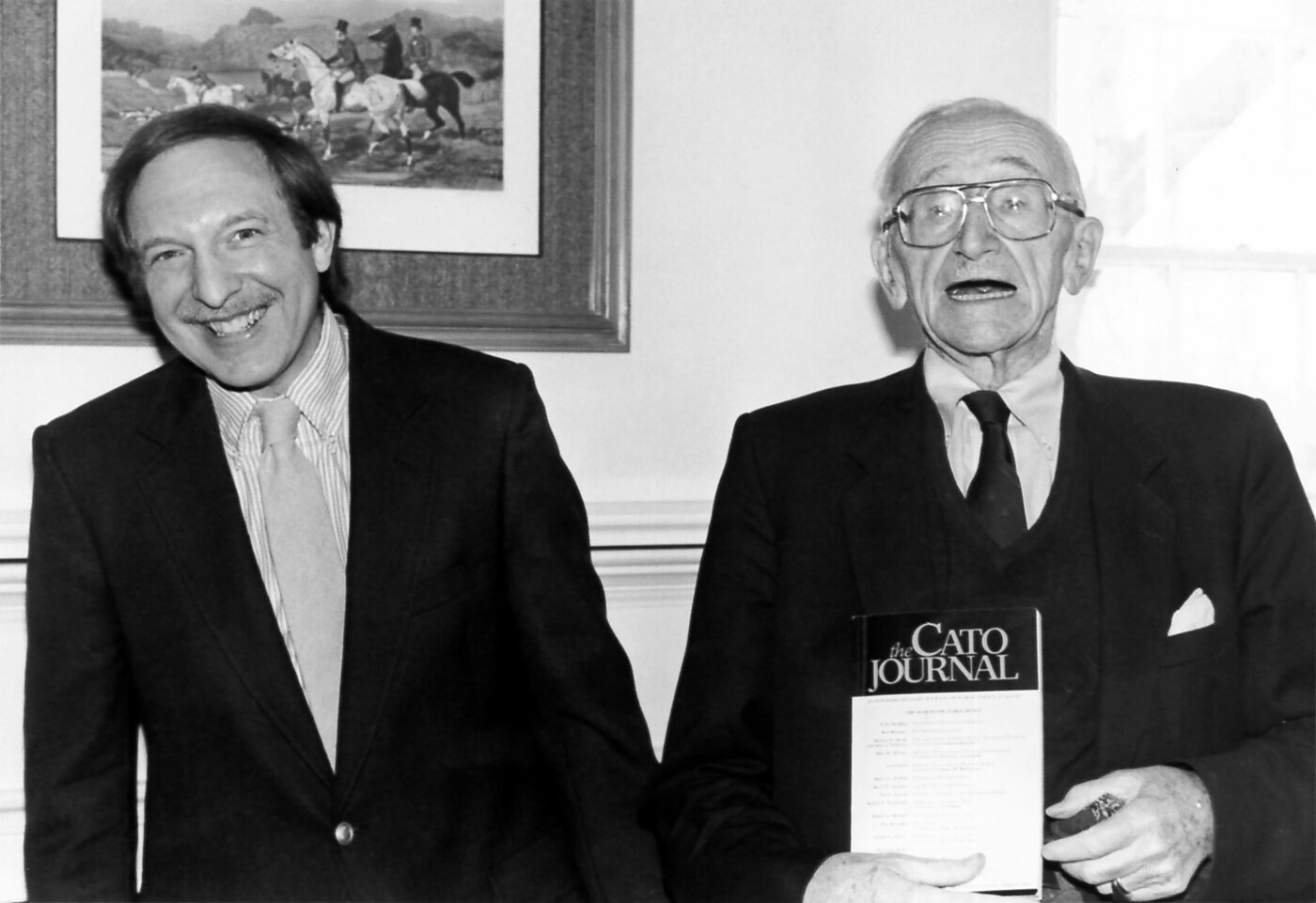

The Winter 2018 edition of the Cato Journal is out!

For 38 years, the Cato Journal has published articles by leading scholars that explore libertarian public policy ideas. The current edition features articles on the welfare state, school choice, and -- most importantly for loyal Alt-M readers -- seven articles on monetary issues, which I summarize and link to here.

“Monetary Policy in an Uncertain World: The Case for Rules”

Jim Dorn, the Cato Journal’s long-time editor and Cato’s vice president of Monetary Studies, provides an in-depth study of the case for rules over discretion in monetary policy. He pays particular attention to certain types of stable spending rules, including rules that would target nominal GDP or nominal domestic final sales, which he compares to more popular alternatives including a rule targeting the rate of inflation.

He discusses as well the difficulty of implementing any rule under the current environment in which unconventional Fed policy has plugged up the monetary transmission mechanism. After confronting the “knowledge problem” at the heart of discretionary monetary policy -- that policymakers are unable to know the true structure of an increasingly complex and global economic system -- Dorn calls for the establishment of a Centennial Monetary Commission to evaluate the performance of the Fed over its 100-plus years of discretionary monetary authority and to discuss how best to reform the country’s central bank.

“Reforming the Rules that Govern the Fed”

Charles Calomiris of Columbia Business School calls for a series of reforms at the Federal Reserve that would address the structural problems that leave it susceptible to “bad thinking and politicization” -- deficiencies Allan Meltzer identified in his renowned review of Fed history.

Calomiris is concerned that the same problems will, once again, result in the Fed departing from its central objectives: price stability and financial stability. Indeed, Calomiris describes a Fed that, since the 2007-09 financial crisis, has failed to operate within a transparent and systematic framework, has employed “untested and questionable policy tools with uncertain effect” (such as an “unprecedentedly large balance sheet”), “has been making highly inaccurate near-term economic growth forecasts for many years,” and is more subject to politicization than “any time since the 1970s.”

Calomiris proposes (1) internal governance reforms that would decentralize power within the Fed and promote diversity of thinking; (2) policy process reforms that would narrow the Fed’s primary mandate to price stability and require the Fed to adopt and disclose a systematic approach to monetary policy; and (3) other reforms that would constrain the Fed’s asset holdings and activities so as to avoid actions that conflict with its monetary policy mission and that risk undermining its independence.

“Improving Monetary Policy by Adopting a Simple Rule”

Athanasios Orphanides of MIT's Sloan School of Management examines how monetary policy can be improved by replacing the present discretionary regime with one that relies upon a “transparent process of selecting and periodically adapting a simple policy rule.”

The main argument against using a rule to guide monetary policy, according to Orphanides, is that ever-changing economic conditions necessitate agile policymaking and that rules would prevent Fed officials’ from reacting to surprises. Orphanides argues, instead, that rather than supporting grounds for monetary discretion, uncertainty supports the need for a systematic and robust rule, clearly communicated as part of the Fed’s Statement on Longer-Run Goals and Monetary Policy Strategy and subject to periodic review.

Such a rule resembles the one described in the Federal Oversight Reform and Modernization (FORM) Act. However, Orphanides notes, legislation is not required for the adoption of a simple rule; rather, the Fed could embrace it voluntarily, just as it embraced inflation targeting in 2012.

“Against Helicopter Money”

Kevin Dowd, professor of economics and finance at Durham University, makes a case against so-called helicopter money -- the hypothetical idea that a government could print large sums of money and distribute it to the public in order to stimulate the economy.

First, he describes how helicopter money should be accounted for on a central bank balance sheet, and compares it to alternatives such as debt monetization, quantitative easing, and gold stock revaluation. Next, he examines some of the problems presented by helicopter money; for example, that it would involve the central bank in fiscal policy decisions and would raise profound constitutional questions.

The biggest danger of helicopter money, according to Dowd, is that it feeds an illusion that “monetary magic can conjure up real goods and services out of nothing.” Dowd ends by warning that if policymakers go on entertaining that fallacy, then “rational economic policymaking will become impossible.”

“Sorting Out Monetary and Fiscal Policies”

Mickey Levy, chief economist for the Americas and Asia at Berenberg Capital Markets LLC, claims monetary and fiscal policies are both on unsustainable tracks. Ultimately, Levy says, monetary and fiscal policies “interact in undesirable ways” that distort financial and economic performance, adversely affect the allocation of government resources, and impose incalculable risks on future generations.

Fixing this situation will, Levy says, require a “reset of monetary and financial policies.” In particular, Levy argues that the Fed must raise interest rates and shrink its balance sheet more aggressively than outlined in its current strategy. The Fed must also acknowledge the limitations of monetary policy and remove itself from credit allocation and “short-term fine-tuning” of the economy.

On the fiscal side, Levy says Congress must tackle the difficult task of restructuring entitlement programs to be more efficient while maintaining their intent and promises to current and future beneficiaries. Finally, all levels of government must address the ever-growing levels of government debt, which “may eventually impinge on the Fed and its independence.”

“Liquidity Risk After the Crisis”

Allan Malz, a professor of risk management at Columbia University and former vice president at the Federal Reserve Bank of New York, comments on the anomalous state of liquidity since the financial crisis and outlines the complex ways in which it has been affected by monetary and regulatory policies.

Market indicators paint conflicting pictures of the state of liquidity. On the one hand, declining bond market activity and the persistence of low-risk arbitrage opportunities imply liquidity is impaired, while, on the other, low volatility and high demand for risky assets suggest that liquidity is alive and well.

These and other “puzzling” and “troubling” indicators, Malz argues, signal a “general decline in market responsiveness” and a “larger underlying disfunction” not explained by government policies alone. Malz speculates that, as the Fed raises interest rates and reduces its balance sheet, disruptions in the financial system could emanate from “surprising corners.”

“Reorganization of Failing Financial Firms: A Capital Structure Solution”

Steven Gjerstad of Chapman University’s Economic Science Institute addresses the key challenges of restructuring a failing systemically important financial institution (SIFI); namely, that of preserving its “core intermediation and payment functions… avoiding a fire sale of its assets to cover liabilities, and allocating losses in a manner that is transparent and understood by [its] creditors.”

Gjerstad argues the Dodd-Frank Act’s “single-point-of-entry” approach to SIFI reorganization allows “similarly situated creditors” to be treated unequally and thus stands “at odds with a fundamental precept of American bankruptcy law.” Another drawback of the Dodd-Frank solution is that it requires the Federal Deposit Insurance Corporation to take full control of the failing firm as a receiver, and gives the FDIC full discretion to decide which creditors will end up repaid and which will lose their money -- with limited avenues for creditors to challenge its decisions.

Gjerstad’s solution is the creation of a class of creditors that would hold “reorganization bonds” that convert into controlling equity stakes in the institution in the event of a SIFI’s failure. This procedure would create a transparent, market-based alternative to the current bailout-prone, government-centric approach.

Read these articles and more here. Or order a hard copy of the Winter 2018 Cato Journal here.

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.