New Hampshire has one of the most restrained governments in the nation. The state’s relatively small government is unique in the Northeast.

Less government means more freedom for New Hampshire residents. In Cato’s Freedom in the 50 States report, which assesses economic and social freedoms, New Hampshire is ranked #2, while Massachusetts is #23, Maine is #39, Vermont is #46, and New York is #50.

New Hampshire has the fifth lowest state and local tax burden in the nation as a percent of income. By this measure, New Hampshire taxes are 14 percent lower than Massachusetts, 27 percent lower than Maine, 28 percent lower than Vermont, and 40 percent lower than New York.

Do New Hampshire’s low taxes result in poor public services? Not at all. U.S. News ranks New Hampshire public schools third best in the nation and the state second on overall quality of life. Besides, poor public services would repel residents, yet New Hampshire enjoys net in-migration from other states, while all nearby states except Maine suffer out-migration.

I discussed these policy issues with New Hampshire Governor Chris Sununu in a recent Cato forum. Sununu earned the highest score in this year’s Fiscal Report on the Governors.

Sununu recently noted, “It is no surprise that people are fleeing high-tax states across the country and coming to the Live Free or Die State. We have no income tax, we have no sales tax, we have a high quality of life. This is what we call the New Hampshire Advantage.” Fewer tax bases generates less fuel for government growth.

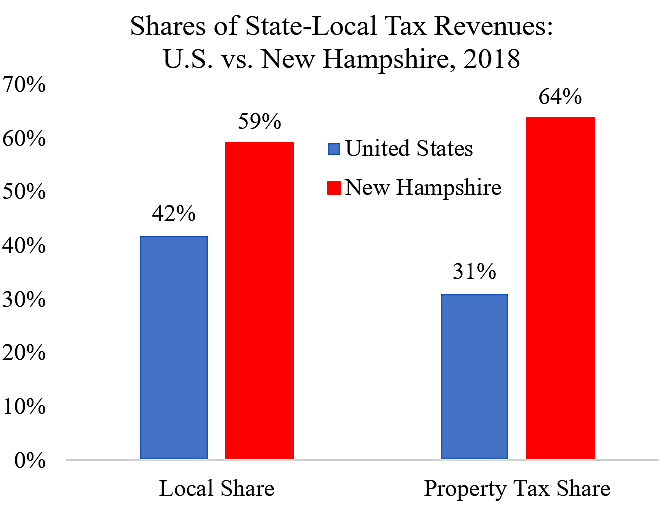

Without a broad-based income tax or general sales tax, property taxes are the dominant tax in New Hampshire. The chart below from Census data shows that property tax revenues are 64 percent of total state and local tax revenues in New Hampshire versus 31 percent across all 50 states. Polls show that property taxes are the most disliked tax, which likely tempers the demand for government by Granite Staters.

A related factor supporting freedom in New Hampshire is the decentralized nature of its government. The chart shows that 59 percent of state and local tax revenues in New Hampshire are local versus just 42 percent across all states. Decentralization generates healthy competition between local governments and keeps political power and decision-making close to the people.

The Free State Project discusses New Hampshire’s advantages here. The Cato Fiscal Report Card on America’s Governors is here.