“In 1934, the government price of gold was increased to $35 per ounce, effectively increasing the gold on the Federal Reserve’s balance sheets by 69 percent. This increase in assets allowed the Federal Reserve to further inflate the money supply.” (“FDR takes United States off gold standard,” History.com, November 24, 2009.)

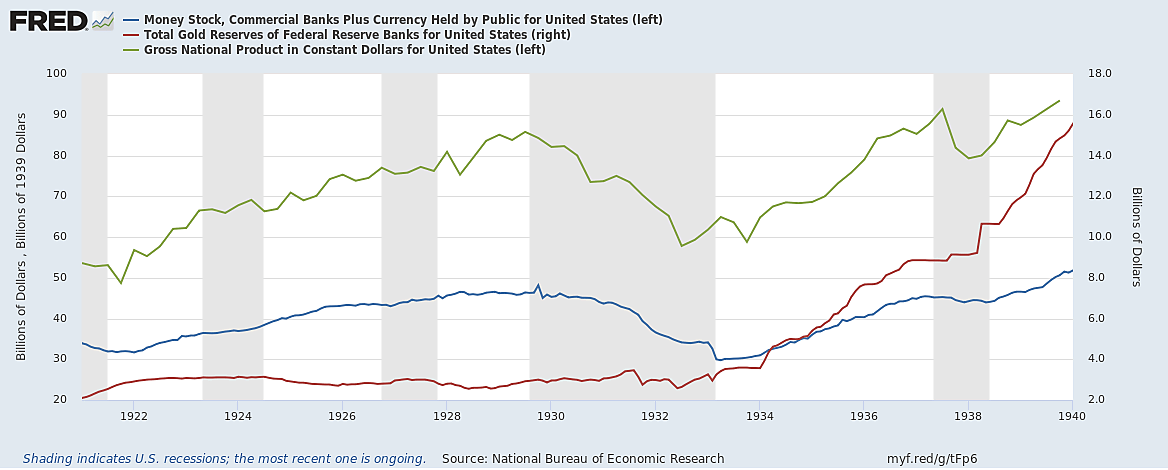

As I pointed out several installments ago, the recovery that followed FDR’s assumption of office was fueled almost exclusively by growth in the Federal Reserve’s gold holdings. As the following FRED chart shows, those holdings almost tripled during the four years following the nationwide bank holiday, allowing the M2 money stock to concurrently grow to 150 percent of its pre-holiday level. The result was a “Great Expansion” of real GNP that more than offset the “Great Contraction” of the preceding three years.

Today I’ll discuss the causes of the gold inflow that fueled the post-1933 recovery, and especially the part played by FDR’s decision to devalue the dollar. I hope to convince you that, although devaluation certainly helped, it was neither the only nor the most important reason why the U.S. monetary system, having shut-down on account of a gold shortage, soon found itself once again awash with precious metal.

Unto Caesar

Before we turn to consider what devaluation itself did or didn’t accomplish, I’d like add a bit more to what I said in my post on the bank holiday, which (among other things) addressed the pre-devaluation steps that got gold flowing into the Fed, not from overseas, but from American hoards. One of those steps consisted of telegrams the Federal Reserve Board sent to each of the 12 Federal Reserve banks on March 8th, requesting that they

prepare and forward to the Board as soon as possible after Mar. 13 1933, as complete a list as can be made from information you are able to obtain, of the names and addresses of all persons who have withdrawn gold from your bank or a member bank in your district since Feb. 1 1933, and who have not redeposited in a bank on or before Mar. 13 1933.

The Fed banks in turn asked their members to assist them by supplying “the names and addresses of persons who on or after Feb. 1 1933, have withdrawn gold coin or gold certificates from your bank and who have not, to your knowledge, redeposited the same in a bank on or before Mar. 13 1933,” together with “a separate list containing similar information, so far as available, regarding withdrawals of gold coin and gold certificates from your bank prior to Feb. 1, 1933.”

As The New York Times reported later that same day, these requests were made in response to direct instructions from FDR, who was anticipating the passage, on March 9th, of the Emergency Banking Act. Among its other provisions, that act would grant him the authority to prohibit the “export, hoarding, melting, or ear-marking of gold or silver coin or bullion… by any person within the United States or any place subject to the jurisdiction thereof.” It also stipulated that anyone who violated the prohibition might

be fined not more than $10,000, or, if a natural person, may be imprisoned for not more than ten years, or both; and any officer, director, or agent of any corporation who knowingly participates in such violation may be punished by a like fine, imprisonment, or both.

Considering these circumstances, it’s hardly surprising that bankers complied with the Fed’s requests, and that many of the hoarders whose names they’d divulged to the Fed rushed to redeposit coin and bullion. According to the March 10, 1933 New York Times,

repentant hoarders displayed a good deal of agitation, but they were received courteously by the guards of the reserve bank, and came out with an evident air of relief when they had disposed of their dangerous treasure.

When that Times report came out, $65 million in gold had already been returned to the Fed. By the end of the month, after the deadline for preparing and forwarding lists of gold hoarders was extended to March 27,th, the Fed’s gold reserves were up to $625 million, as compared to just $365 million on inauguration day.

But the government wasn’t through reining-in hoarded gold. On April 5th, Roosevelt issued Executive Order 6102, “forbidding the hoarding of gold coin, gold bullion, and gold certificates.” What had until then been a mere threat now became reality: those who still hadn’t surrendered hoarded gold or gold certificates now had until May 1st to return all but $100 worth of coins (excepting collectible coins and gold for non-monetary uses) to the Fed or face either or both of the stiff penalties allowed for by the Emergency Banking Act. On April 28th, FDR issued another Executive Order (No. 6260), calling for anyone who still possessed gold coin, gold bullion, or gold certificates, to file a return within 45 days with Internal Revenue Bureau documenting what they possessed, for whom, where, and what for. Finally, in a step worthy of Scrooge himself, the government revoked the $100 gold coin exemption three days after Christmas, forcing children to trade those shiny coins Santa put in their Christmas stockings for the Treasury’s paper certificates! But it only took until May 10th for the total value of gold coin and certificates returned to the Fed to reach $770 million—a sum roughly corresponding to the amount American’s had hoarded between the start of the year and the start of the national bank holiday.

Having corralled most of the nation’s gold back into the Fed’s coffers, Roosevelt then made sure it could no longer escape abroad. On April 20th, he issued another Executive Order (No. 6111) indefinitely continuing the restrictions on international gold transactions he’d imposed on March 10th (Executive Order No. 6073) and otherwise prohibiting “the earmarking for foreign account and the export of gold coin, gold bullion or gold certificates from the United States or any place subject to the jurisdiction thereof” except when licensed to do so by the Treasury Secretary. Finally, the same April 28th Executive Order that called for those possessing gold to report their holdings to the Internal Revenue Bureau spelled-out the special circumstances under which gold export licenses might be granted.

The Road to Devaluation

With most American gold safely ensconced in the Fed’s vaults, and strict limits placed on gold exports, the Great Contraction was over. But as we’ve seen, recovery from that contraction would take place only once the gold that had fled the U.S. during the depression started flowing back to it.

FDR eventually encouraged that return flow by reducing the dollar’s official gold content. But by the time he did so, gold’s market price had already risen to a level roughly corresponding to that change. FDR first let it rise on its own by letting the dollar float on April 19th, 1933. But when stock and commodity prices started sagging again in July, he decided to have the government intervene to deliberately boost gold’s market (London) price. The result, which FDR unveiled during his fourth fireside chat of October 22nd, was the controversial gold purchase program, aimed at deliberately regulating gold’s market price by having the RFC purchase it at prices set daily by FDR and his Treasury Secretary. From then onward the dollar’s depreciation became a deliberate object of policy, informed by George Warren’s controversial theory that a depreciating dollar would go hand-in-hand with a proportional rise in commodity prices. FDR hoped to reduce the dollar’s gold value enough to fulfill his long-standing promise to get commodity prices back to their mid-1920s level, and to do so before he settled on a new gold dollar.

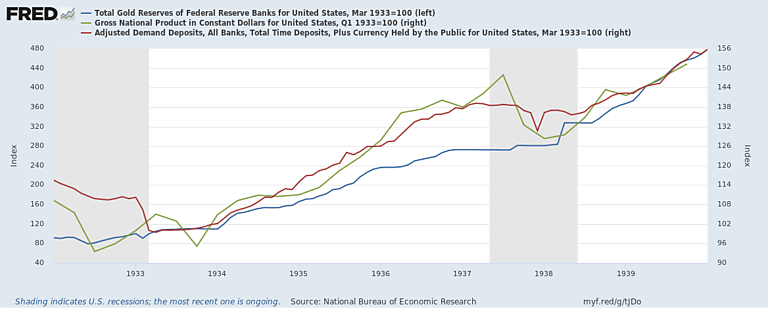

So the dollar fell. Yet until January 31st, when its gold content was officially and permanently reduced from 25.8 to 15 5/21 grains of gold nine-tenths fine, the dollar’s depreciation did little to spur growth in either the U.S. gold stock or broader money measures. Instead—and despite increased world gold output—between March 1933 and the end of January 1934 the U.S. monetary gold stock shrank slightly, while M2 grew by little more than 2 percent—hardly enough to fuel a recovery. Real GNP, which had risen sharply during the weeks following the bank holiday, dropped just as sharply after July.

In contrast, as the next FRED chart shows, the new year would see more or less steady growth in all three measures, with the gold stock rising especially rapidly (note the different index scales on the figure; the one for gold is on the left) and M2 and real GNP growing at more modest but almost identical rates. These trends continued through 1935, 1936, and the first quarter of 1937.

Why was the dollar’s de facto devaluation between April 1933 and January 1934 less effective in luring gold back to the U.S., and in promoting money growth and recovery, than the de jure devaluation that followed? As Scott Sumner explains in The Midas Paradox (p. 238), with most former gold bloc currencies still fixed to gold, the RFC’s gold purchases could only raise gold’s market price by depressing other gold bloc nations’ price levels. Because the purchases themselves did nothing to raise U.S. prices, the terms of trade stayed unchanged. As the London Times reported on November 17th,

So far as [FDR’s] campaign has gone at present, it has had less effect in raising prices in America than in depressing prices and checking recovery in the rest of the world. It must moreover, continue to exert a deflationary influence until there is some plain indication of the level to which President Roosevelt intends to drive the dollar (quoted in ibid, p. 251).

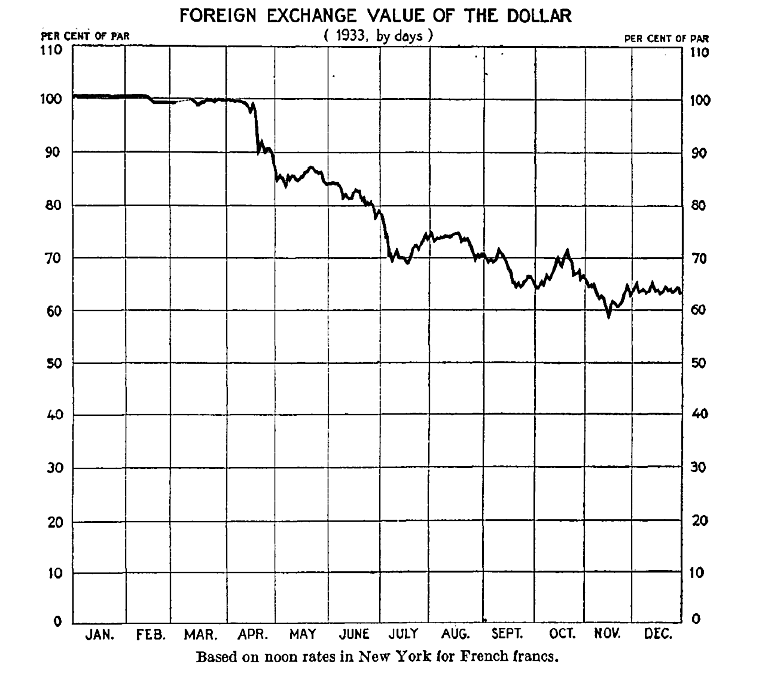

In his famous December 1933 open letter to the New York Times, Keynes offered a further explanation for the gold purchase program’s failure to draw gold to the U.S. “The recent gyrations of the dollar,” he said, “have looked to me more like a gold standard on the booze than the ideal managed currency of my dreams.” They presumably looked that way to others as well. Here, from the 1934 Federal Reserve Board Annual Report, is a chart showing what they looked like to a Frenchman:

A drunken gold standard, Keynes argued, bred uncertainty, which favored neither foreign trade nor foreign investment. “In the field of gold-devaluation and exchange policy,” he concluded,

the time has come when uncertainty should be ended. This game of blind man’s bluff with exchange speculators serves no useful purpose and is extremely undignified. It upsets confidence, hinders business decisions, occupies the public attention in a measure far exceeding its real importance, and is responsible both for the irritation and for a certain lack of respect which exists abroad.

One tangible consequence of this lack of respect was a flight from the dollar. On November 18th the New York Times reported that $1 billion in American capital fled via sterling into gold, including some purchased on the open market “for private American accounts” (Sumner, p. 252n28). Clearly, if devaluation was going to aid recovery, it would have to be devaluation of the sober sort.

Yet even the drunken dollar may have accomplished something. Whatever Keynes and Frenchmen might think of it, the bulls of Chicago and Wall Street were at first keen on the dollar’s wobbly descent: much as George Warren predicted they would, stocks and commodities soared as soon as FDR let the dollar float; and for a while they kept on rising as the dollar fell. According to Sumner (Midas Paradox, pp. 197–8), who himself refers to the well-known articles of Peter Temin and Barry Wigmore (1990) and Gauti Eggertsson (2008), instead of rising in response to money growth, those exceptionally sensitive prices rose in anticipation of such growth, because they led traders to expect “a dramatic change [in] the future path of monetary policy.” Like the bank holiday, which started the process of recovery by quelling expectations of further deflation, and the April 19th prohibition of gold ownership, which succeeded in raising inflation expectations above zero, FDR’s gold purchase program did some good by further boosting inflation expectations.

In fact the RFC’s gold purchases were almost certainly too small to have mattered in themselves. Instead it was the government’s daily gold price settings that suggested to traders that it was testing the waters and would soon announce a permanent plunge. Traders’ reactions in turn supplied FDR with valuable information concerning just how high the dollar’s gold price would have to go to accomplish his goal of raising commodity prices to their 1925 level—too high, apparently, for when he finally devalued the dollar, commodity prices were still well below their 1925 level.

Still, it’s hard to resist the conclusion that, all things considered, FDR’s gold-buying program was a costly waste of time. It didn’t raise commodity prices as much as FDR had hoped it would; and whatever it did accomplish might have been accomplished sooner, and with much less turmoil, if instead of playing cat and mouse with speculators for four months, he’d taken advantage of the Thomas Amendment to throw the devaluation switch in October, if not before.

Gold Rush

As Sumner notes (p. 269), once the dollar was formally devalued, “gold flows continued to influence U.S. monetary policy, perhaps even more so than prior to 1933.” And as we’ve seen, so far as the U.S. was concerned, those flows were positive, persistent, and prodigious: between January 31st, 1934 and May 1st, 1939, the U.S. gold stock rose from $6,829 million to $15,795 million. The money stock rose with it, as did bank lending and investment, but they rose less than the Fed’s gold reserves did because the nation’s still-traumatized banks thought it wise to accumulate large cushions of excess reserves.

Why did the U.S. gold stock grow so rapidly after 1933? There were several reasons, not all of which had to do with the dollar’s devaluation. The most obvious reason was devaluation’s immediate effect on the dollar value of existing U.S. gold holdings, which rose at once by $2.8 billion. That didn’t mean, however, that the Federal Reserve’s gold holdings increased that much. In fact, for a while they didn’t increase at all, because the devaluation took place after the Fed swapped all its gold for the Treasury’s dollar-denominated gold certificates. The $2.8 billion paper profit from devaluation therefore went straight to the Treasury. Of that gain, $2 billion was used to establish the Treasury’s Exchange Stabilization Fund, while the rest, together with another $200 million in accumulated RFC gold purchases, went into the Treasury’s general Fed account. So long as the Treasury didn’t spend it, its windfall did nothing to promote growth in the U.S. money stock. But as the Treasury disbursed funds from its Fed account, member banks’ reserve balances increased by the same amount.

Because it cheapened the dollar, devaluation also altered the balance of trade, encouraging exports while discouraging imports. This change accounted for over a third of the $1,217 million in gold imports during 1934. Afterwards it typically accounted for much less. 1938, however, proved a banner year: during it, net U.S. merchandise exports alone drew in $1,133 million in gold—more than in any year since 1921.[1]

More aggressive gold mining, itself a consequence of both the dollar’s devaluation and that of other gold-bloc currencies, also increased U.S. gold reserves for several years, to the tune of about $1 billion each year.

Hot Money

But the most important source of new gold by far was foreign capital, vast amounts of which began pouring into the United States from the start of 1934, dominating the balance of U.S. international payments from then until the end of the decade. The inflow of foreign capital contributed $4,396 million to the U.S. gold stock between 1934 and 1938, or three times the amount added by net trade receipts. And it would contribute a lot more after that.

Although the start of this capital inflow roughly coincided with the dollar’s devaluation, the inflow had little to do with that step. Devaluation did matter for several weeks: by stabilizing the dollar’s gold value, it prompted the return of foreign capital that had taken flight when FDR started tinkering with gold’s price. After that, foreign capital came to the U.S. because the situation in Europe itself was becoming more and more precarious. War clouds, which began gathering there when Hitler became Germany’s chancellor in January 1933, thickened rapidly when he became its Fuhrer in August 1934.

From then onward, a steady stream of capital flowed in from Europe, with larger waves set off by each new European crisis. The first wave followed Hitler’s March 16th, 1935 announcement that he planned to rearm Germany. By May, Eric Rauchway writes (The Money Makers, p. 121), the French were “changing a billion francs a day into gold” to ship overseas. “All the steamers scheduled to depart France were loaded with the stuff.” As if the Nazi threat itself weren’t enough, the French also worried that “at any moment the government might devalue the franc, embargo gold, or institute exchange controls.” Italy’s invasion of Ethiopia (Abyssinia) that October started a second wave. Other waves followed the foreign exchange crisis brought about by Germany’s rearmament (August and September 1936), the Munich crisis (September 1938), Germany’s occupation of Prague (April 1939), the Nazi-Soviet pact (August 1939), Germany’s invasion of Poland (September 1939), and the first rumors of an impending invasion of France (November 1939). Perhaps surprisingly, European capital didn’t fly to the States following the Anschluss of March 12th, 1938. But that was so only because that the invasion took place while the U.S. was having its own crisis: the severe “Roosevelt Recession.”

These huge capital inflows weren’t just unconnected to the dollar’s devaluation: they had nothing to do with any New Deal policy. Indeed, far from seeking to attract capital from abroad, or welcoming it as it flew in, FDR and his Treasury team became increasingly worried that what they disparagingly called “hot money” would lead to unwanted… inflation! At last, in the late summer of 1936, they decided to do something about it. As I’ll explain in a later post, it was mainly owing to that decision that the promising recovery of 1933–1937 gave way to the aforementioned Roosevelt Recession, which undid a large share of the preceding years’ gains.

But if capital inflows were responsible for most of those gains, and if those inflows were neither planned nor encouraged by the Roosevelt administration, they can’t be included among the New Deal’s accomplishments. Frank Steindl makes the point more starkly: “without Adolf Hitler to spawn a capital flight to the United States,” he says, “virtually no U.S. recovery would have occurred before 1941.” Of course we owe Hitler no thanks for helping us to all that capital—which he did at Europe’s, and eventually the entire world’s, expense. But we can’t thank FDR for it, either.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

- Part 4: FDR’s Fed

- Part 5: The Banking Crises

- Part 6: The National Banking Holiday

- Part 7: FDR and Gold

__________________

[1] These and other details reported here about sources of U.S. gold inflows are mostly taken from Amos Taylor’s article, “Capital Movements in the United States Balance of Payments,” in the May, 1939 Survey of Current Business, pp. 12–14.