Today, when we speak of ways to fight recessions, two options inevitably take pride of place: expansionary Fed policy (meaning lower interest rates or more asset purchases or both) and expansionary fiscal policy (more government spending or lower taxes or both).

But if you’ve been keeping up with this series, you’ll know that, although the U.S. economy rebounded between March 1933 and early 1937, neither expansionary fiscal policy nor Fed actions of the sort we count on today deserve much credit for that rebound. Instead, the Treasury and the Fed played only bit parts, while the spotlight shone on FDR and his virtuoso gambol with gold.

FDR’s handling of gold helped the U.S. economy recover from the Great Depression in part by getting the precious metal to flow into it, countering the persistent effects of a previous gold drain. That drain led to a nationwide banking crisis that brought the U.S. economy to its knees just before FDR took office. Before I can explain how, and to what extent, FDR’s gold policies contributed to the recovery, we must step back in time to consider the causes of the banking crisis, including the part gold played in it.

A Weak Banking System

To understand how the world’s largest economy ended up shutting-down its entire banking system, one must first be aware of a long-standing defect of that system and of how it led, first to the proliferation of small and under-diversified banks, and then to as many bank failures.

That crucial defect, which dates to the earliest days of banking in this country, and which afflicted the vast majority of banks in the years leading to the depression, was “unit” banking. A unit bank is one that does business only from its headquarters, instead of also conducting it at branches set up elsewhere in the same state, if not in other states. Although branch banking is now the rule, for most of U.S. history it was the exception. In 1920, branching was altogether prohibited in 18 states; in most other places it was allowed on a limited basis only. Until as late as the 1980s, branching across state boundaries was virtually unknown.

Even before World War I, the combination of unit banking laws and low regulatory capital requirements in many state banking laws (the minimum capital requirements of nationally-chartered banks tended to be higher) had resulted in a banking system consisting mainly of large numbers of very small banks. Because the U.S. was then a predominantly rural nation (not until 1920 would more Americans live in cities than in the countryside), and farm output made up about 25 percent of total private GDP, most of these banks served rural communities, whose business was farming. Their fortunes were therefore necessarily bound up with those of the farmers they served, which often turned on the profitability of a small number of crops, if not of a single crop. The opportunities for diversification of unit banks in larger towns and cities were also limited, though not so severely.

Unit banking made U.S. banks highly vulnerable to major economic shocks. So it’s hardly surprising that occasional panics, like those of 1884, 1893, and 1907, witnessed clusters of bank failures, including though not always limited to failures of rural banks. But between them the 1907 panic and World War I made matters much worse, by encouraging the creation of many new banks of the weakest sort, setting the stage for unprecedented bank fatalities.

The change brought by the Panic of 1907 consisted of deposit insurance schemes set up in eight states (Oklahoma, Kansas, Nebraska, Texas, Mississippi, South Dakota, North Dakota, and Washington) between then and 1917. According to David Wheelock, the premiums banks paid in these systems were small in comparison with, but otherwise unrelated to, the riskiness of their loans and other investments. Insurance therefore subsidized risky banks in states that adopted it.

The Great Farm Boom and Bust

But WWI would indirectly do even greater harm to the banking system. Because the war shut-down many European farms, and troops needed to be fed, crop and livestock prices rose sharply, encouraging U.S. farmers and ranchers to extend their acreage. Then, when the U.S. entered the war, the Agricultural Extension service egged farmers on further with a vigorous campaign aimed at getting them to contribute to the war effort by farming more intensively with the help of tractors and new methods of pest and weed control. More new banks popped up in turn to finance farmers’ purchases of land and tractors and other inputs using credit secured by mortgages. Between them, subsidized deposit insurance and the WWI farm boom caused the number of banks to more than double, from 12,427 in 1900 to 30,291 by 1920. Bank lending to farmers itself doubled between the start of the War and 1920.

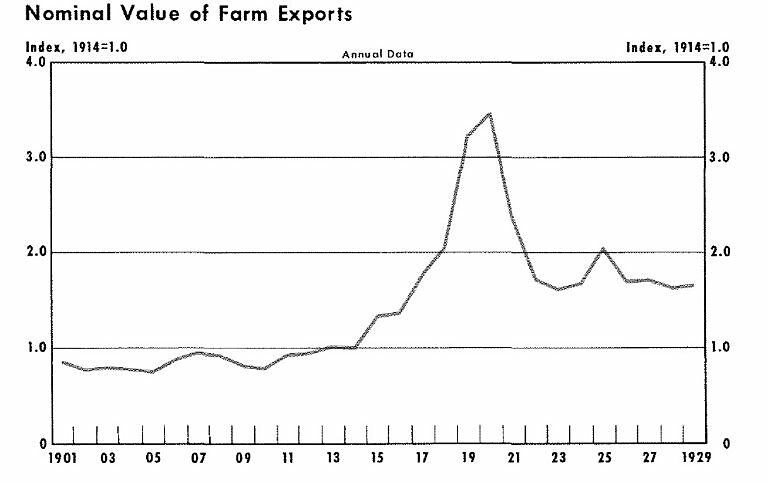

After the war, crop prices fell as sharply as they’d risen during it (see the chart below, reproduced from an article by Joe Belongia and Alton Gilbert), triggering a farm crisis that was to ruin many farmers over the course of the next decade, often bringing their banks down with them.

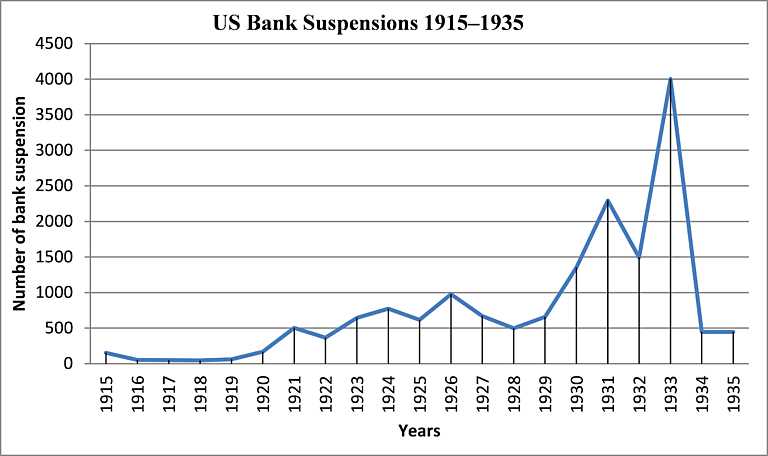

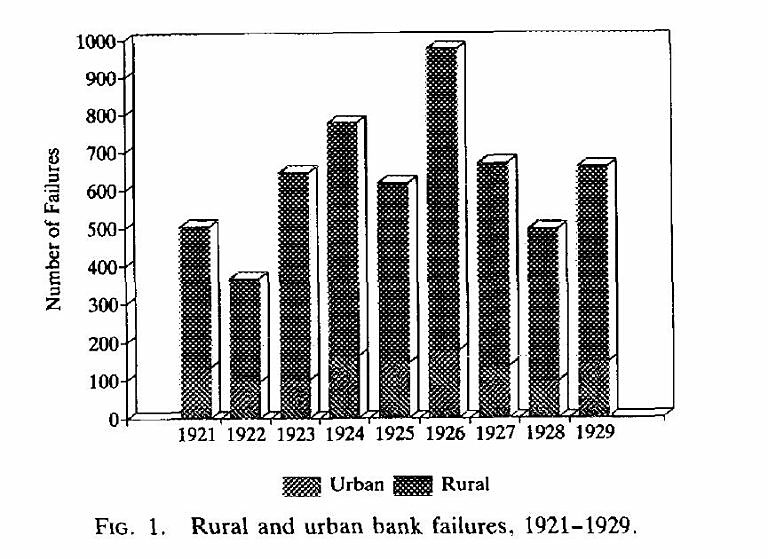

In 1921 alone, over 500 banks failed, topping the previous record reached during the Panic of 1893. The 1921 failures coincided with the general, severe depression of that year. But while most industries recovered quickly from the depression (and did so with little help from either the Fed or the Treasury), agriculture and banking didn’t. Instead, as the next chart (H/T “Lord Keynes”) shows, bank failures mounted, with almost twice as many banks failing in 1926 as had failed in 1921. By the end of the decade 5,411 banks had failed, over 80 percent of them rural. Sure enough, four-fifths of the failures were in states that altogether prohibited branch banking, and failure rates were higher, other things equal, in states with deposit insurance than in those without it. Nor did those state deposit insurance schemes spare depositors from losses: every one of them failed during the 1920s, and every one of those failures save that of Texas’s guarantee fund left depositors with losses.

Still another chart (from a very good paper by Lee Alton, Wayne Grove, and David Wheelock) shows the predominance of rural banks among those that failed:

Depression-Era Changes

After the 1929 crash, rural banks kept on failing. But their ranks were joined by increasing numbers of urban banks, especially during a series of banking crises culminating in the systemic crisis of early March 1933.

Until that final crisis, fundamentals—that is, poorly performing bank loans and investments, as opposed to panicking depositors—continued to account for most bank closings, including some spectacular ones. One difference was that prices for securities and other assets banks either owned outright or held as collateral against loans now declined as precipitously as crop prices had declined after the war, putting more urban banks in jeopardy, including some larger ones. These included a chain of banks owned by Caldwell and Company in Tennessee and some surrounding southern states, which failed in November 1930, and the New York-based Bank of United States, which when it collapsed a month later was the largest U.S. commercial bank to fail up to that time.[1]

Nor did falling crop and livestock prices cease to take their toll. In October 1932, not quite a year after Rogers Caldwell’s banks went under, a dozen Nevada banks owned by George Wingfield found themselves in hot water thanks to depressed livestock prices. The twist was that those banks were the source of more than 75 percent of Nevada’s bank credit. On October 31st, after loans from the Reconstruction Finance Corporation proved insufficient to save Wingfield’s banks, Nevada governor Fred Balzar decided to buy time for them by declaring a twelve-day bank holiday that was eventually extended until December 18th. Wingfield’s banks were ultimately saved by merging them, with the help of some supporting loans, to form the Bank of Nevada. But by then Balzar’s holiday idea had itself become a scourge to bankers that was about to engulf every bank in the country.

Going for the Gold

Bank holidays, starting with Nevada’s, were only the most notorious manifestation of a new factor that had come to join bank fundamentals as an important cause of banking troubles: fear.

The first wave of fear to wash over U.S. banks came not from panicking depositors but from Europe, where it was set in motion by the Bank of England’s decision to suspend gold payments. That decision caused other European central banks, and those of Belgium and France especially, to withdraw gold from the United States to bolster their own reserves. By the end of October, the U.S. gold stock had shrunk by $320 million. According to Susan Kennedy (p. 30), “The rush from abroad to convert dollar balances into gold frightened American depositors,” causing them to start hoarding gold themselves. By November 7th they’d withdrawn another $500 million in gold. The withdrawals put that much extra stress on an already badly strained banking system. During October alone another 522 banks, with almost half a billion in deposits, failed.

President Hoover countered these developments with an anti-hoarding campaign and by establishing the National Credit Corporation on October 17th. When the NCC—a voluntary, banker-funded and operated credit pool—proved inadequate, he encouraged Congress to pass the Reconstruction Finance Corporation Act, which he signed on January 22nd, 1932.[2] By the start of March 1932, the government-funded RFC had made a thousand loans, mostly to banks and trust companies, and they seemed to help: only 46 banks failed that month, compared to 342 in January.

In the meantime, however, domestic and foreign gold withdrawals reached the point of making Treasury Secretary Ogden Mills declare, on February 7th, 1932, that the country was within two weeks of having to either default on its foreign obligations or violate the Fed’s gold reserve requirements. It was this close call that inspired the passage, on February 27th, of the first Glass-Steagall Act, allowing Federal Reserve notes to be backed by Treasury securities instead of either commercial paper or gold. Unfortunately, badly needed structural reforms, including a plan to ease barriers to branch banking, which was tenaciously fought for by Carter Glass but just as doggedly opposed by Henry Steagall, failed to make it into law.

Despite the lack of fundamental reform, and thanks in part to the RFC’s emergency loans, the banking situation calmed down that spring. By late spring it seemed to some that the worst might be over. In New England especially, economic conditions were improving; and commodity, stock, and output figures started moving up. Gold even started coming back into the banks’ coffers. Hoover began to hope his policies would be vindicated after all, cinching his reelection.

But things didn’t turn out that way, in part because the presidential campaign itself ended up rekindling depositors’ fears.

Campaign of Fear

The false dawn ended abruptly that June when Chicago and surrounding towns suffered another wave of bank failures, though one still confined to insolvent banks. Late summer brought another lull, but that also proved misleading. New England’s example wasn’t followed elsewhere. Instead, conditions worsened. By the fall not only Nevada’s banks but banks everywhere faced new runs that caused them to rein-in their lending. As Susan Kennedy (Banking Crises, p. 131) notes, although at first the runs’ targets were still mostly rural banks, runs on metropolitan banks became increasingly common.

For all his efforts to shore up ailing banks and all his preaching about the importance of confidence, Herbert Hoover unwittingly contributed to banks’ troubles by sowing seeds of suspicion. He did so, first of all, during an October 4, 1932 campaign speech in Des Moines, when he revealed how close the country had come that February to defaulting on its gold payments. As Scott Sumner explains in The Midas Paradox (pp. 141–2), although Hoover had hoped to rack-up kudos for having saved the situation, he merely succeeded in raising new doubts concerning the state of the U.S. gold stock: within days, the dollar had fallen sharply against other gold-standard currencies, and was said by the New York Times to appear “feeble and delicate.” Having been repeatedly assured until then that the dollar was rock solid, depositors now had reason to distrust such assurances. Because of this, Paul Einzig (quoted in ibid., p. 142n19) observed, when a run on the dollar started some months later, “no official reassuring statement was able to restore confidence.”

If in Des Moines Hoover unintentionally undermined voter’s confidence in his own government, both there and elsewhere he very deliberately tried to undermine their confidence in his opponent, declaring (among other things) that he planned to tinker with the gold standard. As we’ll see, when FDR finally resorted to it, devaluation would help to bring gold rushing back into the U.S. monetary system. But devaluation is one thing; the prospect of devaluation is quite another: if people, at home or abroad, anticipate the reduction of a currency’s gold content, to avoid a capital loss they’ll want to trade their paper notes, deposits and securities denominated in that currency for gold itself. So the more who believed Hoover’s lurid account of FDR’s plans, the more banks and the dollar suffered.

Yet FDR did little to assuage their fears. In fact, as he told his own staff, he had no idea whether the country could stay on the gold standard, and he wished to avoid committing himself to it for that reason. But he could hardly declare that he was not committed to it—not without guaranteeing a crisis. So he mostly left it to others, including Carter Glass, to deny Hoover’s charges; and when he did reply himself he did so obliquely, as when, in a November 4th speech at the Brooklyn Academy of Music, he accused Hoover of conjuring up a “rubber dollars” bogeyman. During the interregnum FDR, pressed more and more, said less and less. As inauguration day approached, the exchanges again turned against the dollar. “Uncertainty over Roosevelt’s plans for the dollar,” Sumner says (p. 181), “was most responsible for this change in sentiment.”

Panic in Detroit

Faith in the dollar could only weaken so much before it broke; and several developments in early 1933 hastened that breaking point’s arrival. The first serious blow came on January 6th, when Congress’s decision to name banks that received RFC assistance “exposed even saved banks to heavy withdrawals by frightened depositors” (Kennedy, p. 132). Then, in early February, runs on some New Orleans banks caused Huey Long to declare that the state would take two days holiday to commemorate the United States’ decision to sever diplomatic ties with Germany sixteen years earlier. More serious still was the Detroit banking crisis. Detroit was a one-industry town, whose banks were mostly owned by just two companies: the Guardian Detroit Union Group, comprising 31 banks, and the 40-bank Detroit Bankers Company. By the start of 1933 several of these banks, including the Guardian Group’s Union Guardian Trust Company, were in trouble, both because automobile sales had collapsed and because their holding companies had been squeezing fat dividends from them.

Come mid-January it was clear that Union Guardian Trust couldn’t survive without help, which it tried to get from the RFC. But the RFC couldn’t lend it enough on the collateral it had to offer. All hopes now rested on the possibility of further local support, including Henry Ford’s agreement to “freeze” his $7.5 million deposit with the Trust, in effect reducing its current liabilities by a like amount. Alas for Detroit, Ford not only refused to go along, but threatened to cash in his firm’s deposit at Detroit’s First National Bank—the Detroit Banking Group’s flagship. When failed pleas from RFC and other regulatory authorities, and ultimately from Herbert Hoover himself, made it clear that Ford wasn’t bluffing, only two options remained: either Michigan could declare a bank holiday, as Nevada and Louisiana had done, or upon reopening for business the next day most of its banks would fail. At last, in the small hours of Valentine’s Day, Comstock declared a holiday.

Although it gave Michigan’s own bankers a breathing spell, Comstock’s declaration was bad news for bankers elsewhere: fearing that their own governors might follow Comstock’s example, depositors in other states rushed to withdraw their money. Their prophecies were self-fulfilling. State banking systems started shutting-down one after another, like so many dominoes toppling: New Jersey on February 20th; Maryland and Ohio on the 25th, and a dozen other states before March 2nd. By the 3rd, another two dozen states had shut their banks down.

A Run on the Dollar

Yet those holidays weren’t themselves the last straw. What finally precipitated the national bank holiday was not a general loss of confidence in the nation’s commercial banks but the growing conviction, both at home and overseas, that the gold standard’s days were numbered.

Several developments informed that conviction, including an attempt, in January, to provide for devaluation in the (ultimately doomed) Glass-Steagall bill that was then being considered. The most upsetting of these happened in the second week of February, when word got out that Carter Glass had refused to serve as FDR’s Secretary of the Treasury because FDR would not promise not to devalue the dollar. Pressed about his intentions, FDR became more taciturn than ever. Soon a full-fledged run on the dollar had begun. By its end, $1.8 billion in paper currency had been withdrawn from the banks, of which almost a third—$563 million—was afterwards presented to the Fed for payment in gold. Before long the Federal Reserve Bank of New York, where most of the nation’s gold was kept, had lost so much gold that it had to suspend its gold-reserve requirement.

As I’ve explained elsewhere, it was not commercial bankers but the leaders of the New York Fed

who first pleaded for a national bank holiday, and who were relieved when New York State Governor Herbert Lehman declared a state banking holiday that anticipated the national one. The significance of this becomes all the more apparent when one considers that officials at several of New York’s biggest banks, fearing such a holiday would damage their banks’ reputations, argued against it, telling Lehman that they’d “rather stay open and take their beating.”

Those New York banks were actually well-prepared to withstand a beating that February. They joined the New York Fed in asking Lehman to declare a holiday only because George Harrison, its governor, asked them to do so to keep the public from realizing that the Fed itself had its back against the wall. Once Lehman agreed, officials at the other Fed banks began urging the governors of states in their districts that had not yet declared holidays to do so. When FDR took office on March 4th, most of the banks in the country had temporarily closed.

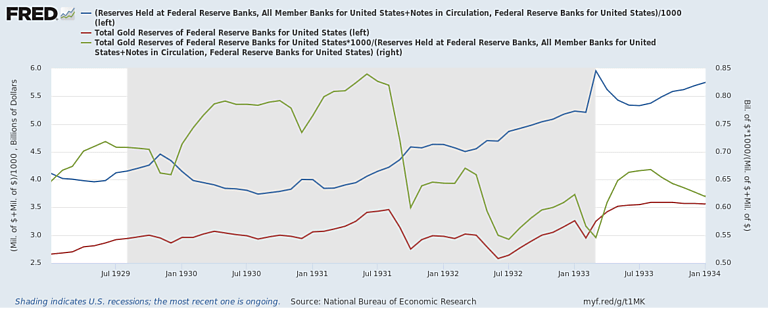

No System-wide Gold Shortage

Paradoxically, although a shortage of gold at the New York Fed was the proximate cause of the national bank holiday, the Federal Reserve System was never short of gold. Instead, as the next FRED chart shows, at its nadir, the Fed banks’ gold stock (red line) was worth almost $3 billion, or almost 55 percent (green line) of its combined note and member bank deposit liabilities (blue line). As against that the law required only two-thirds of that amount.[3] In other words, when the New York Fed pled for the holiday that eventually shut down the entire U.S. banking system, the Fed banks still had $1 billion in gold to spare.[4]

“It is difficult to imagine a more shocking indictment of U.S. monetary policy,” Scott Sumner says (Midas Paradox, p. 149), “than the fact that on the day FDR took the United States off the gold standard it still held over 37 percent of the word’s gold stock.” It is indeed. But how could it have happened? The sadly prosaic answer is that the Federal Reserve System failed. The System failed first of all by not taking advantage of its statutory power to temporarily relax the Fed banks’ high gold reserve requirements. When, the day after FDR had declared a nationwide holiday, Senator Glass asked Governor Harrison why the New York Fed asked for a holiday when it still held substantial amounts of gold, he received the perfectly unsatisfactory answer that, had it not done so, it would eventually have run out!

The Fed banks also failed by not cooperating with one another. Officials at the Chicago Fed in particular pointedly refused to help their New York counterparts by buying or re-discounting some of the New York Fed’s securities. Not only didn’t they help: at one point they threatened to stage a run of their own on the beleaguered New York bank![5]

***

Although this series is mainly concerned with the New Deal, and specifically with its contribution to ending the Great Depression, no account of that contribution would be complete without a discussion of FDR’s handling of the national bank holiday and his consequent dethroning of the gold standard. But to properly assess those, we’ve had to review the events leading to the nationwide banking crisis. As we’ve seen, although he was not yet president, FDR could not help being part of that story. Soon he’d play a much bigger and very different part, as the man who promised to reverse the tide he had himself inadvertently helped to set in motion.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

- Part 4: FDR’s Fed

- Part 5: The Banking Crises

__________________

[1] Just how close to insolvency the Bank of United States was at the time of its failure on December 11th, 1930, is controversial. Surveying the relevant literature and evidence, Paul Trescott concludes that although the bank “was not seriously insolvent at the time of its closing,” its “condition was deteriorating rapidly.” Trescott’s conclusion is at least consistent with Ted Temzelides’ observation that upon being liquidated it “paid off 83.5 percent of its liabilities” despite having “had to liquidate a large fraction of its assets under unfavorable conditions.”

[2] As James Olson observes, by establishing the RFC, Hoover took “an extraordinary step forward in the history of American public policy. Indeed, the tragedy of Hoover’s reputation lies in the comparison historians have made between the Republican president and those presidents who followed him. Hoover becomes a landmark figure in the history of American politics when one compares him with his predecessors. In 1931, for the first time, an American President had admitted that the federal government was responsible for maintaining the economic welfare of the nation, for controlling the operation of the business cycle.”

[3] Each Fed bank had to maintain a gold reserve equal to at least 40 percent of its outstanding Federal Reserve notes, plus a reserve of either gold or greenbacks equal to at least 35 percent of its members’ deposits.

[4] In case you wonder, the previous two low points in the Fed’s gold holdings coincide with the foreign drain on gold that followed Great Britain’s abandonment of the gold standard on September 22, 1931, and the Chicago banking panic of June 1932.

[5] Several economists have argued that the Fed need never have suspended gold payments, and that it might have avoided doing so even as it pursued more expansionary monetary policies that could have averted the Great Contraction. Although the possibility is of immense interest, it falls beyond the scope of our topic. See, however, Bordo, Choudhri, and Schwartz (2002) and Hisieh and Romer (2006), and Sumner’s discussion of these, in The Midas Paradox (pp. 148–56). A more recent study by Garo Garabedian and Rebecca Stuart concludes that, although more extensive Fed asset purchases during 1932 would have gone far toward achieving an earlier end to the U.S. depression, they would also have forced the U.S. off the gold standard sometime that year.