“[The COVID-19 crisis] wouldn’t be the first time America has resorted to large-scale fiscal stimulus in a peacetime emergency. The New Deal of the 1930s, a response to the Great Depression, is probably the most far-reaching example.” (Katia Dmitrieva, “The Times America Went Big and Flooded Economy With Federal Cash,” Bloomberg, March 9, 2020.)

***

It may seem perverse of me to begin an appraisal of the New Deal’s bearing on recovery by discussing fiscal policy. After all, FDR came into office in the midst of this country’s worst banking crisis, and this left him little choice but to give immediate attention to monetary policy steps that might end it. Still I want to start with fiscal policy, not because I suppose it belongs first chronologically, but because I’m sure it ranks last in importance.

Fallen Spending, Deflation, and Reflation

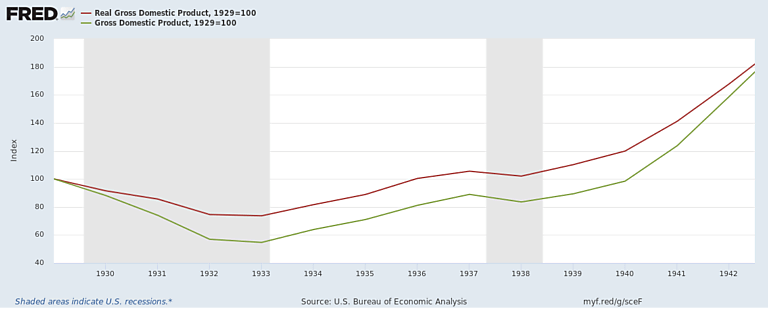

The proximate cause of the Great Depression was a dramatic collapse of overall spending, or what economists call “aggregate demand” for goods and services between 1929 and early 1933. In the FRED chart below, that collapse is represented by the green line, showing the nominal value of U.S. Gross Domestic Product (GDP). The red line shows how real GDP fell along with its nominal counterpart, though not as much, and then recovered along with it. I’ve drawn the chart to cover the period from 1929 until July 1942, because the latter date marks the recovery’s completion, when real GDP is supposed to have returned to its underlining, long-run trend.

Figure 1. United States Real GDP and Nominal GDP, 1929–1942

For all its simplicity, this chart can help us to account for the methods by which the recovery was achieved, as well as for ways in which it might have been hastened. The first and perhaps least obvious of these methods, and also the least reliable, is deflation. When spending declines, the result must be either that fewer goods and services are sold, or that prices decline to allow any given amount of spending to purchase more goods and services, or some combination of both things.

It follows that the more completely prices respond to fallen spending, the less sales will suffer. Because falling prices, besides preventing inventories from accumulating, also mean falling input costs, production may also be revived. In the chart, the gap between the red and green lines reflects the extent to which deflation prevented real output from collapsing as much as spending did. It’s therefore conceivable that, had it been possible for prices of all kinds to decline further, the depression would have ended sooner. “Conceivable.” But anything but certain, because deflation would have been of little help either to those struggling to pay debts contracted before it took place, or to their creditors.

Instead, those who owed money would still owe as many dollars as ever, while each of the dollars owed would be more valuable than before. Consequently, the greater the extent of indebtedness when demand collapses, the less capable deflation becomes of supplying a way out; and, as Irving Fisher observed in 1933, “the debts of 1929 were the greatest known, both nominally and really, up to that time.” Under such circumstances, said Fisher in proposing his famous “debt-deflation” theory of the depression,

the very effort of individuals to lessen their burden of debts increases it, because of the mass effect of the stampede to liquidate in swelling each dollar owed. Then we have the great paradox which, I submit, is the chief secret of most, if not all, great depressions: The more the debtors pay, the more they owe. The more the economic boat tips, the more it tends to tip. It is not tending to right itself, but is capsizing.

In short, deflation was the least reliable, and therefore the least desirable, of possible remedies for depression. It remains true, nonetheless, that so long as spending itself stayed depressed, policies that prevented prices from falling only tended to make matters worse. As we’ll see in later installments to this series, the Roosevelt administration didn’t always appreciate this unpleasant truth.

The more sure-fire ways to fight a depression consist of means for reviving spending itself, so as to bring equilibrium prices back to their pre-depression levels—a procedure Fisher and his contemporaries called “reflation.” Broadly speaking, there are two ways to do this: expansionary monetary policy, and expansionary fiscal policy. The first consists of policies that increase the money stock—the sum of currency and bank deposits available for the public to spend. The second consists of policies that increase total spending by the government, and especially ones that increase that spending less than they increase taxation, which reduces the public’s spending power. “Fiscal stimulus” is just another name for an expansionary spending policy aimed at combating a recession or depression.

The Fiscal Stimulus that Wasn’t

Although almost everyone assumes that fiscal stimulus played a big part in bringing the Great Depression to an end, the truth is that its contribution was insignificant.

Old myths die hard. Yet this one still ought to have died ages ago when it was thoroughly exploded by M.I.T. economist E. Cary Brown in his paper, “Fiscal Policy in the ‘Thirties: A Reappraisal.” Here Brown reached the now-famous conclusion that fiscal policy “seems to have been an unsuccessful recovery device in the ‘thirties—not because it did not work, but because it was not tried.” More specifically, he reported that

the direct effects on aggregate full-employment demand of the fiscal policy undertaken by all three levels of government was clearly relatively stronger in the ‘thirties than in 1929 in only two years—1931 and 1936—with 1931 markedly higher than 1936… The trend of the direct effects of fiscal policy on aggregate full-employment demand is definitely downward throughout the ‘thirties.

Although the federal government’s fiscal policy was itself “more expansionary throughout the ‘thirties than it was in 1929,” in most years after 1933 it wasn’t sufficiently so to offset reductions in state and local government spending.

Brown was hardly alone in concluding that New Deal fiscal policy wasn’t particularly expansionary. He himself quotes Alvin Hansen, “the American Keynes,” writing to the same effect in 1941:

Despite the fairly good showing made in the recovery up to 1937, the fact is that neither before nor since has the administration pursued a really positive expansionist program.

Save for only one exception I’m aware of—a rather unconvincing paper by Nathan Perry and Matias Vernango[1]—more recent scholarship concurs with these earlier findings. This includes Christina Romer’s especially influential 1992 finding that “fiscal policy contributed almost nothing to the recovery” of the 1930s. Price Fishback (2010) sums the current consensus up thus:

A nationwide Keynesian fiscal stimulus was never really attempted in the 1930s. During the Hoover Presidency Congress doubled federal spending and ramped up federal lending through the Reconstruction Finance Corporation. The Roosevelt Congresses then spent nearly double the Hoover levels. But both administrations collected enough taxes in a variety of new forms to maintain relatively small deficits throughout the period. Relative to a Keynesian deficit target designed to return to full employment, the deficits were minuscule.

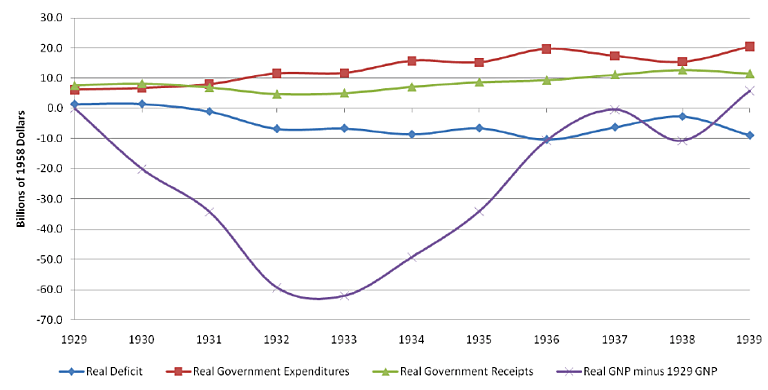

If some readers find this conclusion hard to believe, one of Fishback’s charts, comparing the small size of consolidated (federal, state, and local) real government spending and deficits to the Great Depression decline in real GNP relative to its 1929 level, should help them to overcome their skepticism:

Figure 2. GNP minus 1929 GNP, and Federal Expenditures, Revenues, and Budget Surplus/Deficit in Billions of 1958 Dollars, 1929–1939

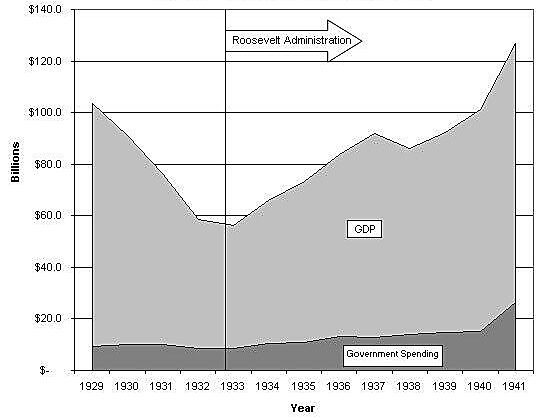

And here, for good measure, is another chart, this time from an essay by my Cato colleague Tom Firey, showing just how small total government spending in the thirties was in relation to the size of the U.S. economy:

Figure 3. U.S. GDP and Government Spending

The New Deal’s Fiscal Conservatism

Why, despite the New Deal, didn’t government spending—and federal government spending in particular—grow more than it did? And why was the growth of federal deficit spending even more modest?

The answer to both questions is that, despite frequent claims to the contrary, the New Deal did not usher in a Keynesian fiscal revolution, or anything close. Instead, as Julian Keliser (p. 125) remarks in his brilliant essay on the subject, “fiscal conservatism…remained normative for most of the New Deal.” FDR himself held fairly orthodox views about fiscal policy, and then made a point of picking Treasury secretaries whose views were even more orthodox. The chairs of almost all the key Senate and House committees, mostly southern Democrats, were also fiscal conservatives, as were some progressive Democratic representatives. Only after 1938, after the government had been blindsided by the 1937–8 depression and the New Deal was drawing to a close, did the Roosevelt administration finally abandon its commitment to limited spending and a balanced budget.

In short, FDR really meant it when, during his campaign, he railed against Hoover’s “reckless spending” (“the greatest spending administration in peacetime in all our history”) and budget deficits. Indeed, if either Hoover or FDR can be said to have initiated a break with the past, Hoover probably deserves the credit. Spending doubled under his administration; and after a decade of year after year government surpluses starting in 1920, Hoover presided over the country’s biggest peacetime budget deficit.

New Deal Spending

Among other things, FDR had pledged to cut government spending by “at least 25 percent”; and he might well have done so had it not been for his commitment to offering relief to the unemployed. Owing to that commitment, FDR’s policy might be defined pithily as consisting of a commitment to a balanced budget plus a “relief valve,” that is, a willingness to tolerate deficits provided they were due to efforts to get money to the unemployed. It was mainly owing to FDR’s unwillingness to limit relief spending, and despite his determined efforts to cut spending of other sorts, that federal spending as a whole increased.

The first of those determined efforts came soon after FDR’s inauguration when, on March 11th, Congress passed the Economy Act. The bill didn’t quite cut spending as much as FDR had promised to cut it during his campaign, but it did trim the government’s $3.6 billion budget by $500 million by eliminating some government agencies and by cutting government salaries, pensions, and veterans’ benefits. The Act also strengthened FDR’s ability to make further cuts through executive authority. “Too often in recent history,” Roosevelt told Congress in recommending the measure, “liberal governments have been wrecked on the rocks of loose fiscal policy.” Nor was Roosevelt merely pandering to Congress’ powerful fiscal conservatives. According to Frank Friedel, his first major biographer, far from being “a hypocritical concession” the Economy Act “was an integral part of Roosevelt’s overall New Deal.”

In 1936, FDR took another big stab at cutting federal spending, this time by trimming “outlays on relief and public works in a great show of budget balancing” aimed at improving his reelection prospects: as Bernard Lee, whose words I just quoted, observes (p. 74), and as many may not realize, the very first Gallup poll, taken in September 1935, showed that 60 percent of the American public “thought government expenditures for relief and recovery were ‘too great,’ while only nine percent deemed them ‘too little’.” FDR made his third and last attempt to balance the budget in the spring of 1937, this time by reluctantly cutting relief spending.

Notwithstanding these and other attempts at “economy,” New Deal spending was anything but modest by the standards of the time. On the contrary, as a share of GNP, FDR’s spending during the 30s was roughly twice Hoover’s, just as Hoover’s had been roughly twice Coolidge’s. In part, as we’ll see, this happened because Congress eventually managed to pass a Veterans Bonus Bill by overriding a second FDR veto. But it was mostly the result of “emergency” spending on various New Deal relief programs. The 1935 Emergency Relief Appropriations Act, which launched the WPA and PWA (among other programs), alone cost almost $4.88 billion, or almost $1 billion more than total federal expenditures during Hoover’s last year in office!

New Deal Deficits and Taxes

Yet even such prodigies of spending didn’t bring correspondingly impressive deficits. As Fishback reports, “only the deficits of 1934, 1936, and 1939… are much larger than Hoover’s 1932 and 1933 deficits,” and only that of 1936—the administration’s largest—was large enough to have given a substantial boost to aggregate demand. Alas for the theory that FDR was an early pioneer of Keynesian deficit spending, the 1936 deficit resulted from the passage, over his veto, of a $1.8 billion World War I Veterans Bonus Bill that January. John Hausman puts this singular New Deal instance of fiscal stimulus in perspective by noting that was roughly enough to allow every vet to buy a new Ford V8, and about the same share of GDP (2.1 percent) as President Obama’s 2009-10 Recovery and Reinvestment Act.

The prosaic reason for the New Deal’s generally modest deficits is that New Deal tax revenues were also high. But the fundamental reason is that practically no one in government at the time believed in any such thing as “fiscal stimulus.” Instead the prevailing view, to which FDR himself subscribed, was that a balanced budget served “to instill confidence in consumers, business, and the markets,” and to thereby “encourage investment and economic expansion.” If FDR tolerated massive relief spending, and any deficits that went with it, it wasn’t because he believed in “Keynesian” economics. It was because he didn’t want people going hungry and also (it must be said) because generous relief expenditures, appropriately directed, helped to improve his odds of winning-over swing states in the 1936 election.

The non-Keynesian motivation behind New Deal spending went hand-in-hand with efforts by FDR and his Treasury team to fund as much of it as possible through increased taxation. Tax-funded spending had also been Hoover’s preference. But both presidents faced stiff Congressional opposition that ultimately caused their budget-balancing efforts to fail. The main difference between their tax policies consisted of the alternative taxes each president proposed. Hoover had favored, but was unable to get, a national sales tax, and instead ended up depending mainly on excise taxes that, besides failing to generate sufficient revenue to cover his government’s expenditures, fell most heavily on the poor. Most New Deal government revenue also came from regressive excise taxes, including a revived liquor tax. Unlike Hoover, FDR tried to supplement these taxes not with a sales tax but by raising income tax rates and introducing other sorts of new taxes.[2]

Indeed, because high tax rates tended to retard economic growth, FDR’s attempts to balance the budget by resorting to them sometimes backfired. According to Fishback, this seems to have been the result when, by raising the top marginal income tax rate first to 63 percent and then to 79 percent, the Roosevelt administration encouraged aggressive tax avoidance. Various new taxes likewise “led to relatively small amounts of revenue at the cost of chilling some forms of investment activity,” while certain excise taxes, besides continuing to place a disproportionate burden on the poor, discouraged “growth in the leading technological growth sectors in the economy.”[3]

Post-New Deal Keynesianism

It was, ironically, partly owing to FDR’s efforts to balance the budget that he was ultimately compelled to embrace deficit spending. For besides making aggressive cuts to relief programs to compensate for the Bonus Bill debacle of 1936, FDR introduced several new taxes, including the notorious undistributed profits tax. The government also began collecting the new social security tax, authorized by the 1935 Social Security Act, in January 1937. Because the government wouldn’t begin paying social security benefits until 1940, the overall result of the 1937 tax was a considerable reduction in the government’s net contribution to overall spending. Steps were also being taken in the meantime, both by the Treasury and by the Federal Reserve, that all but slammed the brakes on growth in the money stock, dampening spending that much further. The combined results of these developments was the devastating depression of 1937–8 that undid much of the recovery achieved during Roosevelt’s first term.

The “Roosevelt Recession,” as Republicans especially liked to refer to it, was to alter FDR’s policies in two ways. First, it marked the winding-down of the New Deal, properly understood. 1938 saw the last major piece of New Deal legislation, the Fair Labor Standards Act. Second, it marked the beginning of “Keynesian” fiscal policy, first as a matter of necessity, but soon enough as a matter of genuinely revised beliefs. With FDR’s request, in April 1938, for $3 billion in spending for immediate relief efforts, the idea that deficits might actually serve a countercyclical purpose, which certain economists had been urging for years, at last took hold in the halls of power.[4] Even then the conversion was far from complete. The New Dealers were still not ready to see tax cuts as a means for achieving fiscal stimulus. “In the late 1930s,” Joseph Thorndike (2009, p. 122) observes, “the notion of countercyclical tax cuts…remained in the land of economic theory, not political reality.” Robert Musgrave puts the point even more strongly, saying that expansionary tax cuts were still “unthinkable” then. According to Thorndike, such cuts only gained acceptance “after the fiscal watershed of World War II.”

***

That New Deal fiscal policy contributed little to recovery from the Great Depression, and probably contributed to the setback of 1937–8, doesn’t mean that the New Deal as a whole contributed little to recovery. To assess the New Deal’s overall contribution to the recovery, we have to consider the consequences of other New Deal programs and policies, including those that influenced the behavior of the U.S. money stock. I’ll take up New Deal monetary policy next.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

___________________

[1] Perry and Vernengo attempt to argue that New Deal fiscal policy mattered more than others have claimed partly on a priori grounds, and partly by questioning extant estimates of the New Deal era fiscal multiplier. But as Bernard Lee noted in 1982 (pp. 69–70), even allowing for a generous multiplier New Deal spending was never sufficient “to support more than a fraction of the vast numbers of jobless and destitute at anything but a minimum level.” As for Perry and Vernengo’s a priori argument, it seems to rest upon a strange dichotomy between growth in the supply or velocity of money and growth in spending. Thus they write that while “recoveries tend to rely both on increasing money supply and increased velocity of circulation,” they “also rely on the expansion of spending (in general a combination of private and public spending)” (my emphasis). That illogical “also” allows them to conclude that an increase in the money stock (or in MV) “is only one of the several elements needed for economic recovery” and that expansionary fiscal policy must, therefore, have played an important part.

[2] For more on New Deal tax policy see Mark Leff’s fascinating study, The Limits of Symbolic Reform: The New Deal and Taxation, 1933–1939 (Cambridge University Press, 1984). According to Ellis Hawley, “Leff shows that there were really two New Deal tax systems: a ‘revenue work- horse,’ featuring regressive levies so masked as to allow coexistence with Populist and redistributionist rhetoric, and a ‘symbolic showpiece,’ raising insignificant amounts of revenue but serving the New Deal politically by undercutting and diverting attacks from both the Left and the Right. One became the hidden substance; the other produced the image that still persists.”

[3] Concerning the adverse effects upon the investment of New Deal tax policies, and of high rates of dividend taxation especially, see Ellen McGrattan’s painstaking 2012 study. According to it, New Deal tax policies can account for the steep declines in tangible investment both between 1933 and 1935 and in 1937, where the second decline was mainly a result of the undistributed profits tax.

[4] On this see William J. Barber, Designs within Disorder: Franklin D Roosevelt, The Economists, and the Shaping of American Economic Policy, 1933–1945 (Cambridge University Press, 1996), p. 83.