(This post completes my three-part discussion of the “regime uncertainty” hypothesis, according to which the New Deal hampered recovery by causing businessmen to fear policy changes that might render their investments unprofitable. Links to the previous posts about regime uncertainty, and to the other posts of my series on The New Deal and Recovery, occur at the end of this post.)

Proving It

Nothing seems more plausible, on its face, than the claim that policy shocks like those we’ve surveyed, coming as they did from a president who was often openly hostile to businessmen, discouraged investment. It’s no doubt largely owing to this, and to businessmen’s own insistence that New Deal policies frightened them, that the regime uncertainty hypothesis has gained adherents among economists.

But proving that regime uncertainty really mattered is an altogether different kettle of fish. It means establishing, first, that regime uncertainty is theoretically capable of causing a substantial and persistent decline in investment spending and, second, that it did in fact account for low investment levels during the New Deal.

Of these challenges, the theoretical one has been met reasonably well: numerous papers show how, in theory at least, “bad news,” “uncertainty shocks,” “risk shocks,” and such, can lead to substantial reductions in investment, employment, and output. Back in 1983, for example, Ben Bernanke showed how even risk-neutral firms’ propensity to proceed with irreversible investment projects can be very sensitive to “downside uncertainty,” thereby adding some formal flesh to the bare-bones reasoning of Keynes and Schumpeter. Since Bernanke’s paper appeared, numerous other works have elaborated upon his “wait and see” thesis.[1]

A related strand of the macroeconomics literature explores the role of “animal spirits” or “sunspots” in propagating business cycles. In a recent NBER working paper, for instance, Roger Farmer constructs a model in which investment spending depends on exogenous shocks to would-be investors’ “beliefs,” meaning their confidence or optimism. The model implies that even a temporary “bout” of pessimism can permanently lower an economy’s capital stock, output, employment, and consumption. Not surprisingly, a permanent adverse investment shock has similar but larger long-run effects. Finally, Farmer finds that offsetting increases in government consumption (e.g., relief) spending can’t compensate for adverse investment shocks because they don’t make up for the lost capital investment. These findings echo the 1938 complaint of W.L. Crum, R. A. Gordon, and Dorothy Wescott, referred to two posts ago, that the New Deal’s “stimulated revival” was no substitute for “a more normally balanced expansion, predicated upon long-run undertakings by business leadership in an environment sufficiently secure from interference to justify assumption of risk.”

Counting on Confidence

Unlike Crum et al., Farmer doesn’t trace confidence shocks on any sort of government “interference.” Instead he treats them as random, autonomous events—or the dimming and brightening of what Keynes called “animal spirits.” Whether New Deal policy developments were also a source of confidence shocks is something statistical evidence alone can establish. Alas, coming up with such evidence is anything but easy.

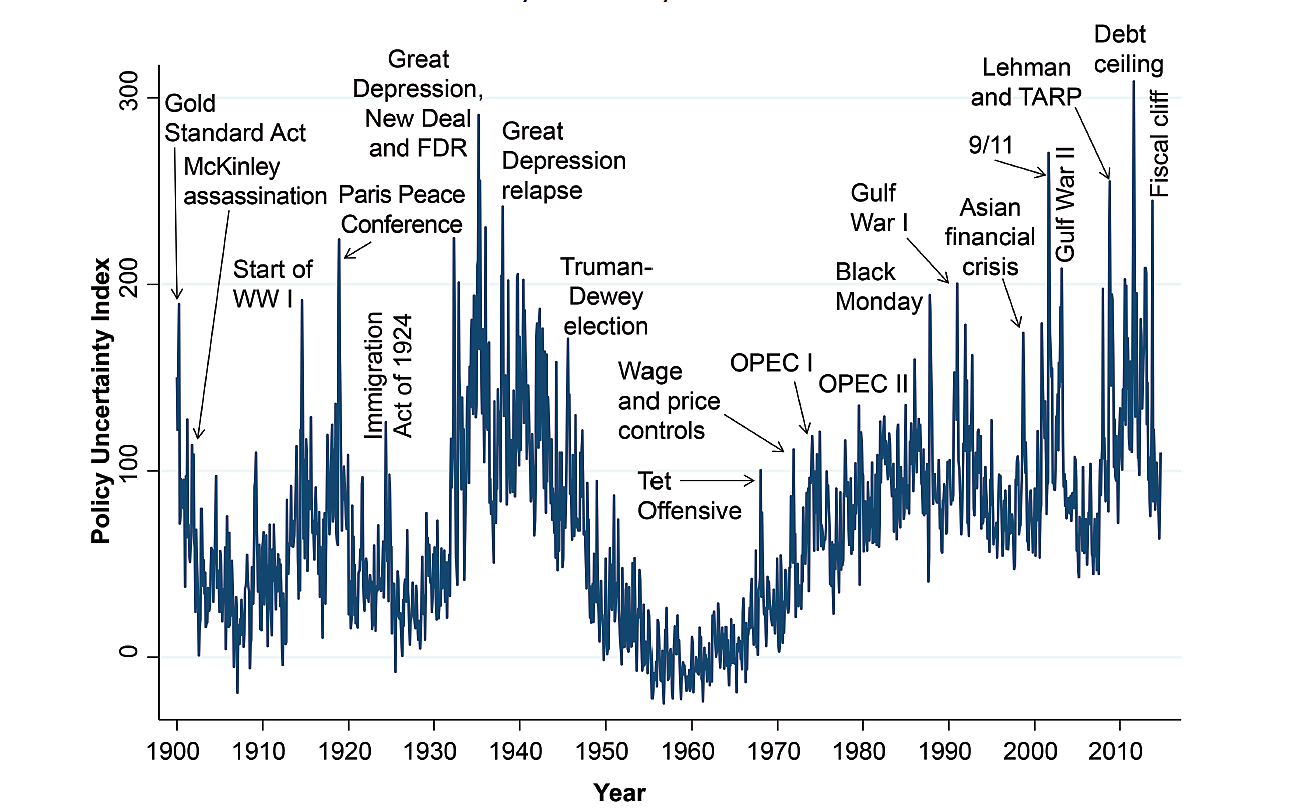

The first challenge is that of measuring the extent of policy uncertainty. Until relatively recently, hardly anyone tried. But the Great Recession saw a revival of interest in the regime uncertainty hypothesis, as many blamed U.S. policy experiments, including the Fed’s resort to unconventional monetary policy, for perpetuating that downturn. Economists accordingly came up with various measures of regime or “policy” uncertainty. The most notable of these, the Economic Policy Uncertainty Index developed by Scott Baker, Nicolas Bloom, and Steven David, measures uncertainty by the number of articles in various newspapers containing the terms “uncertainty” or “uncertain” and “economic” or “economy” together with any of the following: “congress,” “legislation,” “white house,” “regulation,” “Federal Reserve,” or “deficit.”

As Baker, Bloom, and David report in a 2016 article, and illustrate with the chart shown below, their index reaches its highest levels during the Great Depression and again during the Great Recession. In that respect, at least, it lends credence to the regime uncertainty hypothesis.

But while the apparent coincidence of high policy uncertainty and persistent depression or recession is suggestive, it falls far short of establishing that scary policies, or the threat thereof, contributed substantially to either downturn. Apart from the possibility that the policy uncertainty measure is itself unreliable,[2] it’s not clear to what extent causation runs from uncertainty to lower activity rather than vice-versa. Nor is it possible to say whether policy shocks can account for either the extent or the timing of year-to-year, if not month-to-month, fluctuations in uncertainty.

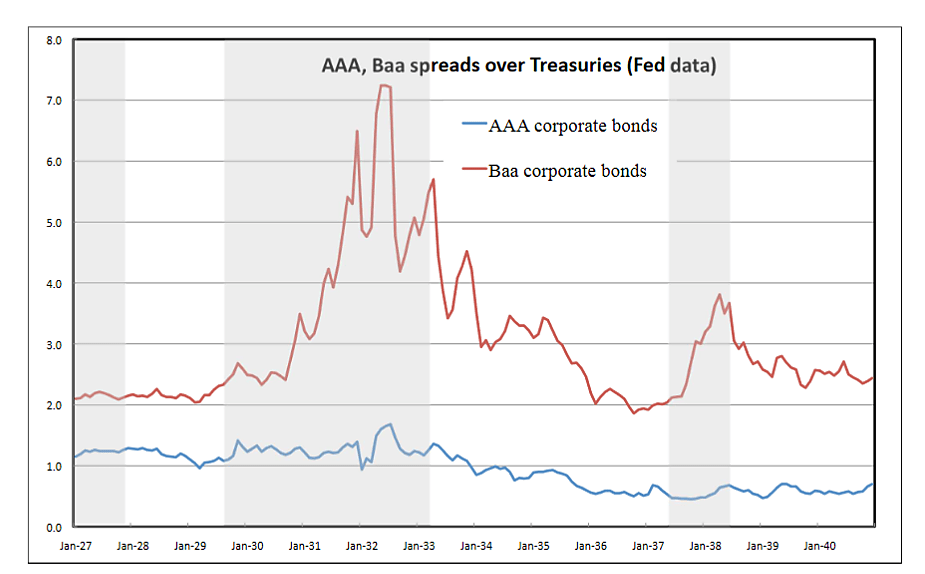

A 2006 study by Sharon Harrison and Mark Weder goes a long way toward addressing these issues. Harrison and Weder develop a Great Depression-era time series for what they call “sunspots”: changes in confidence that can’t be attributed to past or current changes in economic “fundamentals,” including the growth rate of output, the real money stock, the price level, or nominal interest rates. Because their research predates the work of Baker and his colleagues, Harrison and Weder use a different measure of uncertainty: the interest-rate spread between Baa and Aaa securities. Like the Baker et al. measure, this one also reaches its highest levels, roughly 4 to 5 percentage points higher than usual, during the Great Depression and the Great Recession. Here (from a slideshow by Tony Daglish and Lyndon Moore) is a chart showing how the two bond rates varied during the early crisis:

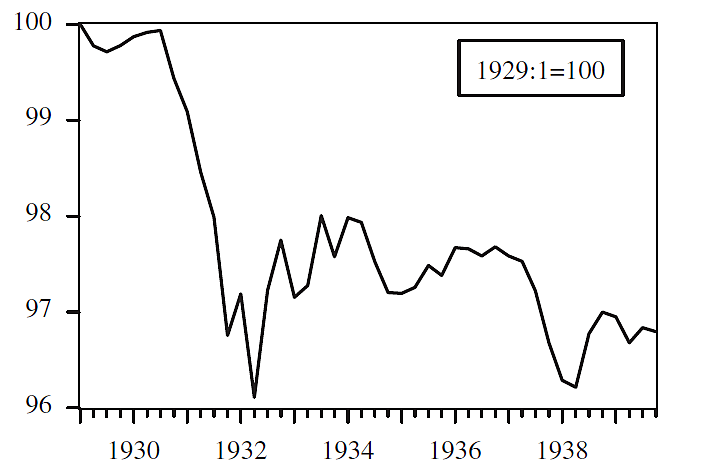

To get their “sunspot” series, Harrison and Weder perform a vector autoregression (VAR) using their confidence measure and the previously-mentioned fundamental variables. The sunspots consist of the errors—the unexplained residuals—from this regression. The next chart, from Harrison and Weder’s paper, shows how their “extrinsic confidence” index—an index of depression-era confidence levels based on sunspots only—changed between 1929 and 1940. Because this extrinsic confidence series is independent of output, it neatly avoids the problem of reverse causation.

What remains to be seen is whether, and to what extent, changes in “extrinsic confidence” can account for the actual behavior of investment, output, and other macroeconomic variables during the depression. To answer that question, Harrison and Weder start with a standard dynamic general equilibrium model in which equilibrium values depend in part on agents’ expectations, which in turn depend on their confidence. They then feed their sunspot (or extrinsic confidence) values into the model, after scaling them to make the maximum decline in output predicted by their model match the actual, maximum decline. Finally, they then compare the changes in various macroeconomic variables predicted by the model to the actual changes.

The results are striking: though its predictions are driven by “sunspots” alone, “the model,” the paper’s abstract reports, “can explain well the entire Depression era,” including “the decline from 1929 to 1932, the subsequent slow recovery, and the recession that occurred in 1937–1939.”

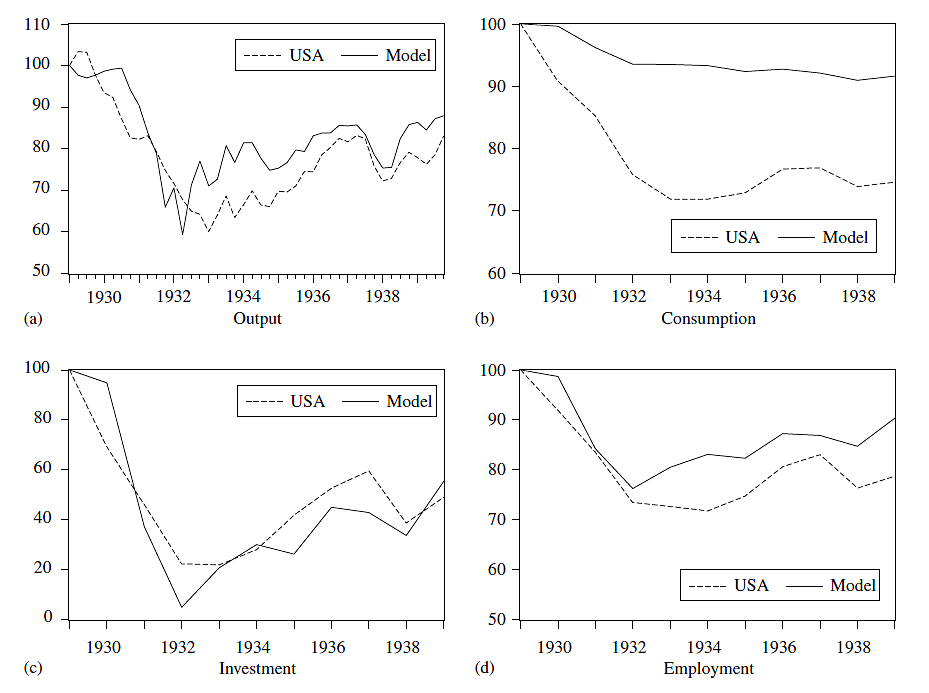

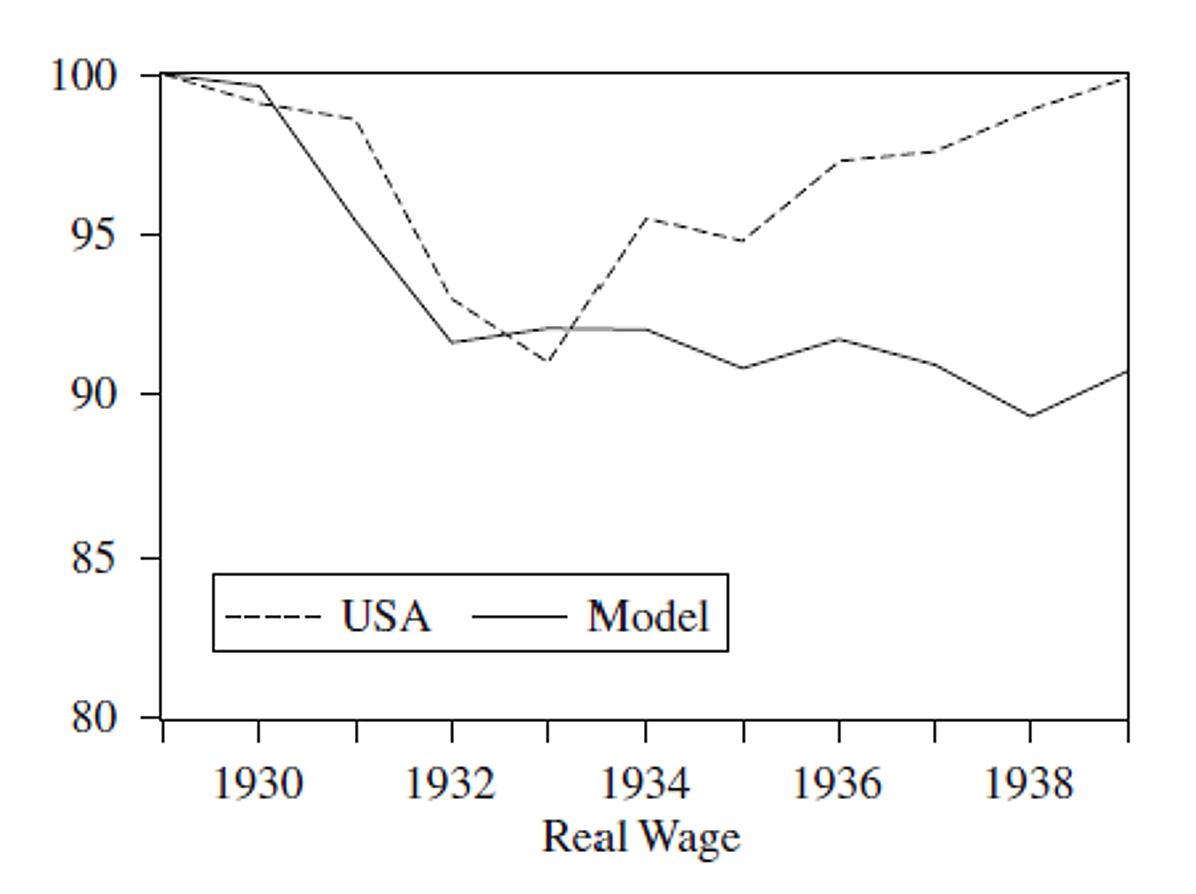

Here is another figure from the paper, showing the predicted and actual courses of output, consumption, investment, and employment:

As the figure shows, although it predicts the course of New Deal investment very well, the model predicts a somewhat more substantial recovery of employment and output after 1933 than what actually took place. Furthermore, as the next figure shows, it also fails to account for the behavior of real wages: although its predictions track them reasonably well until mid-1933, after that it has them continuing to decline slowly, whereas they actually jumped up, and then kept on rising. But far from being troublesome, these differences between the model’s predictions and reality are easily explained as being accounted for, first by the NRA codes and, after those were struck down, by the Wagner Act’s strengthening of labor unions’ bargaining power.[3]Timing is (Almost) Everything

Impressive as Harrison and Weder’s findings are, they still don’t clearly affirm the regime uncertainty hypothesis. Although those findings suggest that “sunspots” or changes in “extrinsic confidence” can go a long way toward explaining the persistence of the Great Depression, save for ruling-out any role for a handful of “fundamentals,” they leave the sunspots themselves unexplained, instead of trying to link them to the New Deal policy shocks. Indeed, by referring to sunspots as a “continuing sequence of pessimistic animal spirits,” Harrison and Weder suggest that they’re inexplicable.

Of course that reference to “animal spirits” alludes to Keynes. But as we’ve seen, far from thinking that animal spirits were the only possible, “non-fundamental” cause of changes in businessmen’s confidence, Keynes was keenly aware of the adverse effects of various New Deal policy developments on that confidence. The question, then, is whether one can show a clear statistical relation between those developments and Harrison and Weder’s sunspot series, or something akin to it.

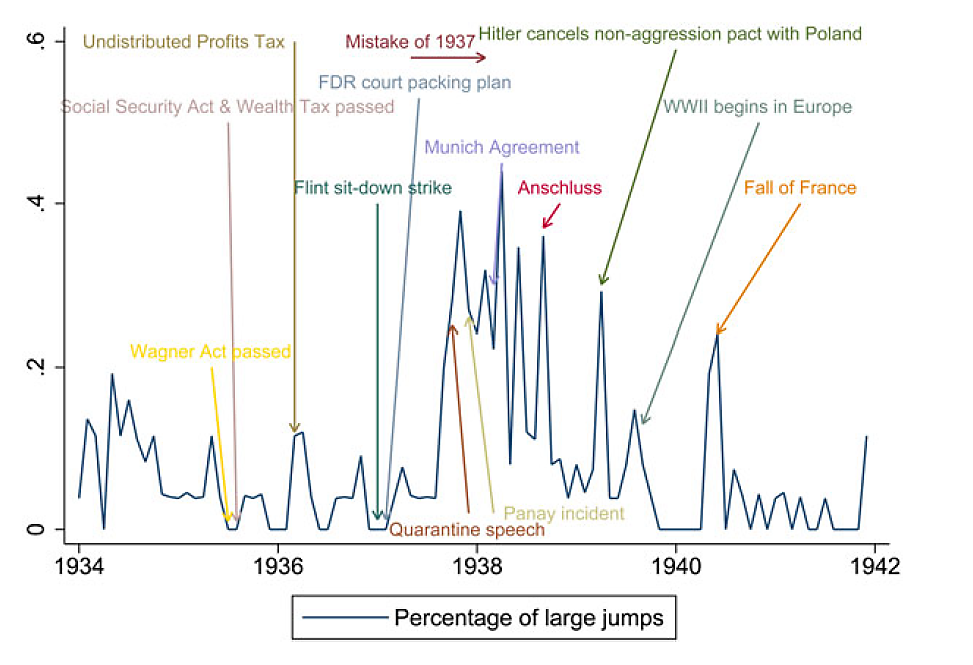

So far as I’m aware, only one study has tried. In a 2016 paper, Gabriel Mathy starts with yet another measure of uncertainty—“jumps” in stock returns—and then constructs a timeline of depression-era events that are supposed to have contributed to that uncertainty, including many of the New Deal policy shocks discussed here and in the last installment to this series. Comparing the events to the timing of stock-return jumps (see the figure below), Mathy finds little evidence for the regime-uncertainty hypothesis.[4] “Other than the NIRA’s passage,” he observes,

none of these [New Deal policy] events line up with high volatility and jumps, which were vastly reduced from the volatile period of 1929–1934. While policy uncertainty could absolutely create uncertainty shocks, the evidence doesn’t show that policy uncertainty played a large role in the weak recovery.

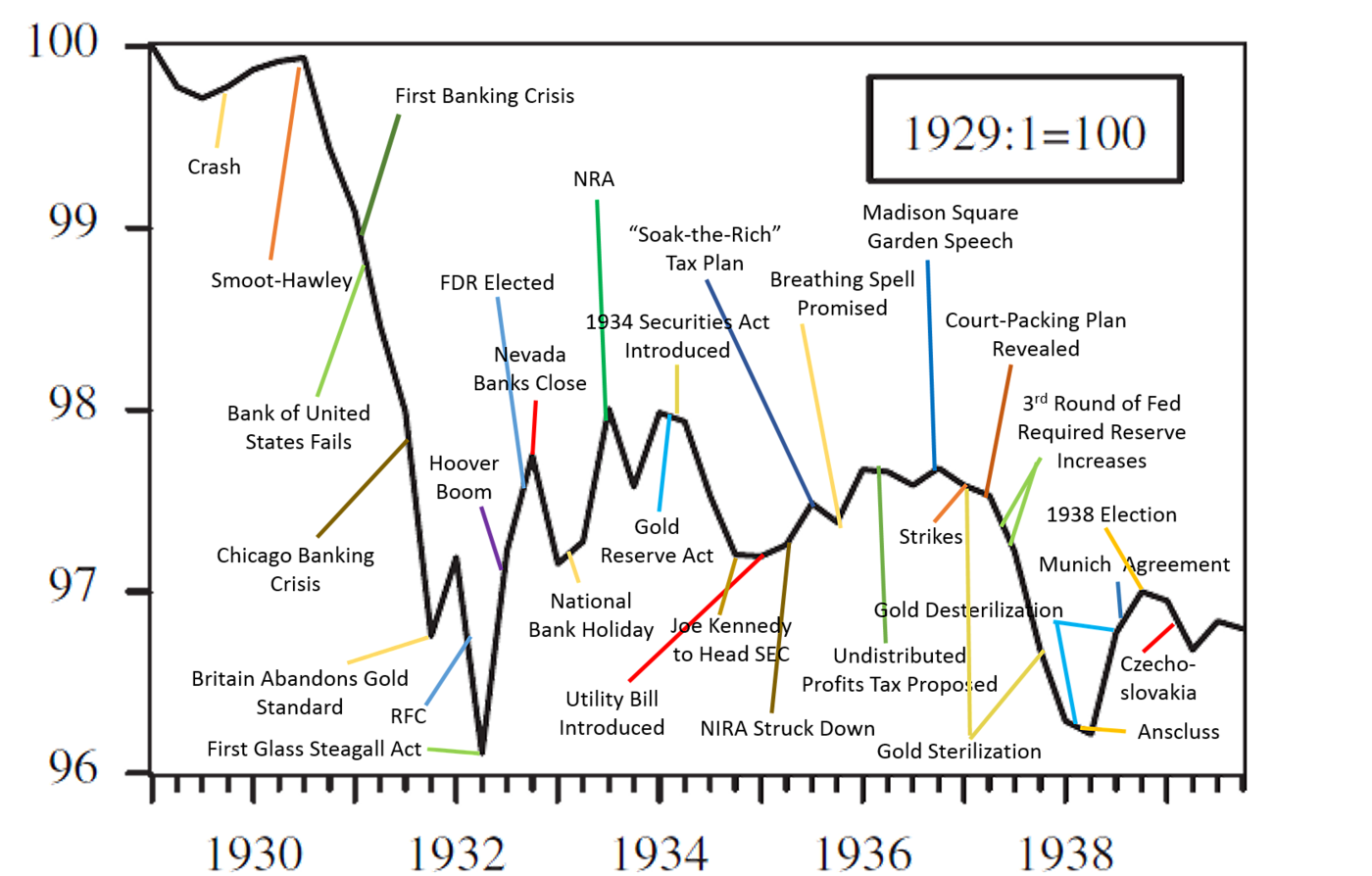

But Mathy’s shouldn’t be the last word on this topic. Unlike Harrison and Weder’s “sunspot” series, his stock-jump measure of uncertainty doesn’t correct for “fundamental” determinants of stock returns. It therefore can’t distinguish changes in uncertainty driven by the ups-and-downs of the business cycle itself from “extrinsic” or “autonomous” changes having other causes. (The same goes for other “raw” uncertainty measures, including Baker et al.‘s, all of which tend to rise during severe downturns.) If one performs an exercise similar to Mathy’s, using key dates from our own narrative of “shocking” New Deal developments along with those for other major events, and replacing Mathy’s stock-jump measure of uncertainty with Harrison and Weder’s extrinsic confidence series, the results, seen in the picture below, seem both intuitively reasonable and broadly consistent with the regime uncertainty hypothesis.

It would of course be interesting to see the outcomes of other such studies, using different “extrinsic confidence” measures based on various alternative raw uncertainty measures. But one needn’t await that research to conclude that the regime uncertainty hypothesis offers a tantalizing and highly plausible, if as yet not thoroughly proven, explanation for some of the “greatness” of the Great Depression.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

- Part 4: FDR’s Fed

- Part 5: The Banking Crises

- Part 6: The National Banking Holiday

- Part 7: FDR and Gold

- Part 8: The NRA

- Part 8 (Supplement): The Brookings Report

- Part 9: The AAA

- Part 10: The Roosevelt Recession

- Part 11: The Roosevelt Recession, Continued

- Part 12: Fear Itself

- Part 13: Fear Itself, Continued

- Part 14: Fear Itself, Concluded

- Part 15: The Keynesian Myth

- Part 16: The Keynesian Myth, Continued

- Part 17: The Keynesian Myth, Concluded

- Part 18: The Recovery, So Far

- Part 19: War, and Peace

- Part 20: The Phantom Depression

- Part 20, Coda: The Fate of Rosie the Riveter

- Part 21: Happy Days

- Part 22: Postwar Monetary Policy

- Part 23: The Great Rapprochement

- Part 24: The RFC

- Part 25: The RFC, Continued

- Part 26: The RFC, Conclusion

- Part 27: Deposit Insurance

_____________________

[1] See, inter alia, Pindyck (1991), Dixit and Pindyck (1994), Bachmann and Bayer (2013), and Stokey (2016).

[2] One wonders, for starters, about the index’s failure to allow for approximate synonyms for “uncertainty” and “uncertain,” such as “fear,” “fearful,” “afraid,” and “worried,” as well as phrases like “low business confidence.”

[3] The Harrison and Weder model also predicts a less severe decline in consumption than actually took place.

[4] In his figure, Mathy transposes the dates of the Anschluss and Munich Agreement.