The Census Bureau has released new data on state population growth between July 2017 and July 2018. Domestic migration between the states is one portion of annual population change. The Census data show that Americans are continuing to move from high-tax to low-tax states.

This Cato study examined interstate migration using IRS data for 2016. The new Census data confirms that people are moving from tax-punishing places such as California, Connecticut, Illinois, New York, and New Jersey to tax-friendly places such as Florida, Idaho, Nevada, Tennessee, and South Carolina.

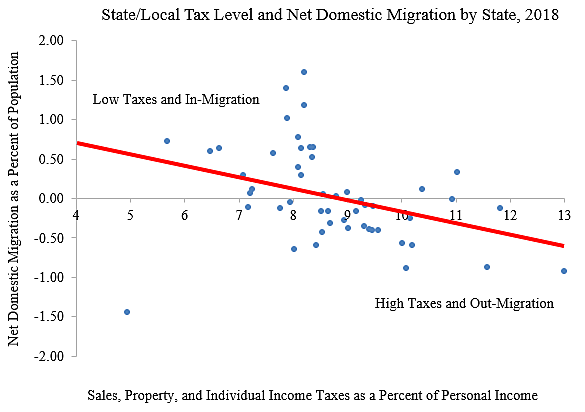

In the chart, each blue dot is a state. The vertical axis shows the one-year Census net interstate migration figure as a percentage of 2017 state population. The horizontal axis shows state and local household taxes as a percentage of personal income in 2015. Household taxes include individual income, sales, and property taxes.

On the right, most of the high-tax states have net out-migration. The blue dot on the far right is New York with a tax burden of 13 percent and a net migration loss of nearly 1 percent (0.92) over the past year.

On the left, nearly all the net in-migration states have tax loads of less than 8.5 percent. The outlier on the bottom left is Alaska. If policymakers want their states to be people magnets, they should get their household tax burdens down to 8.5 percent of personal income or lower.

The red line is fitted from a simple regression that was highly statistically significant.