Here are a couple of dishes Cato Institute scholars cooked up for Tax Day:

- Writing for National Review Online, Chris Edwards warns against the dangers of rapidly increasing government spending:

When filling out your tax forms, you might want to think for a second about where all that money is going. After federal spending roughly doubled in the Bush years, it is growing by leaps and bounds under President Obama. What’s more, the federal government is increasing the scope of its activities — it is intervening in many areas that used to be left to state and local governments, businesses, charities, and individuals.

There are now a staggering 1,804 subsidy programs in the federal budget. Hundreds of programs were added this decade, and the recent stimulus bill added even more. The result is that we are in the midst of the largest federal gold rush at taxpayer expense since the 1960s.

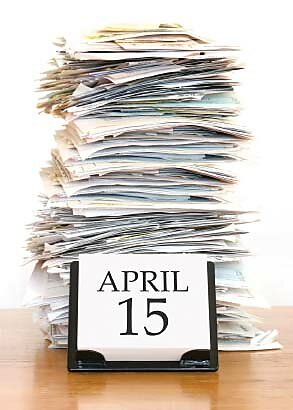

- At Townhall, Dan Mitchell rails against the current tax code:

Beginning as a simple two-page form in 1913, the internal revenue code has morphed into a complex nightmare that simultaneously hinders compliance by honest people and rewards cheating by Washington insiders and other dishonest people.

But that is just the tip of the iceberg. The tax code also penalizes economic growth, distorts taxpayer behavior, undermines American competitiveness, invites corruption and promotes inefficiency.

- At CNSNews.com, Edwards argues that policymakers should give Americans the low and simple tax code that they deserve.

- Also, don’t miss the new Cato video that reveals how troubling the American tax system really is.