Insider trading law makes no sense. As I have argued, the current rules are incredibly convoluted and make it difficult for individuals to be sure they are on the right side of the law. This is a problem given the fact that an insider trading conviction can carry up to ten years in prison (and potentially more). But one of the difficulties that leads to such convoluted lawmaking is the fact that there is no unifying justification for why some trades are permitted and others are not. Many people have a gut reaction to insider trading, feeling that it is somehow wrong or dishonest. And there may be something to that, but current law fails to adequately address the “why.” Why is this trade based on material nonpublic information criminal while this other one, also based on material nonpublic information, is not? The result is a bizarre patchwork of “dos” and “don’ts.”

This confusion is illustrated beautifully by new research suggesting that an SEC rule intended to prevent conflicts of interest among staff has actually had the perverse effect of causing staff to profit from their knowledge as insiders of the SEC. Specifically, SEC staff are required to divest themselves of holdings in companies before they begin investigations of those companies. At first glance, this makes sense. It is clearly unseemly for a government official to have a financial stake in a company she is investigating.

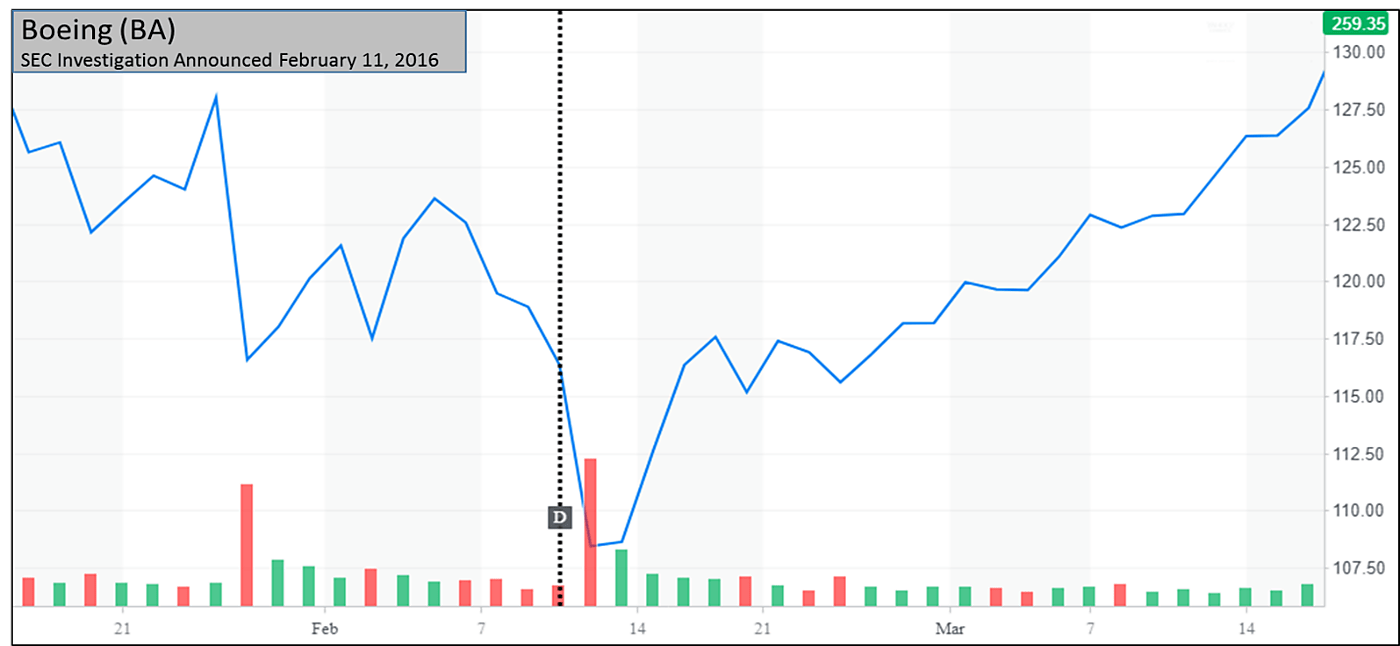

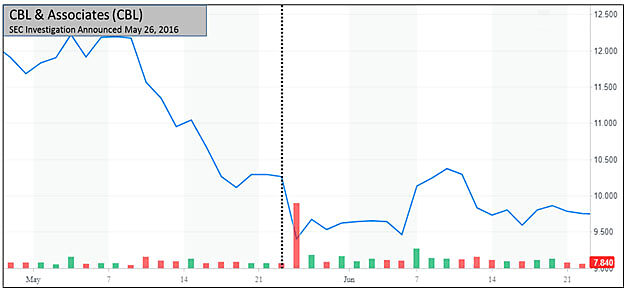

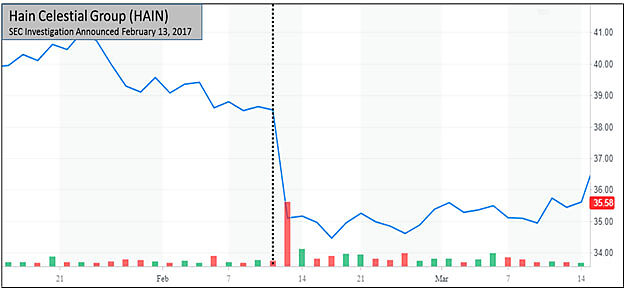

But news of an SEC investigation can have a huge impact on stock price. As seen in a few examples in the graphs below, regardless of what an investigation might find, the mere fact that one has been started can significantly lower the value of a company’s shares. An undisclosed impending investigation is clearly material nonpublic information.

Boeing shares closed down 6.8% on news of the SEC investigation. (Chart: Yahoo Finance)

CBL & Associates shares fell 12.1% on news of the SEC investigation. (Chart: Yahoo Finance)

Hain Celestial Group shares opened down >13%, closing down 8% after news of SEC investigation. (Chart: Yahoo Finance)

For this reason, if an actual company insider dumped shares before an investigation became public, it is likely that insider would be accused of insider trading. While there may be an argument that, for example, the CEO of a company guilty of wrongdoing should not be able to run up profits before the company goes off a cliff, it’s important to note that many “insiders” are not in control of the company at all. For example, a lawyer can be considered to be an “insider” for the purposes of insider trading law and therefore barred from using confidential information to trade in a client’s securities.

As I have discussed elsewhere, the rationale for criminalizing insider trading is often that it undermines confidence in the market. If investors suspect they are trading with people who have unique and otherwise unavailable information, they will be wary of entering the market at all. But from the buyer’s perspective, what is the difference between buying from an insider who knows of an impending investigation and buying from an SEC official who is leading that investigation?

To be clear, I don’t think that any SEC staff member who divests herself of stock pursuant to this rule is doing anything wrong. I also believe the rule itself was written with the best intentions. At this point, I don’t even have a firm recommendation for how the SEC should handle staff stock holdings. It’s possible that the best solution is for SEC staff to be barred from holding individual securities. But there are other considerations at play that may weigh against such a rule.

My point is simply that the result of this SEC rule highlights the muddiness of insider trading law and its underlying rationale (or lack thereof). I find it difficult to distinguish the effect on the market of an insider selling stock ahead of an unannounced investigation and an SEC staffer doing the same. Our laws should criminalize only that behavior that causes a clear and substantial harm. Unless the effects of this SEC rule can be distinguished from the effects of similar behavior by a company insider, neither should trigger criminal liability.