As devoted followers of this blog already know, one of my (many) free-banking hobbyhorses concerns counterfeiting. Assuming similar penalties for convicted counterfeiters, is a system of competing suppliers of redeemable paper currency more or less likely to encourage counterfeiting than a currency monopoly? Having sketched-out some basic ideas on the topic, I’d like to see more economists address it systematically, instead of just deferring to conventional wisdom. That wisdom has long had it that a system of competing banks of issue encourages counterfeiting, because, as the variety of legitimate banknotes increases, so does the cost of information required to distinguish legitimate notes from fake ones. So (the argument goes), whatever its other merits or shortcomings, central banking at least has the virtue of reducing the volume of spurious paper money.

Back in 2007 this prevailing view got a major boost when Harvard University Press published A Nation of Counterfeiters, by Stephen Mihm, a professor of history at UGA, where I was also employed at the time. Mihm views the extensive counterfeiting of U.S. banknotes prior to the Civil War as an inevitable consequence of the failure of the Federal government to assume responsibility for supplying the nation with paper currency. According to HUP’s blurb for his book,

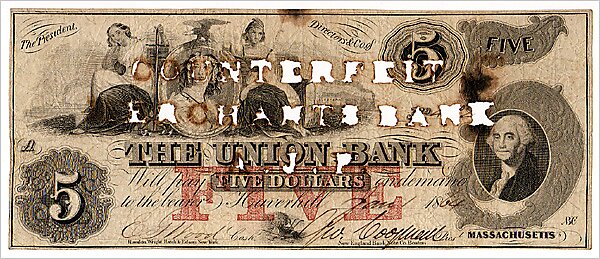

Few of us question the slips of green paper that come and go in our purses, pockets, and wallets. Yet confidence in the money supply is a recent phenomenon: prior to the Civil War, the United States did not have a single, national currency. Instead, countless banks issued paper money in a bewildering variety of denominations and designs—more than ten thousand different kinds by 1860. Counterfeiters flourished amid this anarchy, putting vast quantities of bogus bills into circulation.

In a brief essay published elsewhere, Mihm observes that

The antebellum era’s counterfeiting problem was a consequence of the nature of the money supply at this time. There is a tendency to assume that the greenback is a timeless creation, that the nation-state has always taken the lead in issuing and safeguarding the currency. Nothing could be further from the truth. Prior to the Civil War, the United States exercised little control over the money that circulated within its borders, having abdicated that responsibility decades earlier.

In fact, the roots of the problem date back at least to the previous century, when the colonists began issuing paper money contrary to the wishes of the imperial authorities.

In fact, as I tried to convince Stephen back when, and as a glance at several other nations’ experience might have suggested to him, the “roots” of the U.S. counterfeiting problem did not go nearly so deep as he supposed. The problem was not that the Federal government refused to enforce a monopoly of currency. It was that, by refusing to regard banking as a form of “commerce,” it tolerated state and territorial governments’ interference with the development of nationwide branch banking, not to mention their occasional inclination to outlaw banking altogether. Hence the proliferation of so many thousands of tiny banks, and the corresponding lack of facilities for the prompt clearing and redemption of rival banks’ notes. Rampant counterfeiting of banknotes wasn’t a problem in Canada before the Bank of Canada’s establishment in 1935, or in Scotland before Peel’s Act was applied there. By treating the antebellum situation as a result of the absence of a Federal monopoly rather than as that of an excess of state-government interference with free trade in banking, Mihm reinforces the quite misleading notion–the source of so much mischief–that with respect to currency, as opposed to most other necessities, competition is a bad thing.

As for the simple transactions-cost argument favoring a single currency supplier over multiple ones, the trouble with it, as I tried to explain in my “Notes” linked above, is that it’s far too simple. Sure, more notes mean higher information costs, and therefore more counterfeiting other things equal. But the case here is one in which other things are manifestly unequal. Most importantly, in a system of competing currency suppliers, and especially one involving a well-developed system of bank branches and clearinghouses, issuers will routinely return their rival’s notes for payment, just as banks “return” checks drawn upon their rivals for payment, virtually if not actually, today. Non-note-issuing banks do not, on the other hand, routinely return a central bank’s notes for payment, even if those notes are mere claims to precious metal, preferring instead either to retain them as vault cash or to exchange them for central bank deposit balances.

Though this might seem a small difference, it has very large implications, because it means that, although a competitive system does involve more distinct varieties of legitimate banknotes, if nothing like the huge numbers of banks seen in the antebellum U.S., it also involves much shorter average circulation periods (the length of time between initial issuance and return to their source) for those notes. This short circulation period in turn means more frequent occasions for expert scrutiny and detection of counterfeits, and a correspondingly greater chance of would-be counterfeiters getting nabbed.

A competitive bank of issue also has a greater incentive, ceteris paribus, than a monopoly issuer does to protect itself against counterfeiters, by catching them and by making its notes hard to replicate, because, having but a relatively small share of the total currency market to itself, it incurs greater harm from any absolute nominal sum of counterfeits of its notes. A monopoly issuer of fiat money, at the opposite extreme, offers an especially tempting target to counterfeiters, both because it’s notes are only returned for “payment” (in fresh currency) once they have been badly worn, and because it needn’t fear being ruined even by large quantities of undetected replicas of its notes, and so is less inclined to embellish those notes with cutting-edge anti-counterfeiting devices.

In short, the answer to the question whether competition encourages or discourage counterfeiting isn’t a matter of mere logic, simple or otherwise, but one that must be resolved by referring to experience.

Alas, the nature of the subject is such as makes quantitative evidence scarce even today–a situation not helped by the tendency of enforcement agencies to treat their counterfeiting data as classified information–and almost completely unavailable for centuries past. “Anecdotal” evidence from plural note issue systems not hampered by the same infirmities as antebellum U.S. arrangements must therefore carry the day. But even that sort of evidence is hard to come by. Consequently I was very pleased to discover, in reading some old British banking-controversy documents recently, some relevant testimony. The source is Charles Lyne’s generally excellent pamphlet, published anonymously in 1821, entitled “A Review of the Banking System of Britain: With Observations on the Injurious Effects of the Bank of England Charter” etc. The “lower orders,” Lyne notes (pp. 78–82),

are very unfond of Bank of England notes, from the numerous forgeries committed upon them; and unless, during the existence of a “run” on their provincial Banks, generally prefer their paper, however doubtful they may suspect them to be, ultimately, in the point of security. The prohibition of provincial issues under £5, would have greatly increased the forgeries of Bank of England notes, which were to supersede them, and these forgeries are already sufficiently numerous…; on the other hand, the circulation of each provincial Bank being confined, in a great measure, to a comparatively small section or division of the country, any attempt to circulate forgeries upon it, are almost immediately detected. Besides, there Bankers are so sensibly alive to the injurious effects of a successful forgery on their notes, that they ferret out the forgers with the eagerness of men whose interests are deeply at stake; and with so many local checks of this description, provincial forgeries are rarely attempted. When they do take place, the public is seldom allowed to lose much by them; for the Banks find it more for their own interest, to receive, as genuine, two or three hundred pounds of forgeries, than to excite public alarm by refusing to do so, which might injure their circulation very materially… Every pound so paid for forgeries, communicates, if possible, additional energy to to their exertions for detection of the criminals, and usually produces improvements in the paper, water marks, engraving, signatures, &c. of the notes of such Bankers, which render their imitation more difficult afterwards. From every inquiry, the loss sustained by the Banks, and the public, from forgeries of Scots notes, betwixt 1815 and 1820, did not exceed £500 in all, or £100 annually.

So supine were the directors of the Bank of England on this point, that they not only disregarded all remonstrances respecting the execution of their notes until very lately, but also retained the forged notes presented to them, granting the holder merely what was termed an investigator’s ticket, specifying the date, sum, and marks on the forgery; so ineffectual a method of enabling the holder to trace back through whose hands it had passed, that it looked rather like a bounty or protection to forgers… . But the interest which an individual feels in the case of a £1 or £2 forgery, is seldom sufficiently powerful in itself, to lead to the detection of the makers; and even when aided by the exertions of the Bank’s law agents or officers, there must be fewer chances of detection, than if the Bank’s circulation was more local or of smaller in amount, another reason why rival issuing Banks should be established in London.

Although one pamphleteer’s observations can’t be expected to settle the larger debate, I note that Lyne’s claims concerning the relative abundance of fake Bank of England notes compared to that of Scottish bank notes agrees with testimony to the same effect from a number of other sources. What he adds that’s new is the claim that the notes of English provincial banks–then limited by law to six or fewer partners–were also less frequently imitated than their Bank of England counterparts. Such testimony should at very least suffice to warn students of banking history to resist drawing conclusions about the pros and cons of currency competition based solely on U.S. experience.