In a previous post, I argued that Paul Volcker didn’t put a stop to inflation by having the Fed systematically increase interest rates when commodity prices rose, and lower them when commodity prices fell. While commodity-price targeting, aka a “price rule” for monetary policy, had some prominent proponents back in the 1980s, neither Volcker nor any other Fed chair embraced the idea.

Today’s post has to do with two things that I didn’t say in that earlier one. I didn’t say that commodity price movements played no part at all in the Fed’s decision-making. And I didn’t say whether they should or shouldn’t play any part in it. I plan here to review studies of the actual role commodity price movements have played in the Fed’s monetary policy decision-making, as well as ones that ask whether the Fed would do a better job if it let them play a bigger one.

This post is, I warn you, both long and very wonkish. But if the Fed is to consider once again the possibility of basing its monetary policy decisions on the behavior of commodity prices, it’s useful to take account of what a substantial body of previous research has had to say on the topic.

Targets and Indicators

In that research, the distinction between statistics that may serve as indicators of economic conditions to which the Fed might wish to respond and ones it should attempt to target, that is, to keep within specific bounds or on some specific path, is of crucial importance. The claim that Volcker’s Fed relied on a commodity “price rule” implies, not just that it referred to commodity price movements as one of several indicators of monetary conditions, but that it actually endeavored to target commodity prices.

Although Volcker never targeted commodity prices, it doesn’t follow that either he or later Fed chairs made no use of commodity prices as policy indicators. On the contrary: the Fed has often referred to commodity price movements in making monetary policy decisions. What’s more, at least one Fed chair appears to have assigned considerable weight to commodity price changes, and to changes in the price of gold especially. That chair was, not Paul Volcker, but Alan Greenspan. I know this because I co-authored a study on the topic with my then-UGA colleague, Bill Lastrapes.[1]

Bill and I affirmed something that Greenspan himself had claimed[2], namely, that during his tenure the Fed treated sensitive commodity prices, and the price of gold in particular, as important indicators of the state of the economy. It was more likely to raise the fed funds rate when either general commodity prices or the price of gold rose, and more likely to reduce the rate when either commodity prices generally or the price of gold fell. Bill and I were, however, careful to note that this “does not necessarily mean that the Fed ‘targets’ the price of gold, or focuses solely on sensitive commodity prices to guide policy.”

Are Commodity Prices Useful Indicators? Should the Fed Target Them?

Did Greenspan’s policy make sense? And if it did, might the Fed have done still better, either then or since, by actually targeting a commodity price index, instead of just using it as one of several economic indicators?

Many economists tried to answer these questions during Greenspan’s term. And while most concluded that commodity prices were indeed useful economic indicators, they also tended to confirm the conclusion, reached by FRB Kansas City economist C. Alan Garner in the earliest of the studies, “that monetary reforms requiring a close link between commodity prices and money growth are inadvisable.”

Garner’s 1985 article, like several subsequent ones, was written in response to price-rule proposals of Jude Wanniski and Robert Genetski, among others. Those proposals, Garner notes, called “for using either the price of gold or an index of sensitive commodity prices” not merely as economic indicators but “as an intermediate target of monetary policy.” (Wanniski favored a gold price target, whereas Genetski argued for gearing Fed policy adjustments to movements in a broader commodity index.)

The appeal of a commodity price rule is that commodity prices, being set in auction markets, adjust more rapidly than others, and might therefore serve to reveal imminent inflation or deflation before either becomes evident in broader price indexes, like the CPI. However, Garner says, a commodity price rule also suffers from two fundamental drawbacks. First, because “large fluctuations in the relative prices of commodities are not uncommon…a policy response based on changes in commodity prices could have undesirable effects on aggregate output and prices.” In practice Fed officials would have to ignore certain commodity-index movements, rather than respond to them, to avoid contributing to the business cycle instead of dampening it. The narrower the commodity set, the greater this problem becomes. For that reason a gold price target would generally be even less reliable than a broader commodity price target.

Second, the loose and uncertain relation between commodity price movements and the Fed’s actions also limits a commodity index’s usefulness as an intermediate policy target. “The channels through which monetary policy affects commodity prices are complex and circuitous,” Garner says. Consequently, “it would be difficult for policymakers to produce the desired movements in an index of sensitive commodity prices.”

These drawbacks of a price rule didn’t necessarily mean that commodity prices weren’t useful as policy indicators or, in Garner’s phrase, “information variables.” However Garner also found that they “provide only limited information about the future course of the economy,” making them insufficiently reliable “to justify a central place in monetary policy.” Commodity price movements were a poor leading indicator of changes in real GNP, and an even poorer guide to impending changes in CPI inflation. “It seems best,” Garner concluded, “to employ commodity prices as one of several information variables” the Fed used to guide its monetary policy decisions. Garner recommended, in other words, that the Fed stick to using commodity prices just as it had been using them, at least according to my and Bill Lastrapes’ research. Significantly, then-Federal Reserve Vice Chairman Manuel Johnson also believed that “commodity prices are probably more valuable as an indicator of monetary policy than as a target.”

In 1989 Garner published a more exacting econometric study of the merits of a “commodity price rule,” this time specifically addressing the claim that “commodity prices are so closely related to the general price level that achieving the commodity price target range would also control the general inflation rate.” That study reached the same conclusions as his earlier one.[3]

In the meantime, several other studies either reached conclusions very similar to Garner’s (e.g. DeFina 1988; Webb 1988; Whitt 1988; and Furlong 1989), or found that commodity prices were not even useful policy indicators (e.g. McCallum 1990).

I’ve located one study only from the period in question suggesting that the Fed might have improved its performance by linking its policy decisions more closely to commodity price movements. According to a 1989 paper, by Brian J. Cody and Leonard O. Mills, and contrary to my and Lastrapes’ findings, the Fed had “not responded to commodity price innovations in the past,” and that, so long as it attached some weight to stabilizing inflation, it might have improved its performance by using them. But, Cody and Mills add (in a passage that now seems as relevant as ever), even their favorable verdict does not mean that the Fed would have been wise to adopt a commodity price rule.

One issue that we have not examined in this paper is whether the relative merits of a commodity price rule in comparison to other recently advocated rules based on nominal quantities such as the monetary base…or nominal GNP… . It may be that the Fed could improve its policy by simply having greater feedback on any nominal variable in setting nominal interest rates. Advocates of a commodity price rule would argue that such feedback would occur in a more timely manner using commodity prices because there are no data lags or revisions. Whether this advantage, and possibly others, is large enough to favor commodity prices over other nominal variables is a subject for future research.

Getting Colder

So much for studies from the 1980s. A sampling of later studies suggests that the case for leaning heavily on commodity prices has gone from weak to weaker over time, thanks in part to the diminishing role of commodities as a share of U.S. final output.

Thus a pair of Chicago Fed Letters published in November 1993 and December 1994 found that “inflation forecasts based on individual commodity prices and commodity price indexes can be highly misleading” and “that commodity price indexes are not statistically useful in predicting consumer price inflation.” According to S. Brock Blomberg and Ethan S. Harris, the authors of a 1995 Chicago Fed study, “none of the channels through which commodity prices signal more generalized inflation” were then “operating as well as they did in the past.” More specifically, they found that the relation between changes in commodity price indexes and subsequent movements in the CPI inflation rate had “weakened considerably starting in the mid-1980s” to the point of rendering the indexes useless, if not worse than useless, even as policy indicators.

Still later studies reach similar conclusions. According to a 2010 paper by Florian Verheyen,

While there was a strong link between commodity prices and CPI inflation in the 1970s and the beginning of the 1980s, the relationship has weakened, respectively diminished over time. Today we are unable to detect a reaction of commodity prices to commodity price shocks. Thus, commodity prices might not serve as good indicator variables for monetary policy.

Verheyen adds that his findings “are pretty in line with” those of most other studies published since the mid-1990s. However, at least two studies of the period, a 2003 study by Titus Awokuse and Jian Yang, and a 2007 working paper by Frank Brown and David Cronin, found using different methods that commodity prices still possessed some information value.

Changing Goals

Of course no study of the usefulness of commodity prices as monetary policy guides can ever be regarded as the last word on the subject. That is so because the relationship between commodity price movements and changes in other macroeconomic variables continues to change. But it’s so for another reason as well, namely, the fact that our understanding of the ultimate goal of monetary policy has also been changing.

Until recently, economists generally took for granted that monetary policy should treat a stable overall inflation rate either as its sole goal or (as in the Fed’s case) as one of a small set of goals. Hence the emphasis that previous studies of the usefulness of commodity price indexes placed on the relation between movements in those indexes and changes in the CPI inflation rate. But increasing numbers of economists are now either endorsing or giving serious attention to the view that the aim of monetary policy should be, not a stable inflation rate, but a stable growth rate of some measure of aggregate nominal spending, such as nominal GDP or nominal Final Sales to Domestic Purchasers.

One of the more obvious reasons for this change of opinion has to do with the implications of productivity innovations, and adverse ones especially. The question is simple: if, say, a war or harvest failure or both (to offer a stark example) were to halve an economy’s output, would it make sense for that economy’s central bank to tighten money to keep prices from rising? Since goods are in fact less abundant, keeping their prices from rising means reducing the public’s earnings so it has less to spend on them. But that in turn means reducing firms’ ability to recoup their nominal outlays, and also making it harder for people to pay their debts. Ultimately, although prices don’t rise, real output, consumption, and employment decline more than they would were the aggregate spending kept constant. And it’s the levels of real variables like output and employment, rather than the price level, that determine peoples’ well-being.

Similar arguments hold for less severe adverse supply shocks, and also (though the fact is often overlooked) for positive ones: a decline in the inflation rate below some long-run target is no cause for concern so long as it reflects a proportionate gain in productivity. Why shouldn’t we have less inflation, if not occasional deflation, when goods’ unit production costs are falling especially rapidly, and more when those costs are falling less rapidly than usual, or rising?

Nor is there any lack of rigorous argumentation supporting these intuitive arguments favoring stable spending over stable inflation as the key to overall macroeconomic stability. I review a number of works, both early and recent, here. And new ones, like this one in the most recent JMCB number by David Beckworth and Josh Hendrickson, and this one by Jim Bullard and Aarti Singh (also forthcoming in the JMCB), are coming out regularly.

The case for maintaining a constant rate of inflation in the face of productivity gains and set-backs is, in comparison, neither intuitively compelling nor grounded in sound micro-economic analysis. Most models that appear to support it either (1) abstract from productivity innovations altogether; (2) unrealistically treat factor prices (including wages) as less “sticky” than output prices (while assuming that output prices are equally unresponsive to both aggregate demand and unit cost innovations); or (3) simply treat the absolute value of the rate of inflation, or the difference between actual and target inflation, as an argument in either agents’ utility functions or the central bank’s loss function. One only has to point out these often overlooked assumptions to appreciate the shortcomings of the models in question.

The Summer of ’08

So let’s suppose, for the sake of argument, that instead of aiming for steady inflation the Fed aims for steady NGDP growth. Might a commodity price rule help it to do that? As Cody and Mills suggested some years ago, the matter warrants further study. But I wouldn’t count on a positive finding, for commodity prices are especially likely to be influenced by supply-side innovations (such as gold discoveries) or blights. Because of that, a central bank that follows a commodity price rule would almost certainly render NGDP and other measures of nominal spending even less stable than they would be under conventional inflation targeting. For that reason, and until someone comes up with some stats suggesting otherwise, those of us who prefer NGDP targeting (or something like it) over inflation targeting have more reason than most to hope that the Fed will resist pressure to assign additional weight to commodity price movements in making monetary policy decisions.

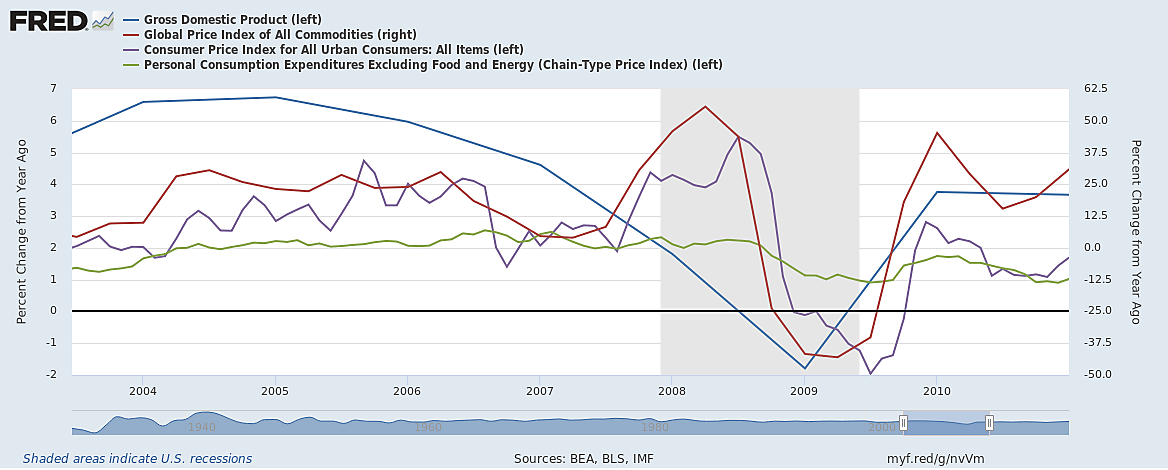

For evidence of this sort of peril, we need look no further than the events of 2008. Throughout that period, as I’ve reported elsewhere, Fed officials — and the FOMC’s inflation hawks especially — were worried not about a possible recession but about inflation. By mid-2008 headline CPI inflation, which had been rising for a year, breached 6 percent. For that reason, and despite rapidly deteriorating financial markets, the Fed resisted cutting its fed funds target.

Of course we now know that the U.S. economy had in fact been in a recession since December 2007, and that both the headline CPI inflation rate and other measures of inflation were misleading indicators of the true state of affairs. That state was eventually made clear by NGDP data showing that the NGDP growth rate had been declining for months, and (as the above chart shows) was turning negative just as headline inflation reached its peak.

Would it have helped matters had the FOMC paid more attention to commodity price movements? Hardly. In fact such movements (shown in the chart using the IMF’s global commodity price index), and an increase in the price of oil in particular, were the chief force behind the high CPI inflation rate. It was, in other words, precisely because they were placing too much emphasis on commodity-price increases, instead of downplaying them, that Fed officials made the fatal mistake of failing to ease monetary policy as the U.S. economy floundered. Had Fed officials instead focused on a “core” inflation measure, like the core PCE inflation rate, which leaves out the influence of both food and energy prices, they might have avoided that mistake. And had they been able to ignore inflation altogether, either by tracking more accurate and frequent NGDP statistics, or by forecasting NGDP, they might have done better still.

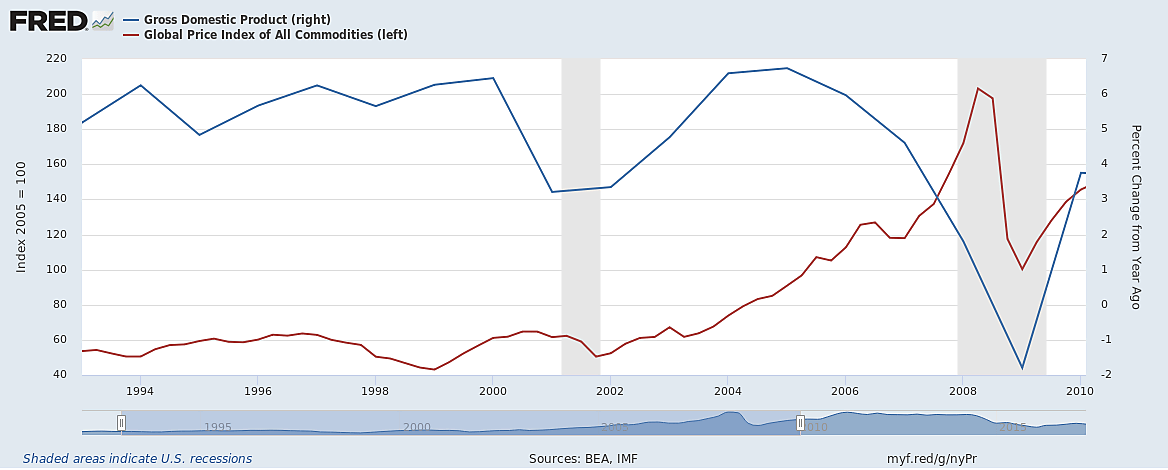

In fairness to proponents of commodity-price targeting, the 2008 episode is a particularly unfortunate example of how commodity-price targeting can go wrong. On other occasions, as the chart below shows, placing more weight on commodity prices might have helped to tame the business cycle, as in the post-2003 run-up of commodity prices, which foretold a subsequently-revealed rise in the annual NGDP growth rate to a peak just shy of 7 percent. Commodity prices fell, on the other hand, during the peak years of the dot-com bubble, when annual NGDP growth also topped 6 percent, only to start rising as the bubble burst, dragging NGDP growth down with it.[4]

The point, once again, is that while commodity prices may provide monetary authorities with useful information, to be helpful they must be used carefully and in conjunction with other indicators. Although a central bank’s commitment to a strict commodity price rule might sometimes contribute to overall macroeconomic stability, at other times it could do just the opposite.

And No, I’m Not Against Monetary Rules

Although I’ve pointed to various disadvantages of a commodity price rule, I hasten to add that I’m far from being opposed to any sort of monetary rule. On the contrary: I’d much prefer a Fed that stuck to a predictable, systematic policy, to our present Fed with its constant policy flipping and flopping. I’d prefer it because I’m pretty sure it could simplify the challenge of economic calculation and forecasting, and thereby ultimately make us all better off. But favoring a monetary rule is one thing; favoring any old rule is another. And bad as our flip-flop Fed may be, it is not yet so bad that the wrong monetary rule couldn’t possibly make it worse.

_______________

[1] Although we never published the study in question, the editors of The Wall Street Journal somehow got wind of it. See “Review & Outlook: Free Ride for the Fed,” Dec 19, 1995.

[2] See “Greenspan Takes the Gold,” The Wall Street Journal, Feb. 28, 1994.

[3] A subsequent study questioned Garner’s statistical procedures, but reached similar conclusions using what it’s author regarded as a more appropriate procedure.

[4] The same patterns hold, by the way, if one uses the Thompson-Reuters core CRB index.