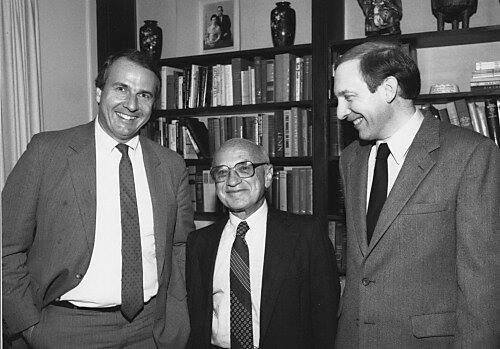

Milton Friedman with Cato’s Ed Crane and Jim Dorn

Although I don’t call myself a Friedmanite or a monetarist (or anything else), and many of my opinions on monetary economics are ones that he rejected, I’m a huge Milton Friedman fan. I regard him as the most influential champion of free market economics after Adam Smith, and as one of the greatest monetary economists of the last century. He is certainly among the dozen monetary economists of any era from whom I have learned the most. Finally, in my own dealings with him I found him to be an upright and generous man, as well as one who gave me a great deal of encouragement and support when I most needed it.

Consequently it distresses me to see Friedman attacked, and especially so when the attacks come from persons who share my fondness for monetary freedom. One such attack came my way two weeks ago, in the shape of a complaint about a Cato email notice commemorating what would have been Friedman’s 103rd birthday, on July 31. The writer, a free-market gold standard advocate, and a generally pleasant and mild-mannered fellow, called “Chicago School” monetary economics “a virulently anti-free market conception that has institutionalized our unstable…monetary system,” and said that, in leading it, Friedman “did us and the world an unfathomable disservice.”

Alas, far from being rare, harsh opinions about Friedman are easy to come by among the more uncompromising critics of government intervention in monetary affairs. Ludwig von Mises, another of my monetary economics heroes, may have started the trend when, according to Friedman himself, he stormed out of a debate at the first (1947) Mont Pelerin meeting after calling its other participants, Friedman among them, “socialists.” Some years later, in 1971, Murray Rothbard reached a similar verdict, this time in print, though he substituted “statist” for “socialist.” (That Friedman was more of a statist than Rothbard himself was certainly true. But who, in 1971, wasn’t?) Today more than a few “End the Fed” libertarians still accept Rothbard’s judgement.*

My first personal encounter with Friedmanophobia took place in 1988. Thinking that The Freeman might review it, I had sent a copy of The Theory of Free Banking to the Foundation for Economic Education. But instead of getting a review, I got a terse letter from Hans Sennholz, FEE’s director at the time, who was also a well-known champion of monetary freedom. In the letter Sennholz lashed out at me for having had the brass gall to send him a book that expressed approval for some of Friedman’s ideas, while also offering some (mild) criticisms of “The Master.” (“The Master,” in case you don’t know it, was von Mises.) Of course I was taken aback, and all the more so since I considered myself, back then, much more a Mises than a Friedman fan.

Even now I’m sure I’m as aware as any of Friedman’s toughest critics of the various forms of government intervention in the monetary system he favored at one time or another. Throughout most of his career Friedman categorically favored a managed fiat standard over a gold standard. He also favored (as was only natural given that first preference) flexible over fixed exchange rates. Finally, for much of his career he dismissed free banking as the equivalent of legal counterfeiting. These are all, needless to say, positions that are objectionable, if not obnoxious, to persons who believe that unhindered markets are more capable than governments are of producing orderly and reliable monetary systems.

But there is another side to the ledger that Friedman’s more radically free-market critics seem to overlook. Two items especially deserve notice. Although he favored fiat money, Friedman was an unflinching and relentless opponent of monetary discretion. We also have him (and Anna Schwartz, another of my economist-heroes), to thank for the fact that the Great Depression is no longer considered proof of the inherent instability of free markets.**

Friedman’s more strident critics also seem unaware of how his monetary ideas changed over time, evolving in a way that fans of either the gold standard or free banking ought to find gratifying. Much of this evolution appears to have taken place during the mid-1980s. In various articles written then, Friedman admitted having erred in treating fiat money as a less expensive alternative to gold. He also renounced his previous defense of central banks’ currency monopolies, conceding that there was in fact no good reason for prohibiting commercial banks from issuing their own paper notes. Instead of recommending a constant growth rate for the money stock, as he had in the past, he switched to arguing for a constant or “frozen” monetary base, which was tantamount to recommending that the Fed’s monetary and discount window operations be altogether shut down. Finally, he publicly declared himself in favor of abolishing the Fed on numerous occasions. Think what you will of Friedman’s later opinions, you will go blue in the face trying to convince me that they are those of a “statist.”

Finally, had it not been for Milton Friedman, I and other academic (or formerly academic) proponents of monetary laissez-faire would be an even more pathetically forlorn bunch than has actually been the case. For setting a handful of “Austrian” economists aside, the list of academic economists, including economists working for central banks and other financial regulatory authorities, who have shown a willingness to take free banking ideas seriously, and to treat their authors courteously, even allowing some of their articles to get published in mainstream academic journals, consists overwhelmingly of prominent “Chicago-School” monetary economists, if not of Friedman’s own students. Had it not been for Friedman and his students, in other words, there would almost certainly not be a Modern Free Banking School of any academic standing today.***

One of those students — and yet another of my monetary economics heroes — is David Laidler, who wrote me just recently. Like that other recent correspondent David was passing on some of his thoughts about Milton Friedman on the 103rd anniversary of his birth, in the shape of a copy of his speaking notes for a talk he gave on “Milton Friedman’s Intellectual Legacy” at Canada’s Institute of Liberal Studies. David has kindly allowed me to make those notes available here. As David’s appraisal of Friedman is, like all of his work, both thoughtful and well-written, I urge everyone to read it.

In fact, I disagree with only one sentence in David’s otherwise excellent talk. This occurs when David says that, starting in the 1980s, “Milton’s…inclination was to drift toward ‘free banking’.” That doesn’t sound right to me, for “drifting” was hardly Friedman’s style. Instead, I’m inclined to believe — and Friedman himself claimed — that he moved toward free banking quite deliberately, upon finding that the predictions of its theorists conformed better to observed reality than his own earlier views did.

I hope that David would not disagree.

______________________________

* An amusing illustration of this — though one of admittedly doubtful evidential value — consists of a straw poll taken on the Ron Paul Forum in which 16 out of 28 participants held that Friedman was either “a statist leaning libertarian, or a flat out statist.” (Since I eat vegetables now and then, I suppose I must be a “radical vegetarian-leaning carnivore.”)

**In America’s Great Depression, originally published in the same year as Friedman and Schwartz’s Monetary History of the United States, Murray Rothbard also blamed the Great Depression on the Fed, basing his arguments not on monetarist ideas but on the Mises-Hayek theory of the business cycle. But regardless of the the different theories, it was Friedman and Schwartz’s work rather than Rothbard’s that was primarily responsible for reversing the tide of opinion, especially among academic economists.

***I also owe a particular debt to Dick Timberlake, a Chicago-trained monetary economist who had Friedman among his teachers. It was Dick who brought Larry White to the University of Georgia and who later, with Larry’s help, got me a job there. Dick has been yet another hero to me, as a monetary economist certainly, but also in lots of other ways.