The Producer Price Index (PPI) is a measure of prices U.S. business receive from U.S. and foreign buyers, including governments. Like the headline CPI, the overall PPI likewise moves up with higher crude oil prices. The core PPI tries to fix that problem by excluding direct food and energy prices, as far as possible, but the core PPI also omits misleading methods of estimating wholesale and retail trade prices.

The BLS cautions that, like food and energy prices, “it has been observed that the indexes for wholesale and retail trade, which measure changes in margins, also are subject to potentially large short-term changes in prices. Consequently, to assist data users looking to exclude this volatility, PPI calculates a number of indexes excluding prices for trade services” [emphasis added].

Retail and wholesale profit margins collapsed during COVID-19 lockdowns, of course, so year-to-year percentage increases in the PPI looked large in January to July of 2021 partly because reopened merchants switched from negative to positive profitability (as well as obvious base effects from falling core prices in early 2020).

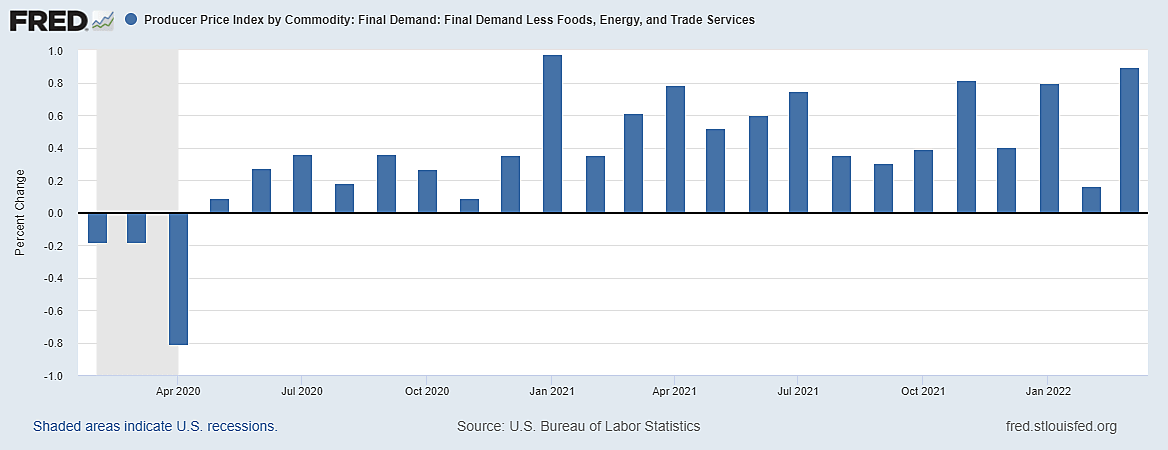

The first graph shows that even the Core PPI (excluding food, energy, and trade) is still extremely volatile from month to month but shows no evidence of an upward trend over the past eight months.

There are many more service prices included in the CPI and, unlike the PPI, the CPI does not define a cyclical recovery in retail profit margins as inflation. But some key service prices in the CPI are not driven by sticky labor costs, such as dental or hair salon services, but by oil prices.

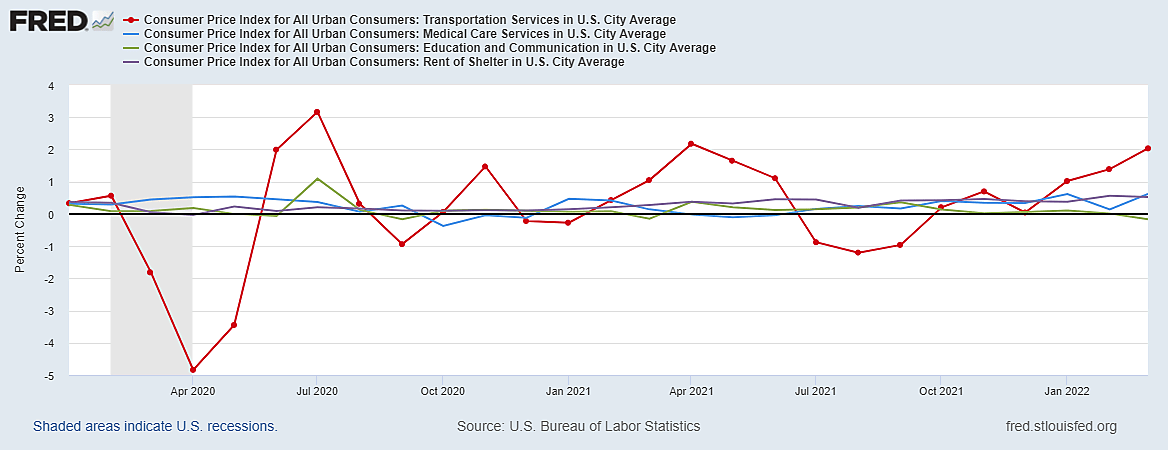

The print version of an April 13 Wall Street Journal report on the “Moderate Core CPI” worried that “prices of overall services, which tend to be stickier than prices of goods, continued to show strong upward momentum.” That passage was edited out of the online version, and the second graph may explain why.

Overall services include transportation services such as Uber and Lyft fees, and airline, bus, and subway fares. This is another reason the core CPI does not actually exclude global shocks to the supply and price of oil or food. As Alan Blinder reminds us, “What product doesn’t include energy in its cost, either directly (to keep the lights on) or indirectly (via delivery trucks)?”