In a November 27 Wall Street Journal article, “Raise Rates Today to Fight a Recession Tomorrow,” Martin Feldstein reminded us he has been repeatedly cheerleading since 2013 for the Fed to raise interest rates faster and higher “to prevent the overvaluation of assets” whose prices “will collapse when long-term interest rates rise.” I critiqued one of Feldstein’s similar articles in 2017.

November 27 was an odd time to be fretting about overvaluation. The day before Mr. Feldstein’s article appeared, a headline in the same newspaper – “Stocks, Bonds Face Year in Red” – observed that “stocks, bonds and commodities are staging a rare simultaneous retreat”

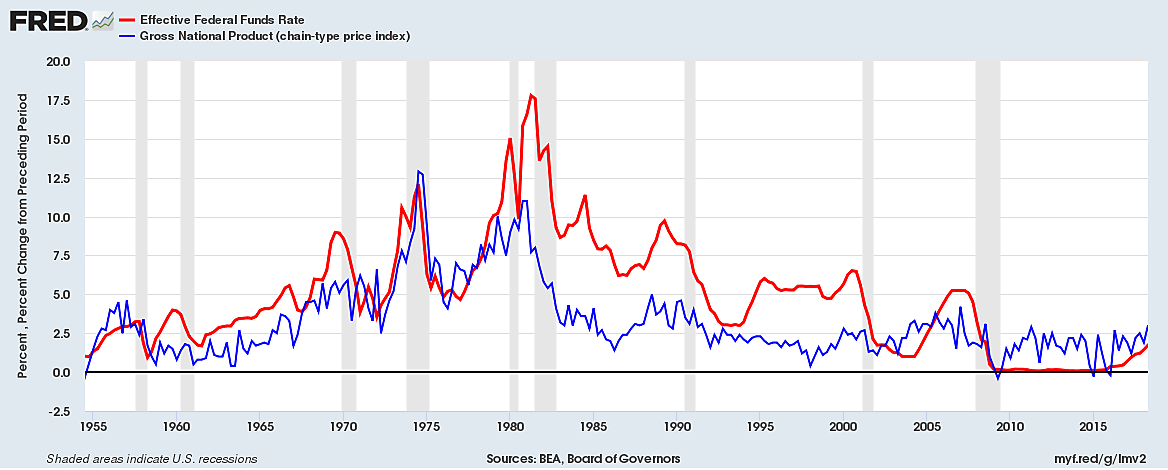

Yet Feldstein urged the Fed to keep pushing short-term rates higher (3.4% “will not be high enough”) to somehow ease the pain of a supposedly inevitable increase in long-term interest rates (even if inflation stays near 2%), and to also make it easier to lower short-term rates in response to some future recession, a recession probably caused by the Fed raising rates too much (see graph).

Mr. Feldstein defined “overvalued assets” in terms of historical averages. “The price-earnings ratio is nearly 40% above its long-term average,” he warned. But that is because long-term interest rates are more than 50% below their long-term average. The yield on 10-year Treasury bonds averaged 6.5% since 1970, ranging from 1.8% in 2012 to 13.9% in 1981. The p/e ratio almost always moves higher when long-term interest rates move lower.

Why are long-term interest rates so low? Because inflation has remained persistently low, and because the Fed can’t push short-term rates much above inflation for long without provoking asset liquidation and recession. The graph uses the GNP deflator (blue line) to gauge inflation because it covers the whole economy and is available over many decades. The fed funds rate clearly rises with higher inflation and falls with lower inflation, so the notion of raising the funds rate to reduce inflation is self-contradictory. Even before Irving Fisher (1896) economists such as Thornton and Mill understood that nominal interest rates rise and fall with inflation, with real interest rates being cyclical but relatively stable.

When Feldstein predicted a stock market crash “when long-term interest rates rise” he explicitly did not predict a rise in inflation. His prediction relied instead on a key conceptual ambiguity: What does a “normal” interest rate mean, and why should we presume that global bond markets gravitate toward such a historical norm?

Former Senator Phil Gramm and Michael Solon, writing in the December 11 Wall Street Journal, redefine “normal” to mean arbitrarily excluding the high interest rates of 1977–82 and also the low interest rates of 2009–2018. After further subtracting inflation, this leaves them with a postwar trimmed average rate of 1.2% for real Treasury “borrowing costs” (presumably a weighted blend of short-term and long-term rates). “This suggests,” they conclude, “that if the Fed could meet its 2% inflation target during this recovery, Treasury borrowing costs might stay close to the 3.2% range.”

The authors nevertheless raise concerns that if borrowing costs rose to 4.8% – which implies 3.6% inflation – it could become difficult to roll over the accumulated Obama-era debt without the Fed monetizing too many Treasury bills and bonds (paying for them by crediting bank reserves that currently pay interest). They conclude, convincingly, that firm spending caps and making peace on trade would make the future economy far more predictable and secure.

The day after Feldstein’s article, Fed Chairman Jerome Powell questioned the wisdom of continually raising short-term interest rates regardless of economic reality. His comments greatly increased prices of stocks and bonds until “Tariff Man Tuesday” terrified world investors. Yet Chairman Powell’s changing conjectures about the fed funds rate being either near or far from to some unknowable “neutral rate” seem nearly as arbitrary and unsettling as Mr. Feldstein’s divinations about U.S. long-term rates reverting to an ancient average.

To sum this all up: 1. Stock prices have been high relative to earnings because bond yields have been low; 2. Bond yields have been low because the fed funds rate has been low; 3. The fed funds rate has been low because inflation has been low.

Anyone predicting a sizable increase in long-term interest rates must also be predicting a sizable increase in inflation. Because inflation is largely a global phenomenon, however, it would be extremely challenging to persuasively predict higher inflation (and therefore higher bond yields) while much of the world economy is struggling to expand, the dollar has been rising and commodity prices falling.