Martin Feldstein has a new short paper out with some thoughts on a relatively under-researched subject: Why is Growth Better in the United States than in other Industrial Countries?

He begins:

In 2015, real GDP per capita was $56,000 in the United States. On a purchasing power basis, the real GDP per capita in the same year was only $47,000 in Germany, $41,000 in France and the United Kingdom, and just $36,000 in Italy. So the official measures of real GDP clearly point to the cumulative result of higher sustained real growth rates in the United States than in the major industrial countries of Europe and Asia.

Over the very long term, this is a truism. In order for the U.S. to be that much richer, it must have experienced faster real GDP per capita growth than comparator countries. We know from figures collated by the Maddison Project that the U.S. had around half the level of GDP per capita of the UK in the early 18th century, but by 1900 it was overtaking the UK as the richest country by income per head, and has remained in that leading position for almost all the period since.

But showing higher levels of income does not necessarily mean that the U.S. growth of GDP per capita was higher than other countries over more recent periods.

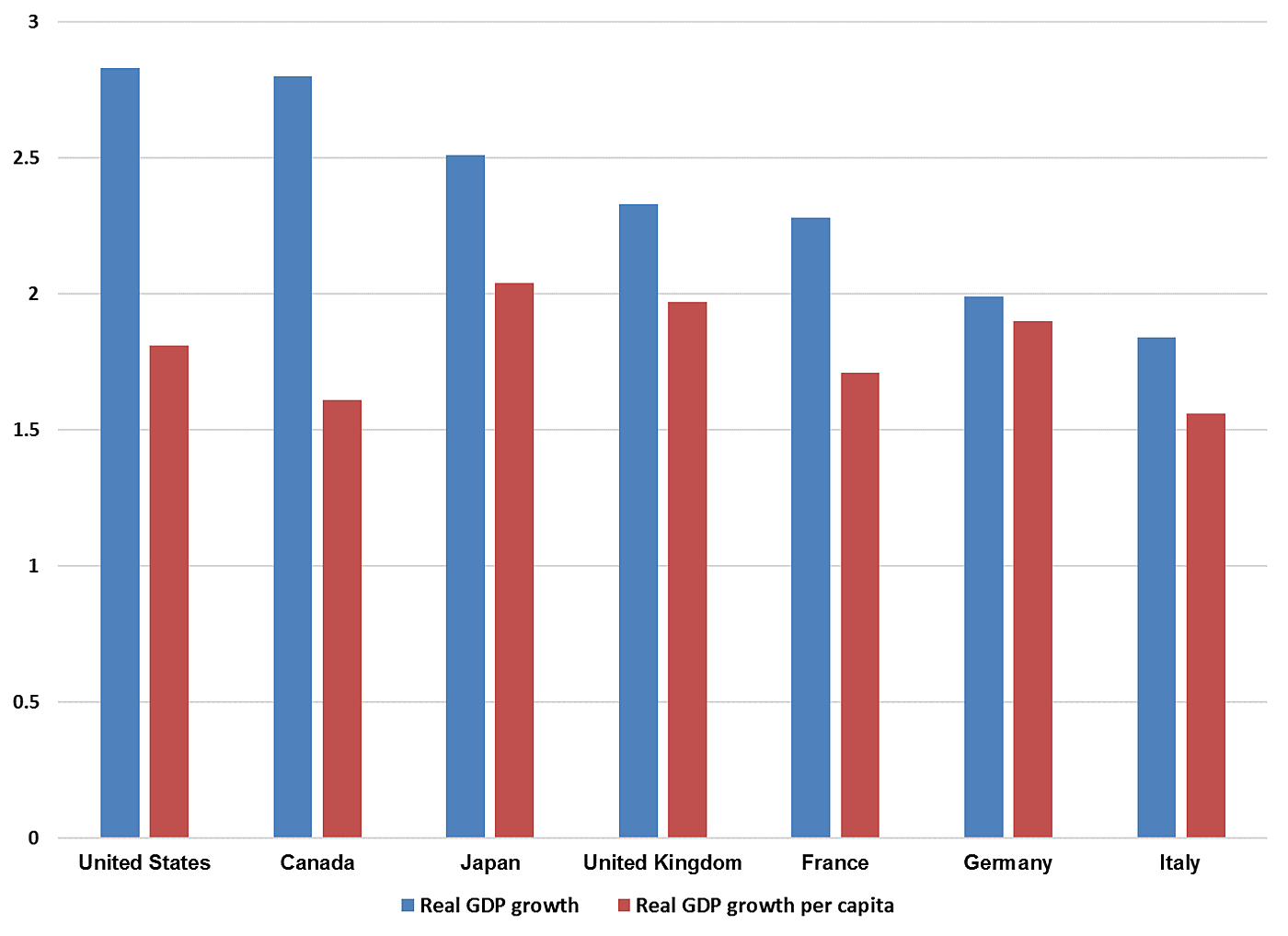

Figure 1 outlines the growth performance of G7 countries since 1970. As can be seen, U.S. average annual real GDP growth has indeed been higher than the rest, but average annual real GDP per capita growth was actually stronger in Japan, the UK and Germany over that period. In other words, the U.S. relative real GDP growth strength over that period is primarily about demographics.

Figure 1: Average annual real GDP and real GDP per capita growth, 1970–2015.

Source: World Bank Databank

The U.S. is still richer than the other countries, of course. That is, the level of real GDP per capita is still higher, but that gap already existed in 1970. Some other countries have grown more quickly since then from a lower base. In 1970, Japan’s real GDP per capita was 79 percent of the U.S., whereas in 2015 it was 91 percent. For the UK, the figure has increased from 77 percent to 80 percent. But no country appears to be fully converging.

The real question then appears to be this: though individual countries have converged somewhat towards the U.S. during periods since 1945, why does there seem to be a permanent gap in the level of GDP between the U.S. and other major economies?

In other words, what structural features in the U.S. help to make it permanently richer than other major economies?

Feldstein posits 10 possible explanations:

- An entrepreneurial culture

- A developed system of equity finance and local banks

- World class research universities

- Relatively free labour markets

- A growing population

- Culture and policy that encourages hard work and long hours

- Abundant energy combined with private mineral rights

- A favorable regulatory environment

- A smaller size of government than in other industrial countries

- A decentralized political system in which states compete

Whole theses could be written about each. But I’ll limit myself to seven quick comments here:

- It’s incredibly difficult to measure the individual effects of these things on growth, not least because they are inter-connected too in complex ways. That America was founded by self-selecting migrants might have brought with it a more entrepreneurial and harder-working culture, and also one which then leads to a greater acceptance for fairly liberal migration in future. A smaller government, with a lower tax burden increases the return to entrepreneurial activity. And so on.

- A lot of these explanations beg other questions, the most common of which is, “yes, but why?” What is the cultural, institutional or policy reason for the U.S. having 15 of the highest ranked 25 universities in the world, for example?

- There are potentially omitted explanations too, such as the sheer size of the internal American market under common language and customs (compare this to heavy national and cultural barriers in Europe even within the single market), and having a system of common law.

- Some of Feldstein’s explanations need not necessarily be “good things” from a libertarian perspective. For example, if people in the U.S. simply have a relative preference for working longer hours compared to leisure than the French, then the fact Americans work longer hours is not “better”. (Of course, if the difference is down to damaging policies, then that is another matter).

- Most of the explanations at some point come back to, as Feldstein puts it, “the general intellectual and political climate of the country” and how this affects the economy both directly and indirectly. Policies and systems of government do not fall manna from heaven, but tend to change over long periods to reflect ideas.

- Though the U.S. still has relative advantages over other major economies, it clearly faces significant challenges in many of these areas. Tyler Cowen’s new book highlights how the U.S. is becoming less entrepreneurial on many measures. Opposition to liberal migration seems to be hardening. Younger people seem to be more open to the idea of socialism, which could in future affect 4, 8 and 9 negatively.

- The experience of my own country ceding the forefront of the technological frontier suggests these relative advantage need not always hold. In the past 15 years, that the U.S. is doing relatively well largely reflects more significant relative deterioration in other countries than its own success.