Sebastian Mallaby’s biography of Alan Greenspan does just about everything right. Despite its length, it’s eminently readable. Yet there’s nothing superficial about it: Mallaby seems no less comfortable with economics than he is with English, allowing expert monetary and macro-economists to join non-expert readers in both enjoying and learning from his carefully-crafted book.

But what is perhaps the greatest strength of The Man Who Knew is its success in steering a safe course between hagiography on one hand and hatchet-job on the other. Mallaby is evidently fond of his subject, who comes across here as exceedingly intelligent and talented (had he not had such a head for figures, Greenspan might have played the sax, or perhaps the clarinet, for a living), politically shrewd, and (to women especially) almost preternaturally charming. Yet when it comes to accounting for the former Fed Chairman’s failures along with his achievements, Mallaby doesn’t cook the books. Because his criticisms come across as those of a sincere if somewhat crestfallen admirer, they seem all the more damning.

Most damning of all is Mallaby’s claim that, for all his knowledge and cleverness, and despite his having written a long paper, in 1959, arguing that central banks should guard against “speculative flights from reality” by choking-off asset bubbles while they’re getting started, at the Fed Greenspan, instead of seeking to pop incipient bubbles, became a virtuoso bubble blower.

In particular, according to Mallaby, Greenspan

should have raised rates to fight bubbles on two occasions — in late 1998 and early 1999, and again in 2004–5. In both instances, unemployment was low, deflation was not threatening, and yet markets were evidently too hot. The Fed should have raised rates more aggressively, accepting somewhat lower growth in the short run in exchange for a more stable economy in the medium run (p. 682).

Mallaby’s narrative supports this verdict with detailed accounts of Greenspan’s boom-time decision-making, including his clashes with less sanguine Fed experts. With the benefit of hindsight, these often make for excruciating reading. Throughout his long tenure Greenspan frequently dismissed, and often dismissed curtly, warnings to the effect that the Fed’s easy money policies, rather than market fundamentals, were driving interest rates, and long-term rates especially, to dangerously low levels.

The alarm raised by then-Governor Lawrence Lindsay in 1993 is a case in point. Lindsay, as Mallaby tells it, urged Greenspan and the rest of the FOMC to consider that

low inflation might offer a false signal for monetary policy. The consumer price index appeared stable because imports were getting cheaper: low-cost emerging nations were joining the world economy; globalization restrained prices for everything that could be traded. In this environment, the Fed could supply a surprising amount of easy money without being punished by inflation. But it did not necessarily follow that easy money was desirable… . Ordinary Americans were being tempted into borrowing imprudently. The resulting fragilities — asset bubbles on the one hand, precarious towers of household debt on the other — could upset the smooth path of the economy just as surely as inflation (p. 435).

Consistent with Lindsay’s warning, and also with that of some high-level Fed staff economists, the bond bubble of 1993 burst dramatically when the Fed finally raised rates in the early months of 1994. But instead of supplying a lesson for the future, the episode was merely to serve as “a dry run” for far worse bubble-bust cycles to come.

Thus a decade after the 1994 crash, FOMC members were again warning Greenspan that the Fed’s accommodative stance was contributing, not only to “speculative excesses” (Boston Fed President Cathy Minehan), unprecedented risk taking (Governor Mark Olsen), and a flattened yield curve (Vice Chairman Roger Ferguson), but to “distortions in financial markets that can only be unwound with some drama” (New York Fed President Tim Geithner). For his part Greenspan admitted then that the Fed was “undoubtedly pumping very considerable liquidity into the financial system” and that partly as a result of this “everybody is reaching for yield.” Yet once again he preferred to take no action to counter what looked to more and more observers like a cluster of rapidly expanding asset bubbles.

Why did Greenspan ignore the sort of advice Lindsay and others tried to offer him? According to Mallaby, he did so because he believed that making the avoidance of bubbles part of the Fed’s mission would have required, not only a revision of the Fed’s dual mandate, but a revision of basic monetary economics:

Greenspan mused to his FOMC colleagues that price stability might coexist dangerously with financial instability… . But then he quickly backed away, acknowledging that the implications of his hypothesis were impossibly unsettling. “All of our concepts about how the monetary system works will have to go into a radical revision, which I can’t at this stage even remotely contemplate,” he confessed… .

In short, Greenspan knew that financial instability mattered. But he focused instead on inflation for a simple and not entirely good reason. Controlling asset prices and leverage was hard; fighting inflation was easy.

Nor does Mallaby believe that things have gotten better since: “By committing more formally to inflation targeting after Greenspan’s retirement,” he says, “the Fed has unfortunately compounded the problem.”

If Mallaby’s assessment of Greenspan’s performance itself suffers from a serious shortcoming, it is that he too readily accepts the conventional wisdom concerning just how “hard” it is for the Fed to guard against asset bubbles, employing that term loosely to refer to any unsustainable asset price movement. Doing so would not, first of all, require any revision to the Fed’s present mandate. On the contrary: if history is any guide, that mandate is more than sufficiently vague and malleable to readily accommodate adjustments of the Fed’s policy stance aimed at avoiding bubbles, or at least at reducing their frequency and amplitude. Moreover, it is easy enough to sustain the argument that it is only by making such adjustments that the Fed can avoid serious departures from “maximum employment.”

Nor is guarding against bubbles as daunting and fraught a technical exercise as those who oppose it assume. The tendency to consider it so is largely a result, IMHO, of the belief that Fed officials must choose between pricking bubbles and ignoring them. Putting the matter that way suggests that, in order to do anything about bubbles, Fed officials must treat asset price movements themselves as relevant policy indicators, if not policy targets. What’s more, they must somehow be able to distinguish sustainable from unsustainable asset price movements. The thought of the FOMC dabbling in market timing usually suffices to cinch the argument that we can do no better than to have the Fed ignore bubbles altogether.

But the suggestion that a Fed that can’t be relied upon to recognize bubbles has no other choice but to tolerate them is false. It overlooks a third alternative: instead of having to either recognize and prick bubbles or tolerate them, monetary policymakers can pursue policies calculated to avoid blowing bubbles in the first place. It is the possibility that bubbles can develop, not only despite but because of, central bankers’ wrongheaded pursuit of ordinary macroeconomic objectives, that the conventional “prick or ignore” dichotomy overlooks.

More precisely, the conventional wisdom assumes that, so long as they maintain a relatively stable and low rate of inflation, central bankers are also doing all they can do to avoid blowing bubbles. In fact the assumption that a low and stable rate of inflation always suffices to avoid monetary bubble-blowing is exceedingly naive. Instead, an economy’s maximum non-bubble-blowing inflation rate tends to vary with its (total factor) productivity growth rate.

Too see why, consider a steadily growing economy with modest rates of output price inflation and total factor productivity growth. Now assume an unexpected but persistent increase in that economy’s productivity growth rate. The increase implies a decline in the equilibrium rate of output price inflation relative to the equilibrium rate of input price inflation. It follows that, to preserve a stable rate of output price inflation, the authorities must respond to the unexpected increase in productivity with an equally unexpected increase in money growth sufficiently great to raise the actual rate of factor price inflation to a level reflecting the higher rate of productivity growth. Full adjustment of the factor price inflation rate is likely, however, to take time, owing to the stickiness of many nominal factor prices (and of wage rates and salaries especially), and to the unexpected nature of the change in monetary policy. Until the adjustment is complete, both actual and expected future firm profits will be bolstered. That bolstering will in turn tend to be reflected in asset prices. The boom comes to an end once factor prices find their new, equilibrium levels.

To avoid this sort of thing, central banks don’t have to keep an eye on asset prices, let alone know when those prices are poised to go south. Instead, they can quit trying to stabilize the rate of output price inflation, and instead stabilize the growth rate of a factor-price index or, what comes close to the same thing, the growth rate of either total or per-capita NGDP. In other words, they need only do what Scott Sumner, David Beckworth, and other Market Monetarists have been urging them to do since the outbreak of financial crisis, and what many good economists once recommended, before inflation targeting managed, despite its weak theoretical foundations, to become de rigueur.

To sum up, having the Fed deal effectively with asset price bubbles doesn’t call for changing it’s dual mandate into a triple mandate. It doesn’t even call for the flexibility implicit in a dual mandate. All that’s needed is a single mandate, so long as it is the right single mandate.

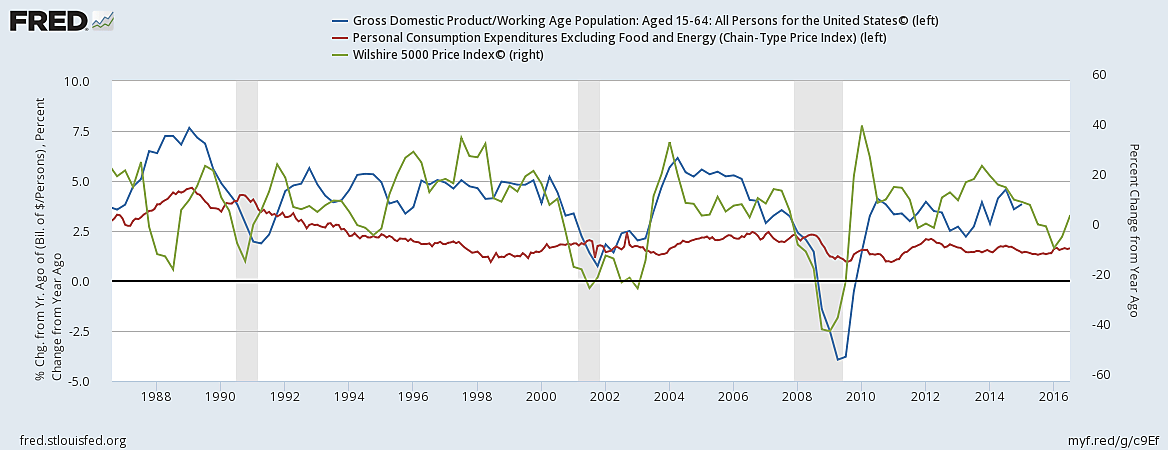

As an illustration of what I mean, consider the following chart, which shows the year-over-year rates of per-capita NGDP growth and core PCE inflation since 1988 (left scale) together with year-on-year percentage change in the (quarterly) Wilshire 5000 index (right scale) . The chart clearly shows that pre-recession booms tend to be accompanied by persistently high rates of per-capita NGDP growth, whereas the pattern of core PCE inflation is largely unrelated to that of asset-market booms and busts:

Of course these patterns do no more than hint at the possibility that, by targeting the per-capita NGDP growth rate rather than inflation, and without having to refer to movements in asset prices themselves, the Fed might have avoided blowing unsustainable bubbles in the past. But as I’ve suggested, there are also plenty of good theoretical reasons for thinking the hint a good one.