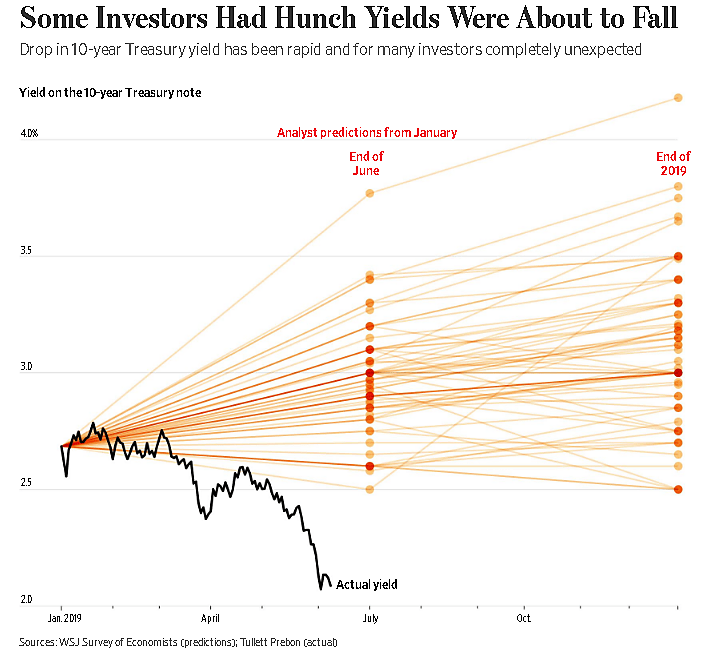

The yield on 10-year Treasury securities is currently 2.1 percent. Now look at the chart below from the Wall Street Journal showing expert predictions about what the current rate would be.

The Journal reports:

- “Not a single respondent in January’s Wall Street Journal survey of economists predicted the yield on the 10-year Treasury note would fall below 2.5% this year.”

- “In October, when yields on the 10-year Treasury were near their peak of around 3.2%, none of the more than 50 respondents in The Wall Street Journal’s monthly survey of economists predicted yields would dip below 2.75% by June 2019. The average forecast was 3.39%.”

Forecasts of interest rates appear pretty awful, and this is a market where vast profits are at stake so there are big incentives to get it right. I’ve noted (here and here) that economists are also lousy at predicting economic growth.

What are the policy implications? The economy is too complex and uncertain for even the best economists to predict, so politicians stand no chance. It seems unlikely that political schemes from Washington to manage and manipulate our future economy would work.

Furthermore, while businesses are forced to eat humble pie and change direction when the economy changes, the government is a rigid institution led by people who never admit their mistakes. So when politicians move economic resources around, the resources often get stuck in low-value uses for years on end.

Note: my critique here regards macroeconomic predictions. Microeconomic analysis is different.