President Obama has been expressing inordinate alarm about differences between income groups, and about mobility between such groups over time. “The combined trends of increased inequality and decreasing mobility,” he says, “pose a fundamental threat to the American Dream, our way of life, and what we stand for.”

A fundamental limitation of annual income distribution figures is that income in any given year may not be at all typical of a family’s normal or lifetime income. Job loss or illness can push one year’s income well below normal, for example, and asset sales can produce one-time windfalls. People are commonly much poorer when young than they are by middle age, after accumulating experience and savings. For such reasons, the President’s strong opinions about “decreasing mobility” could be important, if true.

We need to separate two concepts of mobility. One is intergenerational mobility – whether “a child born into poverty … may never be able to escape that poverty,” as the President put it. Another involves intertemporal mobility – whether starting with a low wage at your first job supposedly impedes moving up the ladder of opportunity.

The President’s opinion that intergenerational mobility has declined was rigorously debunked by Raj Chetty, Emmanuel Saez and others. As for inequality and mobility being related, they also found that, “the top 1 percent share is uncorrelated with upward mobility [p. 40].” Moreover, “The fraction of children living in single-parent households is the strongest correlate of upward income mobility among all the variables we explored [p.45].” Since other countries have fewer single-parent households, this is just one reason for being wary of facile international comparisons.

Intertemporal mobility is not about links between parents and children, but about the ease with which individuals move from a lower to a higher income group, and vice-versa. Are we stuck with the same paycheck we had just after leaving school, or can we move up with effort, experience, learning and saving? Did having a big gain in the stock market in 2007 ensure that would happen again in 2008–2009?

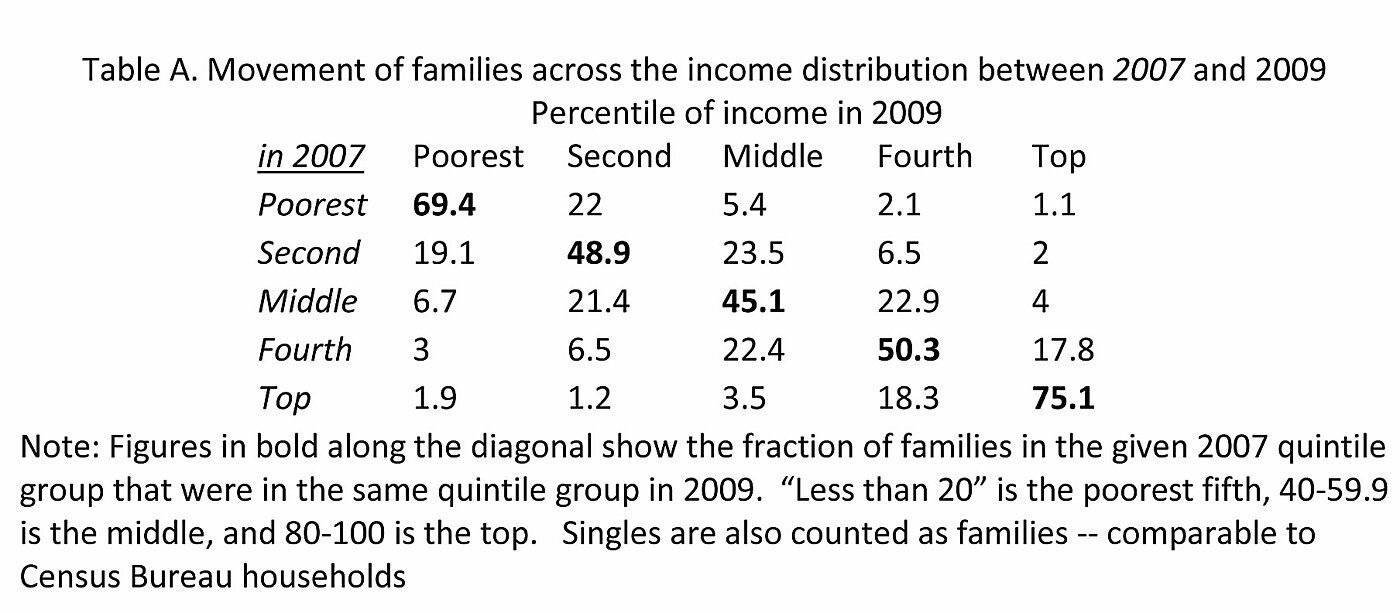

The Federal Reserve Board’s Survey of Consumer Finances (SCF) tracks income mobility of the same families over time. It turns out that mobility is surprisingly hectic even over short periods.

Table A, adapted from the latest SCF report shows changes in income by quintile (fifth) between 2007 and 2009. For example, only 45.1 percent of families with incomes in the middle fifth of the distribution in 2009 were also in the middle in 2007 (indicated by the bold font along the diagonal). Among the rest, slightly more moved up from a lower income group (28.9 percent) than slipped down from a higher group (25.9 percent).

With 50–55 percent of middle-income families changing places in just two years, there is obviously no shortage of “mobility” during recessions. This highlights one of two common fallacies in studies purporting to show that mobility was “higher” in some other time or place.

Studies about changes in mobility over the years often make no distinction between moving up and moving down. Is a quicker game of musical chairs really a “fairer” game? If so, deep recessions are the fairest years of all.

Periods with booms and busts such as 1969 to 1982 appear far more “mobile” in terms of movements between income groups than periods of stability and prosperity such as 1983 to 2000. As I wrote in Income and Wealth (p. 174), “The pace at which families moved between income quintiles over seven to ten years may tell us something about how volatile the economy was, but it provides no information about anyone’s ease or difficulty of earning a higher income.”

A second fallacy among mobility studies is to express concern that the pace at which families move between quintiles appears slower among top and bottom quintiles than it does in the middle. As the SCF report explains, however, “The movements of families across income groups in two years was more substantial for the three central percentile groups than for families with incomes in the two extreme groups, in part because families in one of the extreme groups could move in only one direction [emphasis added].”

The middle three quintiles are defined by both a floor and ceiling. Unlike the middle quintiles, however, movement in or out of the top or bottom income groups can be in only one direction. Anyone in a top income group in any particular year must have either been in the same or a lower group in previous years, because there is no higher group to move down from. Anyone in a bottom income group must likewise have either been in the same or higher groups in previous years, because there no lower group to move up from.

This simple mathematical distinction has led many careless observers to deplore the illusory fact that there appears to be less “mobility” among rich and poor than there is in the middle. Rather than indicating that the poor are stuck at the bottom and the rich secure at the top, this is simply the unavoidable consequence of the fact that only families at the top and bottom can move in only one direction. Like so much overheated rhetoric about inequality and mobility, this is just another example of people forming extremely strong opinions on the basis of extremely weak logic and evidence.