Running for president in 1976, Jimmy Carter promised to simplify the tax code. He said, “It is time for a complete overhaul of our income tax system … It is disgrace to the human race.” The simplification never happened, and today’s tax code is more complicated than ever.

Consider the low-income housing tax credit (LIHTC). The program hands out $11 billion a year in tax subsidies, which are supposed to flow to tenants in lower rents. But studies suggest that investors, developers, and banks gain most of the benefits, as Vanessa Calder and I discuss here. The tax credits are also prone to abuse and result in very costly housing projects. Unfortunately, the Biden administration has ignored these failings and is proposing to increase LIHTC subsidies.

Perhaps the worst flaw of the LIHTC is the intense bureaucracy. Project financing, construction, and regulatory compliance are more complex than for market-based housing projects. The IRS auditing guide for this one tax credit is 350 pages long. With such complex loopholes to administer, it is no wonder that the IRS is too busy to answer phone calls from the public.

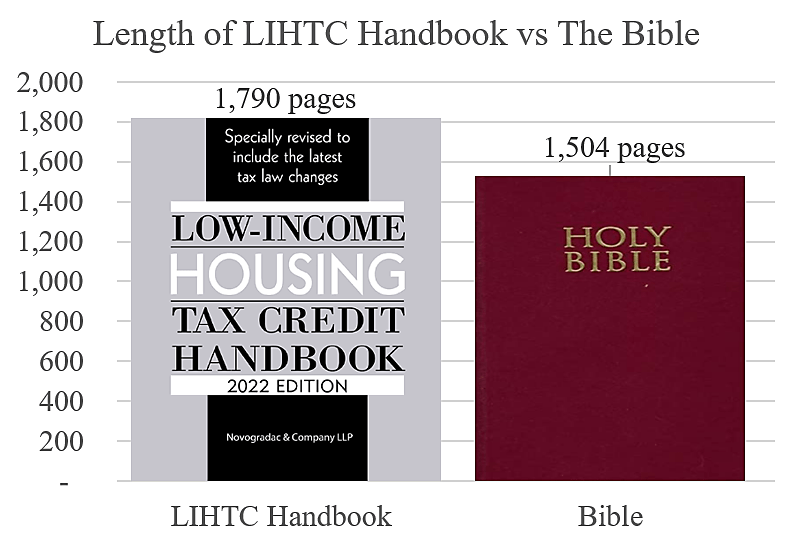

The LIHTC is so complex that one handbook for the credit spans 1,790 pages! The figure shows that this tax-credit bible is longer than the actual Bible at 1,504 pages. You can get a sense of the LIHTC’s vast bureaucracy by skimming the handbook’s table of contents here.

Congress should greatly simplify the tax code. It has an opportunity to do so leading up to the expiration of provisions in the Tax Cuts and Jobs Act (TCJA). The TCJA simplified parts of the code but also added new complexities. In upcoming Cato studies, Adam Michel and I propose reforms for a less disgraceful tax code, including repealing the absurdly complicated low-income housing tax credit.