Keynesian economics is the perpetual motion machine of the left. You build a model that assumes government spending is good for the economy and you assume that there are zero costs when the government diverts money from the private sector.

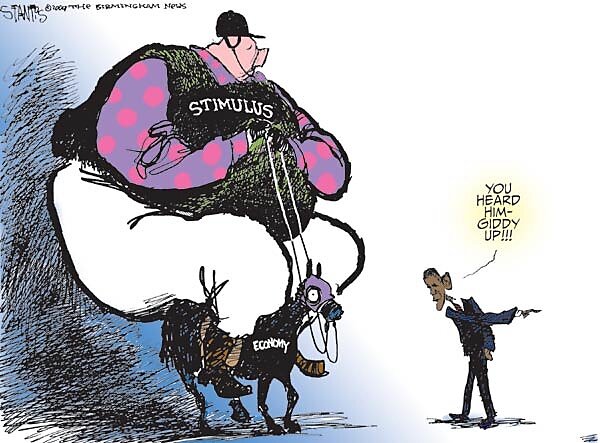

With that type of model, you then automatically generate predictions that bigger government will “stimulate’ growth and create jobs. Heck, sometimes you even admit that you don’t look at real world numbers.

This perhaps explains why Keynesian economics has a long track record of failure. It didn’t work for Hoover and Roosevelt in the 1930s. It didn’t work for Nixon, Ford, and Carter in the 1970s. It didn’t work for Japan in the 1990s. And it hasn’t worked this century for either Bush or Obama.

But politicians love Keynesian theory because it tells them that their vice is a virtue. They’re not buying votes with other people’s money, they’re “stimulating” the economy!

Given this background, you won’t be surprised to learn that Keynesians are now arguing that the recent partial government shudown hurt growth.

Here’s some of what Standard and Poor’s wrote about that fight and why the shutdown supposedly reduced economic output, along with their warning of economic cataclysm if politicians had been forced to balance the budget in the absence of an increase in the debt ceiling:

…the shutdown has shaved at least 0.6% off of annualized fourth-quarter 2013 GDP growth, or taken $24 billion out of the economy. …the resulting sudden, unplanned contraction of current spending could see government spending cut by about 4% of annualized GDP. That would put the economy in a recession and wipeout much of the economic progress made by the recovery from the Great Recession. …The bottom line is the government shutdown has hurt the U.S. economy.

Part of me wonders whether the bottom line is that S&P was simply looking for an excuse for having made a flawed economic prediction earlier in the year. They basically admit they goofed (though, to be fair, all economists are lousy forecasters), as you can see from this excerpt, but we’re supposed to blame the lower GDP number on insufficient government spending.

In September, we expected 3% annualized growth in the fourth quarter… Since our forecast didn’t hold, we now have to lower our fourth-quarter growth estimate to closer to 2%.

Unsurprisingly, the Obama Administration has been highlighting S&P’s analysis:

A number of private sector analyses have estimated that the shutdown reduced the annualized growth rate of GDP in the fourth quarter by anywhere from 0.2 percentage point (as estimated by JP Morgan) to 0.6 percentage point (as estimated by Standard and Poor’s)… Most of the private sector analyses are based on models that predict the impact of the shutdown based on the reduction in government services over that period.

And the establishment press predictably carried water for the White House, echoing the S&P number. Here’s an example from Time magazine:

The financial services company said the shutdown, which ended with a deal late Wednesday night after 16 days, took $24 billion out of the U.S. economy, and reduced projected fourth-quarter GDP growth from 3 percent to 2.4 percent.

If nothing else, this is a good example of how a number gets concocted and becomes part of the public policy discussion. Let’s take a step back,however, and analyze whether that $24 billion number has any merit.

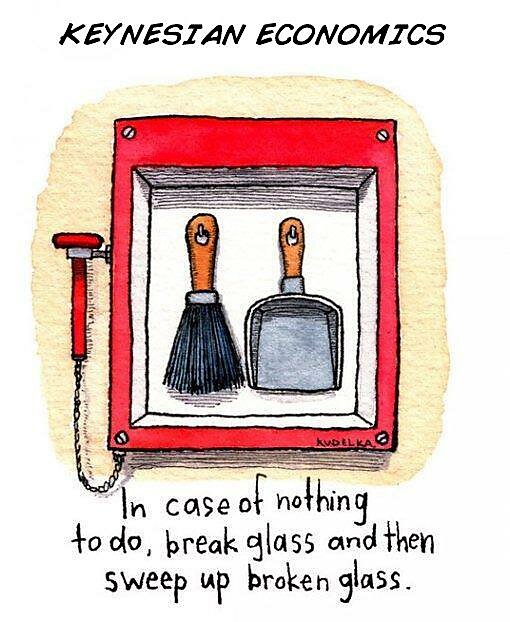

The Keynesian interpretation is that the shutdown took money “out of the economy.” According to the theory, money apparently disappears if government doesn’t spend it.

In reality, though, less government spending means that more funds are available in credit markets for private spending. This video explains why Keynesian theory is misguided.

And if you want to dig further into the issue, you can click here for a video that explains why we might get better decisions if policy makers focused on how we earn income rather than how we allocate income.

Now that I’ve shared the basic arguments against Keynesian economics, let me give two caveats.

First, resources don’t get instantaneously reallocated when the burden of government spending is reduced. So I’ve always been willing to admit there could be a few speed bumps as some additional labor and capital get absorbed into the productive sector of the economy.

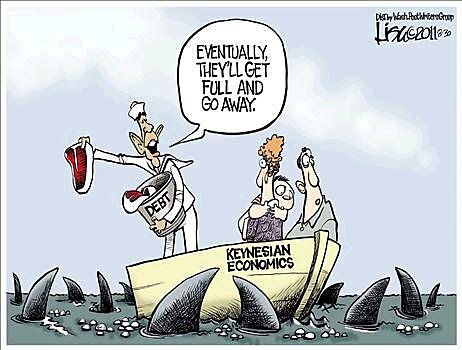

Second, a nation can artificially enjoy more consumption for a period of time by borrowing from overseas. So if deficit spending is financed to a degree by foreigners, overall spending in the economy will be higher and people will feel more prosperous.

But these caveats aren’t arguments for more spending. The ongoing damage of counterproductive government outlays is much larger and more serious than the transitory costs of redeploying resources when spending is reduced. And overseas borrowing at best creates illusory growth that will be more than offset when the bills come due.

Ultimately, the real-world evidence is probably the clincher for most people. As noted above, it’s hard to find a successful example of Keynesian spending.

Yet we have good evidence of nations growing faster when government outlays are being controlled, including Canada in the 1990s and the United States during both the Reagan years and Clinton years.

And the Baltic nations imposed genuine spending cuts and are now doing much better than other European countries that relied on either Keynesian spending or the tax-hike version of austerity.

P.S. Here’s a funny video on Keynesian Christmas carols. And everyone should watch the famous Hayek v Keynes rap video, as well as its equally clever sequel.

P.P.S. Switching to another topic, we have an encouraging update to the post I wrote last year about an Australian bureaucrat who won a court decision for employment compensation after injuring herself during sex while on an out-of-town trip. Showing some common sense, the Australian High Court just ruled 4–1 to strike down that award.