Three years ago, I wrote about the importance of intragroup funding, liquidity, and capital flows within a banking group composed of multiple entities , as is common nowadays. In short, I suggested that, based on the evidence, intragroup funding — or “internal capital markets,” as some academics refer to it — benefited banking groups by allowing the efficient transfer of liquidity where and when it was needed within the multinational bank’s legal entity structure. This helped to avert crises, or at least dampen their effect, thereby solidifying banking groups as a whole.

In a series of follow-up posts, I looked at historical and contemporary examples demonstrating the relation between intragroup funding and stability. First, I compared the relative stability of the U.S. and Canadian banking systems in the 19th Century. Canadian banks demonstrated a much higher level of financial resilience, thanks in large part to their ability to open branches nationwide. By contrast, large U.S. state banks, whose ability to open branches in other states or districts was severely constrained by law, and “unit” banks, which were not allowed to open branches at all, experienced great instability and recurrent crises. Next, I considered a modern banking model that was able to combine the fragmented nature of the 19th Century U.S. system with the great resilience of the Canadian one, thanks to its peculiar, liability-sharing funds transfer mechanism and use of local clearinghouses, namely, the German Sparkassen Finanzgruppe (i.e., saving banks group; see post here).

Throughout this series, I pointed out that all empirical and historical evidence actually runs contrary to the current regulatory trend toward fragmenting and siloing banking. Since the financial crisis, regulators have fallen into a very dangerous fallacy of composition. Their belief that the financial system will be made safer by making each separate entity of a larger integrated banking group stronger while simultaneously raising barriers between such entities is deeply flawed.

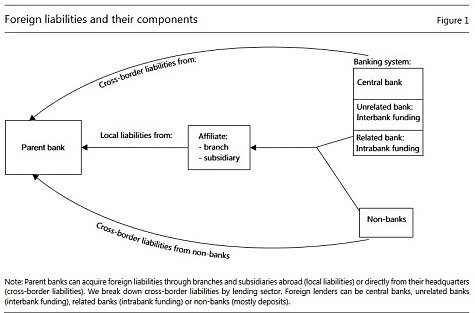

Last month, a new paper was published that confirmed the critical importance of intragroup liquidity transfers for financial stability: “Changing business models in international funding,” by Gambacorta, van Rixtel, and Schiaffi. The paper looks at whether banks altered their funding profile when the financial crisis struck and money markets froze. More specifically, the paper investigates changes in the nature (retail, wholesale, intragroup, etc.) and origins (domestic or foreign) of the liabilities at holding and parent company levels, as well as at branches and subsidiary levels. Unsurprisingly, the authors find that:

Following the first episodes of turbulence in the interbank market (after 2007:Q2), globally active banks increased their reliance on funding from branches and subsidiaries abroad, and cut back on funding obtained directly by headquarters (cross-border funding). In particular, banks reduced cross-border funding from unrelated banks — e.g. those that are not part of the same banking group — and from non-bank entities. At the same time, they increased intragroup cross-border liabilities in an attempt to make more efficient use of their internal capital markets.

The authors do a great job of summarizing the current literature on this topic: there is overwhelming evidence that banks rely on “internal capital markets” to absorb external liquidity shocks. Yet the authors also highlight the fact that intragroup flows of this sort have been declining, chiefly due to regulator-mandated siloing of liquidity and capital, among other factors:

… [R]egulatory reform has been the main catalyst of the profound changes observed in global banking and its funding structures in recent years. This includes most prominently Basel III and structural banking reforms, such as the “ringfencing” of domestic operations and “subsidiarisation,” which requires banks to operate as subsidiaries overseas, with their own capital and liquidity buffers, and funding dedicated to different entities. Moreover, several jurisdictions have implemented enhanced oversight and prudential measures, including local capital, liquidity and funding requirements and restrictions on intragroup financial transfers, promoting “self-sufficiency” and effectively reducing the scope of global banking groups’ internal capital markets (Goldberg and Gupta, 2013). In effect, these regulations restrict the foreign activities of domestic banks and the local activities of foreign banks (“localisation;” Morgan Stanley and Oliver Wyman, 2013). [Emphasis original.]

The authors point out that

“[R]ing-fencing” and “subsidiarisation” may constrain the efficient allocation of capital and liquidity within a globally active banking group and the functioning of its internal capital markets; in fact, these proposals have led to concerns that structural banking reforms may potentially trap capital and liquidity in local pools. [Emphasis original.]

This is a real concern. Driven by a fallacy of composition, and with no empirical evidence to justify their reforms, regulators are weakening the financial system as a whole, and in doing so repeating the mistakes of the 19th century U.S. banking system. Moreover, disjointed discretionary regulatory actions are likely to make things worse when the next crisis strikes: domestically-focused regulators are likely to attempt to protect their own national banking system, preventing domestic subsidiaries from transferring much-needed liquidity to their parents abroad, resulting in a weakened international financial system.

The long-term consequences of trapping capital and liquidity where they are not needed is unknown. Nevertheless, banks are profit-maximizing private enterprises, and therefore may well decide that putting those funds to use is better than leaving them idle — even if those funds could more profitably have been used elsewhere, absent regulatory constraints. Those constraints, in turn, distort the allocation of capital in the economy, with potentially dramatic economic outcomes.

Worryingly, it has recently been reported that regulatory agencies had in mind an even more drastic idea: the elimination through subsidiarization of most, if not all, international branches, further trapping capital and funding within entities that never needed to hold such funds in the past. Whether this measure is ultimately implemented remains to be seen. However, one thing is certain: political agendas lead to the total disregard of empirical and historical evidence. In banking as in politics, the new ideological fracture seems to be “open” vs. “closed.”

________________________

[This article is edited from an original version that appeared on Spontaneous Finance.]

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.