—

May 17, 2016

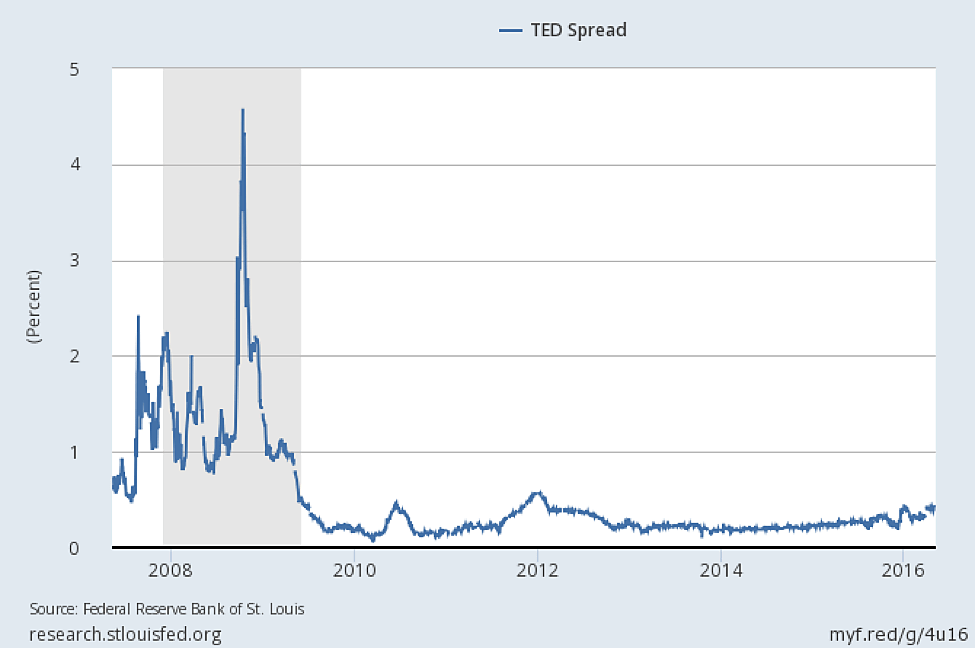

Chairman Huizenga, Ranking Member Gwen Moore, and distinguished members of the Committee on Financial Services Monetary Policy and Trade Subcommittee, my name is George Selgin, and I am the Director of the Cato Institute’s Center for Monetary and Financial Alternatives. I am also an adjunct professor of economics at George Mason University, and Professor Emeritus of Economics at the University of Georgia. I am grateful to all of you for having granted me this opportunity to testify before you on the subject of “Interest on Reserves and the Fed’s Balance Sheet.”

The Federal Reserve was originally given the authority to pay interest on bank reserves effective October 1, 2011 by the Financial Services Regulatory Relief Act of 2006. The intent of that step was to increase commercial banks’ efficiency by reducing the opportunity cost they incurred in being required to hold reserves that bore no interest.

The Emergency Economic Stabilization Act of 2008 subsequently accelerated the effective date upon which the Fed might begin paying interest on reserves to October 1, 2008. The Fed in turn actually began paying banks interest on both required reserves and excess reserves on October 9, 2008.

The rationale behind the early deployment of the Fed’s authority to pay interest on reserves was entirely different from that behind the original, 2006 measure. Interest on reserves was to be relied upon, not as a means for improving banks’ efficiency, but as a new Federal Reserve instrument of monetary control. Specifically, it was resorted to as a contractionary monetary measure, meant to prevent monetary expansion that would otherwise have taken place as a consequence of the Fed’s post-Lehman emergency lending operations. As Chairman Ben Bernanke explained at the time:

our liquidity provision had begun to run ahead of our ability to absorb excess reserves held by the banking system, leading the effective funds rate, on many days, to fall below the target set by the Federal Open Market Committee. … Paying interest on reserves should allow us to better control the federal funds rate, as banks are unlikely to lend overnight balances at a rate lower than they can receive from the Fed; thus, the payment of interest on reserves should set a floor for the funds rate over the day. With this step, our lending facilities may be more easily expanded as necessary.[1]

In his memoir Chairman Bernanke says that “by setting the interest rate we paid on reserves high enough, we could prevent the federal funds rate from falling too low, no matter how much [emergency] lending we did.”[2]

According to Richmond Fed economists John R. Walter and Renee Courtois, Fed officials were concerned at the time that, in pushing the fed funds rate below its target, the Fed’s emergency credit injections might end up “increasing the overall supply of credit to the economy beyond a level consistent with the Fed’s macroeconomic policy goals, particularly concerning price stability…. Once banks began earning interest on the excess reserves they held, they would be more willing to hold on to excess reserves instead of attempting to purge them from their balance sheets via loans made in the fed funds market, which would drive the fed funds rate below the Fed’s target for that rate.”[3]

The Fed’s decision had reflected the FOMC’s belief in the days immediately following Lehman’s failure that the inflation outlook was highly uncertain, and that, in the absence of interest payments on reserves, continued emergency lending could well push inflation above the Fed’s 2% target. In retrospect, the Fed’s fears were tragically misplaced. Instead of assisting it in achieving either its federal funds rate or its inflation target, the Fed’s decision to begin paying interest on bank reserves contributed to a collapse in nominal spending that was already in progress, helping thereby to turn the subprime crisis into a more general macroeconomic downturn. That the Fed realized that the macroeconomic situation was rapidly worsening even before it actually began paying interest on reserves was reflected in its decision to further reduce its federal funds target, from 2% to 1.5%, on October 8, 2008. The Fed chose not to reconsider its decision to commence paying banks to hold reserves a day later.

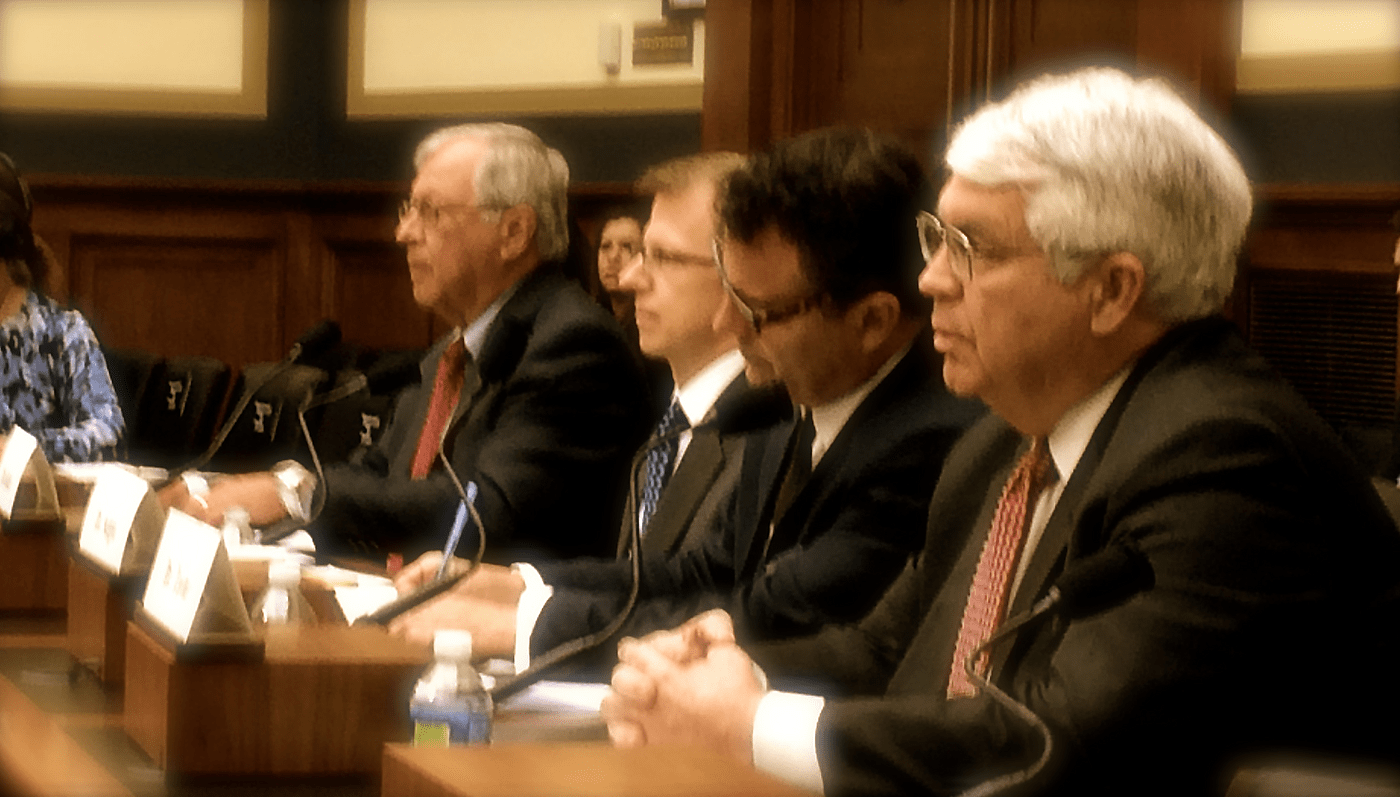

The rapid decline in the growth rate of nominal GDP, from about 3.5% at the start of 2007 to minus 3.3% by the second quarter of 2009, is shown in Figure 1, which also shows the progress of adjustments to the fed funds target and the “effective” federal funds rate, which is the average rate of interest paid on actual overnight loans. The collapse in spending is ipso-facto evidence that the Fed’s stand was overly tight. The figure shows that the Fed’s rate target had become more-or-less irrelevant by the third quarter of 2008, and that this continued to be the case after it began paying interest on bank reserves. The latter policy did, however, reduce the volume of interbank lending and overall credit expansion, contributing thereby to the collapse of nominal GDP.

Figure 1

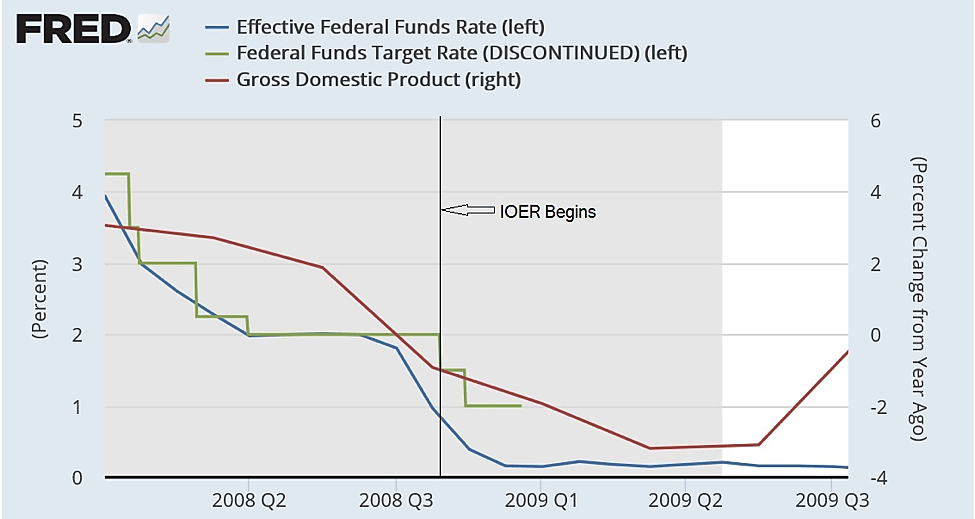

The Fed’s policy of paying interest on excess reserves, combined with the substantial scale of its post-Lehman emergency lending and the even greater scale of later rounds of Quantitative Easing, led to a massive accumulation of banking system excess reserves. As Figure 2 shows, excess reserves, which between 2002 and 2008 had seldom exceeded $1.8 billion, had risen to almost $2.7 trillion in August 2014, and as of this April still exceeded $2.33 trillion.

Figure 2

Although some authorities[4] have claimed that the scale of the Fed’s reserve creation alone made a corresponding increase in bank holdings of excess reserves inevitable, that is not correct. Although the total quantity of bank reserves is largely determined by the Fed’s rather than commercial bankers’ decisions, banks are always capable in principle of reducing their holdings of excess reserves by swapping them for other assets. Although the swapping does not destroy reserves, it does result in overall growth in the quantity of bank deposits, together with a corresponding increase in required reserves and a like reduction in excess reserves. Until the third quarter of 2008 this process kept bank excess reserves roughly constant despite steady growth in total Federal Reserve Bank assets and the monetary base; and it might have done the same afterwards had circumstances not been such as to encourage banks to accumulate excess reserves. Nor did the tremendous scale of the Fed’s asset purchases itself matter: During the notorious Weimar hyperinflation, for example, the growth in total bank reserves far exceeded that witnessed in the U.S. since Lehman’s bankruptcy. Yet Germany’s banks, instead of accumulating excess reserve, increased their lending and deposit creation proportionately, and eventually more than proportionately, with terrible consequences.

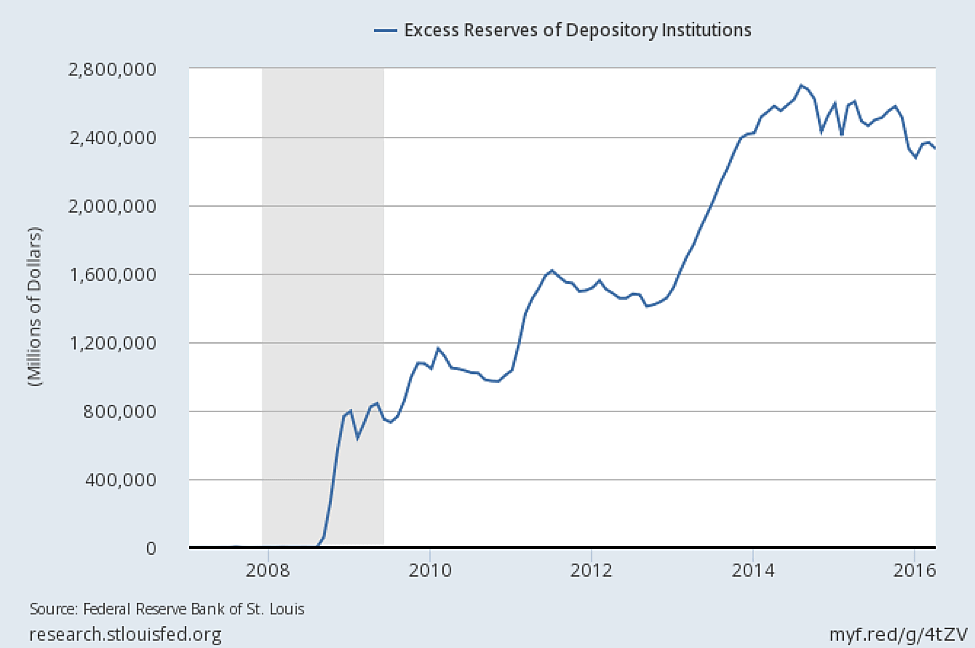

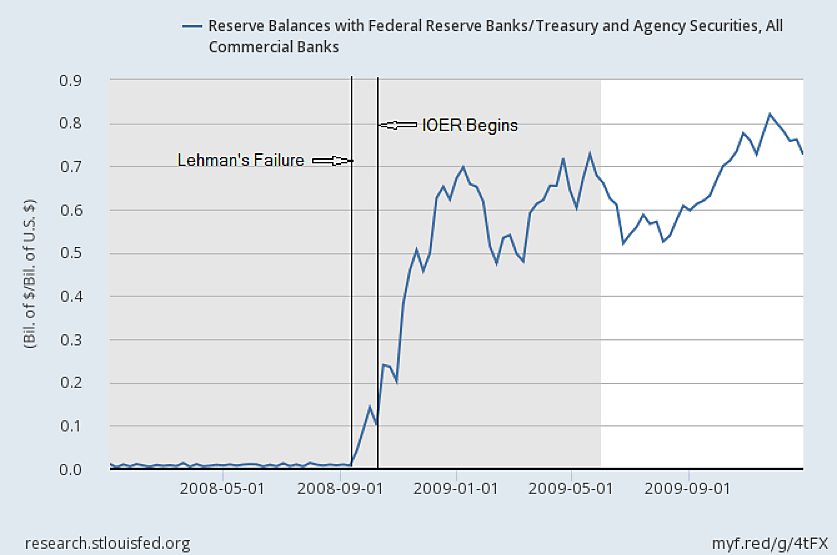

Nor is U.S. banks’ decision to accumulate excess reserves attributable to the panic that followed the Fed’s decision to allow Lehman Brothers to go bankrupt.[5] Although banks’ fear that their counterparties might be allowed to go bankrupt would make them reluctant to lend to other banks, it alone would not necessarily cause them to decisively favor reserves over low-risk Treasury securities. Furthermore, as Figure 3 shows, although the TED spread — a widely-used measure of the perceived risk of bank failures, equal the difference between the interest rate on short-term interbank lending and the interest rate on Treasury securities — spiked not long after Lehman’s failure, the spread returned to normal levels afterwards, mainly in response to the Fed’s decision to rescue AIG, while banks’ excess reserve holdings did not. The persistent increase in bank holdings of excess reserves suggest that the payment of interest on such reserves, rather than banks’ reassessment of the risk of counterparty failures, is behind the increase.

Figure 3

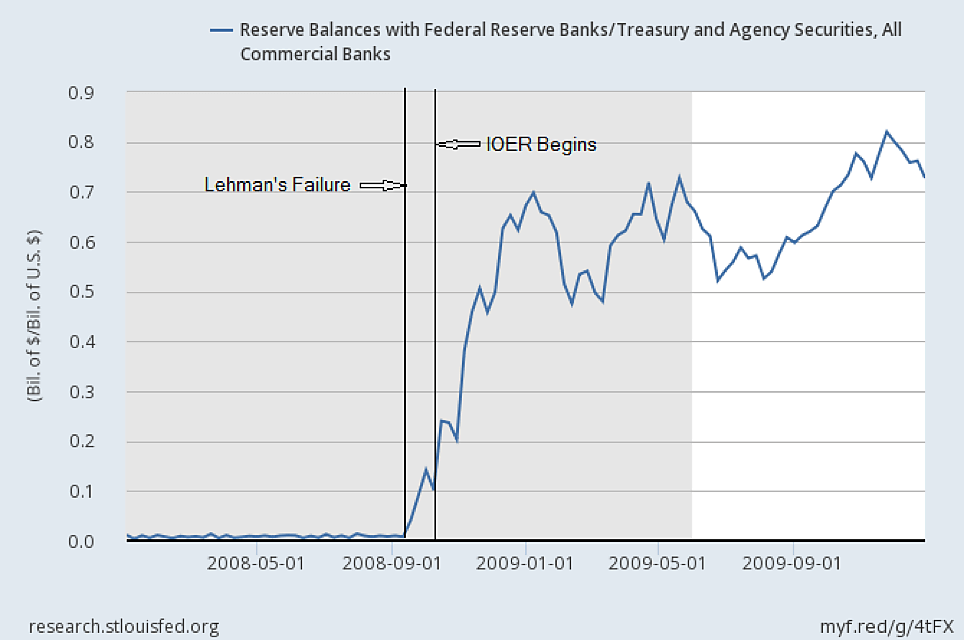

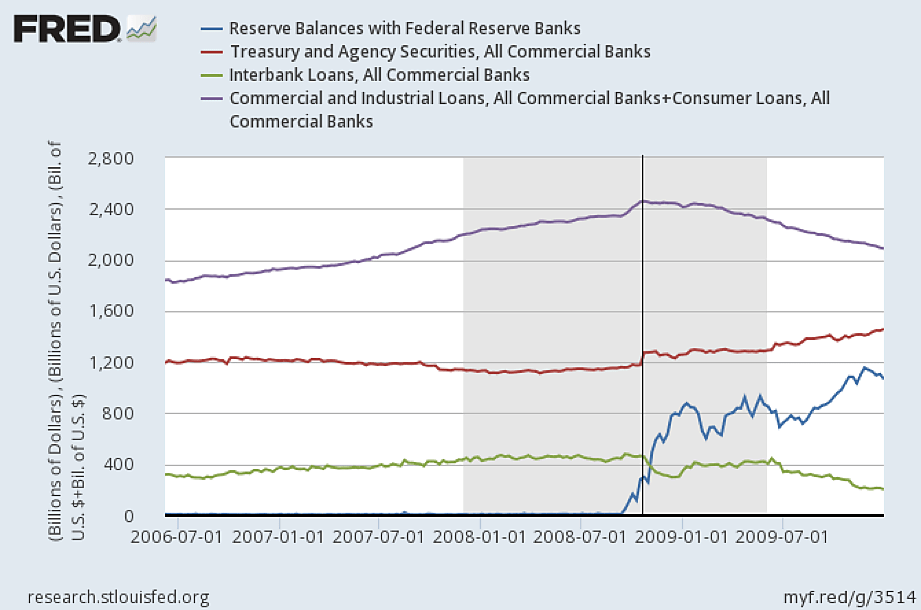

Finally, the timing of the substantial rise in banks’ excess reserve holdings, as shown in the next chart, is also consistent with the view that the Fed’s policy of paying interest on excess reserves contributed more to the increase than Lehman’s failure did. As Figure 4 shows, although banks accumulated excess reserves immediately following Lehman’s failure, most of the increase in excess reserves occurred after the Fed began paying interest on reserves.

Figure 4

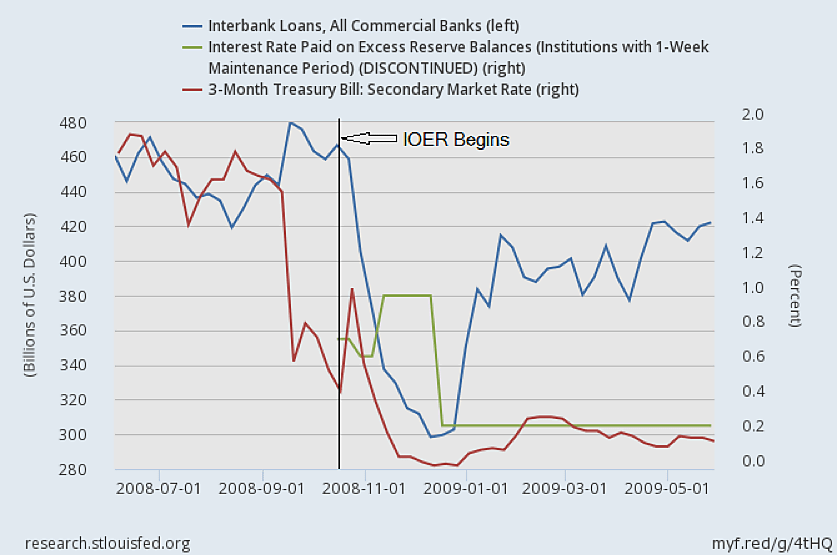

Some experts doubt that the very modest return on excess reserves — for most of the period between October 2008 and December 2015 the rate of interest on excess reserves was fixed at just 25 basis points — can have sufficed to induce banks to hoard reserves. However, banks’ willingness to hold excess reserves depends, not on the absolute return on such reserves, but on how that return compares to the return on alternative liquid and risk-free assets, such as Treasury bills. As Figure 5 shows, the interest rate on excess reserves has generally exceeded the yield on Treasury bills. The same figure shows how the volume of interbank loans has tended to vary according to the difference between the rate of interest on excess reserves and the yield on Treasury securities, which can be regarded here as a proxy for market rates more generally.

Figure 5

Because reserves began to bear a higher return than safe governments securities, the demand for those securities did not increase substantially after Lehman’s failure (Figure 6).

Figure 6

As I’ve noted, a desire to prevent its emergency lending from contributing to the availability of federal funds supplied the original inspiration for the Fed’s decision to begin paying interest on bank reserves, so it is no surprise that the policy should have been responsible for the actual decline in interbank lending that took place after Lehman’s failure. Once they were able to earn interest on their excess reserves exceeding the effective federal funds rate, banks (mainly smaller ones) that until the crisis had generally been net interbank lenders, withdrew from that market, while those (mainly larger ones) that had previously tended to participate as borrowers found it both necessary and no longer onerous to hold substantial quantities of excess reserves instead.

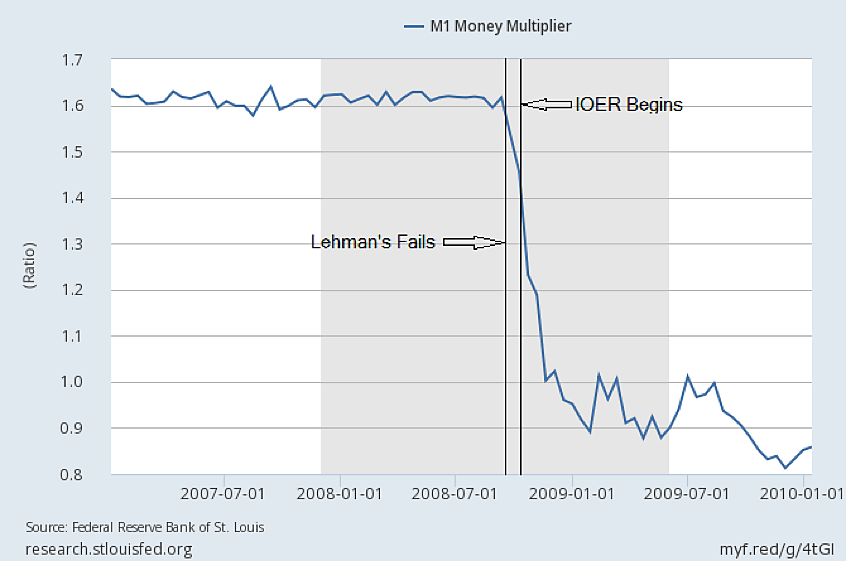

Besides contributing to the collapse in interbank lending, the Fed’s decision to reward banks for holding excess reserves prevented the creation of additional reserves from giving rise to corresponding growth in other kinds of bank credit by short-circuiting of the base-money “multiplier” that normally connects growth in bank reserves to more substantial growth in bank deposits. As the Figure 7 shows, the M1 multiplier, the ratio of M1 (currency in circulation plus demand deposits) to the monetary base (currency in circulation plus total bank reserves) fell from 1.617 on September 10th to half that value by the beginning of 2010.

Figure 7

The collapse of the money multiplier was in turn responsible for the failure of the Fed’s large-scale asset purchases to give rise to any corresponding increase in bank deposits, bank credit, and nominal GDP. Instead, banks’ holdings of excess reserves grew almost in lock-step with the Fed’s creation of new base money. Had banks not been rewarded for holding excess reserves, a much smaller program of Quantitative Easing might have given rise to a much more substantial increase in bank deposits, bank lending, and nominal GDP.

Partly owing to the repressive effect of interest on reserves on bank deposit creation, most forms of bank lending, instead of being revived by the Fed’s creation of fresh bank reserves, remained stagnant or (in the case of Commercial and Industrial Loans) continued to decline long after Lehman’s failure. Commercial and Financial Lending declined until the third quarter of 2010, as seen in Figure 8. And although it has made up for lost ground since, it remains well below the level consistent with its pre-boom trend. Moreover, because the crisis resulted in a large and lasting decline in net “shadow” bank lending to non-financial firms,[6] especially by Money Market Mutual Funds, much of the revival in commercial bank lending has consisted of lending to corporate borrowers that had previously relied upon funding from shadow banks. Lending to small businesses has suffered correspondingly.

Figure 8

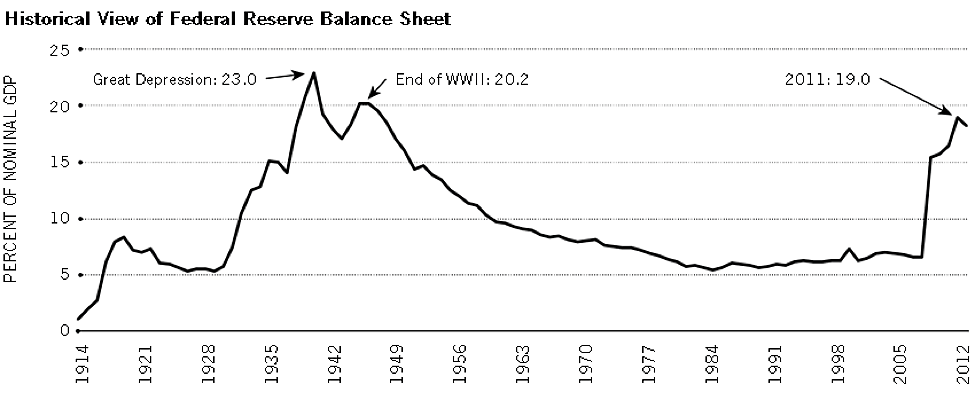

Banks’ unprecedented accumulation of excess reserves has as its counterpart a very large Fed balance sheet relative to both overall economic activity and private lending. As Figure 9 shows, the increase relative to GDP is the largest since the World War II era, when the Fed was committed to setting a floor on the governments’ wartime borrowing costs by serving as a “last resort” purchaser of its bonds.[7] That commitment finally ended with the so-called “Treasury Accord” of 1951.[8] Although the Fed’s balance sheet reached its highest historical level relative to GDP during the Great Depression, that record mainly reflected that era’s extreme drop in GDP, as opposed to growth in the absolute size of the Fed’s balance sheet.

Figure 9

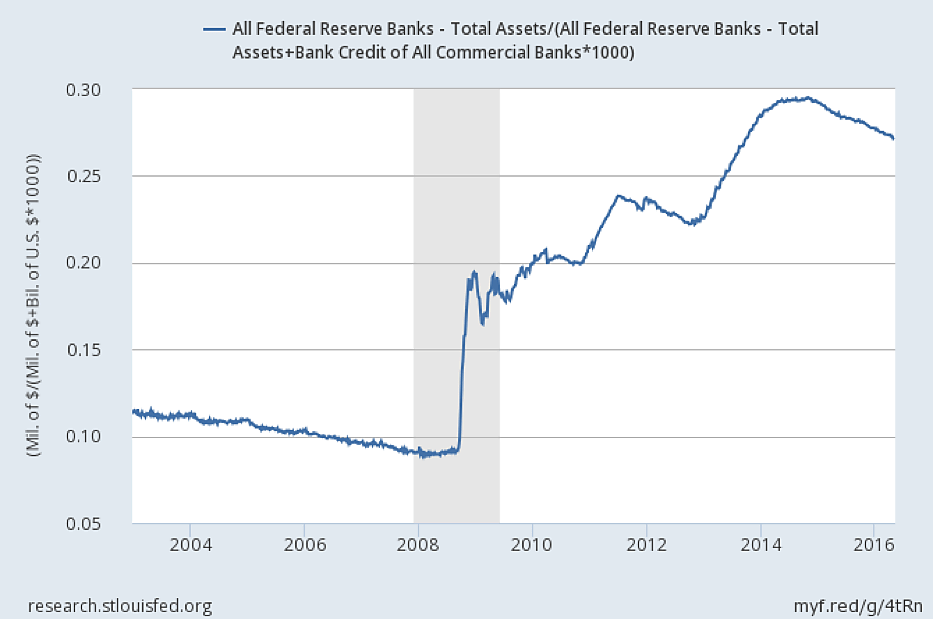

Substantial growth in the Fed’s balance sheet, combined with the incomplete revival of bank lending since the crisis, has caused the Fed’s overall share of bank-based financial intermediation to triple, as seen in Figure 10:

Figure 10

Such a large increase in the Fed’s role in the allocation of scarce savings is much to be regretted, as it almost certainly means that those savings are not being devoted to their most productive or welfare-enhancing uses. At best central banks are inefficient financial intermediaries, not the least because efficient intermediation forms no part of their official responsibilities. Instead, their acquisition of interest-earning assets is supposed to be incidental to their tasks of regulating overall monetary conditions and serving as lenders of last resort. They are, furthermore, generally supposed to avoid exposing themselves — and, indirectly, taxpayers — to loss, and are for that reason expected to fully secure their last-resort loans and to limit their outright asset purchases to safe government securities. Commercial banks, in contrast, are not similarly constrained, and cannot be if they are to take full advantage of opportunities for productive lending.

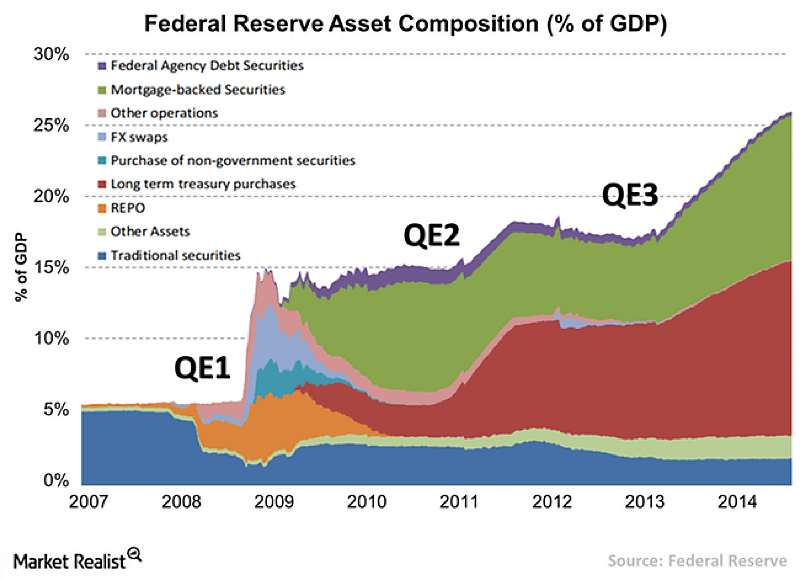

Until the recent crisis, the Fed was no exception to the general rules governing central banks. Before early 2008 Fed assets consisted overwhelmingly of U.S. Treasury bills, notes, and bonds. Since the crisis, however, the Fed’s asset holdings have changed considerably, in ways that generally involve still greater departures from any efficient use of scarce funds, including a substantial increase in MBS holdings and long-term Treasury securities acquired during several rounds of Quantitative Easing (Figure 11):

Figure 11

Although the Fed’s crisis-related asset purchases may have been instrumental in combating the panic and subsequent recession, its continued holding of non-traditional assets long afterwards constitutes a serious distortion in the allocation of scarce capital, including a perpetuation of the very misallocations of which irresponsible private lenders (encouraged in many cases by government policies[9]) were guilty in the years leading to the crisis.

Despite the counterproductive consequences of the Fed’s original decision to employ interest payments on bank reserves as an instrument of monetary control, and the inefficient allocation of savings to which banks’ hoarding of excess reserves contributes, the Fed continues, seven and a half years since the crisis, not only to rely on that new instrument, but to rely on it and changes in the interest rate it offers in its overnight reverse repurchase agreements (ON RRPs) exclusively for monetary control purposes, while dispensing entirely with traditional open market operations. Its decision to do so, and more specifically, to maintain a positive rate of interest on excess reserves, and even to increase that rate (as it did in mid-December 2015), is to be regretted.

The December rate hike itself appears in retrospect to replicate the Fed’s error of October 2008, when it employed interest on reserves to avoid an unwanted loosening of credit, on the grounds that such a loosening might prevent it from achieving its policy targets. In electing last December to raise the interest rate paid on excess reserves from 25 to 50 basis points, the FOMC pointed to a “considerable improvement in labor market conditions,” while declaring that it was “reasonably confident that inflation will rise, over the medium term, to its 2 percent objective.”[10] As of this writing, both core and headline PCE inflation remain below the Fed’s 2% target, while the unemployment rate is again at 5%, its level in October 2015. Many observers have since concluded that the December rate hike was a mistake.

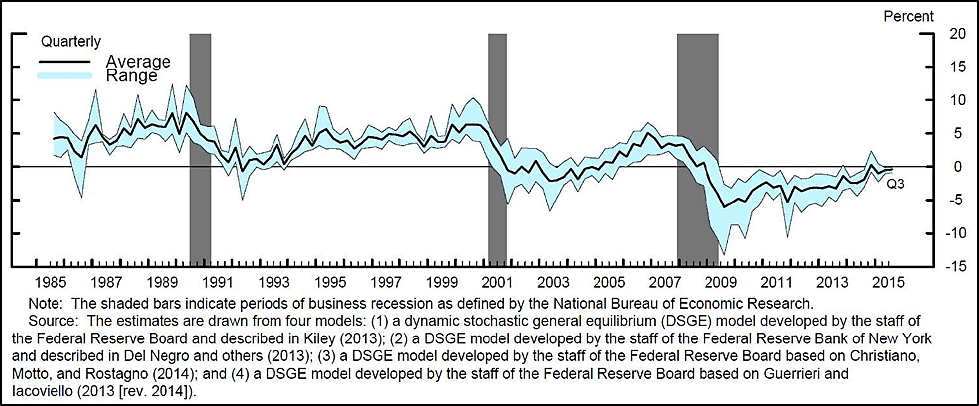

However, it would be more accurate to claim that, while the December doubling of the rate of interest paid on excess reserves was a mistake, the decision to pay 25 basis points on those reserves was a mistake as well. As David Beckworth has put it in a blogpost on the topic, “The Fed…got ahead of the recovery well before December.”[11] According to the Fed’s own estimates, as seen in Figure 12 below, the “natural” fed funds rate, which is the rate consistent with a stable level of spending growth and inflation, has been persistently negative since Lehman went bankrupt. Consequently, in setting a positive funds rate target band, the upper bound of which was determined by the interest rate on excess reserves, the Fed maintained an excessively tight policy.

Figure 12

It is owing to the perception that natural rates in their own struggling economies are also negative that several foreign central banks, including the ECB and the central banks of Denmark, Sweden, Switzerland, and, starting in January this year, Japan, have turned to charging rather than paying interest on bank excess reserve holdings. The step has been controversial, and its consequences have not clearly fulfilled the hopes of those central bankers that have resorted to it. However, regardless of its merits the policy turn raises obvious questions concerning the Fed’s decision to continue pursuing its opposite strategy.

Besides contributing to what may have been an excessively tight policy stance, the continuation of interest payments on excess reserves also serves to perpetuate the Fed’s unusually heavy involvement in the allocation of savings, and the consequent mal-investment of those savings.

The alternative to continuing the present policy is, of course, to dispense with interest payments on excess reserves while restoring conventional open market operations as the Fed’s primary instrument of monetary control. Restoring efficient credit allocation in turn means reducing the size of the Federal Reserve’s balance sheet both absolutely and relative to that of private intermediaries.

For the Fed to do all of these things while maintaining a proper monetary policy will be challenging. But for it to avoid taking these steps is for it to continue to contribute to the economic malaise that has made for a slow and still unsatisfactory recovery from the 2008 crisis. And although the task of normalizing monetary policy may be difficult, it is hardly impossible. The phasing-out of interest on excess reserves, together with the lowering of interest payments on ON RPPs, will help to revive the money multiplier, thereby not just allowing but necessitating a compensating unwinding of the Fed’s post-crisis balance sheet. If it isn’t to disrupt markets the unwinding must be both gradual and anticipated: one proposal would have the Fed begin by committing to sell $4-$5 billion in short-term Treasuries each week.[12] Such a sale would, incidentally, more than make up for the reduction in Fed interest payments to Money Market Funds, by returning to the marketplace securities that such funds have long been craving.

Having the Fed return to its pre-crisis policy of zero interest on excess reserves does not mean forgetting the arguments that supported the 2006 legislation that originally granted the Fed the right to pay interest on reserves. However, meeting the spirit of those arguments requires only that the Fed be able to pay interest on banks’ required, as opposed to their excess, reserves. So long as excess reserves bear no interest, banks have little reason to accumulate them, and would therefore suffer little from the inefficiency connected to their slight holdings. Economic efficiency is in any case better enhanced by encouraging banks to put excess reserves to use, than by paying them to hoard such reserves.

___________________

[1] (http://www.federalreserve.gov/newsevents/speech/bernanke20081007a.htm)

[2] (Courage to Act, pp. 325–6).

[3]https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_brief/2009/pdf/eb_09-12.pdf

[4] See, for example, Todd Keister and Gaetano Antinolfi, http://libertystreeteconomics.newyorkfed.org/2012/08/interest-on-excess-reserves-and-cash-parked-at-the-fed.html#.Vzog6ORGR2A

[5] This claim has been put forward by Alex Cukierman, among others. See “U.S. Banks’ Behavior since Lehman’s Collapse, Bailout Uncertainly and the Timing of Exit Strategies.” Working paper, August 30, 2014.

[6] See Joshua Gallin, “Shadow Banking and the Funding of the Nonfinancial Sector.” Working paper 2013:50, Federal Reserve Board.

[7] The chart comes from Lowell R. Ricketts and Christopher J. Waller, “The Rise and (Eventual) Fall in the Fed’s Balance Sheet.” The Regional Economist, January 2014, Federal Reserve Bank of St. Louis.

[8] A still larger ratio during the Great Depression mainly reflected the tremendous GDP collapse of that episode rather than of absolute growth in the Fed’s size.

[9] See Peter Wallison, Hidden in Plain Sight: What Really Caused the World’s Worst Financial Crisis and Why It Could Happen Again. New York: Encounter Books, 2015.

[10] https://www.federalreserve.gov/newsevents/press/monetary/20151216a.htm

[11] http://macromarketmusings.blogspot.com/2016/02/the-fed-did-not-make-mistake-in-december.html

[12] http://www.ft.com/cms/s/0/520377e8-037e-11e5-b55e-00144feabdc0.html#axzz48p3YArDG. See also Norbert Michel (http://www.heritage.org/research/reports/2014/08/quantitative-easing-the-feds-balance-sheet-and-central-bank-insolvency), who proposes that the Fed take until 2020 to sell 75% of its long-term securities and MBS, at a rate of $45 billion each month, while holding the other 25% until they mature.