When economic journalists speculate about looming inflation risks in the U.S. or any other country, they implicitly assume that each country’s inflation depends on that country’s fiscal or monetary policies, and perhaps the unemployment rate. Yet The Economist for March 3rd–9th shows approximately 1–2 percent inflation in the consumer prices index (CPI) for virtually all major economies.

Inflation rates were surprisingly similar regardless of whether countries had budget deficits larger than ours (Japan and China) or big surpluses (Norway and Hong Kong), regardless of whether central banks experimented with “quantitative easing” or not, and regardless of whether a country’s unemployment rate was 16.9 percent (Spain) or 1.3 percent (Thailand).

The latest year-to-year rise in the CPI was below 1 percent in Japan and Switzerland, 1.5 percent in Hong Kong and the Euro area, 1.6 percent in Canada and China, 1.8 percent in Sweden, 1.9 percent in Norway and Australia, 2 percent in South Koreas and 2.1 percent in the U.S. Among major countries, U.K. was on high side with inflation of 2.7 percent. Three economies with super-fast economic growth above 6 percent (India, Malaysia and the Philippines) do have slightly higher inflation—above 3 percent—but the CPI is up just 1.6 percent in one of them, namely China.

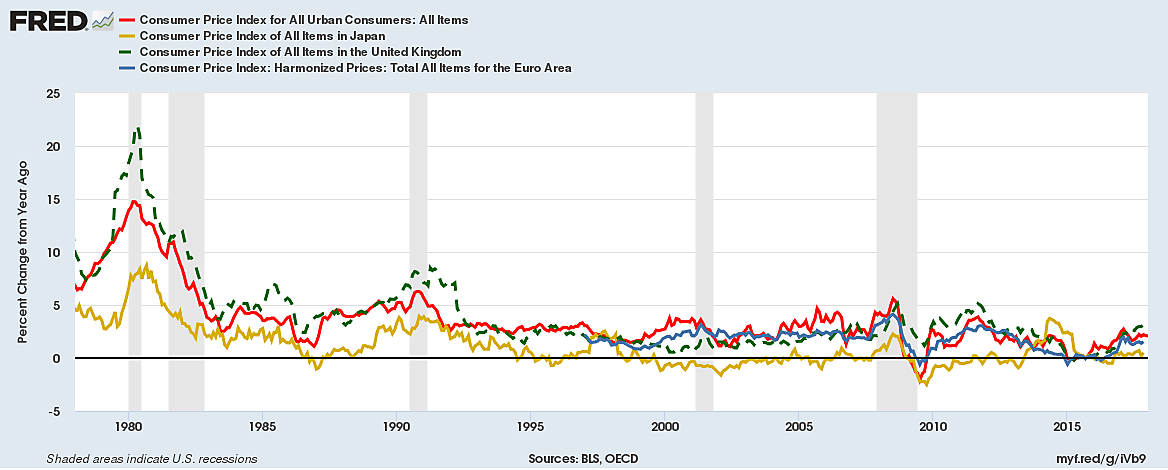

The remarkable similarity of CPI inflation rates is surprising since countries measure inflation differently and consume different mixes of goods and services. The fact that inflation rates are nonetheless so similar, and move up and down together, suggests that inflation is largely a global phenomenon. The U.S. may well have a disproportionate influence on global inflation, since it accounts for about 24 percent of global GDP and key commodities are priced in U.S. dollars. Yet U.S. inflation nonetheless goes up and down in synch with other major economies, as the graph shows.

Average world inflation is higher than inflation among major economies, however, because there are always some countries in chaos with untrustworthy currencies and extreme inflation—currently that includes Venezuela (741 percent), South Sudan (118 percent), North Korea (55 percent), Congo (52 percent) and Syria (43 percent).

The similarity of inflation, aside from a few extremes, is due to arbitrage among traded goods (though less so for local services). If exchange rates were fixed, the “law of one price” would prevent the same goods from selling at different prices in different places (aside from transportation costs, tariffs and sales taxes). Arbitrage—traders buying low and selling high—would ensure that prices varied only temporarily from one country to another.

Differences in inflation, including the extreme cases, is largely explained by exchange rates. Countries with a “strong currency” reputation (Switzerland) invariably have less inflation than countries that mistakenly pursue chronic currency depreciation as a boost to trade (Turkey). Anticipated devaluation is preemptively negated by rising wages and prices, which doesn’t help “competitiveness.”

On the other hand, when currencies rise against the U.S. dollar that makes oil and other commodities cheaper in terms of such rising currencies, which tends to boost world demand for industrial materials and grains and thus put upward pressure on commodity prices in dollars. Over the year ending February 27, for example, The Economist’s commodity price index rose 5.7 percent in dollars, but fell by 8.2 percent in euros because the euro rose against the dollar. (Dollar prices of metals rose from July to December, but little since then).

Exchange rate shifts may offer some insulation against global price swings, with rising currencies experiencing less inflation than others in the 1970s, and devalued currencies experiencing less deflation in the 1930s. But all currencies cannot appreciate or depreciate against each other, so global trends prevailed.

The obvious global synchronization of two broad inflation waves in the 1970s (aside from energy prices), and of deflation in the early 1930s, should have made it clear by now that trying to forecast inflation in one country alone is a futile exercise without taking into account global price trends and national exchange rates.