A short 2010 article of mine in Politico, which still annoys Paul Krugman and Brad DeLong, dealt with Ireland’s brief effort to restrain spending, which (while it lasted) was smarter than imposing uncompetitive tax rates as Greece had done.

Krugman ridiculed my Politico article in at least four columns. He imagines I predicted a “boom” in Ireland, because I wrote in June 2010 that, “the Irish economy is showing encouraging signs of recovery.” That the Irish economy was turning up at the time is undeniable. Although I did not yet have the benefit of real GDP data, Ireland’s GDP was clearly rising before the third quarter of 2010 in this Krugman graph and this one. What went wrong? Bonds and the economy collapsed after Black Thursday, September 30, when the government wasted millions on a gigantic bailout of Irish banks. My unforgivable blunder was in not predicting on June 9 what was going to happen on September 30. Mea culpa.

Ironically, Krugman and I agree Ireland should have let the banks fail. We likely agree that is has been foolhardy to enact higher income tax rates in Ireland, Portugal, Greece, Spain, France and the UK. Although Krugman wants to label me “an austerian,” I have been rebuking IMF austerity schemes since 1978 for imposing rising tax rates and falling currencies on troubled countries.

There is another important point of agreement between Krugman and I, but only in recent years. In February 2004, I debunked fears that projected budget deficits would raise interest rates in a paper presented at the U.S. Treasury. That paper was largely aimed at Brookings Institution scholars but also at Krugman, who was “terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits.” He has since come around to my view.

What Krugman and I cannot agree about, however, is his fantasy about Ireland’s “harsh spending cuts.” On The Colbert Report last year, for example, Krugman said, “Ireland is Romney economics in practice. They’ve … slashed spending; they’ve had extreme austerity programs.”

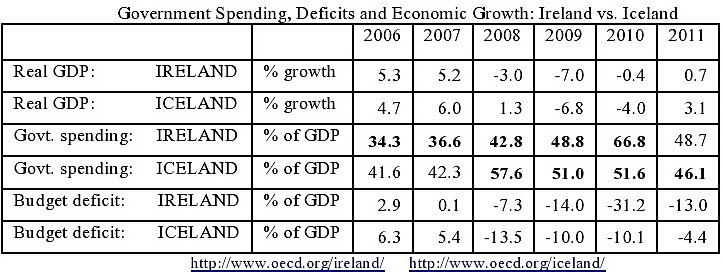

As the table below the jump shows, government spending as percent of GDP nearly doubled in Ireland, from 34.3 to 66.8 percent from 2006 and 2010, with bank bailouts after September 2010 pushing the deficit to 31.2 percent of GDP. By Krugman’s definition, Ireland had extremely “stimulative” spending and deficits since 2008. Does it matter that most spending since late 2010 was for bailing out bank creditors? Krugman’s new book says, “not at all: spending creates demand, whatever it’s for.”

By contrast, Iceland did not bail out its banks and instead cut spending from 57.6 percent of GDP in 2008 to 46.1 percent by 2011, shrinking Iceland’s budget deficit from 13.5 percent in 2008 to 4.4 percent by 2011. By Krugman’s definition, Iceland’s policies were drastically austere.

DeLong rightly complains that I “mischaracterized” the reason Krugman called Iceland’s policies “unorthodox.” I was reacting to a Krugman op ed, “Looking for Mr. Good Pain,” which again blamed Ireland’s anemic recovery on drastic spending cuts and claimed Latvia and Estonia are only examples anyone can find of spending cuts helping an economy.

I should have recalled that Krugman’s End This Depression Now! (181) defines Iceland’s heterodoxy as currency devaluation, which supposedly made it “much easier to cut wages and prices.” But exchange rate changes are surely a minor diversion from the larger issues of whether or not Krugman has been correct to (1) mischaracterize Ireland’s near-doubling of government spending as drastic cuts, and to (2) claim advocates of restrained spending can find no significant example when spending cuts produced better economic growth. In fact, Iceland’s is a good example of spending restraint leading to a stronger economy. A better example is the U.S., where the economy grew stronger as federal spending fell from 22.1 percent of GDP in 1992 to 18.2 percent in 2000. And Canada made deeper and more durable spending cuts in the 1990s with salutary results.

Iceland’s recent devaluation was highly orthodox policy condition for wards of the IMF (strings attached to a $2 bn. loan). Unfortunately, such devaluations often backfire by inflating commodity costs, interest rates and the burden of foreign debt. The Icelandic krona fell from 64 to the dollar in 2007 to 123.6 in 2009, before strengthening with the economy to nearly 116 in 2011.

Since oil, grains and metals are priced in dollars, the 2008–2009 devaluation inflated Iceland’s cost of production and cost of living. Inflation rose from 5.1 percent in 2007 to 12 percent or more in 2008 and 2009; real GDP fell by 6.8 percent in 2009 and 4 percent in 2010. Faced with a collapsing currency, the central bank interest rate was hiked to 18 percent by October 2008. It could have been worse. If Iceland’s Supreme Court had not nullified loans indexed to foreign currencies in June 2010, devaluation would have doubled the cost of repaying foreign debt.

Devaluation was supposed to boost GDP by making imports costly and exports cheap, thus narrowing the trade deficit. The current account deficit did fall after 2008, but that always happens when recessions slash imports. Ireland had a current account surplus from 2010 to 2012 without devaluation, even as Iceland’s current account deficit was still 7–8 percent of GDP.

Iceland’s economy grew by 3.1 percent in 2011 when the currency appreciated and the budget deficit was deeply cut to 4.4 percent of GDP. Devaluation explains the previous spike in inflation and interest rates, but little else.

Krugman, not I, chose to compare the economic policies and performance of Iceland and Ireland. That comparison shows that serious spending restraint (Iceland) is clearly more helpful to heavily-indebted countries than unrestrained spending and higher tax rates (Ireland).