Today, the U.S. Department of Education announced that it will make sweeping changes to the Public Service Loan Forgiveness (PSLF) program, which offers student loan cancellation for people who work in most nonprofit—especially government—jobs. The program is a sort of taxpayer thanks to “public servants,” whether taxpayers want to give thanks or not. It is based on the assumption that working for government or a nonprofit organization is a big sacrifice for the greater good. Indeed, it is so important that people holding degrees get their debts canceled that the Biden administration is violating the Constitution to get it done, bypassing Congress to de facto rewrite law. Not that federal student loans were ever constitutional.

PSLF was created in 2007 as part of the College Cost Reduction and Access Act, bipartisan legislation that the Bush administration signed largely to increase Pell Grants. By law, PSLF applies only to federal Direct Loans—loans paid directly out of the federal treasury—or old Family Federal Education Loans (FFEL)—through which the federal government guaranteed privately originated loans – that have been consolidated into Direct Loans. The program also requires that borrowers make 120 monthly payments while in qualifying jobs.

PSLF has become something of a cause célèbre among politicians as many people have applied for forgiveness, but few have succeeded. In large part, widespread failure is because a program started 14 years ago, requiring 10 years of payments in a qualifying job, is a program that is not yet likely to have many qualifiers. Relatively recent college grads, especially, tend to experience periods of unemployment and to switch employers often. Also, FFEL payments made before consolidation do not qualify. In addition, it has not always been easy to know which jobs count as “public service,” and many people have filled out paperwork incorrectly. Finally, some debtors have had their accounts mishandled, which is what happens with complex, bureaucratic “help.”

The administration says it will now count pre-consolidation FFEL payments toward forgiveness, which appears to be in conflict with the law. It also plans to ignore many errors or paperwork failures by applicants. In addition, the administration will count periods of deferment or forbearance towards 120 payments for members of the military, even though people in those statuses typically are not repaying their loans.

Of course, it is not hard to sympathize with people facing federal bureaucracy, especially the labyrinthine federal student loan system, with its myriad programs, repayment plans, and intricate interactions among them. But we must not lose sight of who will be paying for all of this: taxpayers, many of whom did not go to college, or avoided debt to matriculate. They are real people—or will be—who will have to fund federal spending that repaid student loans were supposed to cover.

Moreover, subverting the Constitution, for any reason, should be enough for the public to say “no way.” But to do it to reward the typically well-off—college grads—is an added kick in the pants. And no, college graduates who go into government work are not taking major financial hits.

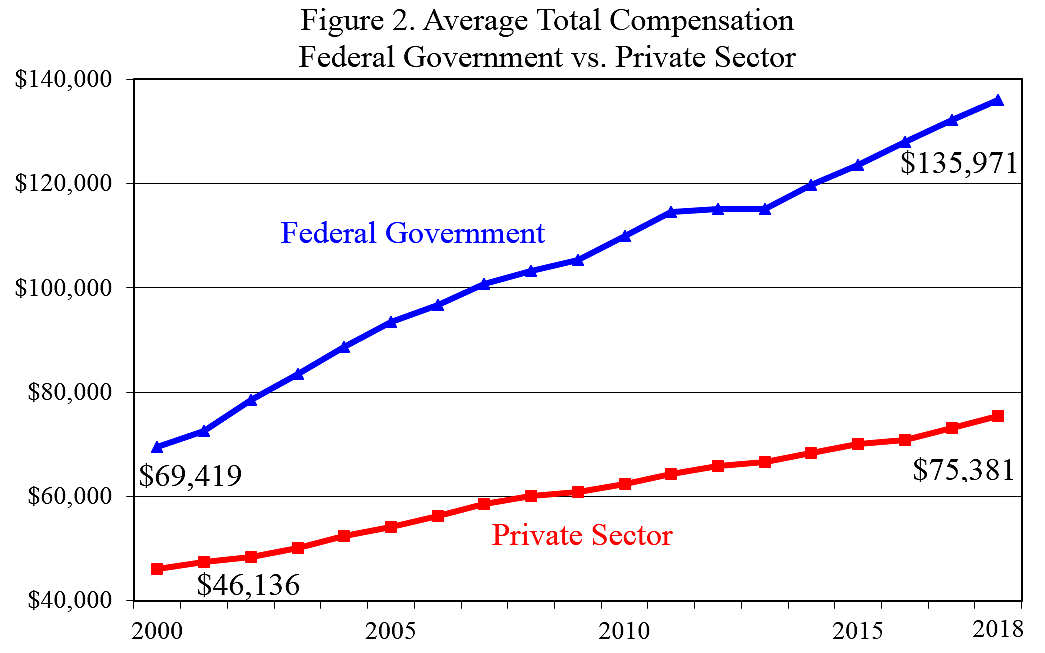

Government employees—especially federal—are well compensated compared to private sector workers, and their relative advantage has grown over time. As the chart above, from Downsizing the Federal Government, shows, the distance between federal and private compensation per worker has expanded from $23,283 in 2000 to $60,590 in 2018. Looking at all government employees versus all private industry, the gap has gone from $21,263 in 2013 to $22,732 in 2020. And while employees with higher education levels may not see government pay advantages, one huge benefit of much government employment – it is hard to lose your job – is tough to put a price on.

With progressives pushing for President Biden to unilaterally cancel up to $50,000 for every federal student debtor, there is a lot of pressure on the president to do something mammoth. By most indications he will not hand progressives the insanely expensive jubilee—about $1 trillion—they want. It would likely be a giveaway to the well-to-do that most people would not stomach. But it seems he is doing all he can to forgive debt piecemeal, even if that means shunting aside the constitutionally proper legislative process. That is not okay.