I’m normally reluctant to write about “depreciation” because I imagine eyes glazing around the world. After all, not many people care about the tax treatment of business investment expenses.

But I was surprised by the positive response I received after writing a post about Obama’s demagoguery against “tax loopholes” for corporate jets. So with considerable trepidation let’s take another look at the issue.

First, a bit of background. Every economic theory agrees that investment is a key for long-run growth and higher living standards. Even Marxist and socialist theory agrees with this insight (though they foolishly think government somehow is competent to be in charge of investments).

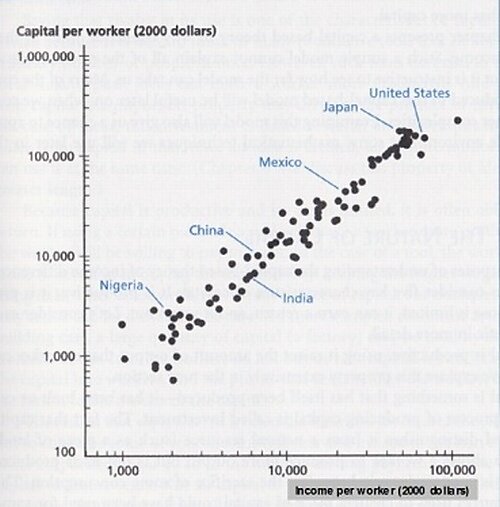

Let’s look at two remarkable charts, starting with one that shows the very powerful link between total investment and wages for workers.

As you can see, if we want people to earn more money, it definitely helps for there to be more investment. More “capital” means that workers have higher productivity, and that’s the primary determinant of wages and salary.

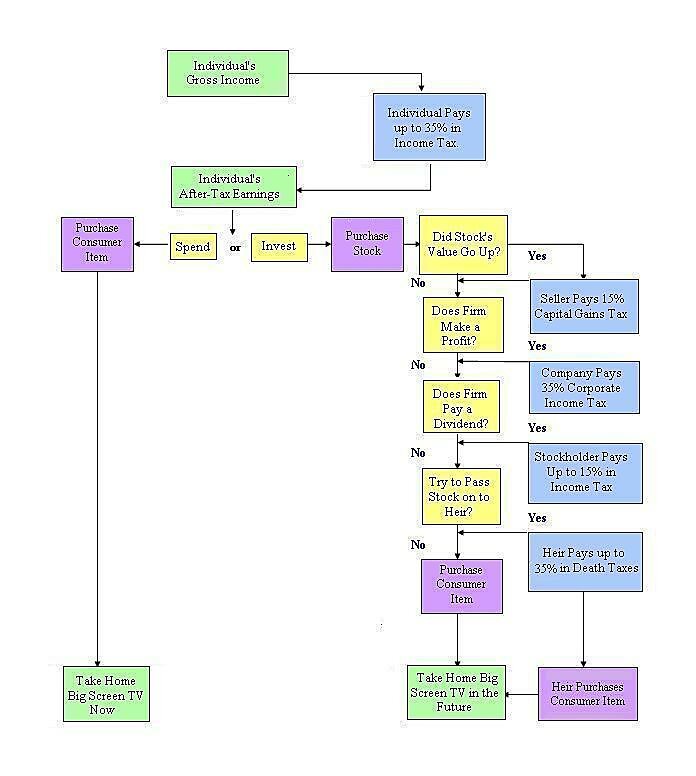

Our second chart shows how the internal revenue code treats income that is consumed compared to how it penalizes income that is saved and invested. Simply stated, the current system is very biased against capital formation because of the combined impact of capital gains taxes, corporate income taxes, double taxes on dividends, and death taxes.

Indeed, one of the reasons why the right kind of tax reform will generate more prosperity is that double taxation of saving and investment is eliminated. With either a flat tax or national sales tax, economic activity is taxed only one time. No death tax, no capital gains tax, no double tax on dividends in either plan.

All of this background information helps underscore why it is especially foolish for the tax code to specifically penalize business investment. And this happens because companies have to “depreciate” rather than “expense” their investments.

Here’s how I described depreciation in my post on corporate jets.

If a company purchases a jet for $20 million, they should be able to deduct – or expense – that $20 million when calculating that year’s taxable income… A sensible tax system defines profit as total revenue minus total costs – including purchases of private jets. But today’s screwy tax code forces them to wait five years before fully deducting the cost of the jet (a process known as depreciation). Given that money today has more value than money in the future, this is a penalty that creates a tax bias against investment (the tax code also requires depreciation for purchases of machines, structures, and other forms of investment).

And I also addressed the issue when writing about the economic illiteracy in one of the Obama-Romney debates.

Now let’s see what some experts on the topic have to say.

Here’s some very sage analysis from Alan Viard of the American Enterprise Institute.

…a deal that cuts the corporate rate could end up doing more harm than good. The problem is that Congress and the Obama administration are thinking of pairing the rate cut with a slow-down of companies’ depreciation deductions. That’s a bad combination. A key goal of corporate tax reform should be to reduce the tax penalty on business investment. Investments in equipment, factories, and other forms of capital help power the long-run economic growth that boosts wages and living standards for American workers. …If depreciation is slowed down enough to offset the full revenue loss from the rate cut, then there’s no reduction in the investment penalty, on balance. The depreciation changes take back with the left hand everything that the rate cut gives with the right hand. …In fact, the policy makes the tax penalty on new investments bigger. …Why is this bad combination being considered? Maybe because the rate cut is easy to understand and the harm of slower depreciation is easy to overlook. …Yes, let’s cut the corporate tax rate. But, let’s not slow down depreciation to pay for it.

Amen. Proposals to lower America’s destructively high corporate tax rate are needed, but I don’t want politicians “paying for” the change with other policies that are similarly harmful to growth and competitiveness.

Margo Thorning of the American Council for Capital Formation adds some wisdom with her column in today’s Wall Street Journal.

…proposals that would increase the tax burden on capital-intensive industries—which are contributing to U.S. economic growth and employment—should be viewed with caution. …stretching out depreciation allowances reduces a company’s annual cash flow and raises the “hurdle rate” that new investments would have to meet before they are approved. For capital-intensive firms in sectors such as energy, manufacturing, utilities and transportation, the trade-off between delayed cash flow and lower corporate income-tax rates may result in cutbacks in capital spending. …Each additional $1 billion in investment is associated with 23,000 new jobs, according to data from the Department of Commerce and the Bureau of Labor Statistics. …Rather than drawing out depreciation schedules, a better, pro-growth approach to corporate tax reform would be to allow all investment to be expensed—in other words, deducted from income in the first year.

I share Margo’s concerns, which is why I’m very suspicious when the President says he wants to lower the corporate tax rate and “reform” the system.

Last but not least, Matt Mitchell (no relation) of the Mercatus Center recently added his two cents to the discussion.

The idea that “accelerated” depreciation is a loophole can be traced back to Stanley Surrey, the Harvard law professor whose work in the 1950s, 60s, and 70s influenced many…, including Senator Bill Bradley. …immediate expensing would mean abandoning “the attempt to tax business income.” That’s because it would essentially turn the corporate income tax into a corporate consumption tax. And that may be a good thing. Capital taxation is notoriously inefficient. This is one reason why Robert Hall and Alvin Rabushka permitted immediate 100 percent expensing in their famous flat consumption tax.

You should realize, by the way, that the distorted view of what’s a loophole doesn’t just apply to depreciation. The Joint Committee on Taxation (the same folks who basically assume that the revenue-maximizing tax rate is 100 percent) also tells lawmakers that it’s a loophole if you don’t double-tax capital gains, or if you allow people to avoid double taxation by utilizing IRAs.

With advice like that, no wonder the tax code is a mess.

Anyhow, congratulations are in order. If you’ve made it this far, you almost surely know more about depreciation than every single politician in Washington. Though, to be sure, that’s not exactly a big achievement.