In just a few weeks Washington enters that alternative universe called “budget season,” when the President delivers his budget proposal to Congress and Congress begins constructing its budget for the coming fiscal year (at least in normal years, don’t expect much budget action in 2012). Underlying the budget process will be government projections of the deficit. Such projections will be given considerable weight, both in Washington and among the press. So if said projections are way off, then budgeting decisions by Washington will also miss the mark.

Just in time to help frame this debate is a new paper from economists at the Federal Reserve Bank of St. Louis. The entire paper is well worth a read, and accessible to the general public. Below is a chart, reproduced from the paper, that expresses the basic point.

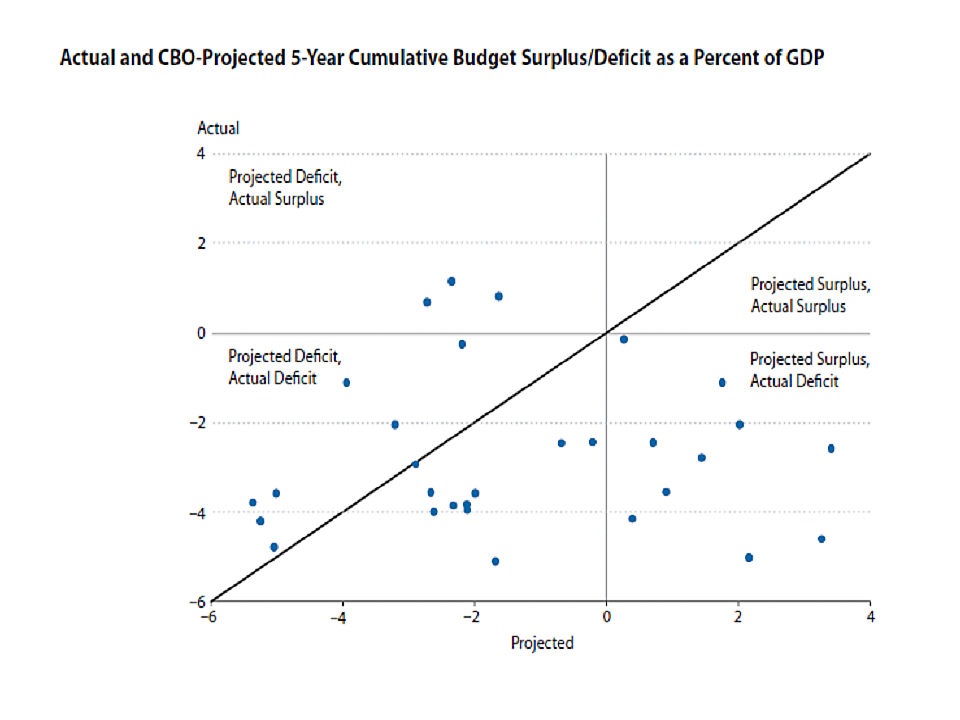

On the X axis is the Congressional Budget Office’s projected 5 year budget surplus/deficit, as a percent of GDP. The Y axis plots the actual budget surplus/deficit. An easy way to read the chart is that points below the 45 degree line are instances of where CBO was too optimistic. Points above the 45 degree line are where CBO was too pessimistic. If CBO’s errors were random, then the number of points below and above the 45 degree line would be about equal. As you can see, however, CBO’s errors were not randomly distributed. They were biased in the direction of being too optimistic. So when you see the next round of CBO budget forecasts, take them with a huge grain of salt. The truth is likely to be much worse.