In my Saturday post warning of the dangers of QE3, I wrote, among other things,

Having kept the federal funds rate at 1.75 percent for a year after the economy began to recover in November 2001, the Fed lowered it to 1.25 percent in November 2002, and to 1 percent in June 2003. Then, in August 2003, the FOMC, still unhappy with the sluggish pace of the recovery, and especially with the high unemployment rate, announced that the f.f.r. was “likely” to remain low for an “extended” period of time. Not for the first time, the Fed in its zeal to assist recovery was in fact setting the next boom in motion. And how!

To which Scott Sumner replies,

I’m tempted to respond; and how? Most people, including George Selgin and market monetarists like David Beckworth, believe that an easy money policy during the early 2000s led to an overheated economy in the middle of the decade, and that this was one factor in the crash during the latter part of the decade. I’m not convinced, or perhaps I should say I doubt the effect was as strong as most people believe. First of all, I see little evidence that monetary policy was particularly expansionary during the early 2000s. Some people cite the low rates, but we all know what Milton Friedman said about that. I agree with Ben Bernanke that NGDP growth is a good indicator of whether money is easy or tight. Here are the facts about NGDP growth during the previous expansion:

1. NGDP grew at a slower rate during the 2001-07 expansion than during any other expansion during my lifetime.

2. NGDP growth modestly exceeded 5% during the peak of the housing boom.

Scott’s reply in turn provokes me to recall an important issue which, though occasionally raised in what I’m going to start calling simply the M‑M-osphere for short, deserves a lot more attention. It concerns the question, “Which spending measure ought the Fed to keep stable?”

Although the focus on NGDP has been such as to allow “NGDP targeting” to become the favored way of referring to what Scott and other Market Monetarists have been plugging for, in fact NGDP is but one of many measures of spending or aggregate demand stabilization of which might be broadly consistent with the underlying economics of Market Monetarism. What’s more, there are compelling arguments for regarding some alternative measures of spending as superior. And yes, it does make a non-trivial difference which measure one chooses to look at in assessing the degree to which instability of spending may contribute to booms as well as busts, as I hope to show.

Among the alternatives to NGDP one in particular, the Dept. of Commerce’s measure of (nominal) “final sales to domestic consumers” deserves particular attention. It is the measure that was favored by the late Bill Niskanen–yet another largely unrecognized but long-standing proponent of nominal income targeting–who offered several good reasons for preferring it to NGDP targeting, the most fundamental of which was that “demand for money in the United States appears to be more closely related to final purchases by Americans than to the dollar level of total output by Americans.”

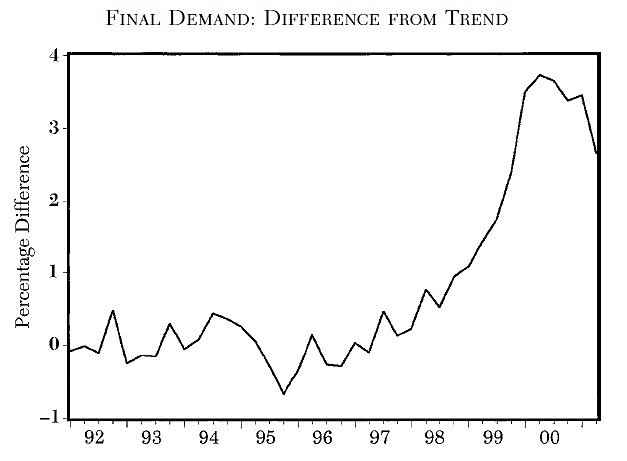

In an article published just after the dot.com crash, from which I just quoted, Niskanen looked at the behavior of final sales from early 1992 until 2001. He found that until early 1998 the annual growth rate of domestic final sales was remarkably steady at 5.5 percent. But as Niskanen’s chart, reproduced below, shows clearly, from early 1998 to the second quarter of 2000, coinciding with the dot.com boom, it shot up to almost 8 percent. The end of the boom brought, per usual, a collapse in spending. Niskanen argued, reasonably, that the Fed should strive next time to maintain the steady 5.5 percent growth rate it had managed to maintain, intentionally or not, throughout the early nineties.

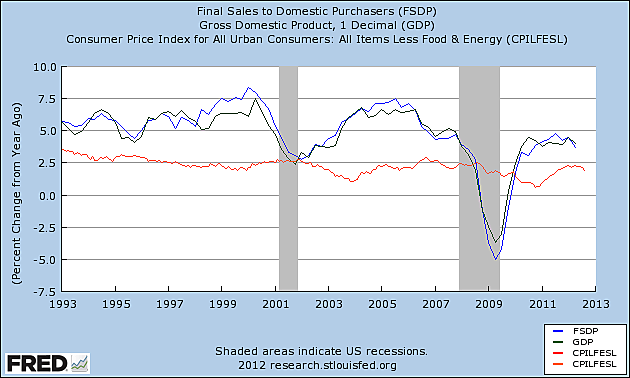

Now, none of this is particularly earth-shattering. But the course of domestic final sales during the longer sample period including that since Niskanen wrote, yields a more striking picture, and especially so if one includes along with the plot for domestic sales those for both NGDP growth and core CPI inflation:

Among things worth noting here are, first, that the coincidence–to settle at calling it that–between periods of exceptionally rapid growth in final sales and “booms” is hardly less evident than that between periods in which domestic sales collapse and “busts”; second, that the coincidence is more evident in considering the behavior of final sales than it is w.r.t. NGDP, because of the more pronounced cyclical amplitude of the former series; third, that the “core” CPI tells us nothing at all about about either booms or busts; and, finally, that, yes, as of the last data record spending remains below Scott’s preferred 5 percent target, and still further below the “Niskanen” growth target–but not by much.

The plain-old CPI is better than the core in reflecting both booms and busts, of course. But even with regard to it it seems entirely mistaken to assume that mere avoidance of >3 percent inflation (or something like that) should itself suffice to guard against the risk of another boom and bust cycle.

None of this, of course, amounts to a proof that excessive spending growth played a major part in either the last boom or any boom before it. But it certainly should suggest the presence of such a correlation as ought to rule out any temptation to reject a causal connection out of hand, and especially so in light of the many theorists, including both monetarists and Austrians (whose agreement concerning this matter is itself striking) who have offered independent evidence of the existence of such a link. Perhaps it’s true that, had the Fed heeded Niskanen’s advice, we would still have gone through the same subprime boom and financial meltdown. But I, for one, wouldn’t bet on it.

P.S. (added at 3:50 EST): I fear that, in failing to say anything regarding the Fed’s decision to direct its latest round of easing toward the purchasing of mortgage-backed securities, I may be thought to have no objection to that aspect of its new initiative. Nothing could be further from the truth. For the record, if the Fed is going to expand the stock of high-powered money, it should do so either the old-fashioned way, that is, by sticking to “Treasuries only,” or it should offer to buy a wide range of investment grade securities, of the sort it might routinely accept as discount-window collateral (as I’ve suggested in my “L Street” paper), or it should scatter the new dollars from helicopters. Anything else is encroaching unnecessarily on fiscal policy, that is, is making decisions about who gets what that should be left to Congress, or to the states, or (lest we forget them) to the people, rather than sticking to the Fed’s assigned function of tending to the economy’s overall state of liquidity.