Rep. Alexandria Ocasio-Cortez is making headlines calling for raising the top individual income tax rate to 70 percent to fund a Green New Deal. Sympathetic commentators are saying that such a high rate on the wealthy is no big deal because the top tax rate used to be 70 percent and above. Noah Smith at Bloomberg says the congresswomen’s plan would be “a return to the 20th century norm.”

The problem is that globalization has dramatically changed the economy over recent decades. High tax rates were not a good idea back then, but they would be disastrous now.

Before the 1980s, capital controls under fixed currency exchange rate regimes kept money bottled up within countries, keeping taxpayers in national economic prisons. That regime broke down, and today trillions of dollars flows over borders under flexible exchange rate systems, while industries and entrepreneurs have become highly mobile. Tax bases are far too movable these days for governments to sustain yesteryear’s excessive tax rates, as I discuss in Global Tax Revolution.

Every industrial country has figured that out, and their policy decisions refute the soak-the-rich tax dreaming of Rep. Ocasio-Cortez. Top income rates have plunged around the world since 1980 under governments of both the political left and right.

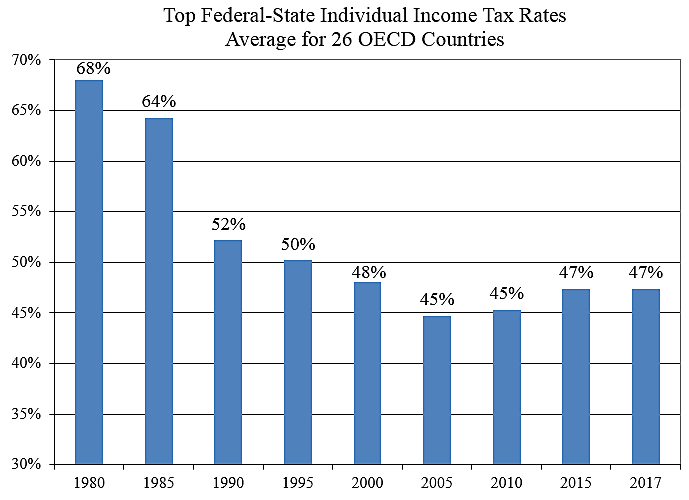

The chart shows the average top federal-state income tax rate for 26 core OECD countries that have good data back to 1980. The average top rate among these high-income nations fell from 68 percent in 1980 to 47 percent today. The average rate for all 35 OECD countries today is 43 percent. The top U.S. federal-state tax rate at 46 percent in 2017 was above the OECD average. The recent GOP tax cut dropped the top federal rate a few points, but raised the effective state rate by capping deductibility. On individual income taxes, America is not a low rate country.

The 26 countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Japan, Korea, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, United Kingdom, and United States. Data for 2000–2017 from the OECD. Data for 1980–1995 from Global Tax Revolution.