President Trump and his advisors are stressing that they want tax cuts for the middle class, not high earners. Trump said, “the rich will not be gaining at all with this plan,” while Treasury Secretary Steve Munchin said, “Our objective is not to create tax cuts for the wealthy. Our objective is about creating middle-income tax cuts.”

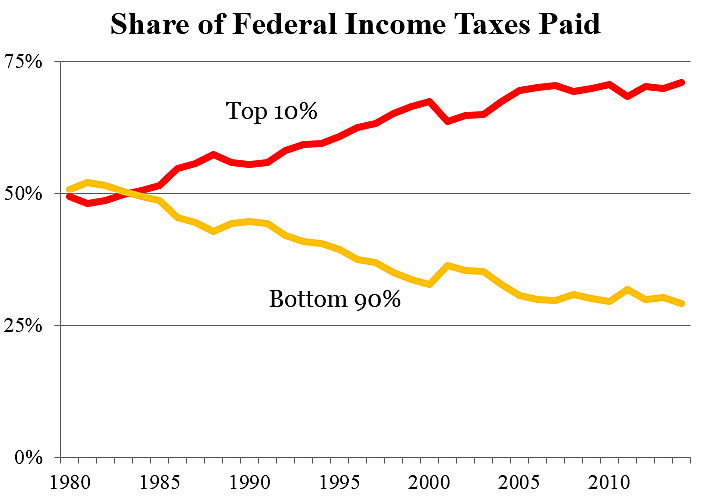

The problem is that high earners, not those in the middle, pay the vast bulk of federal income taxes. As the chart below shows, the share of federal income taxes paid by the highest-earning 10 percent has steadily risen—from 49 percent in 1980 to 71 percent by 2014. Meanwhile, the share paid by everyone else has plunged. (Source: TF based on IRS).

The Trump team is painting itself into a corner with its “tax cuts for the middle-class only” rhetoric. I fear that to satisfy that promise in coming weeks, the administration will seek to expand further the most unproductive parts of the tax plan, such as child credits. In turn, that will reduce budget room for tax reforms that would promote growth and simplify the code.

Cutting the most damaging parts of the tax code—such as our high corporate income tax rate—would benefit all Americans by spurring growth and raising wages. That is what Trump and Republicans should be focusing on.