It’s been a year since Republicans assumed control in the House in the wake of the 2010 elections, which were powered by Tea Party concerns about massive federal spending and deficits. With the more conservative House, has Congress made any progress on spending cuts yet?

Let’s compare the new CBO budget projections to CBO’s January 2011 projections. The new 10-year projections do look a little better, at least by Washington standards. A year ago, CBO’s baseline showed the deficit falling modestly from more than $1 trillion this year to $763 billion by 2021. CBO’s new baseline shows the deficit falling to just $279 billion by 2021.

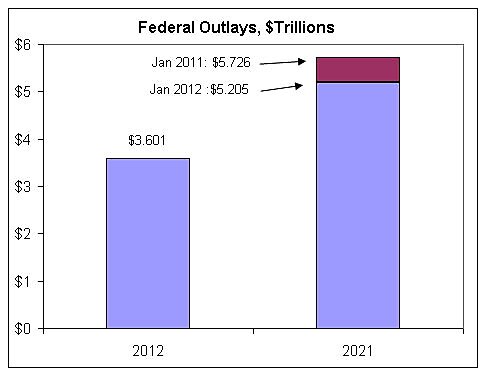

The chart shows federal spending of $3.6 trillion this year and CBO’s projections for 2021 from last year and this year. Last year, 2021 spending was expected to be $5.726 trillion, but this year 2021 spending is expected to be $5.205 trillion. Thus, Congress will apparently be “saving” $521 billion in 2021 compared to what it had planned to spend, although spending is still expected to rise 45 percent over the next nine years.

Of the $521 billion in “savings,” about $317 billion stems from the “cuts” under the budget caps put in place last year plus savings from the upcoming sequester. (The planned sequester results from the failure of the supercommittee). The sequester is supposed to trim entitlement spending a tiny amount and move the budget caps down a little lower. But, as we’ve discussed on Downsizing Government many times, budget caps aren’t real cuts; they are only promises that Congress will restrain spending in the future. “Real” cuts are full terminations of programs or permanent reductions in legislated entitlement benefits. So far, we haven’t seen any substantial real cuts.

The other $204 billion of the $521 billion in savings projected for 2021 result from a sharp reduction in CBO’s projection of federal interest costs. Last year, CBO projected that short-term Treasury rates would rise from about zero percent today to 4.4 percent by the end of the decade, while long-term rates would rise to 5.4 percent. CBO’s new projections show short-term rates rising to 3.8 percent and long-term rates to 5.0 percent. Last year, the short-term rate in 2015 was expected to be 3.9 percent, but this year CBO says it will be just 1.3 percent. These changed interest rate assumptions result in more than $1 trillion of new “savings” over the coming decade.

By the way, I’ve been comparing “baseline” projections here, but most experts think that CBO’s “alternative fiscal scenario” is a better predictor of our future if we don’t make reforms. Under this scenario, spending is expected to rise from $3.61 trillion this year to $5.65 trillion by 2021, a 56 percent jump over nine years. By 2022, spending is expected to top $6 trillion, which would be a 66 percent jump over 10 years.

The upshot is that Tea Party Republicans and other fiscal conservatives have a long, long way to go to get spending under control. Budget caps and sequesters are a step forward, but it’s time for Republicans to step up their game and start focusing on eliminating programs and agencies.