Kamala Harris selected Tim Walz as her presidential running mate. Let’s look at his record on spending and taxes as Minnesota governor since 2019.

Walz has performed poorly on Cato Institute Governor Report Cards. From a small-government perspective, his tax policies have been particularly glaring. He has repeatedly pushed for tax hikes on high earners and businesses, which has seemed more like an effort to punish taxpayers than to fill any real need for more budget revenues.

Spending

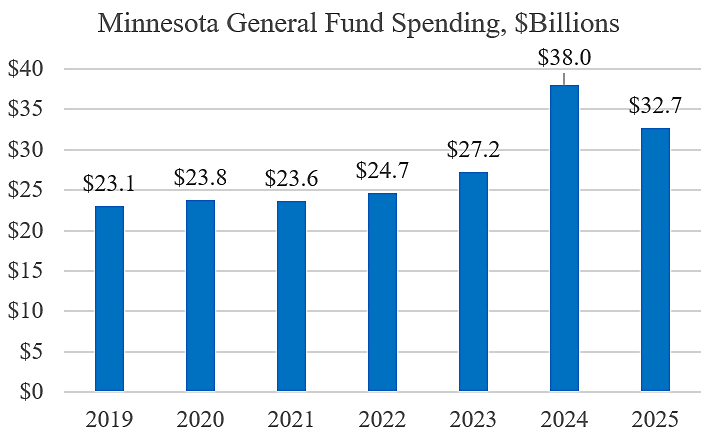

Walz signed a huge budget increase in 2023 that boosted general fund spending 36 percent from the 2022–23 biennium to the 2024–25 biennium. However, state spending increases are more reasonable when measured over Walz’s full tenure from 2019 to 2025, as shown in the chart. Annual average spending growth has been 6.0 percent, which is similar to the 50-state average growth of 5.9 percent over the same period. The Minnesota legislature was divided from 2019–2022, but Walz’s party has had full control since 2023.

An analysis of the Minnesota budget noted, “When the budget for the 2024–25 biennium was enacted in May 2023, a significant surplus from the previous biennium was anticipated to be available for one-time uses in the current biennium. After the close of the FY 2022–23 biennium, the actual surplus that carried forward into the current biennium was $13.103 billion. In the enacted budget, this one-time resource was partially allocated to one-time revenue reductions and one-time spending increases across the budget.” The revenue changes were mainly a one-time $1 billion rebate combined with net tax increases going forward.

Minnesota’s tax revenues and spending are higher than the 50-state average, measured as a percentage of income. But to its credit, the state government has relatively low debt and a large rainy day fund.

Taxes

Despite revenue growth and surpluses, Walz has pushed for tax increases on businesses, high earners, and the middle class. His proposed hikes were mainly passed when his party controlled the legislature but mainly rejected when the legislature was divided. Walz has supported tax cuts, but primarily in the form of narrow tax breaks and subsidies.

In 2019, Walz’s state budget would have added “$2 billion more in new spending, and taxes would increase by $1.3 billion to pay for it, with the rest of the money coming from an existing surplus.” But he compromised with the legislature, and the final tax increase was about $330 million annually. Walz also pushed for higher gas taxes and vehicle fees to raise about $1 billion annually for transportation, but those increases were rejected.

In 2021, Walz proposed adding a new individual income tax rate of 10.85 percent above the top rate of 9.85 percent, a surtax on capital gains and dividends, and a hike to the corporate tax rate from 9.8 percent to 11.25 percent. The proposals—which would have raised about $1.6 billion annually—were rejected by the legislature.

In 2023, Democrats took control of the legislature and Walz could enact his misguided tax policies. He signed HF 1938 raising taxes on businesses with foreign income, reducing the standard deduction for high earners, and imposing a new tax on investment income. At the same time, he handed out an array of low-income credits, a one-time rebate, and special-interest breaks for e‑bikes, green aviation fuel, film production, and other items.

The same year, Walz hit the middle class with HF 2887, which raised taxes and fees on vehicles and transportation. The increases included indexing the gas tax for inflation, increasing vehicle registration taxes, raising fees on retail deliveries, and raising sales taxes in the Twin Cities area.

The governor hit the middle class again in 2023 with a large tax hike to pay for a new paid leave program. The legislation imposed a 0.7 percent tax on wages to fund the program’s benefits, but then new legislation in 2024 increased the tax rate to 0.88 percent of wages. The tax will raise $1.2 billion the first year of operation and rising amounts after that.

Walz has declared, “Cutting taxes for the wealthiest amongst us will not guarantee opportunities in Minnesota for the wider variety of folks, and it certainly won’t grow our economy from the middle out.” But Minnesota’s high tax rates are undermining the economy and driving away the wealthy, who include highly skilled people and job-creating entrepreneurs.

IRS interstate migration data show that the state is losing about ten households earning more than $200,000 for every six that it gains, which is the fifth worst ratio among the states. At the same time, Minnesota ranks 44th on the Tax Foundation’s business tax climate index, giving companies a strong incentive to invest elsewhere. To stem the outflow of skilled people and capital, Minnesota needs to adopt a leaner government and cut individual and business tax rates.

Governors can make good candidates for national office because they have experience balancing an annual budget and making tax and spending trade-offs. But to my taste, Walz seems too intent on raising taxes in ways that undermine prosperity, while using the tax code as a subsidy machine for politically favored groups.

Notes. The spending chart data comes from NASBO, but it also closely tracks data from Minnesota government websites here and here. The spending data is for fiscal years. Cato releases a new Governors Report Card in October.