As Republicans work on details of their tax legislation, many reporters and pundits are painting the effort as slanted in favor of the rich. But that is not a fair reading of what the official data shows. The House bill proposed last week provides the largest percentage cuts to middle-income taxpayers, at least in the early years.

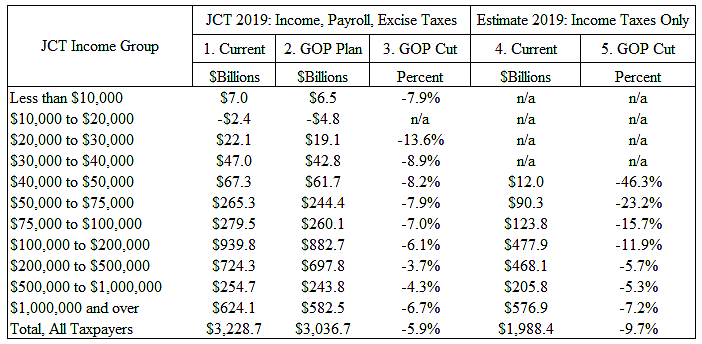

The Joint Committee on Taxation (JCT) has published estimates on the House bill. In the table below, the first three columns show the results for 2019, which is the first year in the JCT analysis.

Column 3 shows that middle-income groups would enjoy somewhat larger percentage tax cuts than higher-income groups under the GOP plan. Those are the raw JCT results.

However, the JCT calculates its results using a denominator that not only includes income taxes, but also payroll and excise taxes, even though Republicans are not changing those taxes. JCT’s inclusion of payroll and excise taxes slants its presentation to exaggerate the benefits to higher groups compared to lower groups.

Columns 4 and 5 include just individual and corporate income taxes since those are the taxes that Republicans are cutting. Column 4 shows my rough estimate (details below) of the 2019 totals of those taxes since the JCT did not provide those figures. In aggregate, households earning less than $40,000 do not pay any income taxes, so they are n/a.

Column 5 shows the GOP tax cuts as a percent of estimated income taxes paid under current law. You can see that using this more sensible denominator, the results show huge percentage tax cuts for middle earners. Households in the $40,000 to $50,000 group would get their income taxes cut almost in half, in aggregate. The House bill would make the tax code substantially more “progressive,” which is not a good idea since the code is already far too progressive or unequal.

Two caveats. The JCT does not include estate tax changes. Also, I focused on 2019, but over time the tax cuts bend more toward the top end. However, my main point is that distribution tables can show the same model results in very different ways, suggesting different messages. To me, the adjusted JCT data reveal that the GOP has moved too far left in designing its tax package.

The most important goal of tax reform is to raise economic output and incomes over the longer term, and the GOP’s business tax reforms will do that. However, because the GOP tilted left on its individual changes, those changes will not spur any economic growth, according to the Tax Foundation. Sadly, that looks like it could be a missed opportunity for tax reform this year.

Data Note: I could not find an estimated breakout of federal taxes between income, payroll, and excise for 2019 on JCT’s website. So I used a recent TPC estimate for 2019 (T17-0045) of the current law breakdown in the same income categories as JCT. Since TPC’s tax and income estimates are somewhat different than JCT’s, I adjusted the TPC data to match the JCT figures.