Reporters and pundits are claiming that Republicans are pursuing a tax giveaway to the rich. In fact, the proposed tax changes, especially in the early years, heavily favor middle-income households.

The skewed media coverage of the GOP tax plan is partly based on a slanted presentation of results by the Tax Policy Center (TPC). As I have noted, TPC has expert analysts and does a lot of great work, but they tilt their reports to make it appear that high-earners are favored by recent Republican proposals.

The summary of TPC’s new report on the House GOP tax plan says, “The largest cuts, in dollars and as a percentage of after-tax income, would accrue to higher-income households.” The largest cuts in dollars go to high-earners—no kidding! TPC’s own data (current law data is here) reveal that the top quintile of households will pay an average of about $65,000 in income and estate taxes in 2018, compared to about $3,200 for the middle quintile. Thus, it is very difficult to cut taxes without the top group receiving the largest dollar cuts.

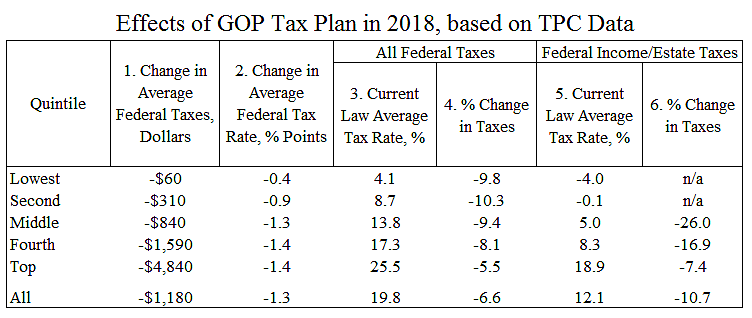

The TPC report presents the data shown in columns 1 and 2 below, which suggest that GOP cuts favor high earners. However, based on TPC data, I calculated columns 4 and 6. Column 4 reveals that the lower and middle groups would receive the largest percentage cuts when total federal taxes are the denominator.

But, as I discuss here, column 6 presents the best data showing the relative size of GOP cuts. It shows income and estate tax cuts as a percentage of current income and estate taxes paid. Under the GOP plan, the middle quintile gets a big 26 percent tax cut, on average, while the top two quintiles would receive cuts of 16.9 percent and 7.4 percent. Looked at this way, middle earners would get the largest tax cuts under the GOP plan.